xStocks: Integrating with Tron Blockchain for Tokenized Equities

xStocks is revolutionizing the way investors interact with traditional equity markets by integrating with the Tron blockchain. This innovative tokenized equities product, developed in collaboration with Kraken and Backed, allows users to hold assets as TRC20 tokens fully backed by real equity listed on Kraken’s platform. With this seamless integration, eligible clients will soon be able to deposit and withdraw xStocks directly through Tron, enhancing the accessibility of decentralized finance solutions. As Kraken expands xStocks into multiple blockchains, including notable launches on Solana and BNB Chain, it underscores a commitment to a more inclusive financial ecosystem. This exciting development aims to bridge the gap between traditional equities and blockchain technology, paving the way for a more efficient and diverse investment landscape.

The emergence of tokenized equities signifies a pivotal transition for the financial sector, presenting a unique opportunity for investors. By transforming traditional assets into digital representations, platforms like xStocks facilitate easier access to equity markets through decentralized networks. This collaboration between Kraken, Backed, and Tron underscores the growing relevance of blockchain in connecting global finance with innovative technology. With the backing of the Tron blockchain, these assets, represented as TRC20 tokens, offer a novel way to engage in decentralized finance. As the landscape evolves, the relationship between traditional investments and modern blockchain solutions becomes increasingly intertwined.

Introduction to xStocks and Tokenized Equities

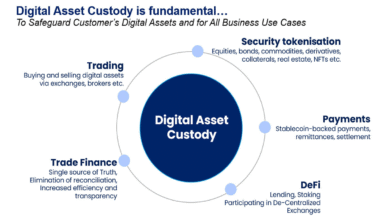

Tokenized equities represent a groundbreaking innovation in the intersection of traditional finance and blockchain technology. Through the efforts of Kraken and its partnership with Backed, the product known as xStocks has become a focal point for investors looking to gain exposure to U.S. equities in a more efficient manner. By utilizing the Tron blockchain, these tokenized equities can be traded as TRC20 tokens, which ensures a seamless integration with decentralized finance (DeFi) applications. With this advancement, investors are now presented with new opportunities to invest in previously inaccessible assets.

The significance of tokenized equities lies in their ability to democratize access to financial markets. By offering xStocks, Kraken enables users to hold assets that are fully backed by the underlying equities at a 1:1 ratio. This model not only fosters trust among investors but also enhances liquidity within the market. As more users begin to engage with these digital assets, the potential for price discovery in traditionally rigid markets becomes increasingly realized, making tokenized equities a centerpiece of innovative financial solutions.

The Role of TRC20 Tokens in Blockchain Integration

TRC20 tokens play a vital role in the integration of xStocks within the Tron blockchain ecosystem. By leveraging the TRC20 token standard, Kraken and Backed ensure that these tokenized equities can harness the benefits of smart contracts and decentralized applications. This integration is pivotal, especially as it enhances interoperability among various blockchains, allowing investors to transact with greater ease and efficiency. As demand for tokenized equities grows, the utility of TRC20 tokens will likely lead to increased adoption of decentralized finance solutions.

Moreover, the deployment of xStocks as TRC20 tokens not only expands Kraken’s offerings but also positions the Tron blockchain as a competitive player in the tokenized equity space. With the capacity to facilitate fast and secure transactions, TRC20 tokens contribute to the fluidity and accessibility that investors seek. The architecture of this collaboration promises to simplify the complexity traditionally associated with equity investment, paving the way for broader participation in financial markets.

Decentralized Finance and Its Impact on Tokenized Equities

Decentralized finance (DeFi) has emerged as a transformative force in the financial landscape, redefining how assets like xStocks are traded and managed. As Kraken integrates its tokenized equities with the Tron blockchain, it exemplifies the potential of DeFi to enhance market accessibility for underserved investors. The ability to deposit and withdraw xStocks directly through Tron opens new pathways for engagement, significantly lowering barriers that have historically restricted participation in equity markets.

This shift towards decentralized finance mirrors broader trends in consumer behavior, where users increasingly favor platforms that offer transparency and reduced reliance on centralized entities. Utilizing blockchain technology allows for real-time settlement and custody of assets, further streamlining transactions. As this trend continues, we can anticipate a rise in the number of users exploring tokenized equities as viable investment options, propelled by the innovative infrastructure provided by DeFi.

