Crypto ETFs Experience $73 Million Investor Withdrawals

Crypto ETFs have recently experienced a notable shift as net outflows highlighted potential volatility within the burgeoning digital asset investment landscape. Following a streak of substantial inflows, both bitcoin ETFs and ether ETFs faced withdrawals totaling $73 million, suggesting that institutional investors may be reassessing their strategies amidst fluctuating crypto market trends. This pullback raises questions about the sustainability of the current investment momentum and underscores the importance of monitoring ongoing trends among institutional participants. As these market dynamics unfold, the correlation between investment outflows and the performance of crypto ETFs will be critical for future predictions. Investors and analysts alike are keenly observing these developments as they navigate the complexities of the cryptocurrency market.

In recent months, exchange-traded funds linked to cryptocurrencies have garnered heightened interest, particularly among major investors who seek exposure to digital assets without the need for direct ownership. These funds, which include popular options like bitcoin and ether ETFs, serve as practical financial instruments that allow access to the evolving crypto landscape. Amidst the recent fluctuations in investment activity, observers are analyzing how these trends impact broader market stability and investor sentiment. Understanding the dynamics of institutional involvement can provide insight into the future trajectory of crypto-related investments. As the digital currency ecosystem continues to develop, the role of these exchange-traded products will be pivotal in shaping the investment behaviors of both seasoned and emerging market participants.

Understanding the Recent Decline in Crypto ETFs

The recent downturn in crypto ETFs, particularly Bitcoin and Ether funds, underscores the volatile nature of the cryptocurrency market. After witnessing a significant uptick in investments, the net outflows of $73 million have raised questions among market analysts and investors alike. Such fluctuations often mirror the broader market trends, emphasizing the unpredictability inherent in the crypto space. Even as institutional investors flock to Bitcoin ETFs, as evidenced by Blackrock’s IBIT attracting $114.40 million, individual fund performance can vary widely, leading to substantial outflows in large allocations.

Moreover, the decline is not an isolated event but appears to be part of a larger pattern within the crypto investment landscape. Recent weeks have showcased remarkable inflows into both asset types, yet the swift reversals hint at potential investor sensitivity towards market changes. For instance, while Bitcoin ETFs like Grayscale’s GBTC suffered from significant redemptions, Ether ETFs faced even sharper declines, indicating that investor confidence, particularly among institutional players, may be contingent upon prevailing crypto market trends. Such trends are closely monitored by both novice and seasoned investors as they navigate the evolving investment climate.

Impact of Institutional Investors on ETF Performance

Institutional investors have increasingly become a prominent force in the crypto market, significantly influencing the performance of Bitcoin and Ether ETFs. Their ability to inject substantial capital often leads to bullish trends. For example, the inflow into Blackrock’s IBIT demonstrates how institutional backing can drive demand and bolster overall market confidence. Yet, the recent $73 million withdrawal signals a potential shift in sentiment among these investors. As speculative trading activity rises, institutions might recalibrate their strategies based on perceived risks and overall market stability.

As we observe institutional interest, it’s crucial to recognize the patterns of investment outflows that can stem from broader economic conditions or regulatory announcements. These investors often possess extensive resources and analytical capabilities, allowing them to react swiftly to market indicators. Therefore, significant pullbacks from these funds can indicate broader concerns regarding market sustainability or may be signals of shifting investment strategies aimed at mitigating risks in a particularly volatile environment. This delicate balance continues to shape the dynamics of crypto ETFs and their reputation in the investment community.

The Role of Bitcoin and Ether ETFs in Diversification Strategies

Investors often turn to Bitcoin and Ether ETFs as tools for diversification within their portfolios, aiming to capitalize on potential gains while mitigating risks associated with more volatile cryptocurrencies. The recent cash outlay of $73 million shows that although these funds are designed to attract new investors, fluctuations can also deter them during downturns. Particularly, the performance of Bitcoin ETFs has been pivotal in drawing the interest of traditional institutional investors, primarily due to their relative established presence compared to other altcoins.

Ether ETFs, while enjoying significant inflows in the preceding weeks, have seen a rapid shift in sentiment, leading to greater scrutiny of their viability as a diversification asset. As trading volumes remain robust, the sharp $59 million outflow signifies a critical juncture for investors reconsidering their exposure to crypto markets. Diversification strategies must adapt to such changes, as declines in ETF performance can lead investors to reassess the relationship between their crypto holdings and traditional assets, ultimately impacting long-term investment plans.

Analyzing Crypto Market Trends Over Time

The crypto market is characterized by rapid shifts, and recent trends indicate a cooling period for Bitcoin and Ether ETFs following an impressive streak of inflows. These downturns prompt analysts to explore the underlying factors that may have contributed to investor behavior. Previous weeks showcased historical highs of inflows, creating an illusion of steady growth, yet this week’s sudden $73 million pullback emphasizes the importance of market timing and sentiment analysis for potential investors.

