Stellar Invests in Archax for RWA Tokenization Growth

Stellar Invests in Archax, marking a significant milestone in the realm of tokenized real-world assets (RWA). This strategic partnership enhances Stellar Development Foundation’s efforts to expand into the lucrative RWA tokenization market, specifically within the UK’s regulated crypto environment. Archax, recognized as the UK’s first regulated crypto exchange, is set to benefit from this investment, which aims to bolster its capacity for institutional clients looking to integrate digital assets into their portfolios. By collaborating with Stellar, Archax can leverage the blockchain’s capabilities to streamline the tokenization processes for real-world assets, ensuring increased efficiency and security. This investment highlights the growing intersection of traditional finance and innovative blockchain technology, particularly in the thriving landscape of RWA tokenization.

In a groundbreaking move, Stellar is joining forces with Archax to pioneer advancements in the tokenization of tangible assets. This collaboration not only showcases Stellar’s commitment to expanding its footprint in the cryptocurrency exchange landscape in the UK, but also emphasizes the increasing significance of RWA tokenization in today’s financial ecosystem. By establishing a strategic alliance with Archax, the Stellar Development Foundation aims to enhance institutional engagement in digital asset allocation, paving the way for greater adoption of blockchain technology. This partnership is a clear indicator of the merging pathways between traditional financial structures and the crypto market, illustrating a future where tokenized assets become commonplace. As the industry evolves, such strategic investments in platforms like Archax will undoubtedly play a pivotal role in shaping the future of asset management.

Stellar Invests in Archax: Empowering RWA Tokenization

In a significant advancement towards the future of finance, Stellar has made a strategic investment in Archax, a pioneering crypto exchange regulated by the UK’s Financial Conduct Authority (FCA). This collaboration is set to provide a robust infrastructure for the tokenization of real-world assets (RWA), allowing for greater access and participation from institutional investors. As the demand for RWA tokenization accelerates, this partnership enhances Stellar’s position as a leading platform in this rapidly evolving sector.

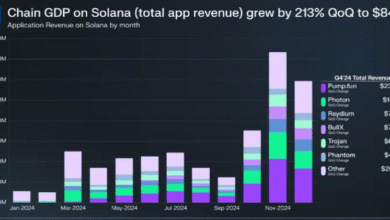

Archax’s impressive growth trajectory, reporting an increase in the RWA tokenization market from $15.2 billion to over $24 billion in just six months, underscores the burgeoning interest in digital assets. With 86% of institutions indicating intentions to allocate resources in this arena by 2025, Stellar’s investment signifies a timely move that positions both entities at the forefront of this transformative wave in the financial industry.

The Growing Market for Tokenized Real-World Assets

The market for tokenized real-world assets is experiencing unprecedented growth, driven by advancements in blockchain technology and an increased confidence among institutional investors. With the rise of RWA tokenization, traditional asset classes such as real estate, art, and commodities are becoming more accessible through digital representations on the blockchain. This innovation not only enhances liquidity but also democratizes investment opportunities, making them available to a broader audience.

In this dynamic landscape, the partnership between Stellar and Archax is pivotal. By leveraging the Stellar network’s capabilities, such as fast settlement times and low transaction costs, the tokenization process can be streamlined, facilitating more efficient market operations. This synergy promises to unlock new opportunities for investors and issuers alike in the burgeoning field of digital asset investment.

Archax’s Unique Position as the First FCA-Regulated Crypto Exchange

Archax holds a unique position in the crypto landscape as the first exchange to receive regulatory approval from the UK’s Financial Conduct Authority. This status provides Archax with a significant competitive edge, as it reassures institutional investors about compliance and security when dealing with crypto assets. Stellar’s investment in Archax amplifies this advantage, allowing the exchange to scale operations and enhance its offerings, particularly in the realm of tokenized real-world assets.

The partnership is not just beneficial for Archax; it also enables the Stellar Development Foundation to extend its operational reach into the European market. Together, they can address the increasing demand for secure and regulated crypto solutions, paving the way for broader adoption of tokenized assets. Stellar’s blockchain technology will play a crucial role in ensuring the efficacy and reliability of tokenized transactions, which is key to capturing the interest of institutional participants.

