Chocolate Prices Rise: What to Expect in 2024

As chocolate prices continue to climb, the sweet treat that millions know and love may become even less affordable. Fluctuations in cocoa prices, influenced by various market factors, are making waves in the chocolate industry, leading many chocolate lovers to brace for more expensive confections. While cocoa prices have recently decreased from their all-time highs, the lingering effects of inflation and earlier supply constraints persist. Production challenges in major cocoa-producing regions like West Africa have further exacerbated these issues, impacting the overall cocoa market. Despite the current state of chocolate prices, analysts are hopeful for a potential turnaround by next Easter, providing a glimmer of hope for dedicated chocolate fans everywhere.

The cost of chocolate, a beloved indulgence for many, is being significantly affected by ongoing shifts in the cocoa commodity market. As manufacturers navigate the complexities of inflation and supply-chain issues, the financial implications for chocolate enthusiasts can be felt around the globe. With recent adjustments in cocoa pricing, particularly after experiencing unprecedented highs, the dynamics within the confectionery sector are under scrutiny. Many confectionery aficionados are concerned about the ramifications of these economic factors as they anticipate rising costs in their favorite treats. Optimism remains, however, as experts suggest improvements in the product supply could offer some relief to consumers in the near future.

Understanding the Impact of Cocoa Prices on Chocolate Sales

Cocoa prices are a critical factor influencing the chocolate industry, as they directly affect production costs for chocolatiers. With cocoa futures rising significantly due to adverse factors such as poor weather and pest infestations in key producing regions, consumers are likely to feel the pinch. As these costs escalate, chocolate manufacturers have no choice but to pass these expenses onto consumers, which typically results in higher retail prices for chocolate products. This chain reaction can lead to a slowdown in demand as consumers become more selective about their purchases amidst rising prices.

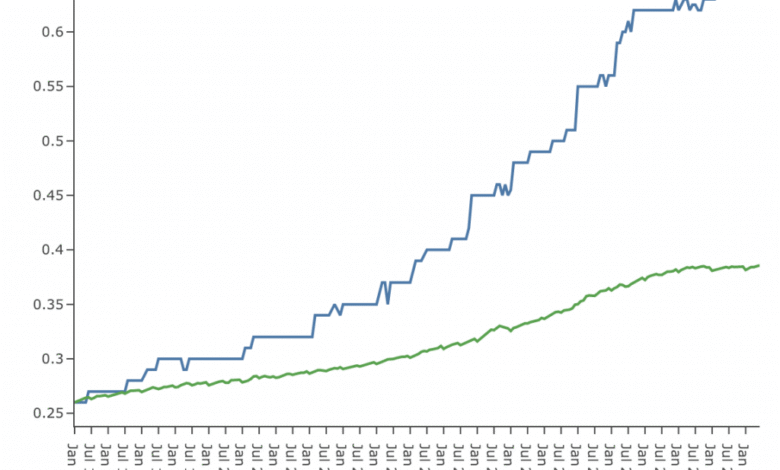

The recent fluctuations in cocoa prices have created a challenging environment for chocolate lovers and producers alike. In recent years, cocoa prices reached unprecedented levels, impacting the affordability of many chocolate treats. Consumers have noticed these changes markedly, with surveys showing that chocolate products have led the way in retail price increases. This situation underscores the intricate connection between raw material costs and the consumer experience, illustrating how shifts in the cocoa market can ripple through the entire chocolate supply chain.

Frequently Asked Questions

What factors are currently affecting chocolate prices in the market?

Chocolate prices are currently influenced by various factors, including the fluctuating cocoa prices, adverse weather impacting cocoa production, and inflation affecting the chocolate industry overall. With cocoa prices experiencing volatility due to decreased supply and rising production costs, chocolate lovers may see these factors contribute to higher prices for their favorite sweet treats.

How have cocoa prices impacted chocolate prices recently?

Cocoa prices have seen significant fluctuations, notably decreasing from record highs, yet the chocolate prices remain elevated. Analysts indicate that the effects of high cocoa prices from previous years continue to trickle down, impacting the overall chocolate industry and resulting in sustained higher prices for consumers.

When can we expect chocolate prices to stabilize amidst rising cocoa prices?

While cocoa prices are showing signs of recovery, analysts suggest that it may take time for these changes to positively affect chocolate prices. With ongoing elevated production costs and market constraints in the cocoa market, consumers may continue to experience higher chocolate prices, potentially stabilizing closer to the busy Easter season.

What role does inflation play in chocolate prices?

Inflation significantly affects chocolate prices, as seen in a recent survey indicating an 11% average annual inflation rate for chocolate products in grocery stores. As broader retail price inflation impacts the chocolate industry, it exacerbates existing cocoa price challenges and leads to increased costs for chocolate lovers.

Are there any predictions for cocoa and chocolate prices in 2025?

Predictions for 2025 indicate that while cocoa prices may remain elevated around $6,000 per metric ton due to ongoing supply issues, there is hope for improved conditions could lead to lower chocolate prices. However, persistent productivity challenges in cocoa-producing regions suggest that consumers might still face higher chocolate prices for the foreseeable future.

How does geopolitical stability affect chocolate prices?

Geopolitical stability, particularly in cocoa-producing countries, plays a critical role in determining chocolate prices. Factors such as local regulations, labor costs, and tariffs can all influence the cocoa prices, which in turn affect overall chocolate prices in the global market.

What should chocolate lovers know about upcoming price changes in the industry?

Chocolate lovers should be aware that while cocoa prices currently show signs of improving conditions, the chocolate prices are still likely to be high due to lingering effects from previous cocoa market fluctuations. Therefore, consumers may continue to see elevated chocolate prices in the short-term, but some relief could be on the horizon.

| Key Points |

|---|

| Cocoa prices decreased from record highs, offering potential relief by next Easter. |

| Adverse weather and decreased production have historically driven cocoa prices up. |

| Chocolate prices surged, with chocolate products seeing an average inflation rate of 11%. |

| Cocoa futures have decreased but will not yet impact chocolate prices. |

| Concerns remain about sustained high prices due to supply constraints and production challenges. |

| There could be an optimistic outlook for Easter due to improved supply and weather conditions. |

Summary

Chocolate prices are expected to stay elevated for the foreseeable future, mostly due to the lingering effects of high cocoa prices driven by past supply chain issues and adverse climatic conditions. As cocoa production improves, there may be some hope for decreased prices by next Easter, but consumers should remain prepared for sustained high costs in the chocolate market. Factors like labor costs and potential tariffs could further influence retail chocolate prices, suggesting a long-term trend of elevated costs for chocolate products.