UK Stablecoin Strategy: Crypto Firms Urge Action Now

The UK stablecoin strategy is becoming increasingly crucial as the country seeks to solidify its position in the rapidly evolving landscape of digital assets. Prominent crypto firms, including Coinbase and Kraken, are urging the UK to develop a national stablecoin policy to ensure it does not fall behind global counterparts like the United States. With the stablecoins market currently valued at over $280 billion, the need for UK crypto regulation that fosters innovation while protecting consumers has never been more pressing. Industry leaders emphasize that stablecoin adoption could not only enhance the financial services sector but also generate new revenue opportunities through transactions involving government bonds. By prioritizing a robust strategy for stablecoins, the UK can pave the way for a thriving digital economy that benefits both businesses and consumers alike.

In a rapidly changing world of finance, a national strategy focused on digital currencies—particularly stablecoins—could redefine the economic landscape of the UK. As more stakeholders recognize the potential of these pegged assets to facilitate seamless transactions, the push for comprehensive crypto regulation is gaining momentum. Discussions around digital assets in the UK are intensifying, with calls for a proactive approach that ensures stablecoin market growth and competitiveness. This evolving conversation underscores the vital link between robust frameworks and the successful adoption of innovations in the financial sector. Ultimately, the establishment of a well-rounded national strategy is essential for the UK to leverage the benefits of digital currencies, positioning itself as a leader in the global financial arena.

The Importance of a National Stablecoin Strategy for the UK

The call for a national stablecoin strategy in the UK highlights the urgent need for a structured approach to harness the growing potential of digital assets. As various crypto firms emphasize, adopting such a strategy is paramount for ensuring that the UK doesn’t lag behind global leaders, particularly the US. Establishing a national strategy would not only position the UK as a pioneer in the evolving stablecoin market, but it would also enhance its reputation as a significant player within the wider digital assets ecosystem.

This proactive approach would encourage stablecoin adoption across businesses and consumers by fostering regulatory clarity and industry collaboration. The UK has the potential to create a robust framework that integrates stablecoins into the existing financial system while safeguarding investors and consumers. By embracing stablecoins as a legitimate extension of financial infrastructure, the UK would set itself apart as a rule-maker rather than a rule-taker in the digital asset arena.

Challenges Facing the UK’s Stablecoin Market

The current state of the UK’s stablecoin market poses significant challenges, particularly in contrast to the dominance of US-based stablecoins. While leading stablecoins like Tether and USDC have established themselves globally, the UK’s equivalent offerings remain grossly underrepresented, with a combined market cap of only £461,224. This stark reality underscores the need for a national stablecoin policy that actively promotes the growth and adoption of local stablecoin solutions.

Moreover, regulatory uncertainty continues to hinder the development of the stablecoins market in the UK. The existing legal definition of stablecoins as “crypto-assets with reference to fiat currency” places undue limitations on their function and use, potentially stifling innovation. The industry’s call for a more flexible and comprehensive approach to regulation is essential to unlock the full potential of digital assets, ensuring that the UK can compete effectively on the global stage.

Enhancing Financial Services through Stablecoin Adoption

A well-defined national stablecoin strategy could transform the landscape of UK financial services, creating new opportunities for revenue generation and market growth. By integrating stablecoins as a legitimate financial instrument, the UK could not only enhance its position as a global financial hub but also attract significant investments in digital assets. This shift towards stablecoin adoption could lead to increased demand for government bonds and innovative financial products that leverage digital currencies.

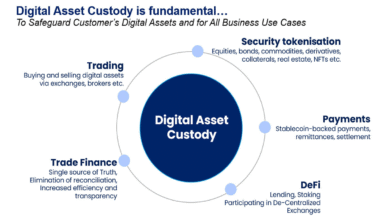

Incorporating stablecoins into the mainstream financial system can streamline money transfers, making them faster and more efficient. This method bypasses traditional banking processes, significantly reducing transaction costs and time delays. Emphasizing the benefits of stablecoins can encourage traditional banks and financial institutions to explore new digital channels, ultimately fostering a more inclusive financial ecosystem for all.