Future Implications of Stellar’s Investment in Archax

The implications of Stellar’s investment in Archax extend well beyond immediate gains. With both entities focused on the RWA sector, they are set to influence how assets are managed and traded in the digital ecosystem. As evidenced by collaborative projects with traditional financial institutions like Lloyds Banking Group, Stellar’s blockchain capabilities may very well redefine conventional asset management strategies, making them more transparent and efficient.

Moreover, the partnership signals a broader trend where collaboration across established financial institutions and emerging crypto platforms is becoming more common. As companies like Archax embrace the tokenization of real-world assets, opportunities for innovation in finance are set to multiply. This partnership can accelerate the development of infrastructure required for large-scale adoption of digital assets, leading to a more integrated financial landscape.

The Role of Stellar Development Foundation in RWA Tokenization

The Stellar Development Foundation (SDF) plays a critical role in promoting the adoption of blockchain technology for real-world applications. By investing in Archax, SDF directly supports the emerging field of RWA tokenization, which is poised to transform various industries. Their mission revolves around creating a seamless environment for institutions to engage with digital currencies and assets through robust platforms that prioritize security and efficiency.

SDF’s ongoing commitment, demonstrated by previous investments in Archax, showcases their strategy to establish a strong foundation for institutional infrastructure within the tokenization framework. By providing resources and guidance, the Stellar Development Foundation aims to ensure that projects like Archax can effectively serve the growing demand for tokenized financial products.

Impact of Archax’s RWA Tokenization on Institutional Investors

The rise of RWA tokenization through platforms like Archax presents a transformative opportunity for institutional investors. As traditional barriers to entry for asset classes diminish, larger entities can now invest in diversified portfolios with greater ease. Tokenized assets facilitate fractional ownership, meaning institutions can access high-value assets which were previously out of reach due to high costs or illiquidity.

This advancement also invites a broader audience into the investment landscape. With Stellar and Archax’s integrated efforts, institutions are more likely to embrace digital assets, affirming their role in the future of financial investments. This shift indicates that traditional finance is gradually melding with the crypto ecosystem, setting the stage for more inclusive avenues for wealth creation.

Archax’s Strategic Partnerships: Leveraging Stellar’s Blockchain

Strategic partnerships are crucial for Archax as they navigate the competitive landscape of crypto exchanges and asset tokenization. By aligning with Stellar, Archax not only enhances its operational capabilities but also establishes a strong foundation for future collaborations with other financial institutions. The ability to leverage Stellar’s blockchain for RWA tokenization projects presents opportunities to innovate and enhance the way assets are managed and traded.

Collaborations of this nature are essential in building credibility within the market. With Stellar’s reputation in the crypto space, Archax can attract more institutional players looking for reliable and compliant channels to engage with digital assets. This partnership is set to foster an ecosystem where real-world assets are seamlessly integrated into the blockchain, providing enhanced security and efficiency for all stakeholders involved.

The Significance of Low Transaction Costs in RWA Tokenization

One of the standout features of the Stellar network is its ability to facilitate low transaction costs, which is vital for the efficient tokenization of real-world assets. In an environment where every basis point matters, reducing costs can make a substantial difference for institutional investors weighing the cost-effectiveness of tokenized assets versus traditional asset classes. Stellar’s partnership with Archax ensures that these financial benefits are passed on to end users, making digital investments more appealing.

By enabling low-cost transactions, Stellar enhances the competitiveness of tokenized RWAs in the market. This factor is pivotal for institutions aiming to maximize their investment returns while minimizing overhead expenses. As Archax expands its offerings through this collaboration, the accessibility and attractiveness of RWA tokenization will undoubtedly increase, paving the way for broader inquiry and investment from seasoned financial players.

Stellar’s Vision for the Future of Digital Asset Investment

Stellar’s vision for the future encompasses a robust digital asset ecosystem characterized by transparency, accessibility, and efficiency. The investment in Archax is a clear manifestation of this vision, targeting the burgeoning field of RWA tokenization as a critical area for growth. By prioritizing real-world applications, Stellar is positioning itself as a leader in the movement towards integrating blockchain technology with traditional financial systems.

