Latin America Cryptocurrency: A Leader in Global Dialogue

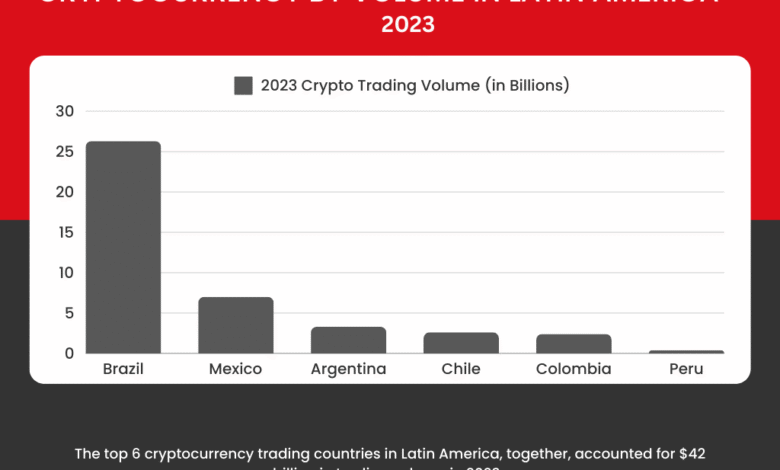

Latin America cryptocurrency is emerging as a powerhouse in the global digital finance landscape, showcasing a remarkable surge in innovation and adoption. Ripple’s Director Isabel Longhi emphasizes the region’s pivotal role, highlighting how various countries are navigating crypto regulations to encourage growth. Events like Blockchain Rio, which anticipates 20,000 participants, crystallize Latin America’s commitment to shaping the future of finance with blockchain technology and cryptocurrencies. With an impressive 12% of crypto portfolios now holding XRP, the popularity of cryptocurrencies continues to rise, marking significant strides towards broader crypto adoption. Furthermore, initiatives surrounding central bank digital currencies (CBDCs) illustrate the ongoing evolution of financial systems in the region, presenting both challenges and opportunities for stakeholders involved in the cryptocurrency ecosystem.

The cryptocurrency landscape across Latin America is garnering attention as a focal point for financial solutions in the digital age. Recent discussions led by key industry figures underscore the area’s potential for crypto innovation and the regulatory frameworks shaping its future. Notably, Ripple’s involvement in advancing digital currency initiatives reflects a broader trend of embracing technology among Latin American nations. As the dialogue around central bank digital currencies (CBDCs) intensifies, countries are exploring various avenues for financial transformation. By observing growing interest in digital assets and the integration of platforms like XRP, it’s evident that Latin America is at the forefront of the global shift towards a more decentralized financial system.

The Rise of Cryptocurrency Adoption in Latin America

Latin America is experiencing a remarkable surge in cryptocurrency adoption, driven by a multitude of factors including the need for financial inclusion, inflation control, and innovative payment solutions. As populations in countries like Argentina and Venezuela seek alternatives to their traditional monetary systems, cryptocurrencies offer a viable pathway to secure digital transactions. The region’s unique economic challenges create a fertile environment for crypto adoption, bolstering both individual and institutional investments in digital assets.

According to recent studies, the rate of cryptocurrency ownership in Latin America is among the highest in the world, with millions of individuals turning to digital currencies for everyday transactions. Moreover, various local exchanges and platforms facilitate this growing interest, supporting not only the purchase and sale of popular cryptocurrencies like Bitcoin and Ethereum but also creating avenues for the seamless exchange of less-known altcoins such as Ripple’s XRP. This increasing familiarity with crypto technologies signifies a vital shift in the financial landscape of the region.

Ripple’s Role in Shaping Crypto Regulations in Latin America

Ripple has been at the forefront of navigating and influencing the regulatory landscape surrounding cryptocurrencies in Latin America. Director Isabel Longhi has highlighted the company’s commitment to engaging with authorities to foster clearer frameworks that support the growth of crypto ecosystems. As Ripple collaborates with regulators in Brazil, Colombia, and other markets, the dialogue around crypto regulations is becoming more robust, reflecting a shared goal of ensuring that innovation can thrive within a safe and structured environment.

The need for comprehensive crypto regulations is urgent, especially with the rising popularity of digital asset investments. Ripple aims to address critical areas such as stablecoin regulations and the operational standards for virtual asset service providers (VASPs). By providing insights and expertise into payment systems, Ripple not only supports regulatory clarity but also empowers other stakeholders to align with best practices. This proactive approach positions Ripple as a key player in paving the way for responsible crypto adoption across the region.

In addition to immediate regulatory concerns, Ripple is also focusing on how these regulations can adapt to future trends, including the integration of central bank digital currencies (CBDCs). As many countries look towards developing their own digital currencies, Ripple’s input can help align decentralization efforts with regulatory compliance.

