European Soccer Investment: U.S. Funds Surge in 2025

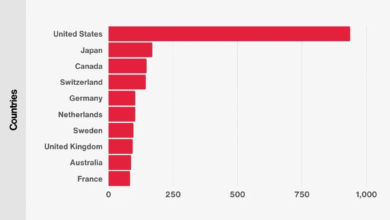

European soccer investment has surged dramatically in recent years, as American investors increasingly pour their capital into top-tier clubs across the continent. Fueled by the staggering club valuations in the Premier League, U.S. money has become a familiar fixture in the ownership structures of elite teams, with notable stakes in traditional powerhouses such as Chelsea, Liverpool, and Manchester United. This influx of funds has been driven by a broader trend of financial growth in the soccer industry, where the revenue generated by Europe’s elite clubs reached a staggering €20.4 billion in the 2023-2024 season. With American investors seeking lucrative returns amidst a limited supply of professional sports franchises domestically, European soccer has emerged as an attractive alternative. As interest escalates, private equity firms also seek to capitalize on this ripe market, further fueling the football financial boom.

The landscape of soccer in Europe is undergoing transformative changes as a result of significant financial influxes from American backers who are eager to invest in international football. These investments have fostered an environment where European soccer club valuations are skyrocketing, positioning the continent as a focal point for high-profile ownership stakes, especially in leagues such as the Premier League. With the shift in capital comes a myriad of opportunities for private equity involvement and multi-club ownership models, demonstrating an evolving approach to soccer finance. As these trends develop, clubs are increasingly exploring avenues for financial growth beyond traditional revenue streams, setting the stage for future innovations in soccer’s economic framework. The intersection of sports finance and international investment is reshaping the very fabric of European soccer, as clubs strive to compete on an increasingly global scale.

The Rise of American Investors in European Soccer

In recent years, American investors have made significant inroads into European soccer, seizing on the lucrative opportunities presented by the sport’s popularity and economic growth. With the Premier League’s exceptional selling power and the massive global fanbase of clubs like Chelsea and Manchester United, U.S. ownership has skyrocketed. This shift signals a transformative moment in soccer’s financial landscape, as American capital flows freely towards clubs desperately needing investment for infrastructure and talent acquisition.

The allure of European soccer for American investors can also be attributed to the lower entry barriers compared to major U.S. sports leagues, where team valuations often reach staggering heights. Investors find the relatively lower valuations of European clubs appealing, as they see potential for substantial returns on investment as clubs continue to harness the commercial potential of global soccer. Moreover, this trend reflects a broader strategy of diversification in the portfolios of American investors, including billionaires and private equity firms, looking to acquire unique assets that offer growth potential.

European Soccer Club Valuations Surge: A Financial Overview

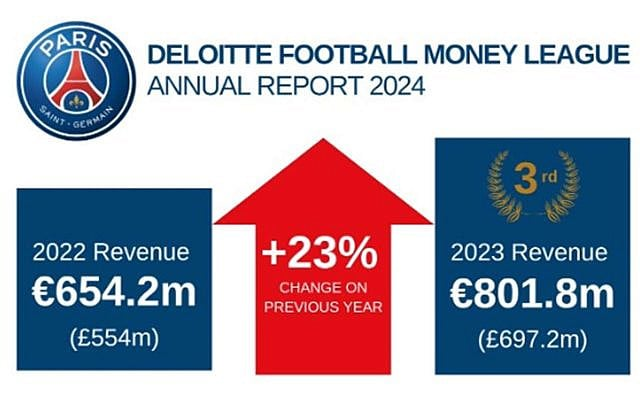

The surge in soccer club valuations across Europe highlights the dramatic financial growth of the sport over the past few decades. For instance, the valuation of Manchester United skyrocketed from £790 million at the time of its acquisition in 2005 to approximately £5 billion in 2024, setting a new benchmark for sports franchises globally. These soaring valuations not only reflect clubs’ revenue generation capabilities fueled by broadcasting and sponsorship deals but also their potential for international brand expansion.

According to reports, the combined revenue of Europe’s top leagues reached a staggering 20.4 billion euros in the 2023-2024 season, a 750% increase from the inception of the Premier League in 1996. This financial growth has been largely driven by lucrative television contracts and the increased commercial appeal of soccer. As the sport becomes more entrenched in global culture, valuations are anticipated to continue rising, attracting even more American capital and prompting ongoing interest from investors keen to capture a slice of this lucrative market.

Private Equity’s Role in Transforming Soccer

Private equity has emerged as a significant player in European soccer, with over 36 clubs in the continent’s major leagues receiving investments through private equity, venture capital, or private debt. This trend underscores a seismic shift towards more institutional investment in a sector traditionally dominated by individual owners. With M&A deal activity surging from 66.7 million euros in 2018 to nearly 2.2 billion euros by 2024, private equity is transforming the operational model of clubs aiming for higher profitability.

