Bitcoin ETF Outflows Hit $1.9 Billion Amid Selloff

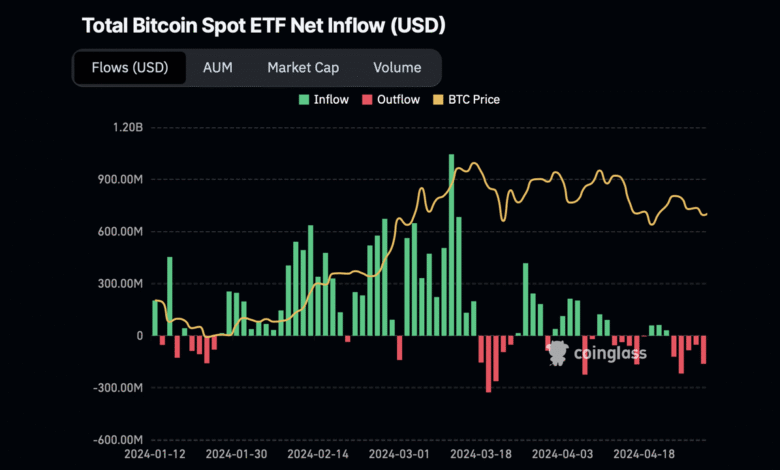

Bitcoin ETF outflows have surged dramatically, with a staggering $312 million pulled from these investment vehicles in just a single day. An ongoing selloff has been fueled by heightened investor anxiety in the face of macroeconomic headwinds, as many are reevaluating their positions in the market. Alongside Bitcoin, Ethereum ETFs are not faring any better, suffering a combined total of $1.9 billion in outflows over a four-day period. This trend starkly highlights the shifting landscape of Bitcoin investment trends, as investors grapple with uncertainty and shifting market dynamics. In light of such significant crypto ETF withdrawals, monitoring the evolving patterns of cryptocurrency trading news has become essential for investors looking to navigate this volatile terrain.

The recent wave of capital withdrawals from cryptocurrency exchange-traded funds (ETFs), notably those tied to Bitcoin and Ethereum, represents a notable pivot in market sentiment. Investors have expressed growing caution as they react to fluctuating economic conditions and reassess their engagements in these digital assets. This climb in ETF selloffs indicates a broader trend where many stakeholders are now rethinking their strategies regarding exposure to leading cryptocurrencies. Observers of Ethereum market analysis have noted that the implications of these outflows could redefine upcoming investment trajectories within the crypto space. Keeping a close eye on the movements within both Bitcoin and Ethereum ETFs will be crucial for anyone seeking to understand the future of cryptocurrency investment.

Bitcoin ETF Outflows Reach Record Levels Amid Investor Uncertainty

The recent trend of significant Bitcoin ETF outflows has captured the attention of both traders and analysts alike. With a staggering $1.9 billion withdrawn from Bitcoin and Ether ETFs within just four days, the outflow streak indicates a growing sense of unease among investors. This heightened volatility can be linked to various factors, including macroeconomic challenges and a cautious risk appetite among potential investors. As Bitcoin undergoes these substantial withdrawals, the impact is felt not just within the crypto market, but across all investment sectors, illustrating how intertwined these financial instruments have become.

A closer examination of the data reveals that the largest single-day outflow occurred on August 20, when Bitcoin ETFs alone saw a dip of 312 million dollars. This troubling trend raises questions about Bitcoin’s investment climate moving forward and mirrors broader patterns observed in the cryptocurrency landscape. The noticeable reaction from institutional investors, who are pivotal in driving Bitcoin investment trends, underscores the importance of tracking these outflows as they can further unsettle the market, leading to increased volatility that echoes through the Ether market as well.

Ethereum ETF Selloff: Investor Sentiment and Market Dynamics

Amid the ongoing selloff in cryptocurrency exchange-traded funds (ETFs), Ethereum ETFs have not been spared from notable outflows, totaling $240 million during the recent turmoil. This reflects a substantial shift in investor sentiment towards Ethereum, following a pattern established by Bitcoin’s decline. The continued loss for Ether ETFs is characterized by significant withdrawals from major players such as Blackrock, highlighting a broader concern about the sustainability of Ethereum’s price amidst economic uncertainty.

The dynamics of the Ethereum market are influenced by a number of external variables, including market analysis and trading performance trends. The lack of sufficient inflows into Ether ETFs to offset losses indicates that investor confidence is waning. This environment affects not just Ethereum but the entire crypto trading ecosystem, creating a challenging environment for traders and hard-won capital preservation. As news regarding cryptocurrency trading evolves, understanding these nuances will be crucial for investors looking to navigate the turbulent waters of the crypto markets.

Furthermore, the recent selloff spikes further scrutiny over Ether’s potential recovery, as many investors seek more stable alternatives amidst rising market volatility. The pattern of withdrawals signals an urgent need for renewed interest and confidence in Ethereum as a viable investment option, particularly with Bitcoin displaying similar selloff patterns. As analysis continues, traders may bring new strategies to the table, seeking opportunities in essential Ethereum trends while adapting to the ongoing challenges facing crypto ETFs.

