Interest Rate Cuts: Powell’s Cautious Outlook Explained

Interest rate cuts are at the forefront of discussions surrounding the Federal Reserve’s monetary policy, as Chair Jerome Powell hinted at their possibility during his recent remarks. With inflation risks looming and economic stability remaining a top priority, Powell indicated that adjustments to the Fed interest rate could soon be on the table. He emphasized the importance of a careful approach, noting that appropriate conditions could ‘warrant’ these cuts as the central bank navigates a landscape marked by uncertainty. The remarks highlight the delicate balance the Federal Reserve must maintain in ensuring full employment while also achieving stable prices. As market reactions unfold, all eyes remain on the Fed’s future decisions under Powell’s leadership, following the trends of economic fluctuations and evolving policies.

In the realm of monetary policy, the potential for reductions in rates is generating considerable debate among economists and policymakers alike. With significant implications linked to Federal Reserve decisions, alternative phrases such as rate reductions or monetary easing capture the essence of what interest rate cuts entail. The discourse revolves around balancing the complexities brought by fiscal policies and external pressures, which can create variances in inflation expectations. Powell’s cautious stance reflects the broader economic context—where the labor market’s resilience faces threats from shifting global dynamics and tariff impacts. As discussions continue, the Fed’s role in ensuring financial equilibrium comes to the forefront, shaping the path ahead for both consumers and investors.

Understanding the Implications of Interest Rate Cuts

Interest rate cuts are pivotal decisions made by the Federal Reserve when responding to the economic climate. In his recent speech, Jerome Powell emphasized that the current economic conditions ‘may warrant’ such cuts, indicating a careful consideration of factors like inflation risks and labor market strength. By lowering rates, the Fed hopes to stimulate spending and investment, addressing concerns about stagnation in economic growth and maintaining overall economic stability.

However, the implications of interest rate cuts are multifaceted. While they can lead to lower borrowing costs for both consumers and businesses, thereby stimulating demand, there are also risks involved. Powell warned about potential inflationary pressures that could arise from external factors like tariffs. The balancing act of maintaining robust employment rates while ensuring stable price levels is central to the Fed’s mandate, making their approach to rate cuts one of cautious deliberation.

Jerome Powell’s Perspective on Economic Stability

During his address, Jerome Powell articulated an understanding of the delicate balance between fostering economic growth and managing inflation. He highlighted how unexpected shifts in policy, such as changes in trade agreements, could disrupt economic stability. This nuanced outlook reflects the Fed’s dual mandate: achieving full employment while ensuring price stability. Powell’s assertion that ‘the baseline outlook and risks may warrant adjusting our policy stance’ demonstrates an intention to adapt to evolving economic conditions.

Powell’s careful approach also underscores the importance of Fed independence. He clarified that decisions regarding interest rates rely solely on empirical data and analysis rather than political pressures. This commitment to data-driven policymaking reinforces the credibility of the Federal Reserve’s strategies in navigating economic uncertainties and inflation risks. By prioritizing an objective assessment of economic indicators, Powell aims to safeguard the long-term health of the economy.

The Role of Federal Reserve Policy in Inflation Control

Federal Reserve policy plays a crucial role in managing inflation and stabilizing the economy. Jerome Powell’s outlook reflects an understanding that recent trends, including rising consumer prices, can complicate the Fed’s objectives. By emphasizing a commitment to a 2% inflation goal, Powell signals to markets and the public that controlling inflation remains a top priority, especially in the context of potential interest rate cuts.

Additionally, Powell noted that ongoing negotiations and changes in tariffs could introduce additional volatility into the economic landscape. While he acknowledged that short-term adjustments may result from these trade-offs, he cautioned that the long-term effects still remain uncertain. This complexity emphasizes the significance of the Fed’s monitoring role, as it navigates both current economic conditions and future expectations regarding inflation and economic growth.