Investors are increasingly adopting a multi-club ownership strategy, which allows them to optimize resources and revenues across different franchises. While this model provides financial synergies and opens up marketing avenues, it has raised regulatory eyebrows, with UEFA beginning to scrutinize these ownership structures more closely. For instance, recent rulings against clubs like Crystal Palace indicate a tightening of regulations on multi-club ownership, suggesting that as private equity continues to gain traction, compliance will become a critical focus for investors.

Challenges and Opportunities in the Soccer Investment Landscape

Despite the rapidly expanding financial framework around European soccer, challenges remain that could impact future investment growth. Deloitte has projected a leveling off of income in the upcoming 2025-2026 season, primarily attributed to a slowdown in the sports media rights market. Clubs will need to pivot and develop alternative revenue streams such as enhanced commercial partnerships and innovative match-day experiences to maintain growth momentum.

Moreover, the push for international matches and events, as seen with La Liga’s efforts to host games abroad, presents both opportunities and challenges. While these initiatives could open new revenue channels, they also risk fragmenting fan engagement and loyalty. For American investors, navigating these waters will require a delicate balance of adhering to regulatory requirements while capitalizing on new growth avenues to ensure sustained financial success.

The Financial Growth of Soccer: Key Drivers

A multitude of factors have driven the financial growth of European soccer, pivotal among them being lucrative broadcasting rights and an increase in match-day revenues. The 2023-2024 season alone saw commercial revenues expand by 6%, fueled by new sponsorship deals and clubs enhancing their service offerings at stadiums. This financial ecosystem is more than just ticket sales—it’s about leveraging the club’s brand to increase global recognition and fan engagement.

Additionally, with the rapid rise of digital platforms and the global consumption of soccer content, clubs are now able to monetize their brands more effectively. Partnerships with tech companies and social media platforms have opened fresh pathways for engagement, allowing clubs to reach fans worldwide. U.S. investors recognize this potential and are increasingly looking to invest not only in clubs but also in technologies that enhance fan experiences and broaden market reach.

The Future of Soccer and American Involvement

As American investors deepen their involvement in European soccer, the future looks promising, albeit filled with competitive challenges. The continuous escalation in soccer club valuations indicates strong potential for returns on investment. However, U.S. investors must remain vigilant and adaptive to changes in regulations and market dynamics as Europe continues to assert itself as a leading footballing marketplace with global appeal.

Investment strategies may evolve, focusing more on sustainable growth and fan engagement as clubs look to diversify their revenue streams. Initiatives to enhance stadium experiences and innovate commercial offerings will likely become integral to maintaining a competitive edge among clubs. The involvement of American capital in the European soccer market not only signifies a strategic investment opportunity but also highlights a cultural crossover that could redefine the game in years to come.

Regulatory Challenges for American Investors in European Soccer

As American investors navigate the European soccer landscape, they must contend with increasingly complex regulatory frameworks designed to maintain competitive balance and protect the integrity of the game. UEFA’s close scrutiny of multi-club ownership structures exemplifies how investment strategies may be impeded by governance and compliance expectations. With the possibility of stricter regulations on club ownership and financial practices, investors need to work closely with legal experts to mitigate risks and adhere to UEFA’s guidelines.

This regulatory environment reflects a broader concern within European soccer regarding the impact of foreign investment on local clubs and the potential for market distortions. As clubs with American backing pursue aggressive enhancements and profitability strategies, ensuring alignment with UEFA’s vision will be crucial to avoid penalties and maintain a positive operating environment. Thus, a proactive approach to regulatory compliance is essential for American investors looking to solidify their presence in European soccer.

Maximizing Returns: American Strategies in European Soccer

To maximize returns on investments in European soccer, American investors are employing various strategies focused on enhancing club performance both on and off the pitch. This includes not just financial investing but also injecting expertise in areas such as marketing, sports science, and player development. By applying successful business practices drawn from their experiences in U.S. sports, investors are looking to optimize club operations and drive commercial success.

Additionally, investors are utilizing technology to improve fan engagement, streamline operations, and develop new revenue streams. The integration of data analytics into player recruitment and match performance has already shown promising results, and as clubs leverage these tools, they can increase their competitiveness, leading to greater success on the field, which translates to higher valuations and improved revenue streams.

