Binance Australia Faces Regulatory Actions from AUSTRAC

Binance Australia is currently under scrutiny as the Australian financial intelligence agency, AUSTRAC, has mandated the crypto exchange to appoint an external auditor within 28 days. This directive arises from serious concerns surrounding the platform’s anti-money laundering (AML) and counter-terrorism financing (CTF) controls, vital for operating as a digital currency exchange in compliance with local regulations. The agency’s regulations are a part of broader initiatives to enforce crypto exchange regulations in Australia, ensuring that firms adhere to AML CTF compliance standards. AUSTRAC’s review of Binance Australia revealed significant shortcomings, including high staff turnover and insufficient local oversight, which pose risks to effective governance. As the landscape of cryptocurrency evolves, Binance Australia must navigate these challenges to maintain its standing in the market and ensure the safety of its users and the integrity of its operations.

The recent developments surrounding Binance Australia’s compliance with AUSTRAC highlight critical issues faced by international cryptocurrency platforms operating locally. As regulations tighten across the globe, digital asset exchanges must grapple with the complexities of adhering to specific national laws regarding financial oversight. The importance of anti-money laundering strategies and counter-terrorism financing controls cannot be overstated, especially for organizations like Binance that deal with significant volumes of digital transactions. By addressing these regulatory challenges, companies can enhance their operational transparency and credibility in the eyes of both regulators and users. As we delve deeper into the landscape of cryptocurrency regulations, understanding local requirements is essential for any exchange striving for sustainable growth and compliance.

Understanding Crypto Exchange Regulations in Australia

In Australia, crypto exchange regulations are overseen by AUSTRAC, which works to ensure that all financial services, including digital currency exchanges, comply with anti-money laundering (AML) and counter-terrorism financing (CTF) laws. This regulatory framework has become increasingly vital as the popularity of cryptocurrencies surges. AUSTRAC’s efforts aim to create a safer financial ecosystem by monitoring and controlling illicit activities that may arise through these exchanges.

The role of AUSTRAC is crucial in establishing robust governance around AML/CTF compliance for digital currency exchanges like Binance Australia. These regulations not only help detect and prevent unlawful activities but also promote transparency and accountability within the crypto industry. The recent directive for Binance to appoint an external auditor highlights the strict measures being taken against non-compliance and the importance of adhering to local regulatory requirements.

The Importance of AML and CTF Compliance for Binance Australia

AML and CTF compliance is foundational for cryptocurrency exchanges operating in Australia, as it safeguards the integrity of the financial system. Failure to meet these obligations can result in severe penalties and reputational damage. Binance Australia, in response to AUSTRAC’s concerns, must improve its compliance mechanisms to better address potential risks linked with money laundering and terrorism financing. This involves reassessing their operational structures and resources dedicated to compliance.

Moreover, the directive from AUSTRAC serves as a stern reminder for Binance Australia that global reach does not exempt them from local regulations. The recent order accentuates that even established exchanges must enforce localized AML/CTF strategies tailored to Australia’s unique risk landscape. The spotlight is on Binance to enhance its supervisory processes to align with regulatory expectations and mitigate risks associated with digital currency transactions.

AUSTRAC and Its Role in Regulating Cryptocurrency

AUSTRAC, or the Australian Transaction Reports and Analysis Centre, is tasked with regulating financial dealings in Australia, including those conducted via cryptocurrency exchanges. The agency operates with a clear mandate to combat money laundering and terrorism financing, ensuring that all entities remain compliant with national and international laws. The nuances of cryptocurrency require regulatory bodies like AUSTRAC to adapt traditional frameworks to encompass the unique characteristics of digital currencies.

As a regulatory body, AUSTRAC monitors the compliance of exchanges through rigorous assessments and has the authority to impose sanctions for non-compliance. With the rising number of scams and cybercrime activities linked to cryptocurrency, AUSTRAC’s role is more relevant than ever. Their ongoing scrutiny of exchanges like Binance Australia is essential in fostering a safe trading environment, ensuring that they implement necessary measures to detect and report suspicious transactions effectively.

