Bitcoin Price Prediction: Could It Reach $150,000 Soon?

Bitcoin price prediction has been a hot topic among investors and analysts alike, especially as exciting developments unfold in the cryptocurrency market. According to industry experts, Bitcoin could surge to $150,000 before experiencing a correction, driven by significant Bitcoin ETF inflows that are projected to exceed $1 billion weekly. This potential growth aligns with rising Bitcoin institutional adoption, where major asset managers have amassed over 5 million BTC, marking a notable shift in investment trends. However, as the crypto market remains volatile, it’s essential to understand the implications of a bear market and the risks associated with such skyrocketing valuations. As we delve into price forecasts and market dynamics, the factors influencing these Bitcoin investment trends will become increasingly clear.

The forecast for the price of Bitcoin has captured the attention of market participants, particularly with the looming possibility of crossing the $150,000 threshold. Recent discussions highlight the intricacies surrounding cryptocurrency investments, referencing significant inflows into Bitcoin exchange-traded funds (ETFs) and a notable shift toward Bitcoin’s acceptance among institutional investors. As these changes unfold, understanding the risks associated with a potential downturn in the market becomes crucial, especially considering historical patterns of corrections that often follow price surges. Industry analysts are closely monitoring these dynamics, noting the influence of macroeconomic factors and regulatory developments on future Bitcoin valuations. Ultimately, the conversation about Bitcoin and its future trajectory involves a comprehensive look at emerging investment behaviors and market trends.

Bitcoin Price Prediction: Insights from Industry Experts

Steven McClurg, CEO of Canary Capital, recently provided a compelling Bitcoin price prediction, suggesting that the cryptocurrency could surge to as high as $150,000 by late 2025. This optimistic outlook is underpinned by several factors, including a significant uptick in Bitcoin ETF inflows, which are projected to reach unprecedented levels exceeding $1 billion weekly. Such inflows are indicative of growing institutional adoption as major investment firms begin to recognize Bitcoin as a legitimate asset class. This trend not only supports Bitcoin’s price trajectory but also highlights a shift in investment strategies among institutions looking to diversify their portfolios.

However, while the near-term outlook may appear promising, McClurg warns that the market should be prepared for a correction following this influx of capital. Historically, Bitcoin has seen substantial price appreciation—averaging around 300% from mid-cycle lows—before entering correction phases. Therefore, investors should be cautious of a potential 30-40% drawdown once the $150,000 mark is breached, especially if regulatory scrutiny intensifies or if geopolitical tensions arise that could destabilize the financial landscape.

The Role of Bitcoin ETF Inflows in Price Dynamics

The impact of Bitcoin ETF inflows on price dynamics cannot be overstated, as they represent a critical indicator of institutional interest in the cryptocurrency. With estimates suggesting these inflows could surpass $1 billion weekly, the liquidity provided by ETFs enables wider access for institutional and retail investors alike. Analysts believe that this pattern will likely push Bitcoin prices higher, facilitating greater market participation and buying pressure. Additionally, as more asset managers begin to engage in Bitcoin investments, the cumulative demand could foster an environment ripe for price surges.

Moreover, the sustained interest in Bitcoin ETFs has broader implications for the cryptocurrency market as a whole. As institutional adoption deepens, it creates a feedback loop where increased investment leads to higher prices, which in turn attracts more investors. This cycle could be pivotal in transitioning Bitcoin from its perceived status as a speculative asset to one viewed as a standard component of institutional portfolios, making Bitcoin more resilient against future market corrections.

Institutional Adoption: Transforming Bitcoin’s Future

Institutional adoption of Bitcoin has been a significant driver of its market trajectory in recent years. Major asset managers collectively holding over 5 million BTC is a testament to changing perceptions within the financial sector. This shift towards incorporating Bitcoin into investment strategies has not only bolstered confidence around the cryptocurrency but has also laid the groundwork for its mainstream acceptance. With institutions now viewing Bitcoin as a hedge against inflation and a viable alternative to traditional assets, the potential for further price increases becomes more pronounced.

As institutional players continue to embrace Bitcoin, we can expect to see a ripple effect across the entire landscape of cryptocurrency investment. Increased participation by large investors tends to stabilize prices in the long term, reducing volatility often associated with retail trading. Consequently, as institutional infrastructure grows—through instruments like Bitcoin ETFs and custodial services—Bitcoin is poised for greater legitimacy and stability in the market, further attracting a diverse range of investors and potentially setting new all-time highs.

Navigating the Bitcoin Bear Market: Strategies for Investors

Understanding how to navigate the Bitcoin bear market is essential for any investor looking to thrive in the cryptocurrency landscape. Historically, Bitcoin has faced several bear markets characterized by significant price corrections after hitting all-time highs. For instance, after prior surges, Bitcoin typically retracts sharply, creating opportunities for savvy investors to acquire assets at reduced prices. Developing a clear strategy for buying during downturns could make a substantial difference for investors willing to adopt a long-term perspective.

