Bitcoin Q4 Performance: Historical Trends Predict Gains

Bitcoin Q4 performance has historically shown remarkable strength, hinting at a potentially lucrative finish for investors as 2025 approaches. Historically, the last quarter of the year often rewards strategic investors with significant returns, as evidenced by the cryptocurrency’s robust quarterly returns in the past. The patterns observed in Bitcoin history reveal that November and December frequently deliver the highest gains, making these months critical for any Bitcoin investment strategy. As market trends shift, keen observers of Bitcoin trends 2025 may find opportunities to capitalize on this seasonal momentum. With insights gathered from cryptocurrency market analysis, it becomes clear that the final stretch of 2025 could bring substantial profits for those who strategically navigate the volatile landscape of Bitcoin.

When examining the performance of Bitcoin in the last quarter, one cannot ignore the compelling indicators that suggest a strong upward trajectory. The concluding months of the year are traditionally viewed by investors as prime opportunities to benefit from Bitcoin’s bullish tendencies. As we explore the historical returns of Bitcoin, it becomes apparent that this digital asset has a tendency to surge during the final quarter, with data reflecting consistent upward trends. As we look ahead to 2025, a thorough investigation into Bitcoin’s behavior during Q4 can provide valuable insights for both novices and seasoned investors alike. Thus, understanding these dynamics is essential for anyone looking to maximize their engagement with Bitcoin in the ever-evolving cryptocurrency landscape.

Understanding Bitcoin’s Historical Performance

The history of Bitcoin’s performance reveals intriguing patterns, particularly when examining its quarterly returns. Over the years, Bitcoin has established a reputation for volatility, but its past also shows remarkable resilience, especially during the year’s final months. Historically, as we approach Q4, there is a noticeable upward trend. Investors often look to these patterns to formulate their Bitcoin investment strategies, relying on data to forecast future performance.

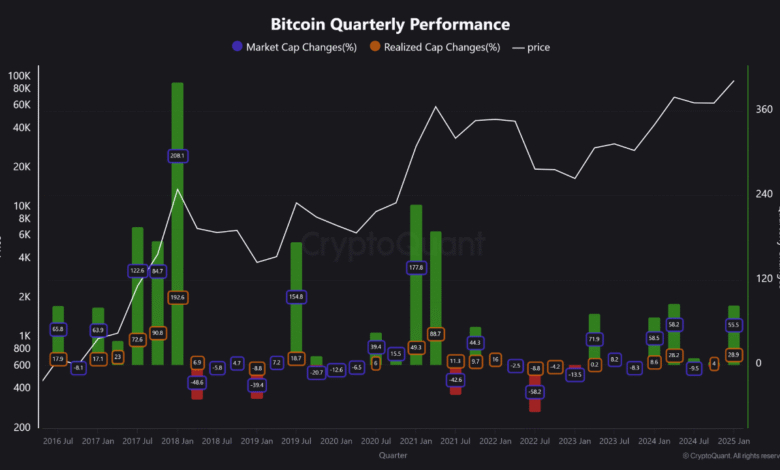

For instance, between 2013 and 2020, the Bitcoin price surged dramatically in the last quarter of the year. In 2017, Bitcoin grew by a staggering 215%, while 2020 saw a robust increase of 168%. These trends indicate that while Bitcoin’s price can fluctuate wildly, the fourth quarter often emerges as a phase of recovery and growth. Investors keeping a close watch on Bitcoin trends for 2025 will find themselves contemplating how historical performance may influence future investment decisions.

Bitcoin Q4 Performance: A Closer Look

Examining Bitcoin’s performance in Q4 over the years reveals a strong track record, with notable gains achieved in many instances. On average, Bitcoin has managed to deliver an impressive 85% return in Q4, with a median return of 52.31%. This data is crucial for investors and analysts alike, signaling a potential increase in Bitcoin’s value as the year concludes. Notably, November is often seen as a particularly favorable month, averaging returns of 46%.

The combination of historical data, coupled with current market trends, hints at the possibility of Q4 2025 following suit. As Bitcoin consolidates in the preceding months, observers hypothesize that the market might set the stage for a significant rally later in the year. Understanding the intricacies of Bitcoin’s seasonal tendencies will be essential for those looking to capitalize on potential gains during Q4.

