Fed Chair Candidates: Marc Sumerlin Backs Interest Rate Cut

Fed chair candidates are stirring excitement in the financial world as discussions about potential successors to Jerome Powell heat up. Among the names being tossed around, economist Marc Sumerlin stands out, actively expressing his desire for the position while advocating for a significant interest rate cut. He argues that a bold move of a 50 basis point cut could be implemented without causing market disruption, a stance that resonates with many who are closely watching Federal Reserve nominations. As the Federal Reserve navigates a shifting economic landscape, the choice of a new chair will greatly influence monetary policy for years to come. With several contenders vying for the role, Sumerlin’s insights and connections could play a crucial role in shaping the future of the nation’s central bank.

The search for the next leader of the Federal Reserve has captivated economists and investors alike, especially with the announcement of various contenders for the pivotal role. As discussions unfold about the next chief of the central bank, attention is drawn to potential candidates such as Marc Sumerlin, who has made headlines with his stance on monetary easing. This is particularly relevant as the need for a decisive interest rate adjustment becomes increasingly urgent amidst economic fluctuations. With the looming succession of Jerome Powell, stakeholders are keen to understand how the upcoming nominations will impact future monetary strategies. Such choices will not only influence interest rates but also determine the trajectory of economic recovery and stability in the months to come.

Marc Sumerlin and His Vision for the Federal Reserve

Marc Sumerlin has emerged as a prominent candidate in the search for the next Fed chair, primarily due to his bold stance on monetary policy. His advocacy for a significant interest rate cut reflects a broader belief that the current economic landscape requires aggressive measures to stimulate growth. Sumerlin asserts that a 50 basis point reduction is feasible without risking instability, emphasizing the need for a proactive approach to address concerns in the labor market and maintain a stable inflation rate. By prioritizing such actions, Sumerlin positions himself as a candidate committed to adapting the Federal Reserve’s policies to current economic challenges.

Sumerlin’s background as a former senior economist under President George W. Bush equips him with a unique perspective on monetary policy. His connection to key political figures, including Treasury Secretary Scott Bessent, suggests he could play a pivotal role in shaping the future of the Federal Reserve. Given the level of discourse surrounding Fed independence and the pressures from the current administration, Sumerlin’s approach illustrates how he aims to balance institutional integrity with necessary economic interventions. His candidacy also reflects an ongoing dialogue about the ideal function and leadership of the Federal Reserve in these unpredictable times.

The Federal Reserve Nominations Landscape

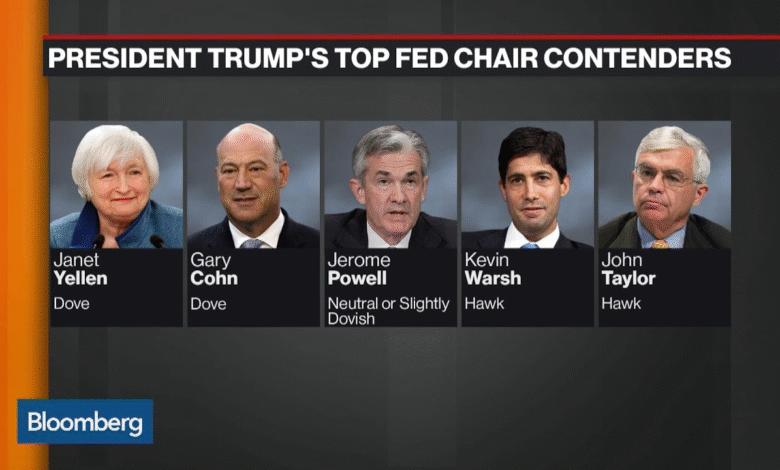

As the search for the next Fed chair heats up, several candidates—including Marc Sumerlin—are making their intentions known in a competitive field. Current governors like Michelle Bowman and Christopher Waller have also thrown their hats into the ring, providing a mix of continuity and change within the Federal Reserve. This nomination process is pivotal, not only for the candidates involved but for the broader economic environment, as the new chair will play a crucial role in guiding monetary policy amid fluctuating market conditions and inflation uncertainties.

The nominations are particularly significant given the recent criticism leveled at the Federal Reserve’s current leadership by figures in the Trump administration. Sumerlin’s call for transparency and proactivity resonates in a climate where public trust in monetary policy is being tested. With his emphasis on Fed independence, he reflects a common concern among economists regarding the potential influence of political pressures on monetary decision-making. As more names emerge in the fold, it is clear that the future of the Federal Reserve will rest heavily on the philosophies and strategies of its next leader.

Interest Rate Cuts: A Necessary Policy Adjustment

The debate surrounding interest rate cuts has taken center stage as economists like Marc Sumerlin advocate for significant adjustments to monetary policy. Sumerlin posits that a reduction of 50 basis points is not only justified but necessary to mitigate the effects of labor market weaknesses and stabilize inflation. This proposal echoes broader concerns in the economic community about the vitality of the U.S. economy and its response to external pressures. By suggesting such a sizeable cut, Sumerlin aims to underscore the urgency for the Federal Reserve to act decisively to sustain economic growth.