Kraken’s Commitment to Multi-Chain Future

Kraken’s strategic expansion to integrate xStocks across multiple blockchains, including its latest partnership with Tron, is indicative of a broader commitment to a multi-chain future in the cryptocurrency ecosystem. The advancements in blockchain interoperability allow users to seamlessly navigate between various platforms, enhancing their trading experiences. This future vision aligns perfectly with Kraken’s mission of creating an open and permissionless financial landscape, where barriers to entry are minimized.

As Kraken continues to evolve its offerings, the emphasis on partnerships with leading blockchain platforms showcases a significant trend in the industry. By enabling the trading of equities through decentralized networks, Kraken empowers users with a higher level of control and flexibility over their investments. The move towards multi-chain architecture heralds a new era for traders and investors alike, promoting an efficient and competitive marketplace for tokenized assets.

Justin Sun’s Vision for the Future of Financial Markets

Justin Sun, the founder of Tron, has consistently articulated a clear vision for the future of financial markets, highlighting how decentralized networks can enhance the accessibility of tokenized equities. In his view, the collaboration with Kraken on xStocks represents a critical step in bridging traditional financial systems with cutting-edge blockchain technology. Sun envisions a market landscape where better public accessibility to investment opportunities translates to higher efficiency and inclusivity.

By making tokenized equities available globally, Sun believes that the demand from previously excluded global audiences will drive a significant transformation. As investment barriers dissolve, the industry can expect new participants who are eager to leverage the advantages of decentralized finance. This evolution serves as a reminder that technology can play a pivotal role in reshaping financial engagement and empowering a broad demographic of investors.

The Financial Implications of Tokenized Equities

The emergence of tokenized equities through initiatives like xStocks has far-reaching financial implications. For investors, this translates to enhanced liquidity and 24/7 access to trade U.S. equities without the constraints of traditional market hours. The ability to easily deposit and withdraw xStocks directly via the Tron blockchain further increases the attractiveness of this investment option, catering to a growing market that values immediacy and flexibility in trading.

Additionally, the efficiency of decentralized exchanges (DEXs) will likely transform how equities are bought and sold, making the overall market significantly more competitive. With over $2.5 billion in trading volume since the launch of xStocks, the appetite for novel investment vehicles is evident. The ongoing advancements in technology and trading infrastructure underscore the necessity for market participants to adapt and embrace these innovative financial instruments.

Challenges and Opportunities in Tokenized Finance

While the integration of xStocks into the Tron blockchain presents numerous opportunities, it is essential to acknowledge the challenges that come with tokenized finance. Regulatory uncertainty and compliance issues are paramount concerns that platforms like Kraken need to address to ensure the security and legitimacy of tokenized assets. As the market matures, navigating these hurdles will require innovation and collaboration between regulatory bodies and financial institutions.

Conversely, the rise of tokenized equities brings about immense potential for growth in the blockchain sector. By tackling and overcoming these challenges, there exists an opportunity to build a more robust framework for trading equities globally. As more users flock to decentralized finance solutions, the demand for secure and compliant trading platforms will only increase, driving further innovation and adoption in tokenized finance.

User Experience and Accessibility of Tokenized Equities

The user experience in trading tokenized equities such as xStocks is paramount to their success in the mainstream market. Kraken’s integration with the Tron blockchain aims to streamline this experience by offering users a hassle-free method to buy and sell equities in a decentralized manner. Improving user interface design and ensuring intuitive navigation through the platform can significantly enhance adoption rates and overall user satisfaction.

Moreover, the accessibility of tokenized equities addresses the needs of a diverse audience. With eligibility to engage in trading across 140 countries, Kraken has positioned xStocks as a global financial product. As awareness around tokenized equities grows, so does the potential for broader community engagement, enabling individuals from various backgrounds to explore investment opportunities that align with their financial goals.

The Future of Crypto and Tokenized Equities

The trajectory of cryptocurrency and tokenized equities appears promising, particularly with innovative platforms like Kraken leading the charge. The collaboration with Tron through xStocks showcases a commitment to marrying the worlds of equity trading and blockchain technology, setting the stage for unprecedented growth. As interest in tokenized assets continues to swell, educating potential investors about the benefits and functionality of these products will be pivotal.