Evaluating Downside Economic Risks

In his speech, Powell referred to increasing downside risks that the economy faces, stemming from both internal and external pressures. These risks underscore the Fed’s need for vigilance in assessing how external factors, such as tariffs and shifts in trade policy, impact inflation. The growing uncertainties prompt the Federal Reserve to consider a more flexible policy approach that could include interest rate cuts if necessary.

Furthermore, Powell’s acknowledgment of potential stagflation—a period characterized by stagnant economic growth combined with inflation—highlights the intricate challenges the Fed must navigate. Financial stability hinges on the Fed’s ability to remain responsive to these risks while balancing its mandates of full employment and inflation control. The ongoing assessment of economic indicators will play a crucial role in guiding future policy decisions.

Market Reactions to Powell’s Statements

Following Jerome Powell’s remarks, market reactions indicated a surge of optimism, exemplified by the Dow Jones Industrial Average rising significantly. Investors often closely monitor Fed communications for signals regarding future monetary policy decisions, and the prospect of potential interest rate cuts can drive bullish behavior in the market. This response reflects the interconnectedness between Fed policy messaging and market sentiment.

Powell’s emphasis on a cautious approach reassured market participants that the Federal Reserve is taking the necessary steps to safeguard economic stability. By proposing a careful review of data before making any policy adjustments, he aims to promote confidence among investors that the Fed will act in the economy’s best interest. The subsequent positive market response may also highlight a broader acceptance of the Fed’s approach to navigating complex economic challenges.

Analysis of Changes in the Labor Market

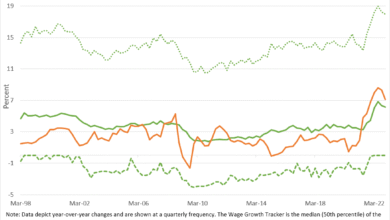

Jerome Powell noted that the labor market remains strong, lending support to the argument for maintaining policy stability, at least in the short term. With low unemployment rates and job growth consistent across many sectors, the Federal Reserve could justify a cautious stance against aggressive interest rate cuts. However, Powell also highlighted the significance of monitoring job market dynamics as potential inflation risks emerge.

As the labor market evolves, any shifts—such as changes in wage growth or job availability—may impact Federal Reserve policy decisions significantly. Powell’s commentary reflects a comprehensive analysis of how labor conditions intertwine with pricing pressures, reinforcing the necessity for a dual-focused approach when examining economic health and formulating responses.

Tariff Implications and Inflationary Trends

The discussion surrounding tariffs and their potential inflationary effects emerged as a critical aspect of Powell’s address. He warned that tariff increases could lead to short-term price shifts, yet the extended impacts on supply chains and consumer behavior could complicate predictions about ongoing inflation trends. As such, the Fed must navigate these dynamics carefully to avoid exacerbating inflation risks.

Understanding how trade policies influence market conditions is essential for the Federal Reserve. Powell’s acknowledgment that adjustments take time to manifest in consumer prices illustrates the complexities involved in economic policymaking. These considerations serve to remind stakeholders of the intricate interplay between monetary policy, trade agreements, and inflation targets.

The Five-Year Review of Fed Policy Framework

Powell’s reflections on the recent five-year review of the Fed’s policy framework reveal significant insights into how past experiences shape current strategies. Lessons learned from the pandemic and previous inflation surges have prompted the Fed to recalibrate its approach, particularly in setting inflation targets. Powell’s insights underline a commitment to learning from history to inform future policy decisions.

This review signifies a proactive effort by the Federal Reserve to adapt to changing economic realities. Powell’s quotes regarding the relevance of previous approaches amidst rising inflation emphasize the need for continuous evaluation and adaptation of strategies. Such a reflective process is crucial for ensuring that monetary policies remain effective in achieving long-term goals.