The Evolving Landscape of Soccer Financial Growth

The landscape of soccer financial growth is continually evolving, driven by globalization, innovation, and increasing competition. Clubs must remain agile and open to change, especially regarding international expansions and diversifying revenue generation. As teams look for ways to stand out in a crowded marketplace, developing unique brand identities, enhancing fan experiences, and capitalizing on global partnerships will be essential strategies for long-term sustainability.

Furthermore, as leagues like La Liga and Serie A consider hosting matches abroad, there exists significant potential for new audiences and revenues. Clubs and investors alike need to adapt quickly to these shifting dynamics, as the appetite for live sports experiences continues to grow. The future of soccer financial growth will be characterized by innovation, adaptability, and a keen understanding of global market trends.

Frequently Asked Questions

How are American investors influencing European soccer investment?

American investors are significantly impacting European soccer investment as they acquire stakes in major clubs, particularly in the Premier League. With American ownership of clubs like Manchester United, Chelsea, and Liverpool, there’s a surge in funding and valuation growth, making the European soccer market increasingly lucrative for investors.

What factors are driving European soccer club valuations to increase?

European soccer club valuations are surging primarily due to immense revenue growth, which reached 20.4 billion euros for the 2023-2024 season. The rise in commercial revenue, soaring fan engagement, and a limited number of elite teams for sale contribute to this escalating market value.

Is private equity becoming more prevalent in European soccer investment?

Yes, private equity is increasingly involved in European soccer investment, with over 36 clubs in the top leagues having private equity participation. The trend reflects a growing interest from investors to acquire minority or majority stakes, highlighting the potential for significant returns in this rapidly expanding market.

What are the implications of American ownership on Premier League clubs?

American ownership has led to enhanced investment and modernization in Premier League clubs, often resulting in improved club infrastructure and marketing strategies. However, this influx raises concerns regarding regulations and competitive balance within the league.

How are club owners innovating to drive financial growth in European soccer?

Club owners are innovating by diversifying revenue streams beyond just broadcast income. They are enhancing stadium facilities, entering new sponsorship agreements, and even planning international matches to boost commercial income and attract global fanbases.

What challenges do American investors face in European soccer?

American investors in European soccer face challenges such as regulatory scrutiny over multi-club ownership models and fluctuating revenue streams. Recent governance issues, like UEFA’s stricter regulations, can impact investment strategies and profitability.

How do European soccer club valuations compare historically?

Historically, European soccer club valuations have increased dramatically, with a 750% rise in revenues since the inception of the Premier League in 1996-97. This growth trajectory illustrates the immense financial potential and attractiveness of European soccer for investors.

Will American investors continue to dominate European soccer ownership?

Given the current trends, it’s likely that American investors will continue to dominate European soccer ownership due to their financial resources, interest in global sports markets, and the rising valuations of clubs, especially in the Premier League.

Why are European soccer clubs appealing to American investors?

European soccer clubs are appealing to American investors due to their rapid revenue growth, high global visibility, and the ability to enter a relatively less expensive market compared to U.S. sports leagues. This environment presents unique opportunities for substantial returns.

What is the trend regarding commercial growth in European soccer?

The trend in commercial growth within European soccer is promising, with a 6% increase reported in the 2023-2024 season. This growth is driven by new sponsorship deals and innovative revenue strategies that expand beyond traditional match-day sales.

| Key Points | Details |

|---|---|

| European Soccer Revenue | Clubs in the top five leagues generated 20.4 billion euros ($23.7 billion) in the 2023-2024 season. |

| American Investment | U.S. investors now own the majority of clubs in England’s Premier League, including Chelsea, Liverpool, Manchester United, and Arsenal. |

| Historical Revenue Growth | Revenue has increased from 2.5 billion euros in the 1996-97 season to 20.4 billion euros in the 2023-24 season, a 750% growth. |

| Valuation of Top Clubs | Manchester United was purchased for £790 million in 2005 and valued at approximately £5 billion in 2024. |

| Private Equity Participation | More than 36 clubs in Europe have private equity or venture capital involvement. |

| M&A Deal Activity | M&A activity has increased from 66.7 million euros in 2018 to nearly 2.2 billion euros in 2024. |

| Regulatory Scrutiny | UEFA is imposing stricter regulations on clubs due to concerns about multi-club ownership. |

| Future Growth Projections | Projected revenue growth is expected to plateau due to a slowdown in sports media rights. |

| International Matches | La Liga and Serie A are considering regular-season matches abroad, following FIFA’s potential regulatory changes. |

Summary

European soccer investment is witnessing an explosive growth phase, with American investors increasingly interested in the lucrative soccer market. The influx of capital not only reflects the soaring valuations of clubs but also indicates a shift towards seeking alternative high-value investment opportunities in a competitive landscape. As club revenues continue to rise and regulatory environments adapt, European soccer investment prospects look promising for the future.