LNG Investments by Big Oil: A Risky Gamble Ahead

In a bold strategic move, major players in the oil industry are ramping up investments in liquefied natural gas (LNG), brushing aside forecasts predicting peak gas demand in the near future. These oil companies are seizing the opportunity to enhance their portfolios and meet the growing global thirst for this cleaner-burning fossil fuel. With energy transition taking center stage in discussions around climate change, the LNG market is being scrutinized by analysts who voice concerns about its sustainability and environmental impact. As the LNG market forecast becomes increasingly crucial to shaping the energy landscape, big oil firms like Shell and TotalEnergies are positioning themselves as leaders in this sector. Yet, this aggressive approach raises questions about the longevity of LNG as a viable energy source amidst looming peak gas predictions and the rapid shift towards renewable energy.

As the energy sector evolves, traditional fossil fuel giants are turning their sights towards the burgeoning field of super-cooled hydrocarbons, often referred to as LNG investments by Big Oil. This shift symbolizes a pivotal moment in the global energy landscape, where the interplay between fossil fuels and cleaner energies draws significant attention. The drive for greater diversity in energy portfolios is evident as oil corporations navigate the complexities of the energy transition. With increasing chatter regarding gas supply dynamics and market stability, the future of liquefied natural gas appears more critical than ever. The collision of peak gas forecasts and the demand urge for cleaner alternatives presents a unique challenge and opportunity for the oil industry amidst the wider energy transformation.

The Growing Significance of LNG in Big Oil’s Strategy

In the evolving landscape of energy, liquefied natural gas (LNG) is rapidly becoming a cornerstone of Big Oil’s strategic investments. Major oil companies, including Shell and TotalEnergies, have recognized the growing global demand for LNG as a critical opportunity to diversify their portfolios. This shift can be attributed to LNG’s flexibility and its perceived role as a cleaner alternative to traditional fossil fuels like coal and oil during the current energy transition. With the global LNG market forecast projected to rise significantly, oil companies are betting that their investments will yield returns in an increasingly competitive energy environment.

Despite the optimistic outlook for LNG, industry analysts note the inherent risks involved. The International Energy Agency (IEA) has issued warnings about the potential for natural gas demand to plateau by the end of the decade. Many experts argue that while LNG presents a viable short-term solution to energy needs, reliance on this fossil fuel may conflict with long-term sustainability goals. The increasing emphasis on renewable energy sources may lead to a decline in LNG’s market relevance if oil companies do not balance their investments with a transition to cleaner technologies.

LNG Investments by Big Oil: A Risky Gamble?

The intense competition within the LNG market has prompted Big Oil to invest heavily despite predictions of peak gas. Companies like Exxon Mobil and Chevron are not only expanding existing projects but also committing to new LNG facilities to enhance their market share. However, the commitment to LNG comes with significant risks. Analysts caution that these heavy investments could become liabilities if global demand shifts towards alternative energy sources more quickly than anticipated. As the world gravitates towards decarbonization, the future profitability of LNG projects could be jeopardized if demand fails to grow as expected.

Moreover, the ongoing geopolitical tensions, such as those resulting from Russia’s invasion of Ukraine, have further complicated the LNG landscape. While these events have temporarily heightened the urgency for LNG as a reliable energy source in Europe, long-term sustainability remains a concern. The IEA’s reports suggest that while LNG demand might see short-term growth, significant investments in this sector may ultimately be misaligned with future energy trends. Companies are faced with the challenge of ensuring their LNG investments can withstand the pressures of an energy transition that favors renewable alternatives over fossil fuels.

Contrasting Opinions on LNG’s Future

Shell’s leadership under CEO Wael Sawan has expressed optimism about the LNG sector’s growth potential. The company’s strategic pivot towards LNG is seen as a response to shifts in global energy dynamics, addressing the diverse needs of different regions, particularly in Asia. By forecasting a 60% increase in LNG demand by 2040, Shell positions itself as a frontrunner in leveraging opportunities within this segment. On the other hand, experts from the IEA urge caution, emphasizing the need for a realistic assessment of future market dynamics that may not favor LNG in the long run.

The conflicting narratives surrounding LNG’s future reflect broader debates within the energy sector. While oil majors paint a picture of LNG as integral to their strategies for future growth, critics highlight the potential for diminishing returns as industries shift towards cleaner energy sources. The peak gas predictions pose a serious question for companies heavily invested in LNG: Can they adapt to a rapidly changing market? As energy demands evolve, the sustainability of ongoing LNG ventures is increasingly scrutinized, with many arguing that the transition to renewable energy must take precedent over investments in fossil fuel derivatives.