Looking ahead, Stellar’s strategic initiatives, including its collaboration with Archax, will play a crucial role in shaping the future of digital asset investment. As institutions continue to explore and invest in tokenized assets, Stellar’s framework of fast settlements and low costs will be instrumental in fostering an inclusive and innovative financial landscape.

Frequently Asked Questions

What is the significance of Stellar’s investment in Archax for RWA tokenization?

Stellar’s investment in Archax represents a strategic move to enhance its participation in the rapidly growing space of tokenized real-world assets (RWA). This partnership not only allows Stellar to leverage Archax’s position as a regulated crypto exchange in the UK but also facilitates the use of Stellar’s blockchain technology in streamlining RWA tokenization processes for institutional clients.

How does Stellar Development Foundation’s partnership with Archax benefit the crypto exchange UK landscape?

The partnership between Stellar Development Foundation and Archax significantly strengthens the crypto exchange landscape in the UK by integrating Stellar’s advanced blockchain capabilities with Archax’s regulatory framework. This collaboration promises to support the tokenization of real-world assets (RWA), enhancing market efficiency and allowing institutions to engage with digital assets more securely and effectively.

What role does Archax play in the tokenization of real-world assets (RWA)?

Archax serves as a pioneering UK-based crypto exchange and custodian that specializes in tokenized real-world assets (RWA). By being the first regulated exchange in its sector, Archax facilitates efficient trading and custody solutions for institutional clients, positioning itself as a key player in the growing RWA tokenization market.

Why is the tokenization of real-world assets (RWA) important for institutional investors?

The tokenization of real-world assets (RWA) is becoming increasingly important for institutional investors as it provides new opportunities for market access, liquidity, and diversification. With 86% of institutions planning to allocate resources to digital assets, the ability to tokenize and trade RWA can significantly enhance financial strategies and investment portfolios.

How will Stellar’s blockchain technology impact future tokenization deals at Archax?

Stellar’s blockchain technology is designed for fast settlement times and low transaction costs, which can greatly enhance the efficiency of future tokenization deals at Archax. This can lead to improved management of tokenized assets, creating more streamlined processes for processes like those involving Lloyds Banking Group and Aberdeen Investments.

What does the partnership between Stellar and Archax mean for the future of digital assets in Europe?

The partnership between Stellar and Archax is set to reinforce the adoption of digital assets in Europe, especially within the realm of tokenized real-world assets (RWA). By combining Stellar’s blockchain strengths with Archax’s regulatory compliance and institutional focus, this alliance is expected to accelerate the integration of digital assets into traditional financial frameworks across the European market.

What are the expected growth figures for the RWA tokenization industry following Stellar’s investment in Archax?

Following Stellar’s investment in Archax, analysts predict substantial growth for the RWA tokenization industry. With figures previously indicating a rise from $15.2 billion to over $24 billion within a short span, the collaboration is anticipated to drive further investments and innovations in tokenization, greatly contributing to this upward trend.

What prior investment did Stellar make in Archax and how does it relate to their current partnership?

Earlier this year, Stellar Development Foundation invested $4 million in Archax to bolster the institutional infrastructure for tokenized funds. This initial investment aligns with their current partnership, reinforcing their commitment to facilitating RWA tokenization and enhancing Archax’s capabilities within the digital asset marketplace.

| Key Points |

|---|

| Stellar, the cryptocurrency project, has made a strategic investment in Archax, a UK-based exchange and custodian for institutional customers. |

| The partnership focuses on RWA (real-world asset) tokenization processes and aims to expand Stellar’s footprint in Europe. |

| The RWA industry is rapidly growing, projected to increase from $15.2 billion in December 2024 to over $24 billion by June 2025. |

| Archax is the first crypto exchange in the UK regulated by the Financial Conduct Authority (FCA). |

| 86% of institutions have or plan to have digital asset allocations by 2025, indicating strong market demand. |

| This is Stellar’s second investment in Archax for the year, following a $4 million investment earlier to support infrastructure development. |

Summary

Stellar Invests in Archax marks a significant step for both companies to capitalize on the booming tokenization of real-world assets (RWA). The partnership not only connects Stellar’s blockchain technology with Archax’s regulatory framework but also positions them strongly within the rapidly expanding European market. With the RWA sector projected to see substantial growth, this collaboration is set to enhance institutional participation and drive innovation in the asset tokenization landscape.