It is also crucial for investors to remain informed about market dynamics and potential triggers for bear markets, such as increased regulation or macroeconomic factors like inflation. By staying attuned to these elements, investors can better prepare themselves for potential drawdowns and make informed decisions on when to enter or exit positions. Thus, while the outlook for Bitcoin’s price might be bullish in the short term, having a plan to navigate periods of market contraction will be vital for ensuring long-term success.

Potential Risks: Regulatory Challenges and Market Corrections

While the future of Bitcoin remains optimistic, it is crucial to acknowledge the potential risks associated with regulatory challenges and market corrections. As more institutions adopt Bitcoin, regulatory bodies are likely to scrutinize these investments more intensively. Increased regulation could create uncertainty that may negatively impact Bitcoin prices, especially if new policies are perceived as restrictive or detrimental to market growth. Investors must stay vigilant and informed about these developments to mitigate potential risks to their portfolios.

Additionally, historical trends indicate that after reaching peak prices—such as speculative forecasts of $150,000—Bitcoin often undergoes significant corrections, sometimes as much as 30-40%. These corrections serve as reminders that while Bitcoin has substantial growth potential, it is equally volatile. Therefore, understanding the inherent risks in high-stakes investment is essential. By employing risk management strategies and keeping a watchful eye on both market and regulatory developments, investors can contribute to their financial stability amid fluctuating conditions.

Bitcoin Investment Trends: What to Watch

As the Bitcoin landscape continues to evolve, staying abreast of the latest investment trends is vital for investors looking to capitalize on opportunities. Trends such as increasing institutional investment, the emergence of Bitcoin ETFs, and academic research into the cryptocurrency’s viability are important markers to watch. The shift towards digital assets like Bitcoin is indicative of broader financial market trends where traditional assets are complemented by innovative investment vehicles, undermining long-held beliefs about asset categorization.

Moreover, observing peak periods of Bitcoin’s valuation gives insight into broader economic conditions. Investors should pay attention to various factors influencing market cycles, such as technological advancements, regulatory changes, and macroeconomic variables. Recognizing these patterns can help investors position themselves advantageously in anticipation of shifts in Bitcoin’s price trajectory, thereby optimizing their investment returns during different phases of the market.

The Merging Paths of Bitcoin and Traditional Finance

As Bitcoin gains traction within traditional financial frameworks, the convergence of these two worlds represents a pivotal moment for the cryptocurrency. A notable aspect of this merger is the increasing acceptance of Bitcoin as an alternative asset class by institutional investors. Consequently, tax incentives or regulated Bitcoin investment products are seeing greater interest. This growing harmonization hints at a broader acknowledgment of Bitcoin within the global finance system, potentially altering how assets are viewed and handled.

Furthermore, as financial institutions build on their Bitcoin offerings—such as custodial services and trading solutions—it reflects increasing confidence in the cryptocurrency’s legitimacy as a long-term investment. This relationship is set to redefine asset allocation strategies for not only individual investors but also for entire funds, as a new environment increasingly acknowledges and incorporates Bitcoin into their models. It is an exciting development that could pave the way for further price appreciation and acceptance within the financial industry.

Analyzing Bitcoin Market Cycles: Key Indicators

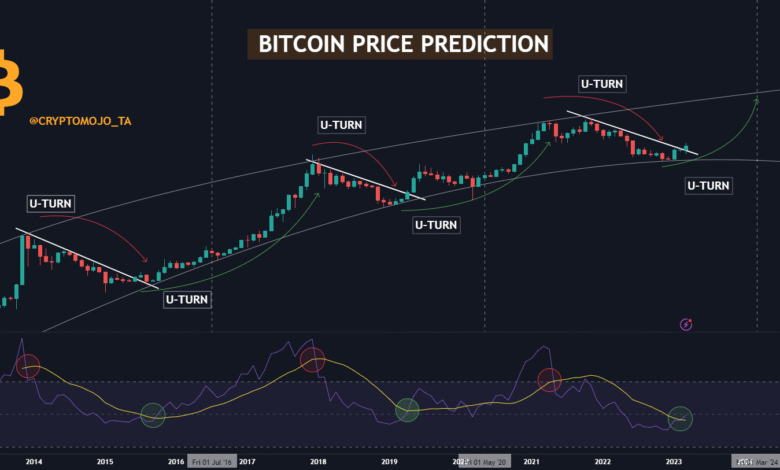

Analyzing Bitcoin market cycles is crucial for understanding price movements and making informed investment decisions. Historically, Bitcoin has exhibited cyclical behavior characterized by rapid price increases followed by significant corrections. Key indicators to consider during these cycles include trading volume, market sentiment, and ETF inflows, all of which can provide insights into the current health of the market. For instance, heightened trading volumes often signal growing interest from investors, while increased ETF inflows can highlight institutional participation, both of which are critical indicators of price momentum.

