XRP ETF Approval: Odds Rocket with SEC Filings Surge

The recent surge in XRP ETF approval odds has sparked significant excitement in the cryptocurrency community, as a flurry of XRP SEC filings signals potential progress in the regulatory landscape. Several firms, including Coinshares and Wisdomtree, have submitted amended S-1 filings to the U.S. Securities and Exchange Commission (SEC), raising hopes that an ETF could soon be greenlit. Experts note that this synchronized wave of XRP ETF news suggests productive dialogue between the SEC and issuers, further bolstering optimism around the approval odds. Analysts are carefully monitoring the SEC review process, which appears more favorable for cryptocurrency ETFs as regulatory reforms take shape. With predictions of increased institutional interest, the potential approval of an XRP ETF could reshape the crypto markets significantly.

The increasing dialogue from regulatory bodies regarding an XRP exchange-traded fund (ETF) has transformed the landscape for digital asset investment. Recent developments, including a slew of SEC filings from various issuers, have spotlighted the shifting dynamics within the cryptocurrency sector and heightened expectations for future approval of financial products linked to XRP. These coordinated actions by notable firms reflect an evolving atmosphere around cryptocurrency ETFs, showcasing a commitment to compliance and adaptability in meeting regulatory guidelines. As the SEC navigates the intricacies of approving these investment vehicles, the anticipation and strategic maneuvers by industry players suggest a burgeoning acceptance of cryptocurrencies in mainstream finance. The focus on XRP and its potential ETF is a pivotal moment, indicating a readiness for broader institutional participation in the crypto market.

Understanding the XRP SEC Filings Landscape

The recent surge in XRP SEC filings has become a focal point for market participants and analysts alike. As multiple cryptocurrency firms, including Canary, Coinshares, and Grayscale, have filed their registration statements, the landscape surrounding XRP ETFs is rapidly evolving. These submissions not only point to a robust interest in cryptocurrency ETFs but also reflect the ongoing engagement and perceived feedback from the SEC. Many see this coordinated push as a positive signal; it indicates that applicants are not merely submitting in hopes of approval, but are actively refining their proposals based on the SEC’s guidance.

The implications of these filings are significant for XRP’s future. As the SEC reviews these submissions, the outcome will not only affect the respective firms but the entire cryptocurrency market. If the SEC grants approval for these ETFs, it could pave the way for mainstream adoption of XRP and enhance its legitimacy among investors. Therefore, understanding the nuances of these SEC filings and the broader regulatory framework is crucial for anyone interested in engaging with XRP and cryptocurrency ETFs.

The Role of the SEC Review Process in ETF Approvals

The SEC review process is pivotal in determining whether cryptocurrency ETFs like those based on XRP will receive approvals. This process involves several stages, including the thorough examination of the submitted S-1 filings, public comments, and potential amendments. Historically, the SEC has taken a cautious approach towards cryptocurrency-related financial products, citing concerns surrounding market manipulation and investor protection. However, the current wave of submissions indicates an evolving dynamic, where regulators are increasingly open to dialogue and feedback.

As analysts speculate on the future of XRP ETFs, the timing and collaboration between issuers during this review process signal a potentially favorable shift. The SEC’s willingness to engage with these firms could suggest a preparedness to reconsider their past stances on cryptocurrency ETFs. With experts now projecting an approval probability of 95%, understanding how the SEC conducts its reviews will be crucial for anticipating the future trajectory of XRP within the regulated financial landscape.

The Growing Buzz Around XRP ETF News

Recently, the buzz surrounding XRP ETF news has reached unprecedented heights, driven by the simultaneous submissions from numerous firms. Events like this not only generate excitement among retail investors but also capture the attention of institutional players who are essential for market stability and growth. With major firms participating, the narrative is shifting towards a collective belief in the inevitability of XRP’s inclusion in the ETF space, reinforcing the idea that cryptocurrency investments are increasingly being recognized in traditional financial portfolios.

As optimism rises, the media coverage around XRP ETF developments has intensified, prompting discussions about the potential impact on market prices and adoption rates. This heightened focus could lead to increased investments into XRP and bolster its market capitalization. Continuous updates and any leaked insights regarding the SEC’s decision-making process will undoubtedly keep investors engaged and informed in the lead-up to any potential approvals.