Understanding CBDC Initiatives: Challenges and Opportunities

Central bank digital currencies (CBDCs) have emerged as a significant topic in the financial dialogue of Latin America, yet their implementation remains complex and varied across different countries. While some nations like Brazil showcase proactive CBDC initiatives, the overall momentum in Latin America has slowed, leading to discussions around the need for clear strategies and frameworks to guide these developments. The insights shared by Ripple’s Isabel Longhi underscore that while Ripple has positioned itself as a supporter of CBDC initiatives, the current landscape necessitates a reevaluation of priorities in terms of regulatory engagement.

The challenges surrounding CBDC initiatives are multifaceted, involving technological readiness, public acceptance, and the establishment of secure payment infrastructure. Ripple’s expertise in payment systems can play a pivotal role in assisting central banks in designing and implementing these digital currencies. However, as Longhi notes, the subdued progress in some markets reflects broader global hesitance, leaving the door open for innovative solutions that can rekindle interest in CBDC developments.

Ripple’s Partnerships with Local Governments in Latin America

Ripple has cultivated strategic partnerships with various governments across Latin America, facilitating discussions that illuminate the benefits of blockchain technology and cryptocurrencies. By collaborating with Brazilian and Colombian authorities, Ripple not only demonstrates its commitment to local development but also positions itself as a trusted adviser in shaping the future of the region’s financial systems. These partnerships are crucial in fostering mutual understanding and trust between industry leaders and policymakers.

Such collaborations have included discussions on the digital economy, regulatory frameworks, and the vital role of financial technology in improving transaction efficiencies. These initiatives play a significant role in addressing both legislative barriers and public misconceptions about cryptocurrencies, showcasing Ripple’s dedication to both innovation and compliance. As Ripple continues to build these relationships, the potential for creating a more robust and inclusive crypto ecosystem in Latin America becomes increasingly tangible.

The Future of Crypto Portfolios: Trends in Latin America

As cryptocurrency gains traction throughout Latin America, the composition of crypto portfolios is evolving. Recent data indicates that about 12% of all crypto portfolios in the region are now holding XRP, showcasing the asset’s growing popularity as a digital currency alternative. This trend underscores a shift in investor mentality, where diversification into different cryptocurrency assets is seen as a strategic move in adapting to market volatility and seizing new opportunities.

The diversification of crypto portfolios not only encompasses major players like Bitcoin but also includes promising altcoins like XRP. Investors are increasingly recognizing the potential of blockchain technologies and their applications in real-world financial systems. This expanding awareness and acceptance of various digital assets indicate a broader understanding of the cryptocurrency market, where individuals look beyond traditional limits and explore innovative solutions for wealth management.

Ripple’s Innovations and their Impact on the Crypto Ecosystem

Ripple has positioned itself as an innovator in the crypto space through its unique approach to digital transactions. By integrating blockchain technology into existing financial systems, Ripple aims to streamline payment processes, reduce costs, and enhance transaction speeds. This commitment to innovation resonates with many users across Latin America, who seek reliable and efficient alternatives to traditional banking.

Furthermore, Ripple’s technology not only supports cross-border transactions but also encourages the adoption of cryptocurrencies as viable payment solutions. By partnering with local exchanges and financial institutions, Ripple enhances its ecosystem, ensuring users have access to advanced tools that facilitate easier cryptocurrency exchanges and investments. This approach fosters an environment conducive to widespread crypto acceptance and furthers Ripple’s mission to build a more inclusive financial future.

Navigating the Complexities of Latin America’s Crypto Landscape

The complexity of the cryptocurrency landscape in Latin America cannot be understated. Each country presents a unique set of challenges and opportunities influenced by local economic conditions, regulatory environments, and cultural perceptions of digital assets. As Ripple engages with various nations, it is critical to tailor strategies to accommodate these diverse landscapes while advocating for a unified, progressive approach to crypto regulations.

Longhi’s insights reveal that despite differing levels of legal clarity, countries like Brazil and Argentina are leading the way in creating frameworks that promote crypto growth, while others, such as Mexico and Chile, face hurdles that need to be addressed. The conversation surrounding these discrepancies is essential, as it allows stakeholders to identify pathways for collaboration and policy refinement to support enhanced crypto adoption throughout the region.

Educating the Market: Community Engagement and Workshops

To further promote cryptocurrency understanding and adoption, Ripple emphasizes community engagement through educational workshops and outreach programs. By providing resources and knowledge about blockchain technology, digital asset classes, and regulatory matters, Ripple aims to empower individuals and businesses to participate confidently in the crypto market. Engaging directly with communities fosters trust and builds a foundation for responsible investment and active participation.

Additionally, these educational initiatives help demystify the complexities surrounding cryptocurrency and blockchain technology. As more users gain access to information, the potential for broader acceptance increases, and misconceptions can be dispelled. Ripple’s dedicated efforts in this arena contribute to a more informed public, ultimately leading to greater participation in the overall crypto economy.