Commitment to Long-Term Price Stability

In closing his address, Powell underscored the Fed’s unwavering commitment to maintaining long-term price stability. He reiterated that despite political pressures, the focus remains on data-driven decision-making. This steadfast commitment reinforces the independence of the Federal Reserve, highlighting its critical role in safeguarding economic integrity and responding appropriately to inflationary pressures.

The dedication to a stable inflation rate of around 2% is a cornerstone of the Fed’s strategy. Powell’s reflections on the challenges faced in achieving this goal demonstrate an understanding of the complexities that characterize modern economies. As the Fed continues to navigate economic uncertainties, maintaining this commitment is essential to fostering trust and stability in the financial system.

Frequently Asked Questions

What are the implications of recent Fed interest rate cuts announced by Jerome Powell?

Recent Fed interest rate cuts, as discussed by Jerome Powell, imply a cautious approach by the Federal Reserve towards economic policy. These cuts aim to support growth while managing inflation risks amidst uncertainties in labor market conditions and tariffs. By lowering rates, the Fed hopes to stimulate some economic activity but must balance it against potential inflationary pressures.

How do interest rate cuts affect inflation risks according to Jerome Powell?

Jerome Powell indicates that interest rate cuts can impact inflation risks by promoting economic activity, which may lead to price stability if performed cautiously. However, he warns that persistent inflation risks remain due to external factors like tariffs. The Fed must carefully monitor these risks to avoid triggering unwanted inflation in the economy.

What factors did Jerome Powell highlight regarding Federal Reserve policy and interest rate cuts?

Jerome Powell highlighted several factors regarding Federal Reserve policy and interest rate cuts, including geopolitical uncertainties, trade negotiations, and the need for careful analysis of economic data. He emphasized that the Fed’s decisions will be made independently, focusing on full employment and price stability while navigating the complexities of current economic conditions.

What did Jerome Powell mean by ‘proceeding carefully’ when discussing potential interest rate cuts?

By ‘proceeding carefully,’ Jerome Powell emphasizes a measured approach in considering interest rate cuts to ensure economic stability. This involves a thorough assessment of the current economic landscape, inflation trends, and labor market strength before implementing any changes to the Federal Reserve’s policy.

Why does Jerome Powell believe interest rate cuts may be warranted under current economic conditions?

Jerome Powell believes that interest rate cuts may be warranted due to the restrictive policy environment and the shifting balance of economic risks, which includes factors such as consumer behavior and potential inflation from tariffs. A careful adjustment in rates could help maintain economic stability while addressing concerns related to inflation.

How do rising consumer prices relate to interest rate cuts as discussed by Jerome Powell?

Rising consumer prices pose challenges to the effectiveness of interest rate cuts as highlighted by Jerome Powell. While cuts can stimulate growth, they may also contribute to higher inflation if demand outpaces supply due to external factors like tariffs. The Fed must navigate these complexities to ensure that rate cuts do not exacerbate inflationary trends.

| Key Point | Details |

|---|---|

| Cautious Outlook | Powell suggests interest rate cuts may be warranted due to uncertainty and risks. |

| Current Economic Status | Labor market remains strong, but increasing downside risks present challenges. |

| Tariffs and Inflation Concerns | Powell warns that tariffs could spark inflation, influencing monetary policy considerations. |

| Fed Independence | Emphasized that decisions will be based solely on data, not external pressures. |

| Market Reaction | Positive response with Dow Jones rising and Treasury yields falling. |

| Five-Year Review Insights | Review of Fed policies since the 2020 pandemic, maintaining a 2% inflation goal. |

Summary

Interest rate cuts may become a key topic as Fed Chair Jerome Powell indicates a cautious approach towards potential reductions. In his recent address, Powell highlighted the significance of base economic conditions and the uncertain landscape shaped by tariffs and inflation risks. As the Fed navigates between ensuring full employment and maintaining price stability, the possibility of adjusting monetary policy remains on the table. The markets’ positive response reflects the anticipation surrounding these developments, suggesting that investors are closely watching the Fed’s next moves.