Moreover, the implications of interest rate cuts extend beyond immediate inflation control; they influence borrowing costs, consumer spending, and investment behaviors within the economy. As Sumerlin prepares to navigate the nomination process for Fed chair, he will need to address how he envisions executing such cuts while maintaining the Federal Reserve’s credibility and effectiveness. His clear communication on this topic may resonate with both policymakers and the public, aligning his candidacy with the urgent needs of the financial landscape.

Identifying Jerome Powell’s Successor

With the tenure of Jerome Powell coming into question, discussions surrounding his successor naturally lead to names like Marc Sumerlin, who represents a potential shift in monetary policy philosophy. Powell has faced significant criticism, and the search for his replacement opens the door for fresh approaches to America’s economic challenges. By stepping into the limelight as a candidate, Sumerlin indicates his readiness to implement a starkly different approach, particularly in the context of interest rate management and Fed transparency.

As the Federal Reserve looks to maintain its role in fostering economic stability, determining the successor to Powell will depend greatly on the incoming leader’s ability to navigate political landscapes, inflationary pressures, and market dynamics. Candidates who prioritize Fed independence, like Sumerlin, might align better with a collective desire for trust and efficacy within monetary policy. Understanding the broader implications of this decision, the selection process is poised to shape the economic trajectory in the U.S. for years to come.

Economic Independence in Monetary Policy

A critical discussion surrounding the future leadership of the Federal Reserve involves the concept of economic independence. Marc Sumerlin has been vocal about the importance of preserving this independence, especially in light of recent pressures exerted by political figures such as former President Trump. The ability of the Federal Reserve to operate free from political influence is essential for maintaining credibility in its monetary policy decisions. A chairperson who respects this principle can advocate for measures that genuinely cater to economic conditions rather than political agendas.

Sumerlin’s perspective on Fed independence reflects his understanding of the delicate balance required in implementing effective monetary policy. His acknowledgment of the potential for criticism while adhering to sound economic principles indicates a readiness to confront challenges head-on. As candidates vie for the role of Fed chair, discussions about the future of monetary policy will undoubtedly focus on who can best uphold the integrity of the institution while still being responsive to economic realities—and Sumerlin’s candidacy epitomizes this balance.

Monetary Policy and Its Economic Implications

As discussions unfold around the next chair of the Federal Reserve, the broader implications of monetary policy remain at the forefront of economic discourse. Candidates like Marc Sumerlin emphasize the need for adaptive strategies as economic conditions evolve. His proposals for interest rate reductions aim to tackle immediate challenges such as unemployment and insufficient economic growth. By prioritizing a responsive monetary policy approach, Sumerlin seeks to demonstrate that the Federal Reserve can play a proactive role in fostering economic resilience.

The prospect of a new chair ushers in a vital opportunity for the Federal Reserve to re-evaluate its monetary strategies and align them with contemporary economic realities. Such realignments are essential for sustaining economic growth and addressing potential pitfalls. As Sumerlin reinforces the necessity of adjusting monetary policy, it is clear that the upcoming leadership change at the Federal Reserve could signal a transformative period in how economic policies are formulated and enacted moving forward.

Understanding the Role of Fed Chair In Economic Recovery

The Federal Reserve chair plays an instrumental role in the trajectory of economic recovery, especially following periods of instability. As Marc Sumerlin steps into the conversation as a potential nominee, his insights on interest rates and monetary policy could significantly influence recovery efforts. With the Federal Reserve’s leadership at stake, it becomes increasingly important for the chair to implement bold yet calculated measures that instill confidence in both investors and consumers. Sumerlin’s advocacy for a 50 basis point cut reflects an understanding of the current economic environment and suggests a willingness to take decisive action.

Fed chairs have historically carried the burden of navigating complex economic landscapes, making strategic decisions that impact millions of Americans. Through his candidacy, Sumerlin reaffirms the importance of adaptive and thoughtful monetary policy to foster growth and stability. His proposed changes could provide a clearer path to economic recovery, signaling that the future Fed chair must be equipped to address both immediate challenges and long-term economic health.

Candidates for the Future: The Search for Fed Leadership

The current search for a successor to Jerome Powell has put a spotlight on various potential candidates, including Marc Sumerlin and others like Michelle Bowman and Christopher Waller. Each candidate brings a unique perspective on monetary policy and economic strategy, contributing to a diverse dialogue on the future of the Federal Reserve. With the economy facing challenges ranging from inflation to labor market fluctuations, the person who ultimately steps into the Fed chair role will have to navigate these hurdles adeptly, ensuring they can guide the institution through turbulent times.