XRP ETF Approval: What It Means for Investors

The much-anticipated XRP ETF approval holds significant implications for investors. If approved, it would grant both institutional and retail investors easier access to invest in XRP through a regulated financial instrument, reducing the complexities traditionally associated with cryptocurrency purchases. This accessibility can foster broader adoption, create more volume in the XRP market, and potentially stabilize prices as more participants enter.

Moreover, approval of an XRP ETF would serve as a watershed moment for the cryptocurrency industry. It could also act as a precedent for other cryptocurrencies seeking similar paths, influencing regulatory perspectives on digital assets. Additionally, it reinforces the growing legitimacy of cryptocurrency, potentially shifting public sentiment positively as more people recognize the value of integrating digital assets into traditional investment frameworks.

Analyzing ETF Approval Odds and Market Sentiment

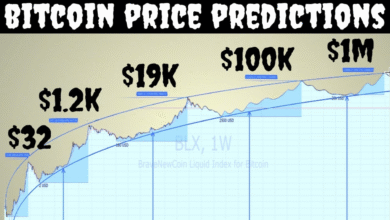

The analysis of ETF approval odds reveals a concerning yet hopeful market sentiment among XRP investors. With recent expert assessments suggesting a 95% probability of approval, the mood in cryptocurrency circles has shifted from skepticism to optimism. Market analysts are closely monitoring how institutional players respond to these developments, indicating a newfound confidence in the XRP ecosystem. This shift in sentiment is indicative not only of individual asset health but also of the overall trajectory of the cryptocurrency market as it seeks increased regulatory clarity.

Furthermore, the positive sentiment surrounding ETF approvals aligns with broader market trends that reflect growing institutional interest in digital assets. As firms like Grayscale pivot towards establishing ETFs, the landscape for cryptocurrency investment is rapidly morphing. An environment rife with uncertainty around SEC regulations is slowly giving way to potential optimism, leading many to speculate on how XRP and similar assets might thrive in the coming months.

Impact of XRP ETF Approval on Future Cryptocurrencies

The potential approval of an XRP ETF is poised to have profound effects beyond its immediate benefits for XRP itself. Such an event could pave the way for subsequent ETFs for other cryptocurrencies, particularly those in similar regulatory circumstances. This evolution in the financial ecosystem could foster a boom in cryptocurrency offerings, inviting more issuers to explore the ETF route as a viable option for gaining market traction.

Furthermore, successful approval and positive performance of an XRP ETF could enhance the overall perception of cryptocurrency assets within the financial community. It sends a message that cryptocurrencies can operate within regulated frameworks, boosting investor confidence. This situation might encourage regulators to consider a more favorable stance towards other digital assets, potentially accelerating the path toward broader acceptance of the cryptocurrency market.

Institutional Interest in Cryptocurrency ETFs

Institutional interest in cryptocurrency ETFs, particularly focused on XRP, has surged, as large investors begin to explore digital assets as a serious class for investment. The interest stems from the recognition that positions in cryptocurrency can complement traditional portfolios, offering diversification and potential for significant returns. As ETFs drive more access to digital assets, institutional traders view XRP as a candidate that can bridge the gap between traditional and cryptocurrency markets.

Moreover, the ability to invest in XRP via an ETF eliminates concerns over private keys and wallet management, making it more appealing to institutional investors who may be wary of direct cryptocurrency ownership. This factor is vital as regulatory environments evolve and institutional players seek products that are compliant with existing frameworks. The growing recognition of XRP and similar assets in ETF formats supports a shift towards mainstream cryptocurrency adoption.

Future Prospects for XRP and Cryptocurrency ETFs

Looking forward, the prospects for XRP and cryptocurrency ETFs appear brighter than ever, especially in light of current SEC activities. With the convergence of various issuer submissions and the SEC’s increasingly responsive stance, the groundwork is being laid for an ETF landscape that could redefine market engagement with digital assets. Should XRP’s ETF approval be realized, it would not only catalyze XRP’s price but may also spur innovation in the ETF market as a whole.