The Role of Bitcoin Trends for 2025

Forecasting the landscape of Bitcoin for 2025 requires a keen understanding of its historical trends and the factors influencing market behavior. Analysts are increasingly focused on how Bitcoin’s established patterns can provide insights into future performance. Recent predictions suggest a conducive environment for Bitcoin’s price, especially considering its past performance in the last quarter of various years. Investors are looking to align their strategies with these emerging trends to maximize returns.

Moreover, as we approach the end of 2025, it’s essential to consider broader cryptocurrency market insights alongside individual assets. Factors such as regulatory changes, macroeconomic conditions, and technological advancements in blockchain can all contribute to the volatility and growth potential of Bitcoin. By integrating this understanding with historical data, investors can formulate comprehensive strategies that encompass risk management while aiming for substantial returns.

Investment Strategies for Bitcoin in Q4

Crafting a successful investment strategy for Q4 involves leveraging Bitcoin’s historical performance and current market conditions. Given its track record of strong returns towards the year’s end, investors should consider positioning their portfolios to capitalize on potential price increases. Diversification is key; by investing in a mix of proven cryptocurrencies like Bitcoin and emergent market innovations, investors can mitigate risks while taking advantage of bullish trends.

Additionally, monitoring market signals over the months leading up to Q4 can provide insight into Bitcoin’s trajectory. Tools such as market sentiment analysis, technical indicators, and macroeconomic data should inform decision-making processes. Investors may also wish to engage in dollar-cost averaging during volatile periods, allowing them to build their positions gradually and with less risk.

Bitcoin Quarterly Returns: What to Expect

Bitcoin’s quarterly returns have long fascinated both seasoned investors and newcomers alike. With Q3 of 2025 showing promising signs, observers are curious about how past performances will influence the upcoming quarter. Historical trends suggest that the transition into Q4 is often marked by upward momentum, derived from various market factors such as increased institutional investments and heightened public interest in cryptocurrency.

Understanding quarterly returns is not just about looking back; it’s also about analyzing present conditions. Current statistics indicate that Q3 has already demonstrated positive performance, with Bitcoin gaining over 10% this quarter. As we transition into Q4, investors are hopeful that this trend will persist, reflecting a typical pattern of growth as the year draws to a close.

The Influence of Market Sentiment on Bitcoin

Market sentiment significantly shapes Bitcoin’s price dynamics, particularly as we approach crucial quarters like Q4. Investor sentiment can drive buying or selling pressure, influencing whether Bitcoin adheres to its historical performance trends. For instance, positive news and bullish projections can encourage buying activity, pushing prices higher as the final months of the year unfold.

Furthermore, understanding market sentiment requires awareness of broader economic indicators. Events such as regulatory announcements or technological breakthroughs in blockchain can sway public opinion and ultimately affect Bitcoin’s price trajectory. Investors who keenly monitor these factors may find opportunities to optimize their investment strategies, aligning with shifts in sentiment as they navigate Bitcoin’s quarterly returns.

Comparing Bitcoin with Other Cryptocurrencies

While Bitcoin remains the flagship cryptocurrency, analyzing its performance in the context of other digital assets can provide valuable insights. Observing how Bitcoin’s Q4 performance compares with altcoins may reveal opportunities for diversification and strategic investing. Historically, Bitcoin often leads the market, establishing trends that other cryptocurrencies tend to follow.

Diving deeper into correlation analysis can help investors forecast potential movements within the cryptocurrency space. For instance, during robust bull markets, altcoins frequently experience accelerated growth as investor confidence in cryptocurrencies swells. By observing these correlations, investors can optimize their strategies and leverage Bitcoin’s historical context to achieve more favorable investment outcomes.

Understanding Crypto Market Volatility

Volatility is synonymous with the cryptocurrency market, and understanding its patterns is crucial for effective investment strategies. Bitcoin, like many cryptocurrencies, exhibits periods of significant price fluctuations, particularly during pivotal quarters such as Q4. Investors must consider how market sentiment, global regulatory developments, and macroeconomic variables can influence these volatility periods.