Understanding Cryptocurrency Trading News and Its Impact on ETF Investments

The landscape of cryptocurrency trading news is continuously evolving, significantly impacting investor decisions regarding ETF investments. With the recent outflows from Bitcoin and Ethereum ETFs, news related to broader market dynamics has amplified market reactions among investors. Information regarding economic indicators and regulatory updates can sway investor sentiment, leading to rapid changes in fund flows. As trading volumes fluctuate alongside major announcements and shifts in market sentiment, it is imperative that traders keep a close eye on cryptocurrency news to inform their strategies.

Moreover, the role of cryptocurrency trading platforms becomes increasingly central during such fluctuations. Active trading remains essential, as evidenced by total trading volumes reported during the outflow period. Understanding how various news and developments influence ETF withdrawals can give investors an edge, allowing them to make informed decisions better suited to changing market conditions. In tandem with the broader investor sentiment towards Bitcoin and Ethereum, awareness of relevant cryptocurrency trading news can lead to more strategic investment practices during times of heightened volatility.

Market Analysis: The Rise of Crypto ETF Withdrawals

Market analysis reveals that the increasing trend of crypto ETF withdrawals mirrors the overall volatility and uncertainty affecting the cryptocurrency market. The sharp declines witnessed in both Bitcoin and Ethereum ETFs, culminating in significant outflows, highlight the challenges investors currently face in navigating this landscape. By analyzing these trends, traders can derive insights into potential future movements in the market, positioning themselves to capitalize on emerging opportunities as they arise amidst the heightened outflow environment.

Furthermore, the effects of the Ethereum ETF selloff underscore how interconnected these assets are. As Bitcoin ETFs suffer, Ether ETFs simultaneously endure their own withdrawals. This correlation suggests that market sentiment sways future inflows and withdrawals across the board, reiterating the cyclical nature of these investments. Investors keen on crypto market analysis must consider these trends, including underlying causes of outflows such as regulatory concerns or macroeconomic pressures, to better navigate the withdrawal landscape.

The Relationship Between Bitcoin Investment Trends and ETF Performance

Bitcoin investment trends play a crucial role in determining the performance of ETFs dedicated to cryptocurrencies. Recent events have showcased that shifts in investor behavior and sentiment can lead directly to significant ETF outflows. As Bitcoin experiences substantial withdrawals, investor confidence tends to dip, and a risk-averse mindset prevails, influencing both individual and institutional investment strategies. With data revealing a $312 million net outflow from Bitcoin ETFs, understanding these investment patterns becomes essential for predicting future trends.

Additionally, the relationship between Bitcoin and broader cryptocurrency investments prompts important reflections. The decline in Bitcoin held within ETFs often leads to a domino effect, impacting other crypto assets like Ethereum. As fear begins to dominate the market, such investment trends create a marked sense of urgency among traders, leading to more decisive action regarding withdrawals. Monitoring these trends will be vital for investment strategies, providing insights into the evolving cryptocurrency landscape.

The Role of Institutional Investors in Crypto ETF Withdrawals

Institutional investors wield significant influence over the cryptocurrency market, especially regarding ETF withdrawals. Their decisions often reflect a macroeconomic outlook that factors into both short-term and long-term strategies for engaging with Bitcoin and Ethereum funds. The recent $1.9 billion withdrawn from crypto ETFs showcases how institutional behavior can swiftly alter market dynamics, as these entities collectively manage a substantial portion of capital within the sector.

Understanding the motivations behind these withdrawals is essential for smaller investors and traders as well. Institutional participants typically adjust their positions based on rigorous analysis of market conditions, regulatory setups, and macroeconomic developments. As institutions continue to reevaluate their positions in Bitcoin and Ethereum, a lag between these adjustments and individual investor reactions can create complexities in managing crypto assets effectively.

Navigating the Challenges of Cryptocurrency Trading amid ETF Fluctuations

The fluctuations seen within ETF markets present both challenges and opportunities for cryptocurrency traders. As capital flows out of Bitcoin and Ethereum ETFs, traders must devise strategies that mitigate risk while still aiming for profitability. The rapid nature of these withdrawals underscores the importance of having a solid understanding of market conditions, such as trading volumes and investor sentiment, to make prudent trading decisions.

Furthermore, staying updated with the latest crypto trading news is paramount in navigating these challenges. As the landscape continues to shift, traders should focus on understanding the intricate factors impacting ETF performance and how that relates to overall cryptocurrency values. Developing an agile trading strategy will empower traders to adapt quickly to any changes resulting from further outflows, ensuring they remain ahead of the curve in a continuously evolving market.