Challenges Faced by Binance Australia in Regulations

Binance Australia’s challenges in adhering to regulatory requirements reflect broader issues faced by many digital currency exchanges. The complexities of operating within varying regulatory landscapes present significant hurdles; global firms must navigate a web of compliance regulations that differ from one country to another. Recent criticisms by AUSTRAC point to concerns regarding staff turnover and the adequacy of local oversight, suggesting that Binance Australia may not be fully equipped to manage compliance properly.

These challenges emphasize the need for robust local governance frameworks and resources for crypto exchanges. Binance Australia’s ability to adapt and comply with AUSTRAC mandates is crucial not only for the survival of the exchange but also for the integrity of the Australian digital currency market as a whole. Addressing these issues will form the basis of an effective compliance strategy going forward, as regulations become increasingly stringent.

The Future of Cryptocurrency Regulations in Australia

Looking ahead, the future of cryptocurrency regulations in Australia seems set to become more stringent with AUSTRAC’s plans to enhance current frameworks. Starting March 2026, new regulations will require digital currency exchanges to collect user data and report financial transactions comprehensively. This regulatory evolution aims to bolster oversight and prevent fraudulent activities, ensuring exchanges comply fully with anti-money laundering standards.

With regulations tightening, exchanges like Binance Australia must be proactive in adapting their operational models to meet these new requirements. This shift not only fosters a safer trading environment but also uplifts the overall reputation of the cryptocurrency industry in Australia. Compliance with these future regulations will likely determine the long-term viability and success of exchanges as they navigate the rapidly changing landscape of digital finance.

AUSTRAC’s Future Enforcement Actions Against Crypto Exchanges

AUSTRAC’s recent intensified enforcement actions signal a commitment to ensuring that crypto exchanges adhere strictly to Australian regulations. With increased fines and penalties for non-compliance, companies like Binance Australia must take these measures seriously. The agency’s actions are indicative of a zero-tolerance approach towards exchanges that fail to implement proper AML and CTF controls, thereby encouraging a proactive compliance culture across the digital currency sector.

As AUSTRAC continues its stringent oversight, it is likely that more exchanges will face similar scrutiny and potential sanctions. In light of this, it is imperative for Binance Australia and other exchanges to establish robust compliance frameworks that not only meet current regulations but also anticipate future requirements. This approach will be essential for maintaining their operational licenses and fostering trust among users in the growing crypto market.

Technology’s Role in Enhancing Compliance for Binance Australia

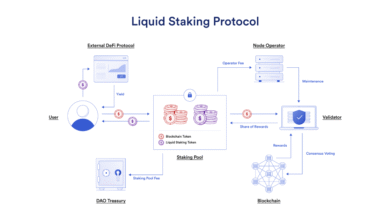

Technology plays a pivotal role in enhancing compliance frameworks for cryptocurrency exchanges, including Binance Australia. The adoption of advanced technologies such as artificial intelligence and blockchain analytics has the potential to improve transaction monitoring and risk assessment practices. By leveraging these technologies, exchanges can better detect suspicious activities, thereby adhering more closely to AUSTRAC regulations regarding AML and CTF controls.

Investing in reliable compliance technologies will not only facilitate Binance Australia’s ability to manage regulatory requirements but also improve operational efficiency. Automation in reporting and transaction monitoring can drastically reduce human error and allow for real-time responses to potential risks, ultimately leading to a more secure trading environment. As regulatory frameworks evolve, the integration of such technologies will be crucial for establishing a competitive edge within the crypto sector.

Community Impact of Increased Regulations on Crypto Exchanges

The increased regulations imposed on crypto exchanges by AUSTRAC have significant implications for the broader community of cryptocurrency users and investors in Australia. Stricter compliance measures are designed to protect users from potential fraud, scams, and unethical practices within the market. As exchanges like Binance Australia become more regulated, users may find greater security and assurance in their transactions, leading to a more engaged and confident user base.

However, the downside of stringent regulations may also result in reduced accessibility for some users, particularly if exchanges struggle to comply with the new requirements. Fees may rise, and certain services could be limited as exchanges shift resources towards compliance, which might affect smaller investors disproportionately. Balancing the need for security while maintaining accessibility will be a critical challenge for the future of Australian cryptocurrency exchanges.