Being aware of volatility’s implications can guide investors in sound decision-making. Utilizing risk management techniques and remaining adaptable in strategy execution are pivotal in maximizing gains during uncertain times. As Bitcoin’s historical performances suggest, embracing volatility while strategically navigating market conditions can lead to profitable investment scenarios, especially as we approach the historically strong Q4.

Long-Term Insights into Bitcoin Trends

Long-term insights into Bitcoin trends are vital for shaping future expectations surrounding the cryptocurrency. Bitcoin’s historical trajectory has proven that, despite moments of extreme volatility, it can yield substantial returns over time. Understanding these long-term trends allows investors to better position themselves for future profits, especially during established growth periods such as Q4.

Investors should also consider the broader implications of technology and innovation in the cryptocurrency landscape. As new solutions emerge, they can impact Bitcoin’s market positioning and overall performance. By combining historical data analysis with an awareness of technological advancements, investors can establish a forward-looking Bitcoin investment strategy that maximizes potential returns and capitalizes on bullish trends.

Frequently Asked Questions

What is the historical performance of Bitcoin in Q4?

Bitcoin Q4 performance has historically been strong, with the cryptocurrency finishing in the green during eight out of the last twelve years. The average return for Bitcoin in the fourth quarter is 85%, and notable years like 2017 saw returns as high as 215%.

How do Bitcoin quarterly returns impact investment strategies?

Understanding Bitcoin quarterly returns is crucial for formulating an effective Bitcoin investment strategy. Historical data shows that Q4 tends to yield higher returns, suggesting that investors may benefit from holding their positions through the end of the year to capitalize on potential gains.

What trends should investors consider for Bitcoin in Q4 2025?

Investors should closely monitor Bitcoin Q4 performance trends as they have typically delivered strong results, particularly in November and December. With recent consolidation, many believe Bitcoin could rally similar to past years, suggesting bullish prospects for late 2025.

Can we expect Bitcoin to follow historical trends in Q4 2025?

While past trends in Bitcoin Q4 performance suggest potential for significant gains, there are no guarantees. Historical averages indicate robust returns, but bitcoin’s performance will depend on market conditions and investor sentiment leading into the last quarter of 2025.

What are the best months for Bitcoin based on historical data?

November and December have been historically significant for Bitcoin, typically yielding high returns, with averages around 46% and 4.7% respectively. This trend supports strong Bitcoin Q4 performance, making these months critical for potential investment decisions.

Are there any factors influencing Bitcoin’s Q4 performance for 2025?

Several factors may influence Bitcoin’s Q4 performance in 2025, including market sentiment, regulatory developments, and macroeconomic conditions. Historically, factors such as previous quarter performance and investor behavior around year-end have also played a substantial role.

How do Bitcoin trends in 2025 compare to past years?

Bitcoin trends in 2025 show mixed performance thus far, but historical Q4 patterns suggest a stronger finish. Given past quarterly returns, particularly during bull markets, 2025 could mirror earlier years with significant year-end gains if trends hold.

What potential challenges could Bitcoin face in Q4 2025?

Despite strong historical performance, Bitcoin could face challenges in Q4 2025 from market volatility, regulatory changes, and broader economic factors. Investors should remain cautious and aware of external influences that may impact Bitcoin’s Q4 performance.

| Key Point | Details |

|---|---|

| Bitcoin’s Q4 Performance History | Historically, Bitcoin has finished Q4 positively in 8 of the last 12 years, with an average return of 85%. |

| Recent Performance into 2025 | Bitcoin has had mixed performance in 2025, with a notable 9.29% gain in January followed by a decline in February. |

| Q3 2025 Performance | Currently up over 10% for Q3, with a volatile history but showing potential for modest gains. |

| Monthly Trends | November and December have historically shown strong returns, with November averaging 46% gains. |

Summary

Bitcoin’s Q4 performance has historically shown strong growth, indicating a promising end to the year. Analyzing previous trends suggests that if past patterns hold true, Bitcoin could achieve substantial gains in the last quarter of 2025. Overall, while the past does not predict future outcomes, the statistical evidence points toward a favorable fourth quarter for Bitcoin enthusiasts.