Solana App Revenue Drops 44% Amid Efficiency Gains

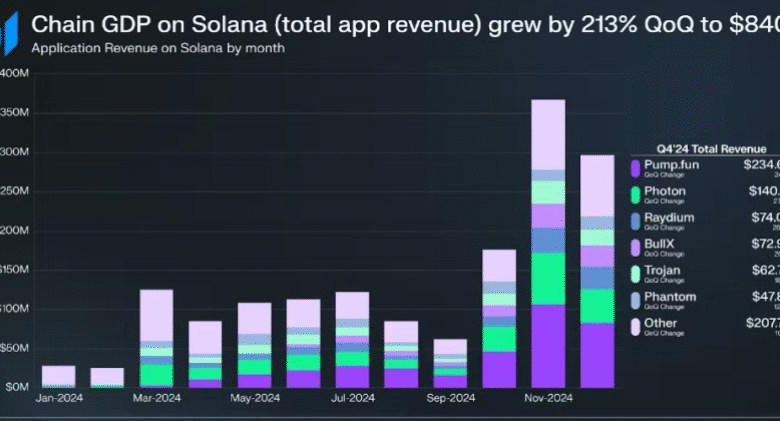

In the dynamic world of decentralized finance, **Solana app revenue** has recently faced a significant downturn, plummeting 44.2% in Q2 2025. This decline is notable, especially considering the simultaneous increase in the app revenue capture ratio, which rose from 126.5% to 211.6%, pointing towards a complex ecosystem performance. Various applications, such as Pump.fun and Jupiter, experienced substantial revenue losses, with the former accounting for a considerable portion of the drop. Despite these setbacks, the total value locked in decentralized finance (DeFi) on the Solana network rose by 30.4%, showcasing the continued interest and investment in the ecosystem. Additionally, the dropping NFT trading volume highlights shifting market trends that could influence future Solana revenue forecasts and strategies.

Exploring the financial metrics of the Solana platform reveals an intriguing narrative surrounding its application earnings and market activity. The revenue generated from apps on the Solana blockchain has witnessed a dramatic decrease, reflecting the broader trends within the ecosystem. While certain segments such as DeFi saw growth in their total value locked, the overall performance of the platform’s applications paints a mixed picture. The fluctuation in revenue, particularly among popular apps and NFT trading activities, underscores the volatility present with cryptocurrencies and decentralized applications. As analysts pivot to evaluate Solana’s revenue framework and strategies, understanding these complex relationships will be crucial for stakeholders looking to navigate through the challenging landscape.

Analyzing the Decline of Solana App Revenue in Q2 2025

In the second quarter of 2025, Solana experienced a considerable downturn in its application revenue, which plummeted by 44.2%, falling to $576.4 million. This drastic decline is attributed to various factors affecting key applications within the ecosystem. Despite a rise in the application revenue capture ratio, where applications generated $211.60 in revenue for every $100 spent on transaction fees, the overall revenue dip raises concerns about Solana’s growth potential. Major contributors to the revenue slump included applications like Pump.fun, which saw its income drop by nearly 40%, while other platforms like Phantom and Photon reported losses exceeding 60%.

This sharp decline in Solana app revenue highlights the vulnerabilities within the platform and its reliance on specific high-performing apps. As Solana continues to evolve, it’s crucial to examine the underlying reasons behind this revenue drop, particularly in the context of growing competition and market dynamics. The high volatility observed in the app performance indicates that while some applications thrive, others struggle, ultimately impacting the overall ecosystem’s fiscal health.

The Impact of DeFi and NFT Markets on Solana’s Ecosystem

Even as Solana’s app revenue took a hit, the decentralized finance (DeFi) segment showcased resilience by increasing its total value locked (TVL) by 30.4%, reaching $8.6 billion. This growth is pivotal in maintaining Solana’s standing in the broader blockchain landscape, especially as DeFi continues to attract capital and users. Platforms like Kamino and Raydium demonstrated impressive growth, solidifying their positions and contributing to the decentralized finance robustness that Solana relies upon—a stark contrast to the decline seen in the app revenue metrics.

Moreover, the NFT market on Solana also witnessed significant challenges during the same period, with average daily trading volume plummeting by 46.4%. This decline may have contributed indirectly to the broader revenue issues faced by apps. A thriving NFT market is often essential for pushing user engagement and transaction activity, which fuels revenue generation across the ecosystem. Understanding these interdependencies is critical for stakeholders to navigate the complexities of Solana’s financial performance moving forward.

