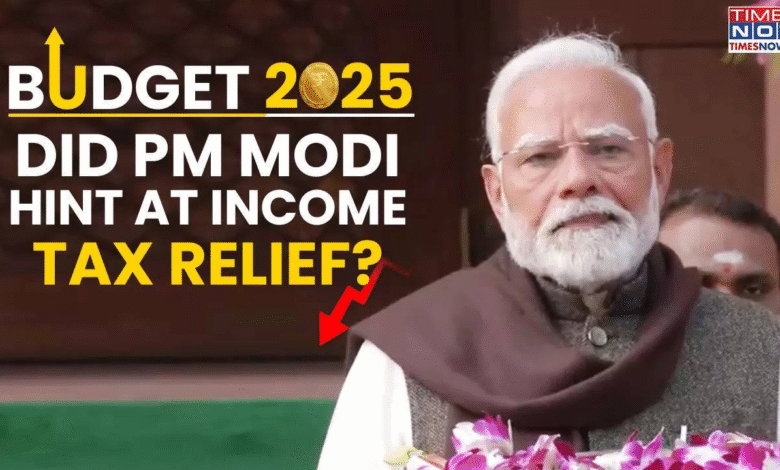

Modi Tax Relief: Boosting India’s Economy Amid Tariff Tensions

In a strategic move to rejuvenate the economy, Modi tax relief has been introduced as a significant measure to stimulate domestic consumption amid rising global tensions, particularly from impending U.S. tariffs. Following Prime Minister Narendra Modi’s announcement of tax cuts, India’s financial markets experienced a notable surge, with the Nifty 50 index and BSE Sensex both climbing on the news. The reforms, including a revamped Goods and Services Tax (GST) structure, are designed to simplify compliance and lower tax burdens, which is expected to invigorate sectors particularly impacted by international trade pressures. As the automotive industry gears up for growth, these tax policies could be the catalyst needed to reverse recent downturns and bolster overall economic health. The combination of strong local consumption and favorable tax incentives may prove essential for navigating the complexities of the current global economic landscape, showcasing the resilience of the Indian economy’s foundation.

In an effort to boost economic stability, the new tax initiatives from the Modi administration aim to enhance domestic spending within India’s economy. As global trade dynamics shift, particularly with the imposition of tariffs by the U.S., these measures are poised to provide much-needed support to various sectors, including the automobile industry. The recently proposed changes to the GST framework are anticipated to streamline processes and ultimately reduce financial burdens on businesses, particularly micro and small enterprises. This strategic focus on easing tax obligations contrasts sharply with the challenges faced from external economic pressures and positions India for a more sustainable growth trajectory. Enhanced consumer confidence and spending could indeed foster a more robust economic environment, aligning with the overarching goal of strengthening the nation’s financial performance amid global uncertainties.

Modi Tax Relief: A Game Changer for the Indian Economy

Prime Minister Narendra Modi’s recent announcement of tax relief is poised to significantly impact India’s economy by enhancing domestic consumption and fostering growth. By introducing tax cuts, Modi aims to alleviate the pressures faced by consumers amid rising uncertainties, particularly due to the looming U.S. tariffs that threaten to destabilize the market. As a proactive measure, these tax reforms are designed to empower local businesses and stimulate expenditure, which is crucial as India navigates through volatile global economic challenges.

The initial market response has been promising, with indices like the Nifty 50 and Sensex posting notable gains following the announcement. This reflects investor optimism in the wake of Modi’s reforms, which promise to simplify the Goods and Services Tax (GST) structure. This shift could directly benefit various sectors, especially as it eases compliance and reduces financial burdens on small and medium enterprises, thus unlocking greater potential for economic expansion.

Impact of GST Reforms on Indian Markets

The introduction of the revamped Goods and Services Tax framework is set to streamline India’s tax landscape, moving towards a two-rate system. This not only simplifies taxation but can also stimulate growth in various industries by reducing rates on essential goods and tax burdens on micro and small enterprises. Experts view this as a crucial step in enhancing business sustainability and investor confidence in the Indian markets, particularly in light of external pressures such as Trump’s tariffs.

As the economy stands to benefit from a more viable GST structure, analysts suggest that sectors linked to consumption, like manufacturing, logistics, and consumer goods, will likely flourish as a result. By cutting down on compliance woes and enabling faster refunds, the government’s initiative paves the way for improved cash flow within these industries, which is vital for sustaining economic growth amid global uncertainties.