The Role of UK Crypto Regulation in Stablecoin Strategy

The regulatory landscape for cryptocurrencies in the UK is critical to the successful implementation of a national stablecoin strategy. Current concerns regarding the regulatory framework hinge on whether it adequately balances innovation with consumer protection. Stakeholders argue that the UK must establish an effective legal and regulatory environment that allows stablecoins to thrive, enabling innovation within the stablecoin market while mitigating associated risks.

By offering clearer guidelines and fostering open dialogue between regulators and the crypto industry, the UK could encourage responsible stablecoin development. This would not only bolster the confidence of investors and users but also facilitate the integration of stablecoins into various financial services, further promoting the adoption of digital assets in the UK market.

International Competitive Advantage of Stablecoins

As the global stablecoin market expands, the UK has the potential to carve out a competitive advantage by prioritizing stablecoin innovation and adoption. The emphasis on creating a national stablecoin strategy can position the UK as a leader in the digital assets space, attracting businesses and investors from around the world. Countries that proactively engage in the digital asset arena stand to benefit economically, showcasing their commitment to modern financial solutions.

Strengthening the UK’s position in the international stablecoin market is essential for fostering an environment where innovative financial technologies can flourish. By supporting stablecoin initiatives that align with global best practices, the UK can ensure that it remains at the forefront of the rapidly evolving financial landscape, facilitating cross-border transactions and ensuring seamless integration into international markets.

Potential Risks and Contingencies in Stablecoin Development

While the benefits of adopting a robust stablecoin strategy in the UK are evident, potential risks and operational challenges must also be considered. The collapse of notable stablecoins, such as Terra, serves as a stark reminder of the vulnerabilities inherent in this technology. A balanced national stablecoin policy would need to address these risks by establishing strict operational standards and investor protections to safeguard against similar future occurrences.

Furthermore, regulators must consider the implications of stablecoin market fluctuations on monetary policy and financial stability. Crafting a resilient framework that anticipates various market scenarios is essential to ensuring the long-term viability of stablecoins in the UK. Ongoing research and collaboration between stakeholders can help mitigate these risks, fostering an environment conducive to safe and responsible stablecoin adoption.

Bridging Traditional Finance and Digital Assets with Stablecoins

The adoption of stablecoins offers a unique opportunity to bridge the gap between traditional finance and emerging digital asset ecosystems. By providing a cash-equivalent mechanism for transactions in the crypto space, stablecoins can facilitate smoother integrations of digital payments into existing financial frameworks. This blending of assets can ease consumer apprehension regarding cryptocurrency and encourage broader acceptance within the UK economy.

As the financial landscape evolves, leveraging the stability of pegged currencies will be critical to fostering innovation in payment systems. Establishing regulations that promote stablecoin use in everyday transactions can redefine how consumers engage with digital assets, ultimately leading to more significant growth within the digital economy and a comprehensive understanding of the potential benefits stablecoins can provide.

The Path Forward: Collaborative Efforts in the Crypto Industry

The formation of a national stablecoin strategy in the UK will require collaborative efforts among financial institutions, regulatory bodies, and the crypto industry. Stakeholders must engage in open dialogue to create a cohesive understanding of stablecoin functionality and address concerns over regulation. By bringing together these diverse entities, the UK can create a unified vision that accelerates the safe and responsible adoption of stablecoins.

Furthermore, fostering innovation within the UK’s fintech sector will necessitate ongoing investment and strategic partnerships across the industry. This collaborative approach can cultivate a supportive environment for stablecoin projects, enabling them to thrive and develop responsibly. By aligning interests and driving shared goals, the UK can enhance its appeal within the global stablecoin market, showcasing its commitment to being a viable player in the evolving landscape of digital assets.

Future Perspectives: A Dynamic Stablecoin Ecosystem in the UK

Looking ahead, the establishment of a national stablecoin strategy holds the promise of creating a dynamic ecosystem within the UK. By prioritizing stablecoin adoption and fostering a conducive regulatory environment, the UK can nurture innovation while protecting stakeholders. As the digital assets landscape continues to transform, ensuring the UK is adaptable to change will be crucial to maintaining competitiveness in the global market.

Ultimately, the collaboration between regulators, industry leaders, and innovators will be pivotal in shaping the future of stablecoins in the UK. With the right strategies in place, the UK can position itself not only as a market leader but also as a hub for stablecoin development, setting trends that could influence regulatory frameworks worldwide and solidifying its status as a leader in the evolving digital finance sector.