In addition, awareness of historical crypto market trends can aid investors in making informed decisions. Many are closely watching the economics surrounding Bitcoin ETFs, particularly the behaviors of institutional investors who continue to drive substantial capital into this sector. Insights into past performance and current market conditions provide essential context for predicting potential future movements within the realm of crypto ETFs, emphasizing a need for strategic thinking among stakeholders in the crypto market.

The Future of Crypto Investments Amidst Volatility

The future of cryptocurrency investments hangs in a delicate balance as volatility defines the market landscape. Recent data indicating net outflows from Bitcoin and Ether ETFs might not just be a fleeting reaction but a reflection of investor sentiment and a cautious approach following significant gains. The evolving climate of the crypto market calls for a deeper understanding of how trends can shift and influence ongoing investment decisions. Investors are now more than ever scrutinizing the movements of institutional players who have the power to substantially impact market stability.

As the cryptocurrency environment continues to mature, the focus on stable investment strategies becomes paramount. This landscape requires investors to be agile and informed, responding to potential shifts in market dynamics. Understanding the forces driving investment outflows and the reactions of institutional players will be crucial going forward, as the influence of Bitcoin and Ether ETFs as mainstay investment vehicles solidifies in the finance world.

Exploring Long-Term Investment Horizons in Crypto ETFs

Investing in Bitcoin and Ether ETFs can present unique long-term opportunities for those looking to incorporate cryptocurrencies into their portfolios. As the market evolves, adaptation to market fluctuations becomes essential, especially in light of recent outflows totaling $73 million. While immediate reactions driven by day-to-day trading might deter some investors, those who maintain a long-term perspective can uncover substantial value in these ETFs, especially as the broader acceptance of cryptocurrencies grows among institutional investors.

Long-term investment horizons mean looking beyond short-term volatility to recognize potential future price appreciations. The backing of ETFs by institutional giants, like Blackrock, provides a foundation for stability in an ever-changing environment. This focus on sustained growth brings a new cohort of investors into the fray—those who are willing to withstand minor market dislocations in pursuit of greater returns. The pivotal role that Bitcoin and Ether ETFs play in shifting investment behaviors cannot be overstated as they increasingly establish their place in diversified portfolios.

Monitoring Investor Sentiment in Crypto Markets

Understanding investor sentiment is crucial in navigating the choppy waters of crypto ETFs, especially given the recent $73 million outflow. The emotional and psychological elements influencing an investor’s decision-making pattern often lead to significant market movements. Whether driven by news events or broader economic climates, recognizing these sentiment trends can help investors preemptively adjust their strategies to maintain stability in their portfolios.

In particular, the dynamics surrounding institutional investors lend weight to these sentiment shifts, as their large positions can sway market trends dramatically. The recent performance of Bitcoin and Ether ETFs illustrates how sentiment can rapidly swing from bullish to bearish depending on underlying factors like regulatory changes or macroeconomic indicators. Investors who are aware of these shifts can leverage that understanding to optimize their engagement with crypto markets, positioning themselves for long-term growth amidst short-term challenges.

Evaluating the Performance of Individual Crypto Funds

The evaluation of individual crypto funds, especially Bitcoin and Ether ETFs, is vital as investors seek to understand where their capital is best allocated. Not all ETFs perform equally, as evidenced by the contrasting fate of Grayscale’s GBTC and Blackrock’s IBIT. The recent outflows denote not just market trends but individual fund performance, raising critical questions for those inclined to invest in cryptocurrency-related financial products.

As investors develop their strategies, dissecting the underpinnings of each fund’s investments and redemption patterns can reveal opportunities for optimization. While institutional inflows can buoy certain funds, the risk of significant redemptions can also highlight the importance of thorough analytical observations on a fund’s sustainability and investor sentiment. Therefore, staying informed about the performance metrics and market-driven factors affecting these funds will equip investors to manage their portfolios more strategically.

The Relationship Between ETFs and Broader Market Dynamics

The interconnectedness of crypto ETFs with broader market dynamics cannot be overstated, particularly when analyzing the observed $73 million withdrawal from these assets. Market changes are often mirrored in ETF performance, prompting investors to reassess their positions in light of fluctuating sentiment and market behavior. The correlation between investor decisions in traditional and crypto markets further underscores this relationship and demonstrates how external influences can broadly impact ETF stability.

Understanding this relationship requires close observation of trends across both Bitcoin and Ether ETFs, as well as the overall crypto investment atmosphere. The recent pullback in funding signifies an opportunity for investors to recalibrate their strategies based on comprehensive market analyses, allowing them to navigate effectively through the crypto terrain. Hence, as market dynamics continue to evolve, the ETF landscape will serve as a crucial indicator of investor confidence and market health.