Adapting Business Models to the Energy Transition

As the energy transition gains momentum, Big Oil is tasked with re-evaluating its business models to remain competitive. Emphasizing LNG investments reflects an attempt to adapt to current market demands while also addressing concerns about emissions and environmental impacts associated with traditional fossil fuels. The industry’s pivot towards LNG as a ‘bridge fuel’ signifies a response to real-time energy needs, particularly in regions heavily reliant on fossil fuels for economic stability. However, this transitional phase raises questions about the long-term viability of such investments amidst a rapidly changing energy landscape.

In light of these complexities, major oil companies are recognizing the importance of integrating their LNG strategies with broader energy transition goals. The investments in low-carbon technologies alongside LNG initiatives could prove crucial for maintaining relevance and profitability. The dual focus on facilitating immediate energy demands while investing in sustainable alternatives could position these companies favorably in a future dominated by clean energy. However, to achieve this balance, oil majors must commit to transparent and adaptive strategies that acknowledge the potential pitfalls of their LNG investments.

The Future of LNG: Risks and Opportunities

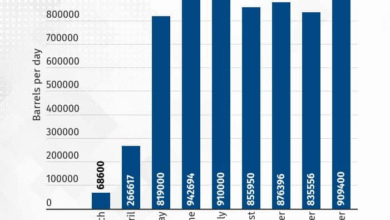

Looking ahead, the future of LNG investments by Big Oil is interwoven with both risks and opportunities. The potential for market growth in LNG remains strong, particularly as global demand surges in response to increasing energy needs. Companies like Baker Hughes and TotalEnergies have made significant capital allocations towards expanding LNG facilities, betting on continued demand driven by economic growth in markets such as Asia. However, the landscape is not without challenges; analysts caution that any miscalculations regarding the longevity and necessity of gas will impact the stability of ongoing and future projects.

Additionally, as the global focus shifts towards sustainability and carbon neutrality, the role of LNG will likely come under greater scrutiny. The IEA’s warning about peak gas and the plateauing of demand highlights that oil companies must be forward-thinking in their strategic planning. Continuous monitoring and adaptation will be necessary to ensure that LNG remains a relevant component of their portfolios. The inevitable transition towards more sustainable energy solutions poses both a challenge and an opportunity for Big Oil in redefining their approaches to energy investment.

Navigating Regulatory Landscapes in LNG Investments

Another significant consideration for Big Oil’s LNG investments is the evolving regulatory environment surrounding fossil fuels. Governments worldwide are increasingly committing to climate goals that may impose stricter regulations on LNG production, distribution, and consumption. These frameworks could affect the profitability and feasibility of existing and future projects. To successfully navigate these regulations, oil companies will need to integrate environmental considerations into their operational assessments. Failing to do so may result in heightened scrutiny or diminished public support for LNG as part of the overall energy portfolio.

In response to these challenges, oil companies may need to engage more deeply with stakeholders to align their LNG strategies with global climate objectives. By promoting transparency and actively addressing environmental impacts, industry players can work toward garnering support while also mitigating regulatory risks. As the LNG market continues to evolve alongside energy transition policies, Big Oil must balance the pursuit of profit with the imperatives of sustainability and regulatory compliance.

LNG’s Role in Energy Security Amid Global Changes

As the world experiences geopolitical shifts, the role of LNG in ensuring energy security is becoming more prominent. The recent crisis in Europe has underscored the vulnerability of relying heavily on a single source of energy, prompting countries to diversify their energy supplies. Big Oil’s investments in LNG offer a way to enhance energy independence, particularly for nations seeking reliable and cleaner alternatives to coal and oil. The ability of LNG to serve as a flexible energy source during crises exemplifies its potential to meet changing energy needs across regions.

However, the reliance on LNG also raises questions about long-term energy sustainability. As nations scramble to secure LNG supplies, the risks associated with fossil fuel dependency become more pronounced. The call for renewables and alternative energy solutions continues to grow, necessitating a careful balancing act in how LNG fits into the broader energy landscape. For Big Oil to successfully navigate this challenge, they must not only amplify their LNG investments but also strategically incorporate renewable energy initiatives that align with future sustainability goals.

The Economic Implications of LNG Investments

From an economic perspective, the influx of investments in LNG by oil companies has significant implications not only for energy markets but also for global economies as a whole. The establishment of new LNG infrastructure has the potential to create jobs, stimulate local economies, and reduce energy costs in areas heavily reliant on imports. Furthermore, the anticipated growth in demand for LNG may lead to increased competition among suppliers, ultimately benefiting consumers through lower prices and enhanced energy reliability.

On the flip side, the heavy investments in LNG also come with economic risks, particularly if demand does not grow as anticipated. Projects with long lead times may face challenges in ensuring profitability if market dynamics shift towards cleaner energy sources. Oil companies must be cautious in their economic projections, especially in the context of global climate commitments and the urgency to transition to low-carbon alternatives. A robust economic strategy that takes into account both the potential rewards and risks associated with LNG investments is crucial for sustainable growth.