The optimistically forecasted growth in the automobile sector exemplifies how targeted reforms can invigorate various segments of the economy. With the auto industry being a critical player in driving domestic consumption, the tax changes are anticipated to encourage consumer spending on vehicles, enhancing overall economic revitalization in the context of Modi’s tax relief initiatives.

Tariff Impact on India and Strategic Responses

The imposition of significant tariffs by the United States presents a formidable challenge to India’s trade dynamics. As the Trump administration levies additional taxes on Indian imports, this situation underscores the urgency for India to bolster its domestic consumption and economic resilience. Prime Minister Modi’s tax relief measures are strategically designed to offset such external economic pressures by fostering an environment conducive to local investment and consumption.

By focusing on self-reliance and domestic growth, India aims to mitigate the negative consequences of international trade tensions. With a strong emphasis on enhancing local industries, particularly those susceptible to tariff impacts, these reforms can serve as a buffer, enabling India to maintain its growth trajectory despite external economic challenges.

Automobile Industry Growth Amid Tax Changes

The automobile sector’s response to Modi’s tax reforms indicates a promising turnaround, reflecting the market’s positive outlook toward government initiatives aimed at revitalizing growth. Following a period of stagnation, the rise in passenger vehicle sales highlights the critical role of tax incentives in stimulating consumer demand within the sector. A projected increase in automobile sales is indicative of both psychological and tangible shifts in consumer confidence, primarily fueled by expectations of reduced financial burdens.

Industry analysts project that the automobile market will see significant boosts as a direct result of the new tax policies. With major auto manufacturers reporting substantial gains, the implications are clear: a streamlined taxation system is likely to invigorate competition and innovation, leading to a robust return of consumer interest and increased market activity in one of the nation’s vital economic segments.

Consumer Confidence and Domestic Consumption Trends

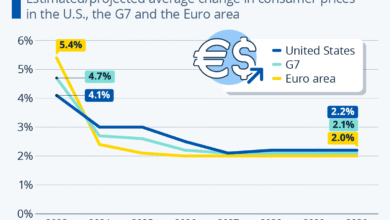

The relationship between consumer confidence and economic performance cannot be overstated. The recent tax relief measures introduced by Prime Minister Modi are designed not just to reduce the financial strain on individuals and businesses but also to restore faith in the economy’s stability. As domestic consumption accounts for a significant portion of India’s GDP, the emphasis on boosting consumer spending is critical at this juncture, particularly with lower inflation rates compounding the effects of tax incentives.

The potential for a rebound in consumer spending aligns well with governmental forecasts. With improvements in purchasing power and lowered inflation rates promising to enhance consumption patterns, the groundwork for sustained economic growth is clearly being laid. As urban spending and preferences shift toward luxury goods, the overarching message is one of optimism bolstered by the newly instated tax relief measures.

Long-Term Benefits of Tax Reforms for Indian Economy

In contemplating the long-term ramifications of Modi’s tax reforms, it’s essential to recognize their capacity to reshape India’s economic landscape. The anticipated benefits extend beyond immediate market corrections to foster a more dynamic and competitive environment for businesses to thrive. Therefore, while short-term gains are encouraging, the real measure of success lies in the lasting changes to fiscal policy that encourage sustainable economic growth.

With the Reserve Bank of India projecting steady growth rates due to these reforms, there exists a palpable sense of forward momentum. Investors and businesses alike are likely to respond positively, translating tax relief into real-world benefits that not only uplift the Indian economy but also position it as a formidable player in global markets.

Role of Infrastructure Development in Economic Growth

As India embraces Modi’s tax relief initiatives, the role of infrastructure development becomes increasingly vital in translating these economic policies into tangible benefits. Strong infrastructure is foundational for fostering trade and enhancing business efficiency, which in turn stimulates growth across various sectors including logistics and manufacturing. A well-developed infrastructure network can directly complement the anticipated recovery in consumption and investment post-reforms.

Efforts to bolster infrastructure spending and improve connectivity will likely attract increased private and foreign investment. This holistic approach not only solidifies the effects of tax cuts but also propels India towards a more resilient and inclusive economic model, aligning with global standards and meeting the growing demands of its burgeoning population.

Investment Opportunities in the Wake of Tax Reforms

Modi’s tax relief package opens new avenues for potential investment, capturing the attention of both domestic and international investors. With the tax framework simplifications and strategic realignments in focus, sectors poised for growth, such as renewable energy and technology, stand to benefit immensely. The envisioned reforms can be seen as an invitation for innovative investment strategies that will drive growth and employment in the coming years.