Future Predictions for Cryptocurrency ETFs Post-Outflow Wave

Looking ahead, the future of cryptocurrency ETFs may be shaped significantly by the recent wave of outflows experienced in Bitcoin and Ether funds. With over $1.9 billion withdrawn concurrently, analysts predict an upcoming phase of recovery and adjustment for these assets. Traders will likely monitor how much institutional confidence returns post-outflow, both critical factors for setting the tone in the months that follow. Establishing trust in the markets again will be essential for inflows to re-materialize.

Moreover, predictions for Ethereum must consider the recent selloff trends and investor behaviors, as these elements blend into the broader landscape of cryptocurrency investment. Should there be a swift recovery from these outflows, analysts may project innovative strategies that allow ETFs to influence market prices positively, stabilizing the crypto environment. The development of regulatory frameworks could also play a vital role in determining the future trajectory for these investment instruments, as compliance introduces a new layer of security and confidence for wary investors.

The Impact of Macro Economic Factors on Cryptocurrency ETF Withdrawals

Macro economic factors have a profound ability to influence the cryptocurrency market, particularly regarding ETF withdrawals. Recent inflation rates and economic uncertainties have prompted investors to withdraw capital from Bitcoin and Ethereum funds, shaking confidence in these traditionally volatile assets. The recent outflow of $1.9 billion reflects such reactions clearly, as traders become more cautious in their investment decisions amid broader economic upheaval.

Future strategies may need to incorporate a keener focus on global economic indicators as they directly correlate with crypto performance. As macroeconomic conditions evolve, ETF managers and investors alike must remain agile, adapting investments and strategies to reflect changing circumstances. Balancing the potential profitability of cryptocurrency with economic realities is essential for sustained investment performance and may mitigate the risks associated with rapid outflows observed in the current climate.

Frequently Asked Questions

What are the implications of Bitcoin ETF outflows on the broader cryptocurrency market?

Bitcoin ETF outflows indicate shifting investor sentiment and can negatively impact the broader cryptocurrency market. Significant withdrawals suggest a risk-averse approach among investors, potentially leading to decreased demand and dropping asset prices. Consequently, these outflows may result in bearish trends in cryptocurrencies like Bitcoin and Ethereum.

How do Bitcoin ETF outflows compare to recent Ethereum ETF selloff trends?

Recent data shows that both Bitcoin ETF outflows and the Ethereum ETF selloff follow a similar pattern of substantial withdrawals. In just days, $1.9 billion was withdrawn from Bitcoin and Ethereum ETFs combined, highlighting a concerning trend across the cryptocurrency investments. Investors are becoming increasingly cautious amid macroeconomic challenges affecting both asset classes.

What factors are driving the current Bitcoin ETF outflows and crypto ETF withdrawals?

Current Bitcoin ETF outflows and crypto ETF withdrawals are primarily driven by macroeconomic challenges and a resulting risk-averse mindset among investors. As economic uncertainties rise, many investors are choosing to liquidate their positions in Bitcoin and Ethereum ETFs, leading to significant capital outflows, particularly evident in the last few trading sessions.

Are Bitcoin investment trends affected by the recent surge in ETF outflows?

Yes, Bitcoin investment trends are significantly affected by the recent surge in ETF outflows. The trend suggests a bearish sentiment among investors, which can lead to reduced inflows into Bitcoin and heightened selling pressure. This shift may result in a broader reevaluation of Bitcoin’s market outlook and investment strategies.

What should investors consider during a period of Bitcoin ETF outflows?

During a period of Bitcoin ETF outflows, investors should closely monitor market conditions, price trends, and macroeconomic indicators. Analyzing the reasons behind the withdrawals can help assess market sentiment and guide investment decisions. It’s also essential to remain informed about potential changes in cryptocurrency regulations and overall trading volume trends.

How significant are the $1.9 billion withdrawal figures for Bitcoin and Ethereum ETFs in the context of cryptocurrency trading news?

The $1.9 billion withdrawal figures for Bitcoin and Ethereum ETFs represent one of the most significant selloffs in recent months, raising alarms in the cryptocurrency trading news. Such high outflows can create ripples throughout the market, potentially leading to increased volatility and shifted investor behavior as they react to changing market dynamics.

| ETF Type | Total Outflow (Last 4 Days) | Largest Outflow Fund | Amount of Largest Outflow |

|---|---|---|---|

| Bitcoin ETFs | $1.9 billion (Combined with Ether) | Blackrock’s IBIT | $220 million |

| Ether ETFs | $1.9 billion (Combined with Bitcoin) | Blackrock’s ETHA | $257.78 million |

Summary

Bitcoin ETF outflows have surged dramatically in recent days, with a staggering $1.9 billion withdrawn in just four trading sessions, reflecting growing investor concern amid macroeconomic challenges. This period marks the fourth consecutive day of significant losses, especially for Bitcoin and Ether ETFs, where capital flight reached $312 million and $240 million, respectively. The outflow trends indicate a noticeable shift in investor sentiment and aversion to risk, suggesting caution towards crypto investments in the current economic climate.