Investors are increasingly optimistic about the implications of successful ETFs, particularly regarding their potential to democratize access to cryptocurrencies. This democratization will likely enhance liquidity, grow the investment base, and encourage a more comprehensive understanding of digital assets among the general public. The future of XRP as an ETF could also influence the regulatory narrative, making it imperative for those involved in cryptocurrency trading to stay informed and agile as developments unfold.

Navigating the Changing Regulatory Environment for Cryptocurrencies

Navigating the changing regulatory environment surrounding cryptocurrencies is becoming increasingly important, particularly as the SEC continues its scrutiny of digital assets and ETFs. Investors must stay informed not only of the status of XRP’s ETF filings but also of broader regulatory sentiment that could impact multiple cryptocurrencies. The ongoing dialogue between firms and the SEC should inform investors about which currencies may be next to benefit from similar transformative offerings.

A solid understanding of the regulatory landscape can significantly affect investment strategies and risk management approaches. As the regulatory environment shifts, investors able to adapt to these changes may find new opportunities in the evolving market. Thus, closely monitoring SEC developments, including their approach toward approving ETFs, becomes crucial for anyone looking to invest in the vibrant world of cryptocurrencies.

Frequently Asked Questions

What are the current odds for XRP ETF approval?

The approval odds for an XRP ETF have significantly increased, with recent estimates suggesting a 95% probability of SEC approval due to multiple issuers advancing their filings, indicating positive feedback and ongoing dialogue with the SEC.

How do SEC filings impact XRP ETF approval prospects?

Recent SEC filings by firms like Grayscale and others signal active engagement with the SEC, which enhances the prospects for XRP ETF approval by demonstrating responsiveness to regulatory feedback and a collective push for cryptocurrency ETFs.

What is the significance of the recent XRP ETF news?

Recent XRP ETF news highlights synchronized filings from various issuers, reflecting growing optimism and signaling that regulatory approval may be on the horizon, particularly given the SEC’s ongoing engagement with these applicants.

What role does the SEC review process play in XRP ETF approval?

The SEC review process is crucial for XRP ETF approval, as it involves assessing the compliance and market implications of ETF proposals. The recent influx of S-1 filings suggests significant movement within this process, likely influenced by SEC feedback.

Who are the key players involved in the XRP ETF filings?

Key players in the XRP ETF filings include Canary, Coinshares, Franklin, 21Shares, Wisdomtree, and Bitwise, all of which have submitted recent S-1 amendments indicating a collaborative effort to secure XRP ETF approval.

What factors contribute to the growing conviction of XRP ETF approval?

Factors contributing to the growing conviction regarding XRP ETF approval include the positive feedback from the SEC as indicated by multiple filings, increased analyst confidence, and Ripple CEO Brad Garlinghouse’s assertion that an XRP ETF is ‘inevitable’.

How does the XRP ETF landscape compare to other cryptocurrency ETFs?

The XRP ETF landscape currently shows significant momentum with recent coordinated filings, positioning it uniquely among other cryptocurrency ETFs, as analysts express heightened optimism for regulatory approval in this competitive field.

What should investors know about XRP ETF approval timelines?

Investors should monitor SEC announcements and filing updates closely, as the timeline for XRP ETF approval may be influenced by continued positive dialogue between issuers and the SEC, with expectations potentially aligning towards a favorable outcome soon.

| Date | Activity | Comments |

|---|---|---|

| August 22, 2025 | Multiple XRP ETF filings | Issuers like Canary, Coinshares, and Grayscale submit initial amended S-1 filings. |

| August 22, 2025 | SEC Engagement | Analysts view synchronized filings as responsiveness to SEC feedback. |

| August 2025 | Analyst Commentary | Experts raise approval odds to 95% based on ongoing SEC discussions. |

| August 2025 | CEO Statements | Ripple CEO claims XRP ETF is ‘inevitable’. |

Summary

XRP ETF approval is showing strong potential as recent filings and SEC engagement indicate that regulatory approval may be on the horizon. The synchronized approach from multiple issuers has fostered optimism, with industry analysts raising the likelihood of approval to as high as 95%. This strategic move highlights the maturation of the crypto market and growing institutional interest in XRP, suggesting that we might see the long-anticipated XRP ETF approved in the near future.