The Importance of Regulatory Support for Crypto Growth

Regulatory support plays a pivotal role in the sustained growth of the cryptocurrency industry in Latin America. By establishing clear rules and frameworks, governments can unlock the potential of digital currencies while ensuring consumer protection and financial stability. Ripple’s involvement in discussions regarding crypto regulations highlights the importance of collaboration between industry leaders and policymakers to forge an environment where innovation can thrive.

Moreover, regulatory clarity enables businesses to operate with confidence, promoting further investment and technological advancements. Countries that proactively engage with industry stakeholders to refine their legal frameworks are likely to attract more businesses looking to establish a presence in the crypto space. This mutually beneficial relationship ultimately drives adoption and fosters economic development within the region.

Frequently Asked Questions

What is the current state of crypto regulations in Latin America?

Crypto regulations in Latin America are evolving, with countries like Brazil, Argentina, and Colombia leading in establishing frameworks that promote cryptocurrency adoption. However, some nations, such as Mexico and Chile, still lack comprehensive regulations. The ongoing dialogue and regulatory participation from companies like Ripple are key to shaping the future of crypto regulations in the region.

How is Ripple influencing cryptocurrency adoption in Latin America?

Ripple is significantly impacting cryptocurrency adoption in Latin America by engaging with local governments and offering solutions tailored to the region’s needs. With 12% of crypto portfolios in Latin America containing XRP, Ripple’s efforts to navigate crypto regulations and support CBDC initiatives demonstrate the company’s commitment to fostering innovation in the local crypto ecosystem.

What role do CBDC initiatives play in Latin America’s cryptocurrency landscape?

CBDC initiatives are crucial in Latin America’s cryptocurrency landscape, as they represent governments’ efforts to integrate digital assets into the existing financial ecosystem. Despite some slowdown in progress, Ripple remains committed to assisting countries in developing their CBDC projects, underlining the importance of collaboration between public authorities and crypto companies for successful implementation.

What recent trends are shaping cryptocurrency in Latin America?

Recent trends in Latin America show a growing acceptance of cryptocurrency, with increased interest from both individual investors and businesses. The rise in crypto adoption is partly due to strategic partnerships and engagements by companies like Ripple, which aim to enhance crypto regulations and support local economic needs through innovative financial solutions.

Why is Latin America considered a leader in global cryptocurrency dialogue?

Latin America is deemed a leader in global cryptocurrency dialogue due to its proactive approach to engaging in discussions around crypto regulations, CBDC initiatives, and blockchain technology. Ripple’s involvement in these conversations highlights the region’s influence and commitment to shaping the future of digital finance on a global scale.

What percentage of crypto portfolios in Latin America hold XRP?

According to a report from Bitso, a notable cryptocurrency exchange in Latin America, 12% of all crypto portfolios in the region hold XRP. This highlights Ripple’s popularity and the growing relevance of XRP in the local crypto landscape.

How is Ripple adapting to the changing landscape of CBDC initiatives in Latin America?

Ripple is adapting to the changing landscape of CBDC initiatives in Latin America by staying informed about regulatory developments and offering support to governments in their endeavors. While the momentum for CBDC development has decreased, Ripple remains poised to provide assistance whenever possible, reflecting their dedication to aiding financial innovation in the region.

What challenges do countries in Latin America face regarding crypto regulations?

Countries in Latin America face challenges such as inconsistent regulatory frameworks, lack of comprehensive laws, and varying levels of acceptance among government authorities. This creates a complex environment for cryptocurrency adoption, which companies like Ripple aim to navigate by fostering dialogue and offering regulatory expertise.

| Key Point | Details |

|---|---|

| Leadership in Crypto Dialogue | Latin America is viewed as a leader in the global cryptocurrency conversation. |

| Ripple’s Commitment | Ripple is actively engaging with regulatory changes in Latin America, focusing on stablecoins and VASPs. |

| CBDC Developments | The progression of CBDC projects in Latin America is slowing, with Ripple prepared to assist where needed. |

| Market Adoption | 12% of crypto portfolios in Latin America are reported to hold XRP, indicating Ripple’s growing popularity. |

| Regulatory Landscape | Countries like Brazil, Argentina, and Colombia have better crypto regulations, while Mexico and Chile lag behind. |

Summary

Latin America cryptocurrency has emerged as a pivotal force in the global crypto economy. With industry leaders like Ripple actively participating in regulatory discussions and advancements in technology, the region showcases a unique blend of innovation and adoption. Despite some slowdowns in the development of central bank digital currencies, the commitment from key players positions Latin America as a critical player on the world stage. As interest from local markets grows, the potential for cryptocurrency use and regulation in the region continues to evolve, marking an exciting time for cryptocurrency enthusiasts and investors alike.