Spain Crypto Taxation: Trader Faces €9M Surprise Charge

Spain crypto taxation remains a contentious issue, particularly for those engaged in cryptocurrency trading. As digital currencies grow in popularity, clarity surrounding cryptocurrency tax Spain becomes increasingly critical for investors and traders alike. Many are discovering that the complexities of DeFi taxation issues can result in unexpected liabilities, creating uncertainty in an already volatile market. The recent case of a trader facing a €9 million tax bill for what should be a non-taxable event has raised alarms about the implications of Spain tax law on crypto transactions. In light of this, understanding the tax implications of cryptocurrency trading in Spain is essential for anyone looking to navigate this emerging landscape.

Navigating the fiscal landscape for digital assets in Spain can be notably challenging, especially given the lack of clear regulations. The interplay of cryptocurrency tax regulations and decentralized finance (DeFi) operations presents numerous hurdles for traders. With the ongoing evolution of Spain’s tax framework, many investors are finding their financial activities subjected to scrutiny and hefty tax burdens. The confusion stemming from Spain’s current taxation practices underscores the urgent need for comprehensive guidelines governing crypto assets. As such, comprehending the repercussions of crypto trading taxes is vital for individuals and businesses aiming to engage in this dynamic economic environment.

Understanding Cryptocurrency Taxation in Spain

The landscape of cryptocurrency taxation in Spain is currently fraught with confusion and uncertainty. The lack of clear regulations results in many traders feeling vulnerable to unexpected tax liabilities. For instance, transactions deemed non-taxable can suddenly be categorized as taxable events, leaving individuals exposed to hefty fines and back taxes. The ambiguous definitions used in Spain tax law fail to accommodate the nuances of cryptocurrency, particularly for operations inherent in DeFi platforms, further complicating compliance for traders.

Moreover, Spain’s current approach to cryptocurrency tax enforcement raises serious questions about fairness and transparency. The recent case involving a trader facing an exorbitant €9 million charge for a transaction that seemingly should not be taxable has underscored the urgency for clear guidelines. Tax implications for cryptocurrency trading are becoming more complicated, stressing the need for regulatory bodies to outline definitive criteria on what constitutes a taxable event in the digital asset space.

Frequently Asked Questions

What are the main aspects of cryptocurrency tax Spain needs to consider?

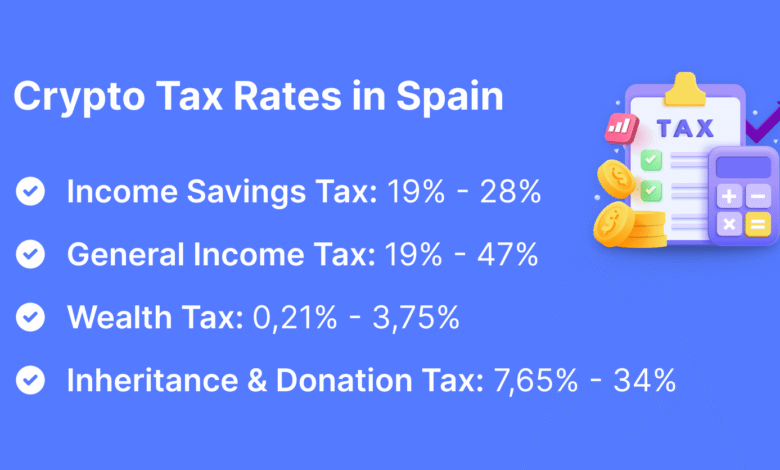

When dealing with cryptocurrency tax in Spain, taxpayers should focus on aspects such as capital gains tax on trading profits, reporting obligations, and the treatment of various crypto transactions under Spain tax law. It’s essential to understand what constitutes a taxable event, as many operations, especially in DeFi environments, may be interpreted differently by the tax authorities.

How does Spain tax crypto trading taxes for individual traders?

Spain applies capital gains tax to profits derived from cryptocurrency trading. Traders must report any gains or losses realized from the sale or exchange of cryptocurrencies. Additionally, crypto trading taxes in Spain include obligations for annual declarations. It’s crucial for traders to keep accurate records of all transactions to comply with Spain tax law.

Are there tax implications for decentralized finance (DeFi) activities in Spain?

Yes, there are tax implications for DeFi activities in Spain. The Spanish tax agency (AEAT) has stated that certain transactions within DeFi protocols may trigger capital gains tax, even if the user did not realize a gain. This includes operations like lending or using tokens as collateral, which can be subject to taxation under current interpretations of Spain tax law.

What should I know about capital gains tax related to cryptocurrency in Spain?

In Spain, capital gains tax applies to any profits made from the sale of cryptocurrencies. This tax is calculated based on the difference between the sale price and the acquisition cost of the cryptocurrency. It’s crucial to note that the formal definition of taxable events is still subject to interpretation, particularly when it comes to non-traditional transactions.

How is taxation on DeFi assets managed under Spain’s tax law?

Taxation on DeFi assets in Spain remains unclear due to the lack of specific legislation. Operations involving DeFi can lead to unintended tax consequences, as they might not follow the standard definitions provided in Spain tax law. It’s advisable for investors to consult tax professionals to navigate potential liabilities.

Is it necessary to report cryptocurrency transactions in Spain?

Yes, it is necessary to report cryptocurrency transactions in Spain, as all profits and losses from cryptocurrency trades must be declared during the annual tax return period. Failing to report these transactions can lead to fines and penalties under Spain tax law.

What legal clarity exists regarding Spain cryptocurrency tax implications for future transactions?

Currently, there is a significant lack of legal clarity regarding Spain cryptocurrency tax implications, especially for non-traditional transactions like DeFi. Analysts anticipate that inconsistencies will continue due to the absence of specific rulings. Therefore, staying informed and consulting with tax professionals is essential for compliance.

How should investors prepare for potential taxes from cryptocurrency holdings in Spain?

Investors in Spain should maintain thorough records of all cryptocurrency transactions, including purchases, trades, and any DeFi activities. Consulting with a tax advisor familiar with Spain crypto taxation can help in understanding obligations and preparing for any potential tax liabilities.

| Key Aspect | Details |

|---|---|

| Unclear Taxation Laws | Spain lacks clear regulations on cryptocurrency taxation, leading to confusion among traders. |

| High Tax Charges | A trader was unexpectedly charged €9 million for a transaction that should not have triggered a taxable event. |

| Nature of the Transaction | The transaction involved depositing collateral for a loan, with no actual profit or change of ownership. |

| Legal Interpretation Issues | The Spanish tax agency (AEAT) considered the transaction as generating capital gains, despite it not meeting legal definitions. |

| Lack of Clear Guidelines | Current legislation does not provide specific rules for taxing cryptocurrency or defining taxable movements. |

Summary

Spain crypto taxation has become a contentious issue for traders facing unexpected charges due to the unclear legal landscape. The recent case of a trader charged €9 million for a non-taxable operation highlights the urgent need for specific regulations surrounding cryptocurrency transactions in Spain. As the crypto market continues to grow, the lack of clarity regarding taxation is likely to result in ongoing challenges for traders.