Bitcoin Derivatives Market: Futures Open Interest Soars

The Bitcoin derivatives market has recently shown remarkable dynamism, marking a pivotal moment in the world of cryptocurrency trading. With Bitcoin futures open interest surpassing $82 billion, traders are keenly engaged in futures trading to harness the potential price movements of this volatile asset. Furthermore, Bitcoin options are gaining traction, demonstrating a slight bullish inclination in the last trading sessions. As traders analyze the fluctuations in Bitcoin’s price, which hovered around $117,860, they are increasingly drawn to the opportunities presented by this expanding market. Notably, the overall activity reflects a growing confidence in Bitcoin’s future, as both institutional and retail investors explore the intricacies of derivatives like futures and options to enhance their trading strategies.

Exploring the realm of digital currency derivatives reveals a complex interplay of market forces that drive Bitcoin valuation. The landscape of Bitcoin contracts—ranging from futures agreements to options strategies—offers investors diverse avenues for risk management and profit potential. As the derivatives sector burgeons, it’s essential to understand metrics like open interest, which hints at the level of market engagement among participants. By delving into these investment vehicles within cryptocurrency markets, traders can navigate the nuances of price speculation and hedge against risk. Ultimately, the evolution of Bitcoin’s options and futures trading underscores the increasing sophistication of market participants as they adapt to changing dynamics.

Analyzing the Bitcoin Derivatives Market Activity

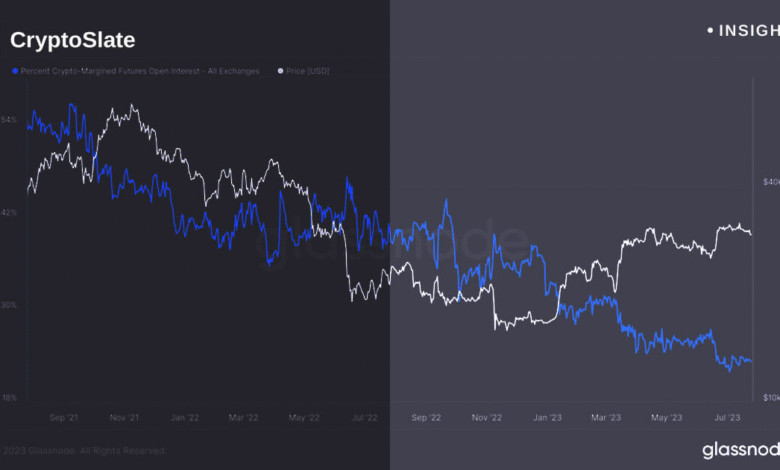

The Bitcoin derivatives market has recently showcased a vibrant landscape, particularly over the weekend, where futures open interest surpassed an impressive $82 billion. This surge is indicative of a growing appetite among traders to engage in futures trading, which has become a pivotal component of cryptocurrency trading strategies. The increase in Bitcoin futures open interest, standing at 699,620 BTC, highlights the significant notional values being leveraged, as traders position themselves based on market trends and price fluctuations.

Investors have certainly taken notice of this bullish momentum, especially as the CME Group emerges as one of the dominating forces in the market with a notable $17.1 billion in open interest. This represents not only a substantial portion of total market positioning but also reflects the trust placed in Bitcoin futures among institutional investors. Consequently, both seasoned traders and newcomers can find opportunities in the growing derivatives market, as evident from the fluctuating prices and increasing open interest figures.

Frequently Asked Questions

What is the current state of the Bitcoin derivatives market?

The Bitcoin derivatives market is currently showing robust activity, with futures open interest exceeding $82 billion. Trends indicate significant participation with a focus on futures trading, where Bitcoin’s futures open interest stands at approximately 699,620 BTC.

How does Bitcoin futures trading impact the derivatives market?

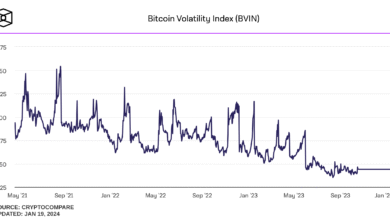

Bitcoin futures trading significantly impacts the derivatives market by increasing open interest and overall trading volume. As active futures contracts grow, like the recent surge, it attracts more institutional and retail traders, contributing to market volatility and price movements.

What role does Bitcoin open interest play in understanding market trends?

Bitcoin open interest reflects the total number of open futures and options contracts. A rising open interest, such as the current $82.44 billion in the futures market, suggests increasing market activity and interest, which often correlates with price trends and trader sentiment.

Which platforms are leading in Bitcoin futures trading?

As of the latest statistics, the CME Group leads in Bitcoin futures trading with an open interest of $17.1 billion, followed by Binance at $15.07 billion and Bybit at $9.66 billion. This dominance indicates their significant role in the Bitcoin derivatives market.

What trends are evident in Bitcoin options trading recently?

In recent trading sessions, Bitcoin options market trends indicate a predominance of call options, with 61.4% of open contracts being calls. Notably, the largest open interest centers around December 2025 contracts, reflecting investor optimism despite a slight bearish turn in recent trading volumes.

How can I engage in Bitcoin futures and options trading effectively?

To engage in Bitcoin futures and options trading effectively, it’s crucial to analyze market trends, monitor open interest, and understand the dynamics between spot prices and derivatives. Utilizing reputable trading platforms and employing sound risk management strategies can enhance your trading outcomes in the Bitcoin derivatives market.

What are the typical risks associated with trading Bitcoin derivatives?

Trading Bitcoin derivatives involves risks such as high volatility, market manipulation, and the potential for significant financial loss. Understanding the underlying assets, maintaining a robust trading strategy, and employing risk management techniques are essential to mitigating these risks.

Why is the Bitcoin derivatives market considered essential for cryptocurrency trading?

The Bitcoin derivatives market is essential for cryptocurrency trading as it provides mechanisms for price discovery, hedging against price movements, and increasing market liquidity. This market helps traders manage risk effectively and allows speculative opportunities in varying market conditions.

| Parameter | Details |

|---|---|

| Futures Open Interest | $82 billion (699,620 BTC) |

| Market Leading Platform | CME Group: $17.1 billion (20.7% of total) |

| Price Range | $116,956 – $118,493 |

| Options Open Interest | 407,278 BTC (61.4% calls, 38.6% puts) |

| Notable Options Position | $140,000 call option, Dec 26 expiry |

| Trading Volume Trend | Slightly bearish; 53.9% puts in last 24h |

| Recent Futures Activity | Gate’s OI +21% in one day; Binance & OKX down |

Summary

The Bitcoin derivatives market is showcasing significant momentum, characterized by strong futures activity and a notable uptick in open interest. With robust participation from both institutional investors and retail traders, this dynamic marketplace is poised for potential long-term growth. The rising futures open interest, coupled with strategic options positioning, underscores a keen interest in Bitcoin as a viable asset class. Overall, market participants are actively exploring opportunities, balancing bullish sentiments with prudent hedging strategies.