The competition for Fed leadership also highlights the interconnectedness of policy, politics, and economics. As candidates relay their visions for the future, it’s essential that they address how they plan to achieve a balanced approach to monetary policy that promotes both stability and growth. The evolving candidacy of individuals like Sumerlin showcases an understanding of the limited window for action and sets the stage for a potentially transformative period in the history of the Federal Reserve.

Public Trust and the Federal Reserve Leadership

In the realm of monetary policy, public trust is an invaluable asset that can shape perceptions of the Federal Reserve’s effectiveness. As Marc Sumerlin and other candidates vie for the position of Fed chair, restoring confidence among the public and markets becomes a primary objective. Sumerlin’s commitment to independent monetary policy demonstrates an understanding of the importance of trust in institutional credibility. His readiness to engage openly about potential interest rate cuts and the rationale behind them may play a crucial role in winning over skeptics who question the Fed’s responsiveness to economic challenges.

Moreover, the necessity for transparent communication with the public cannot be overstated. Candidates seeking the Fed chair must articulate their policies clearly and be transparent about their decision-making processes. Sumerlin’s approach highlights the importance of maintaining a clear dialogue with the public, which can help to rebuild confidence in the Federal Reserve’s ability to influence monetary conditions positively. His candidacy may pave the way for a leadership style focused on fostering trust and engagement between the Fed and the American people.

Frequently Asked Questions

Who are the leading candidates for Fed chair nominations including Marc Sumerlin?

The leading candidates for Fed chair nominations include economist Marc Sumerlin, current Governors Michelle Bowman and Christopher Waller, National Economic Council Director Kevin Hassett, and former Governor Kevin Warsh, among others. Sumerlin has expressed interest in the role and supports a significant interest rate cut.

What is Marc Sumerlin’s stance on interest rate cuts as a Fed chair candidate?

Marc Sumerlin believes that an aggressive interest rate cut is necessary, advocating for a 50 basis point reduction. He argues that the current economic conditions make this cut a ‘no-brainer’ and essential for monetary policy.

How does Marc Sumerlin’s view on Fed independence influence his Fed chair candidacy?

Sumerlin emphasizes the importance of Fed independence, especially in light of recent criticisms from President Trump towards Jerome Powell. He believes a Fed chair must focus on the American people’s needs while being prepared for daily criticism.

What impact could Marc Sumerlin’s nomination have on monetary policy and interest rates?

If nominated and confirmed as Fed chair, Marc Sumerlin’s policies could lead to an aggressive approach to monetary policy, particularly through interest rate cuts. His suggestions reflect alignment with certain political pressures, particularly from President Trump, who favors easing rates.

What conditions does Marc Sumerlin mention regarding his interest in the Fed chair nomination?

Marc Sumerlin has stated that he would be interested in the Fed chair nomination if he aligns with the president’s vision for monetary policy. He emphasizes the need for mutual understanding and shared goals for effective leadership.

How does Marc Sumerlin’s economic background influence his candidacy for the Federal Reserve chair?

Marc Sumerlin’s experience as a former senior economist under President George W. Bush lends him credibility in economic discussions. His understanding of monetary policy, particularly regarding interest rate decisions, positions him as a serious candidate for Fed chair.

Why are interest rate cuts considered urgent by candidates like Marc Sumerlin?

Candidates like Marc Sumerlin view urgent interest rate cuts as necessary to address current economic challenges, including labor market weaknesses and stable inflation. They believe these cuts can stimulate economic growth and improve financial conditions.

What challenges might Marc Sumerlin face if nominated as Fed chair?

If nominated as Fed chair, Marc Sumerlin may face challenges related to maintaining Fed independence amidst political pressures, such as those exerted by President Trump. He must also navigate criticism and public scrutiny while implementing his monetary policy agenda.

| Key Point | Details |

|---|---|

| Marc Sumerlin’s candidacy | Sumerlin is interested in being nominated for Fed chair and has confirmed his candidacy. |

| Proposed Interest Rate Cut | Sumerlin advocates for a 50 basis point interest rate cut, stating it would not disrupt the economy and is a straightforward decision given current conditions. |

| Fed Independence | Emphasizes the importance of Fed independence amidst political pressures; Sumerlin has noted the need for a strong, independent Fed. |

| Relationship with the White House | Sumerlin has been contacted by the White House and is seen as on a list of potential nominees. |

| Other Candidates | The field includes notable figures such as Michelle Bowman, Christopher Waller, and Kevin Hassett, among others. |

Summary

Fed chair candidates must navigate a complex political landscape, and Marc Sumerlin’s confirmation of his interest in the role highlights the ongoing discussions regarding interest rates and Fed independence. As he proposes significant rate cuts to aid the economy, Sumerlin’s perspective reflects a balance between monetary policy and political influences, which will be critical for whoever is selected as the next Fed chair.