Bitcoin Surge Hits Over $122,000 Amid Rate Cut Speculation

The recent Bitcoin surge has captured the attention of investors and enthusiasts alike, as the digital currency skyrocketed to over $122,000 this Wednesday. This dramatic Bitcoin price increase is largely attributed to the speculation surrounding a potential interest rate cut by the U.S. Federal Reserve, which has dramatically influenced the cryptocurrency market. With the probability of this cut soaring to 99.9%, traders have seen Bitcoin trading volume surge nearly 12% in the past day alone. As a result, cryptocurrencies are once again flirting with a collective market cap of $4 trillion, prompting discussions about shifting cryptocurrency trends. Other major digital assets, including ether, have similarly benefited, showcasing a robust recovery amid tightening financial conditions.

The recent surge in Bitcoin has transformed the landscape of digital currencies, sparking a renewed interest in alternative assets. This significant uptick in the valuation of Bitcoin correlates closely with patterns in the financial market influenced by the Federal Reserve’s impending decisions on interest rates. As investors seek shelter from traditional asset volatility, the demand for cryptocurrencies has led to heightened trading activity and increased market capitalization. With Bitcoin’s dominance dipping below 60% for the first time in months, many are now analyzing various cryptocurrencies as they establish diverse investment portfolios. The overall momentum in the crypto space is indicative of a bullish trend, as more individuals recognize the potential of digital currencies as a viable means of wealth preservation.

Understanding the Bitcoin Surge

The recent Bitcoin surge has captured the attention of investors and analysts alike, as the cryptocurrency reached over $122,000, marking a significant milestone in the cryptocurrency market. The upward momentum was primarily fueled by the anticipation of a potential interest rate cut by the U.S. Federal Reserve, which sparked a wave of optimism among traders. As the probability of this cut soared to an impressive 99.9%, market dynamics shifted, propelling Bitcoin and other digital assets into the limelight.

This surge not only highlights Bitcoin’s resilience in the face of economic uncertainty but also reflects broader trends within the cryptocurrency market. As Bitcoin’s price rises, so does the overall market capitalization, which recently crossed $4 trillion for the second time this week. This remarkable growth has a ripple effect on other cryptocurrencies, leading to increased trading volumes and heightened investor interest across various digital assets.

Frequently Asked Questions

What factors contributed to the recent Bitcoin surge reaching over $122,000?

The recent Bitcoin surge can be attributed mainly to rising probabilities of a Federal Reserve interest rate cut, which increased to 99.9% according to the CME Fedwatch Tool. This expectation triggered a positive sentiment in the cryptocurrency market, leading to a significant uptick in Bitcoin trading volume as investors positioned themselves favorably.

How does the rising Bitcoin price impact the overall cryptocurrency market?

The Bitcoin price increase positively influences the cryptocurrency market by pushing the total market capitalization past $4 trillion. As Bitcoin leads the surge, other cryptocurrencies, like ether (ETH), also experience substantial gains, reflecting broader cryptocurrency trends where increased investment in Bitcoin translates to higher interest in altcoins.

What role do Federal Reserve interest rates play in the Bitcoin surge?

Federal Reserve interest rates play a critical role in the Bitcoin surge since expectations of a rate cut typically lead to increased risk appetite among investors. As interest rates potentially decrease, the cost of holding cash rises, prompting greater interest in assets like Bitcoin, which can benefit from capital inflows into the cryptocurrency market.

Has Bitcoin trading volume changed during this surge?

Yes, Bitcoin trading volume surged nearly 12% during this period, reaching $82.38 billion in the last 24 hours. This increased trading activity is a direct result of the anticipated Federal Reserve interest rate cuts and reflects heightened investor interest in the Bitcoin price increase.

What was the impact of Bitcoin’s surge on other cryptocurrencies?

Bitcoin’s surge has had a ripple effect on other cryptocurrencies, with the value of ether (ETH) climbing past $4,700. The increased Bitcoin dominance dropping below 60% indicates that market participants are diversifying their investments into altcoins, suggesting a vibrant cryptocurrency market that flourishes alongside Bitcoin’s price increase.

Could the Bitcoin price continue to rise as we approach the Federal Reserve meeting?

It’s possible that the Bitcoin price could continue to rise as the Federal Reserve meeting approaches, especially if the market anticipates a positive outcome regarding interest rate cuts. The correlation between market sentiment, Bitcoin trading volume, and cryptocurrency trends indicates that as investor optimism grows, so might the price of Bitcoin.

What does the decline in Bitcoin dominance indicate about the cryptocurrency market?

The decline in Bitcoin dominance, which recently fell to 59.50%, indicates increased competition from altcoins like ether and others. This shift suggests that while Bitcoin continues to lead the cryptocurrency market, investors are actively seeking diversified opportunities, highlighting evolving cryptocurrency trends amidst the Bitcoin surge.

What can investors expect from Bitcoin and the cryptocurrency market in the near future?

Investors can expect potentially continued momentum in the Bitcoin price and the cryptocurrency market, especially with the upcoming Federal Reserve meeting. Monitoring Bitcoin trading volumes, market responses to interest rate news, and overall trends in altcoins will be crucial for understanding market directions post-surge.

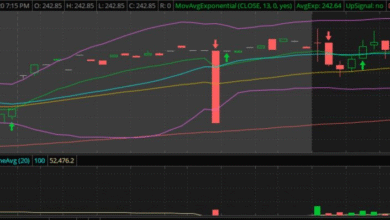

| Metric | Value |

|---|---|

| Bitcoin Price | $122,000 |

| S&P 500 Increase | 0.12% |

| Nasdaq Increase | 0.05% |

| Dow Increase | 0.68% |

| Ether Price | $4,700 |

| Bitcoin Market Cap | $2.42 trillion |

| Bitcoin Dominance | 59.50% |

| 24-Hour Trading Volume | $82.38 billion |

| Futures Open Interest | $82.13 billion |

Summary

The Bitcoin surge has been monumental, reaching over $122,000 as market dynamics shifted due to the Federal Reserve’s anticipated interest rate cut. As this digital currency continues to rise, it influences not just the crypto sphere but also the broader financial markets, highlighting its role as a leading asset. With other cryptocurrencies like ether also seeing significant growth, the atmosphere is ripe with optimism for future trends in cryptocurrency investments.