Assessing the Environmental Impact of LNG Production

The environmental impact of LNG production remains a topic of intense debate as Big Oil continues to invest in this sector. While LNG is often marketed as a cleaner alternative to other fossil fuels, concerns about methane leaks and ecological degradation associated with gas extraction processes are prominent. These environmental issues raise significant questions about the sustainability of LNG as a ‘bridge fuel’ in the energy transition. To address these concerns, companies must prioritize effective emissions management practices and innovate their operational processes to minimize environmental footprints.

Moreover, the increasing public and regulatory scrutiny regarding environmental impacts necessitates that oil companies are proactive in their approach to sustainability. Engaging with environmental stakeholders and adopting transparent practices can mitigate potential backlash against LNG projects. As the global focus on environmental considerations escalates, ensuring that investments in LNG align with broader sustainability goals will be crucial in maintaining public trust and meeting regulatory requirements.

Frequently Asked Questions

What are the main reasons behind Big Oil’s investments in LNG despite peak gas predictions?

Big Oil is investing heavily in liquefied natural gas (LNG) to capitalize on rising global demand and diversify their portfolios. Companies like Shell, TotalEnergies, and Exxon Mobil see LNG as a versatile energy source that can address energy needs amid geopolitical events and climate change. They believe that LNG can play a key role in the energy transition, challenging predictions of peak gas demand by the end of the decade.

How do peak gas predictions impact the LNG market and Big Oil investments?

Peak gas predictions, as indicated by the International Energy Agency, suggest that global gas demand may plateau by the end of the decade. Despite this, Big Oil continues to invest in LNG projects, believing that long-term demand from markets like Asia will sustain growth. However, analysts warn of potential risks, including a supply glut in the LNG market as cleaner energy sources gain traction, which could undermine the profitability of new projects.

What role does LNG play in the energy transition for oil companies?

LNG is positioned by oil companies as a bridge fuel in the energy transition. Industry leaders like Shell emphasize LNG’s versatility in addressing energy needs while transitioning to low-carbon alternatives. While LNG is marketed as a cleaner fossil fuel than coal and oil, concerns about methane emissions and its environmental footprint raise questions about its long-term viability amid global efforts to reduce carbon emissions.

What are the predictions for the LNG market forecast in the coming years?

The LNG market forecast indicates a potential growth rate of 2.5% annually through 2035, driven by increased global export capacity, particularly from the U.S. and Qatar. However, the International Energy Agency warns that demand growth may not continue at this rate post-2040 due to a focus on renewable energy sources and the risk of an oversupply in the LNG market as it adapts to changing energy needs.

How are oil companies like Shell adapting their strategies towards LNG?

Oil companies, particularly Shell, are adapting their strategies by prioritizing LNG as a core component of their future operations. CEO Wael Sawan highlights LNG’s ability to meet diverse energy demands during crises, asserting its importance in the company’s long-term planning. This shift is complemented by initiatives to invest in low-carbon technologies, aiming to balance fossil fuel investment with renewable energy growth.

What challenges does Big Oil face in the LNG market amidst the push for clean energy?

Big Oil faces challenges in the LNG market due to growing concerns about climate change and a shift towards cleaner energy sources. The International Energy Agency’s predictions of plateauing gas demand and environmental criticisms of LNG emissions pose risks to the long-term profitability of LNG investments. Companies must ensure that new projects remain viable as global energy consumption evolves.

| Company | Investment Strategy | Forecast on LNG Growth | Concerns |

|---|---|---|---|

| Shell | Focus on LNG as core part of strategy | 60% growth by 2040 | Risks of methane leaks, alignment with energy transition questioned |

| TotalEnergies | Increase LNG volumes managed by 50% between 2023-2030 | Upwards adjusted forecast, 2.5% annual growth until 2035 | Potential peak gas concerns, reliance on fossil fuels |

| BP | Shifting strategy to include more fossil fuels and LNG | Substantial investments in LNG | Long-term profitability questioned post-2040 |

| Exxon Mobil | Aiming to double LNG portfolio by 2030 | Anticipated market growth with supply increase | Risks of oversupply and market shifts |

| Chevron | Expanding existing projects and constructing new facilities | Optimistic growth predictions | Need for diversification and adaptability |

| Baker Hughes | Acquired Chart Industries for $13.6 billion | Enhancing LNG investments | LNG’s environmental impact concerns |

Summary

LNG investments by Big Oil highlight the strategic pivot of major energy companies toward liquefied natural gas, aiming to address the growing global demand despite warnings from analysts about the potential peak of gas. Companies like Shell, TotalEnergies, BP, Exxon Mobil, and Chevron are heavily investing in LNG to enhance their portfolios, although such a strategy is viewed as risky in light of the ongoing energy transition. Given the contrasting forecasts on LNG growth and the environmental implications, Big Oil faces a critical challenge to balance profitability and sustainability in the coming decades.