Highlighting areas such as MSMEs and high-growth industries underscores the government’s commitment to fostering a vibrant investment climate. As tax cuts begin to unfold, investors may find themselves with renewed opportunities to capitalize on India’s market potential, reinforcing a long-term outlook supported by stable policies and government initiatives.

Navigating Global Economic Uncertainties: India’s Approach

Amid growing trade tensions and geopolitical uncertainties, India’s proactive approach to taxation and reform provides a roadmap for economic resilience. By implementing key tax cuts and GST reforms, the country is strategically addressing external challenges while strengthening internal consumption. Navigating these global dynamics requires agile policy making, and Modi’s administration seems committed to fostering an adaptive economic environment.

This approach not only aids in cushioning against external shocks, such as rising tariffs and fluctuating oil prices, but it also sets a precedent for other nations facing similar dilemmas. The commitment to self-reliance and robust domestic market policies will be pivotal in maintaining economic stability and stimulating growth, ensuring that India stands firm amid global economic uncertainties.

Frequently Asked Questions

What are the key features of Modi’s tax relief initiative for India’s economy?

Modi’s tax relief initiative includes significant tax cuts aimed at boosting domestic consumption amidst U.S. tariff tensions. This includes a simplified Goods and Services Tax (GST) structure with two rates of 5% and 18%, replacing the previous higher rates, which is expected to enhance compliance and reduce tax burdens, particularly for micro, small, and medium enterprises (MSMEs).

How will Modi tax relief impact the automobile industry in India?

The Modi tax relief is set to positively impact India’s automobile industry, which has recently faced a slowdown. With improved tax policies, sales of passenger vehicles are expected to increase, as indicated by rising share prices of major auto manufacturers like Maruti Suzuki and Hyundai following the announcement.

What effect will GST reforms have on the Indian economy under Modi’s tax relief measures?

The GST reforms under Modi’s tax relief measures are designed to simplify the tax structure and make it more conducive for growth. By eliminating higher tax brackets, the reforms aim to stimulate investment, support the manufacturing sector, and ultimately drive economic growth amidst the challenges posed by external tariff impacts.

How do Modi’s tax cuts aim to offset the impact of U.S. tariffs on India?

Modi’s tax cuts aim to bolster domestic consumption in India, which is crucial for offsetting the adverse impacts of U.S. tariffs on imports. By enhancing local purchasing power through tax relief, the government hopes to mitigate the economic effects of increased tariffs on Indian goods in the international market.

What are the anticipated economic growth predictions for India following Modi’s tax relief measures?

Following Modi’s tax relief measures, the Reserve Bank of India forecasts economic growth of 6.5% for the 2025-2026 fiscal year. Tax reforms are expected to sustain domestic consumption, which is a key driver for economic growth, compensating for any negative impacts from tariff increases.

How will the new tax relief impact consumer spending in India?

The new tax relief and GST reforms are projected to encourage consumer spending in India by lowering tax rates on essential goods and streamlining compliance processes. This can boost urban consumption, which contributes significantly to the GDP, as seen in the rising trends of spending on luxury goods.

What role do tariff impacts play in Modi’s tax relief strategy?

Tariff impacts are central to Modi’s tax relief strategy as they pose a challenge to India’s economy. By implementing tax cuts and GST reforms, the government aims to strengthen domestic consumption, ensuring that Indian markets can thrive despite external pressures from tariff increases imposed by the U.S. government.

How is the Indian stock market responding to Modi’s tax relief initiatives?

The Indian stock market, notably the Nifty 50 and BSE Sensex, responded positively to Modi’s tax relief initiatives, showing increases of 1% and 0.84%, respectively. This surge reflects investor optimism regarding the potential boost to domestic consumption and overall economic growth attributed to the new tax measures.

| Key Points |

|---|

| Markets surged following Indian Prime Minister Narendra Modi’s announcement of tax cuts aimed at boosting domestic consumption. |

| India’s economy is grappling with the potential steep U.S. tariffs, exacerbated by its purchases of Russian crude oil. |

| India’s automobile industry stands to gain from the new tax policies. |

Summary

Modi tax relief is poised to invigorate India’s economy by promoting domestic consumption and stimulating growth amidst looming tariff tensions with the U.S. The recent tax cuts announced by Prime Minister Narendra Modi are set to lower the Goods and Services Tax rates, which could ultimately enhance compliance and support various sectors, particularly the automobile industry. As India navigates the challenges posed by international trade tensions, the introduction of these reforms signals a strategic move towards self-reliance and economic resilience.