Frequently Asked Questions

What is the significance of a UK stablecoin strategy for cryptocurrency regulation?

A UK stablecoin strategy is crucial for establishing a comprehensive regulatory framework that allows the UK to actively participate in the evolving stablecoins market. By formulating such a strategy, the UK can position itself as a rule-maker rather than a rule-taker, fostering innovation in the digital assets sector and ensuring safe adoption of stablecoins.

How could a national stablecoin policy benefit the UK economy?

A national stablecoin policy could enhance the UK’s position as a global financial hub by creating new revenue opportunities in fees and foreign exchange. This strategy could also boost demand for UK government bonds (gilts) through innovative digital channels, contributing positively to the economic landscape.

What challenges does the UK face in adopting stablecoins?

The UK faces several challenges in adopting stablecoins, primarily due to existing regulations that categorize stablecoins narrowly as ‘crypto-assets with reference to fiat currency.’ This regulatory perspective may hinder the legitimate usage and growth of stablecoins, emphasizing the need for a national stablecoin strategy that supports innovation.

What role do stablecoins play in the digital assets market in the UK?

Stablecoins serve as the cash equivalent for digital assets, acting as a reference or base currency for nearly every crypto asset. In the UK digital assets market, the adoption of stablecoins could significantly bridge the gap between traditional finance and innovative blockchain payment methods.

Why do crypto firms advocate for a proactive UK crypto regulation regarding stablecoins?

Crypto firms advocate for proactive UK crypto regulation to ensure that the country remains competitive in the digital assets landscape. Without a coordinated national stablecoin strategy, the UK risks falling behind other regions, particularly the U.S., where stablecoin adoption has been more robust and regulatory frameworks more welcoming.

What are the potential risks associated with stablecoins in the UK?

Potential risks associated with stablecoins in the UK include market instability, as illustrated by past failures of certain stablecoins like Terra, alongside regulatory challenges that could hinder their integration into the financial system. Establishing a national stablecoin strategy would aim to mitigate these risks while facilitating responsible growth.

How could the UK leverage stablecoin adoption to enhance its financial services sector?

The UK could leverage stablecoin adoption to enhance its financial services sector by creating a supportive regulatory environment that encourages innovation. This would lead to the introduction of new services, facilitate digital transactions, and potentially attract more investment into the UK’s financial technology industry.

What are some examples of stablecoins that dominate the market but are not UK-based?

Examples of dominant stablecoins in the global market include Tether’s USDT and Circle’s USDC, both pegged to the U.S. dollar. These stablecoins highlight the competitive landscape in the stablecoins market, emphasizing the urgent need for the UK to develop its own national stablecoin strategy for local adoption.

| Key Point | Details |

|---|---|

| Urgency for National Strategy | Crypto firms advocate for the UK to form a national stablecoin strategy to remain competitive with the US. |

| Open Letter to Government | Representatives from major crypto firms urge UK finance minister to adopt a proactive approach to avoid being a rule-taker. |

| Current Market Overview | Total market for stablecoins is over $280 billion, but UK stablecoins are valued at just £461,224 ($621,197). |

| Regulatory Criticism | The existing legal definition of stablecoins as ‘crypto-assets with reference to fiat currency’ is seen as limiting. |

| Potential Benefits of Strategy | A national stablecoin strategy could enhance UK’s financial prominence and create new revenue opportunities. |

| Risks of Stablecoin Market | The collapse of Terra and Luna highlights risks in the stablecoin market, affecting confidence in stability of pegged currencies. |

| Need for Appropriate Regulations | Creating a suitable regulatory framework is essential for the potential growth and adoption of stablecoins. |

Summary

The UK stablecoin strategy is crucial for the country to establish itself as a leader in the digital asset space. As highlighted by several prominent crypto firms, a coordinated and proactive approach is necessary to prevent the UK from lagging behind countries like the US. By embracing stablecoins as part of its financial infrastructure, the UK can foster innovation, create new revenue opportunities, and better integrate with the rapidly evolving global digital economy. Addressing regulatory challenges will be essential to unlock the full potential of stablecoins and ensure the UK remains competitive.