Axiom’s Revenue Surge Amid Solana’s Challenges

In stark contrast to the overall revenue decline on Solana, Axiom, a Y Combinator-backed trading platform, recorded phenomenal growth, with its revenue skyrocketing by an astounding 641.3% to $126.6 million. This surge can largely be attributed to Axiom’s innovative reward systems that incentivize trading volume, particularly appealing to the memecoin traders that currently dominate the market. As Axiom showcases a successful business model that capitalizes on user engagement, it raises questions about how similar strategies might be utilized by other apps within the Solana ecosystem to combat falling revenues.

Axiom’s unique approach exemplifies the potential for revenue diversification within Solana’s app ecosystem. As other platforms experience significant downturns, Axiom’s success reinforces the importance of adaptive strategies amid market fluctuations. Users are increasingly looking for value creation opportunities, and Axiom’s model reflects a savvy understanding of market trends, underscoring the necessity for continuous innovation within the Solana landscape.

Future Prospects for Solana’s Application Ecosystem

Looking ahead, future prospects for Solana’s application ecosystem will heavily depend on its ability to bounce back from the recent revenue dip while fostering growth in both the DeFi and NFT markets. The rise in the application revenue capture ratio suggests that while transaction fees are profitable, there remains a disconnect between app performance and revenue generation. Solana’s strategic focus should pivot toward enhancing user experiences and increasing the longevity of successful applications to sustain growth momentum.

Additionally, the Solana ecosystem must work toward attracting new developers and innovative projects that can enrich the platform’s offerings. By leveraging the strengths showcased in thriving segments like DeFi, developers can capitalize on Solana’s lower transaction costs and faster speeds compared to competitors. Embracing cross-platform collaborations, educational initiatives, and stablecoin solutions will be vital for establishing Solana as a resilient player in the blockchain space and ensuring a more vibrant revenue landscape for applications in the future.

Understanding the Solana Ecosystem’s Financial Dynamics

To fully grasp the financial dynamics within the Solana ecosystem, one must examine various factors influencing revenue generation. With app revenues dropping while DeFi TVL is on the upswing, it’s essential to analyze the underlying economics of Solana’s applications. The balance of revenue capture and application performance will dictate the sustained growth and health of the network as a whole, making it necessary to dive deeper into the mechanics that drive user engagement.

Dissecting the current trends also reveals an intricate web of interactions between DeFi, NFTs, and app revenues. The performance metrics seen in the second quarter of 2025 signal early indicators of how Solana can either rectify its downward trends or further entrench them. As developers and stakeholders improve their understanding of these financial dynamics, they can implement strategies that enhance revenue streams, secure user trust, and maintain Solana’s competitive edge.

Evaluating Solana’s Competitive Edge in 2025

As Solana navigates through the challenges of 2025, evaluating its competitive edge becomes imperative. With a reduced application revenue and fluctuating NFT trading volumes, the network faces increasing pressure to sustain its position against rival blockchain platforms. Solana must leverage technological advancements and user-centric innovations to reclaim and enhance user confidence in its ecosystem. Having experienced substantial growth, particularly in the DeFi sector, the potential to capitalize on these strengths exists, provided that the platforms can integrate new functionalities and user incentives.

Furthermore, Solana may need to adopt best practices from successful competitors while optimizing its unique capabilities. The network should consider hosting more educational events, hackathons, and partnerships that encourage developers to onboard with new and existing DeFi and NFT projects. With the potential for market volatility looming, building a tight-knit community of engaged users and developers will be essential for Solana to maintain its competitive advantage as the blockchain space anticipates evolving practices and user demands.

Addressing Solana’s Revenue Challenges

Addressing the revenue challenges faced by Solana requires a comprehensive approach aimed at revamping revenue streams, particularly for the underperforming applications. Understanding gaps in user engagement and transaction initiation can help pinpoint areas where app developers must innovate. A strategic focus on integrating more gamified elements or promotional incentives can reignite interest in applications that have seen dwindling revenues, appealing to both new users and existing ones.