The Role of Education in Crypto Compliance

Education plays a crucial role in ensuring compliance with cryptocurrency regulations. For exchanges such as Binance Australia, providing educational resources for users about compliance expectations, anti-money laundering practices, and safe trading habits can foster a more informed community. Educating users not only reduces the risk of fraud and illicit activity but also emphasizes the importance of compliance in sustaining the overall health of the cryptocurrency ecosystem.

Moreover, training employees within cryptocurrency exchanges on the latest regulatory requirements and compliance practices is essential. A well-informed workforce can better implement the policies necessary to meet AUSTRAC’s demands, ensuring that the exchanges stay compliant with evolving regulations. By prioritizing education, both for users and employees, Binance Australia can enhance its standing in the marketplace and build trust with regulatory bodies.

Frequently Asked Questions

What are the recent AML CTF compliance issues facing Binance Australia?

Binance Australia has been ordered by AUSTRAC to appoint an external auditor due to serious concerns about its anti-money laundering (AML) and counter-terrorism financing (CTF) controls. The regulatory review identified shortcomings in local oversight and risk management processes.

How is AUSTRAC regulating Binance Australia and crypto exchanges?

AUSTRAC is enforcing strict crypto exchange regulations to ensure AML/CTF compliance in Australia. Following a review, AUSTRAC directed Binance Australia to enhance its governance systems and ensure that its operations align with local laws.

Why did AUSTRAC order Binance Australia to appoint an external auditor?

AUSTRAC ordered Binance Australia to appoint an external auditor due to ‘serious concerns’ about its AML/CTF compliance, particularly regarding insufficient resources and oversight that could undermine the company’s ability to manage risks effectively.

What will happen if Binance Australia fails to comply with AUSTRAC directives?

If Binance Australia fails to comply with AUSTRAC’s directives regarding AML/CTF compliance, it may face further enforcement actions, including fines or restrictions on its operations in Australia, as AUSTRAC intensifies its regulatory oversight of crypto exchanges.

What steps is Binance Australia taking to improve compliance with crypto exchange regulations?

In response to AUSTRAC’s concerns, Binance Australia has been directed to hire an external auditor to assess and enhance its anti-money laundering practices and ensure compliance with crypto exchange regulations set forth by AUSTRAC.

How does AUSTRAC’s directive affect users of Binance Australia?

The AUSTRAC directive aims to improve the security and compliance of Binance Australia, which ultimately protects users by ensuring that the platform has robust measures against fraud, scams, and terrorism financing.

What are the implications of the AUSTRAC review for the future of Binance Australia?

The AUSTRAC review signifies a tightening of regulations for Binance Australia, indicating that the company must improve its AML/CTF controls and adapt to local regulatory demands to continue operating effectively in the Australian market.

What should customers of Binance Australia know about crypto exchange regulations?

Customers of Binance Australia should be aware that the platform is under scrutiny by AUSTRAC for its compliance with anti-money laundering and counter-terrorism financing regulations, which may lead to operational changes aimed at strengthening the exchange’s governance and security processes.

| Key Points |

|---|

| AUSTRAC Orders Binance Australia to Appoint Auditor |

| Timeframe: 28 Days |

| Concerns Over AML/CTF Controls |

| Noted Limitations of Previous Review |

| High Staff Turnover & Local Oversight Issues |

| Regulatory Reviews Intensified in 2023 |

| AUSTRAC’s Future Regulatory Changes from 2026 |

Summary

Binance Australia has recently come under scrutiny from AUSTRAC, the Australian financial intelligence agency, which has mandated the appointment of an external auditor within 28 days. This directive arises from significant concerns over the exchange’s anti-money laundering (AML) and counter-terrorism financing (CTF) practices. The agency emphasized the necessity for global entities like Binance to adequately understand and adhere to local regulatory requirements, especially given the reported limitations in staff oversight and resources. As AUSTRAC heightens its enforcement measures, it is crucial for Binance Australia to address these compliance challenges proactively.