Frequently Asked Questions

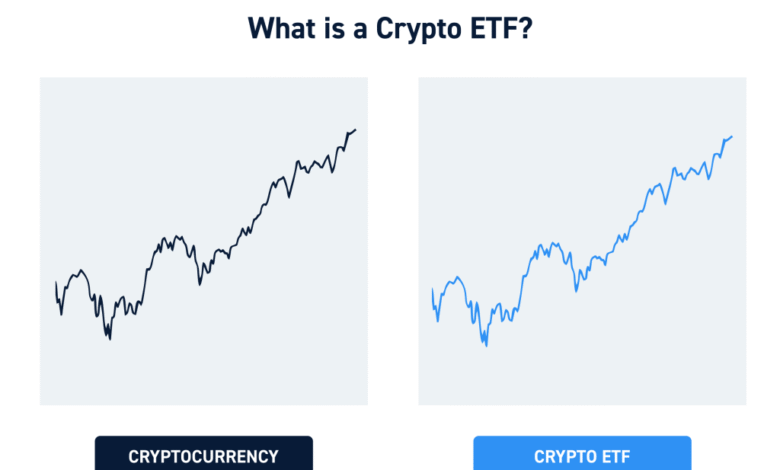

What are Crypto ETFs and how do they work?

Crypto ETFs, or cryptocurrency exchange-traded funds, allow investors to gain exposure to cryptocurrencies like Bitcoin and Ether without having to buy the assets directly. They pool investor capital to track the performance of specific cryptocurrencies, making it easier for both institutional investors and retail investors to invest in the crypto market.

Why did Bitcoin ETFs experience significant outflows recently?

Recently, Bitcoin ETFs saw significant outflows totaling $14 million due to a combination of profit-taking by investors and market volatility. After a strong period of inflows, including notable investments in Blackrock’s IBIT, the market’s cooling off led to redemptions, which impacted total net assets.

What influenced the recent performance of Ether ETFs?

The recent performance of Ether ETFs was influenced by a mix of heavy inflows earlier in the week balanced by substantial outflows totaling $59 million, primarily from funds like Fidelity’s FETH and Grayscale’s ETHE. This volatility highlights the impact of institutional investors and market trends on ether ETF performance.

How do investment outflows affect the crypto ETF market?

Investment outflows can signify shifting market sentiment and often lead to reduced asset values and trading volumes in crypto ETFs. The recent outflows from Bitcoin and Ether ETFs suggest a momentary cooling off, affecting investor confidence and potential future inflow trends.

What role do institutional investors play in the Crypto ETF landscape?

Institutional investors have been pivotal in driving growth in the Crypto ETF landscape. Their large investments in funds like Blackrock’s IBIT for Bitcoin and ETHA for Ether have significantly impacted overall flows; however, their trading strategies often result in notable outflows during market corrections.

Are Crypto ETFs a good investment option compared to direct cryptocurrency purchases?

Crypto ETFs can be a suitable investment option for those looking for easier access and diversified exposure to cryptocurrencies like Bitcoin and Ether without directly managing digital wallets. They are regulated and can provide a safer entry point, especially for institutional investors wary of the complexities of direct crypto investments.

What are the risks associated with investing in Crypto ETFs?

Investing in Crypto ETFs carries risks, including market volatility, regulatory changes, and the risks tied to the underlying cryptocurrencies. While they offer easier access and less direct involvement with digital wallets, fluctuations in the crypto markets can still lead to substantial losses similar to direct cryptocurrency investments.

| Key Point | Details |

|---|---|

| General Overview | Investors withdrew a total of $73 million from Bitcoin and Ether ETFs, marking a downturn after a period of inflows. |

| Bitcoin ETFs Performance | Bitcoin ETFs experienced a net outflow of $14 million, dropping from $114.40 million in prior inflows. |

| Investors in Bitcoin ETFs | Blackrock’s IBIT remained popular, but Grayscale’s GBTC and Ark 21Shares’ ARKB saw significant outflows. |

| Ether ETFs Performance | Ether ETFs suffered a larger downturn with a net outflow of $59 million despite initial strong inflows this week. |

| Factors in Ether ETF Decline | Heavy redemptions from Fidelity’s FETH and Grayscale’s ETHE were key contributors to the losses. |

| Current Trading Volume | Trading volumes remained high at $3.28 billion for Bitcoin ETFs and $3.54 billion for Ether ETFs despite outflows. |

| Market Outlook | The future trend for crypto ETFs remains uncertain as analysts await further market developments. |

Summary

Crypto ETFs have recently faced significant withdrawals, totaling $73 million, as both Bitcoin and Ether funds reported net outflows. While there was a brief period of strong inflows, this downturn raises crucial questions about the sustainability of investor interest in these funds. As the market adjusts, observing how these assets will perform in the coming weeks will be essential for understanding the future of Crypto ETFs.