Moreover, Solana can explore partnerships with businesses and institutions to broaden its application base beyond traditional finance use-cases. Establishing relationships with influencers or popular brands could leverage market reach and enhance user trust. By focusing on addressing these revenue hurdles, Solana not only stands to stabilize its app ecosystem but could also unlock new growth avenues in niche markets and broaden its overall appeal within the blockchain sector.

The Outlook on Solana’s App Ecosystem Post-Q2 2025

As the Solana app ecosystem moves beyond the second quarter of 2025, stakeholders are eager for signs of recovery and stability. The notable drops in revenue underscores the need for strategic re-evaluation and renewed focus on user engagement. With developers and existing applications prompted to innovate, the future outlook hinges on the concerted efforts to plug revenue leaks and drive user participation back to pre-decline levels.

To foster optimism, the upcoming quarters will be essential in determining if the Solana ecosystem can recover its revenues while sustaining its growth. Encouraging adaptive models like Axiom’s can inspire other applications to reinvigorate their offerings. By actively monitoring and adjusting to market conditions, Solana’s app ecosystem may yet chart a path towards revitalized financial health and robust user engagement.

Frequently Asked Questions

What caused the Solana app revenue drop in Q2 2025?

The Solana app revenue dropped by 44.2% in Q2 2025, falling from $1.0 billion to $576.4 million. This decline was primarily attributed to significant revenue drops in key applications, including Pump.fun, Jupiter, Phantom, and Photon, which collectively contributed to the overall loss despite improvements in application revenue capture ratio.

How did Solana’s app performance compare to its previous quarter?

In Q2 2025, Solana’s app performance showed a stark contrast, with a drastic revenue drop of 44.2% while the app revenue capture ratio increased from 126.5% to 211.6%. This indicates that applications on Solana earned significantly more in revenue relative to transaction fees during this period.

What is the outlook for DeFi on Solana following revenue changes?

Despite the 44% drop in Solana app revenue, the DeFi total value locked (TVL) on the platform increased by 30.4% to $8.6 billion in Q2 2025. This growth suggests a robust DeFi ecosystem that continues to thrive on Solana, potentially offsetting concerns about overall revenue.

How has NFT trading volume on Solana been affected in Q2 2025?

NFT trading volume on Solana experienced a significant decline in Q2 2025, dropping 46.4% to an average daily volume of $979,500. This decrease contributed to the overall revenue downturn, indicating a challenging time for NFT transactions on the platform.

What were the key highlights of Solana’s ecosystem in Q2 2025?

Key highlights from Solana’s ecosystem in Q2 2025 include a substantial 44.2% decrease in app revenue to $576.4 million, a remarkable 641.3% revenue increase for Axiom, and a 30.4% growth in DeFi TVL, which reached $8.6 billion. However, NFT trading volume and stablecoin market cap saw declines, marking a mixed performance overall.

| Key Metrics | Q2 2025 Value | Q1 2025 Value | Percentage Change |

|---|---|---|---|

| Total Application Revenue | $576.4 million | $1.0 billion | -44.2% |

| Pump.fun Revenue | $156.9 million | $260.9 million | -40% |

| Jupiter Revenue | $66.4 million | $78.6 million | -15.6% |

| Phantom Revenue | $53.5 million | $154.1 million | -65.4% |

| Photon Revenue | $32.5 million | $117.6 million | -72.4% |

| Axiom Revenue | $126.6 million | $17.1 million | +641.3% |

| Application Revenue Capture Ratio (ARCR) | 211.6% | 126.5% | +67.5% |

| Total Value Locked (TVL) in DeFi | $8.6 billion | $6.6 billion | +30.4% |

| Stablecoin Market Cap | $10.3 billion | $12.4 billion | -17.4% |

| Average Daily NFT Trading Volume | $979,500 | $1.8 million | -46.4% |

Summary

Solana app revenue experienced a dramatic plunge of 44.2% in Q2 2025, indicating a significant downturn amid efficiency improvements in the ecosystem. While the overall application revenue dropped to $576.4 million from $1.0 billion, some platforms like Axiom showcased remarkable growth due to innovative reward systems. This stark contrast in performance underlines the volatility and challenges within the Solana ecosystem. Despite the revenue decline, the application revenue capture ratio improved, suggesting that applications are still finding ways to generate higher revenue relative to user spending. Overall, monitoring the trends in Solana app revenue will be crucial for stakeholders as they navigate an evolving market.