Investors should also pay attention to macroeconomic indicators, such as inflation rates and monetary policy changes, which play a substantial role in Bitcoin’s valuation. In times of uncertainty, Bitcoin often serves as a hedge against inflation, drawing in wary investors seeking stable value. By employing analytical tools to assess these factors, investors can better navigate the unpredictability of Bitcoin’s market cycles, enhancing their chances of maximizing gains while minimizing risks during potential downturns.

The Future of Bitcoin: Long-Term Versus Short-Term Investment

The future of Bitcoin is often viewed through two distinct lenses: long-term versus short-term investment strategies. Long-term investors tend to focus on the significant growth potential Bitcoin has historically exhibited, particularly through market cycles. With forecasts suggesting Bitcoin may reach $150,000, many advocates argue that holding onto Bitcoin for extended periods will yield impressive returns as adoption continues to increase and regulatory acceptance solidifies.

Conversely, short-term traders may capitalize on Bitcoin’s volatility to make quick profits, entering and exiting positions based on market momentum. This trading style demands a keen awareness of market signals and trends, often relying heavily on technical analysis. Both strategies illustrate the diverse nature of Bitcoin investments and highlight the importance of aligning one’s investment approach with personal financial goals and risk tolerance.

Frequently Asked Questions

What are the factors influencing Bitcoin price prediction for reaching $150,000?

Several factors are at play in predicting Bitcoin’s price trajectory towards $150,000. Key influences include significant Bitcoin ETF inflows, which are anticipated to surpass $1 billion weekly, a stable outlook from the Federal Reserve amid inflation concerns, and an increase in Bitcoin institutional adoption. Furthermore, historical data suggests that Bitcoin tends to appreciate around 300% from its mid-cycle lows before facing market corrections, making $150,000 a plausible target in the coming years.

How do Bitcoin ETF inflows impact Bitcoin price prediction?

Bitcoin ETF inflows significantly impact Bitcoin price prediction by increasing market demand for the cryptocurrency. With the expectation that inflows could exceed $1 billion weekly, this influx of capital contributes to upward pressure on prices. Institutional investment through ETFs not only boosts liquidity but also enhances Bitcoin’s legitimacy, suggesting that continued growth in ETF interest may play a pivotal role in driving Bitcoin toward the predicted $150,000 mark.

What role does Bitcoin institutional adoption play in price prediction?

Bitcoin institutional adoption is a crucial driver behind price predictions. As major asset managers collectively hold over 5 million BTC, this reflects growing confidence and acceptance of Bitcoin as an investable asset. Increased institutional participation often leads to higher price valuations, supporting projections like that of reaching $150,000 before a potential bear market.

What does the $150,000 Bitcoin target indicate about future market trends?

The $150,000 Bitcoin target suggests a strong bullish sentiment in the market, indicating that sustained Bitcoin ETF inflows and increasing institutional adoption could push prices significantly higher. Analysts, including Steven McClurg, believe that this level could be achieved before a bear market begins, postulating that historical trends would likely lead to a price correction of 30-40% following such a peak.

Is there a risk of a Bitcoin bear market after reaching $150,000?

Yes, there is a risk of a Bitcoin bear market following a rise to $150,000. Historical trends indicate that once significant price milestones are reached, such as this target, corrections can occur, potentially leading to a drawdown of 30-40%. Factors such as regulatory challenges and geopolitical unrest could also exacerbate this risk, making it essential for investors to stay informed and cautious.

What are the expectations for Bitcoin price trends in the next few years?

Expectations for Bitcoin price trends over the next few years are optimistic, with predictions indicating a potential peak of $150,000 around late 2025. This projection is based on sustained Bitcoin ETF inflows, increased institutional adoption, and the historical performance of Bitcoin, which has previously shown significant growth. However, investors should also be prepared for market corrections that could follow such peaks, in line with past trends.

| Key Factors | Details |

|---|---|

| Price Target | $150,000 before a bear market |

| Expert Opinion | Steven McClurg, CEO of Canary Capital |

| Market Influences | Sustained inflows into Bitcoin ETFs and dovish Fed outlook |

| Institutional Adoption | Major asset managers hold over 5 million BTC |

| Valuation Frameworks | Stock-to-flow and Metcalfe’s Law |

| Projected Peak | Late 2025 |

| Typical Price Appreciation | Approx. 300% from mid-cycle lows |

| Expected Correction | 30–40% drawdown in early 2026 |

| Risks | Regulatory challenges and geopolitical unrest |

Summary

Bitcoin price prediction indicates a promising outlook as experts anticipate a potential peak of $150,000 before entering a bear market. Steven McClurg of Canary Capital credits this prediction to significant factors including strong institutional adoption, steady inflows into Bitcoin ETFs, and economic policies from the Federal Reserve. However, investors should remain cautious, as historical trends suggest a significant correction could follow, particularly as we approach 2026, influenced by market dynamics and external risks.