Moreover, as the financial landscape evolves, there is potential for tokenized equities to redefine traditional investment paradigms. The fusion of DeFi and conventional finance could prompt a reassessment of what it means to invest and trade in securities, with accessibility and efficiency becoming the standard. In this illuminating new era, xStocks and similar products will likely play a significant role in shaping the future of investment.

Frequently Asked Questions

What are xStocks and how do they relate to the Tron blockchain?

xStocks are a product that offers tokenized equities, allowing users to gain exposure to traditional stock markets through the blockchain. In partnership with Backed and the Tron DAO, Kraken is integrating xStocks as TRC20 tokens on the Tron blockchain, enabling users to engage with equity assets in a decentralized manner.

How can I use xStocks on the Kraken exchange?

To use xStocks on the Kraken exchange, eligible clients will soon be able to deposit and withdraw these tokenized equities directly through the Tron network. This integration makes it easier for users to trade equities in a decentralized finance (DeFi) environment, leveraging the benefits of blockchain technology.

What advantages do tokenized equities like xStocks provide to investors?

Tokenized equities, such as xStocks, offer several advantages, including enhanced accessibility to U.S. equities for a global audience, faster transactions, and reduced costs through decentralized finance mechanisms. By being fully backed 1:1 by physical equity assets, xStocks provide a secure and efficient way to invest in traditional markets.

Can xStocks be traded on multiple blockchains?

Yes, xStocks are part of an expansion strategy that includes trading on multiple blockchains. Following their initial launches on Solana and BNB Chain, xStocks are now being integrated with the Tron blockchain, further enhancing the interoperability and accessibility of tokenized equities.

What is the significance of TRC20 tokens in the xStocks integration with the Tron blockchain?

TRC20 tokens represent a standard for creating and issuing smart contracts on the Tron blockchain. The integration of xStocks as TRC20 tokens allows for greater compatibility with decentralized applications (dApps) in the Tron environment, facilitating seamless trading and interaction with tokenized equities in the decentralized finance ecosystem.

How does the integration of xStocks with decentralized finance benefit users?

The integration of xStocks with decentralized finance allows users to access tokenized equities in a more efficient, flexible, and accessible way. It connects traditional equity markets with the benefits of blockchain technology, promoting openness and permissionless financial services that can cater to previously excluded user bases.

Who are eligible clients for trading xStocks on Kraken?

Eligible clients for trading xStocks on the Kraken exchange are users from countries where Kraken operates, which includes over 140 countries worldwide. The integration with the Tron blockchain will soon allow these clients to deposit and withdraw xStocks in a decentralized manner.

What is the future of xStocks in the decentralized finance market?

The future of xStocks in the decentralized finance market looks promising as the demand for tokenized equities continues to grow. With ongoing expansions into various blockchains and an emphasis on creating an interoperable financial ecosystem, xStocks are poised to become a key player in bridging traditional markets with the world of blockchain.

| Key Point | Details |

|---|---|

| Partnership and Integration | Kraken is working with Backed and Tron DAO to integrate xStocks with the Tron blockchain. |

| Deployment as TRC20 Tokens | xStocks will be deployed as TRC20 tokens on the Tron network, fully backed 1:1 by equity assets on Kraken. |

| Expansion Across Blockchains | This is the third blockchain integration for xStocks following the launches on Solana and BNB Chain. |

| Goal of Openness | Kraken aims to create a permissionless and interoperable multi-chain architecture for equities. |

| Decentralized Network Impact | Justin Sun emphasizes that this collaboration increases accessibility of tokenized equities. |

| Market Efficiency | Tokenized equities link traditional markets and blockchain, creating a more efficient market. |

| Recent Performance | Since launch, xStocks has facilitated over $2.5 billion in trade volume globally. |

Summary

xStocks represents a significant advancement in the integration of traditional finance and blockchain technology. By working with Tron DAO and Backed, Kraken is not only enhancing the accessibility of tokenized equities but also underscoring its commitment to openness and interoperability across multiple blockchain platforms. This initiative will enable eligible clients to directly interact with these innovative financial products, ensuring that a broader audience can participate in the evolving market of equities. As xStocks continues to grow, its impact on both the crypto space and traditional markets is set to shape the future of investment accessibility.