Bitcoin Flash Dumps Below $111K After Ether Record Highs

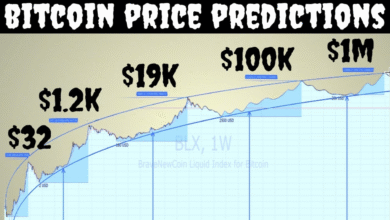

Bitcoin flash dumps have become a focal point in the cryptocurrency landscape, especially following rapid price drops that can leave investors in shock. Recently, Bitcoin’s value plummeted to $110,671 after fluctuating near $114,500 as excitement over Ether’s record highs electrified the market. This sudden Bitcoin price drop exemplifies the volatility that defines today’s crypto environment, with traders left grappling with the consequences of such swift changes. As derivatives market liquidation surges, these flash dumps underscore the increasing unpredictability of bitcoin trading strategies during times of heightened market activity. In this dynamic setting, both seasoned and new investors must tread carefully, understanding that while opportunities abound, so too do risks inherent in crypto market volatility.

The phenomenon of abrupt Bitcoin price declines, often referred to as flash dumps, highlights the turmoil within the digital currency sphere. As cryptocurrencies advance and previously unseen highs are achieved, such as the recent spike in Ether values, the implications for Bitcoin trading become apparent. Market volatility can lead to rapid and sometimes drastic losses, prompting traders to reevaluate their strategies in real-time. The cascading effect of these price tumbles, influenced by heavy liquidation in the derivatives sector, reminds participants of the precarious nature of the crypto markets. Investors must remain vigilant, as the pace of trading can shift dramatically with each new market signal.

Understanding Bitcoin Flash Dumps: Causes and Consequences

Bitcoin flash dumps represent sudden and sharp declines in the price of Bitcoin, often triggered by a variety of market factors. Recently, the crypto community witnessed a significant drop when Bitcoin fell below $111K shortly after Ether reached record highs. Such volatility can be alarming for investors and traders alike, leading to widespread concerns over the stability of the crypto markets. Moreover, when Bitcoin slides, it can create a ripple effect across the entire crypto ecosystem, impacting not just Bitcoin but also other altcoins as seen when Ether reached $4,957, marking an all-time high just before the Bitcoin downturn.

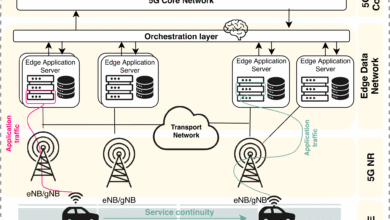

The aftermath of these flash dumps usually sees heightened activity in the derivatives market, where traders react quickly to capitalize on the fluctuating prices. Factors contributing to these abrupt drops can include high levels of market liquidity, panic selling, or automated trading strategies that trigger mass sell-offs. Understanding these phenomena is essential for traders looking to refine their Bitcoin trading strategies in an unpredictable environment. Therefore, it becomes crucial for investors to remain informed about potential market catalysts to mitigate risks and take advantage of potential rebounds after flash dumps.

Frequently Asked Questions

What causes Bitcoin flash dumps after major events like Ether reaching record highs?

Bitcoin flash dumps often occur due to market volatility triggered by significant events, such as Ether reaching record highs. Traders may react to these developments by selling Bitcoin, leading to quick price drops. Additionally, the derivatives market can experience liquidations that exacerbate these flash dumps as positions are closed, resulting in rapid declines in Bitcoin’s price.

How do Bitcoin flash dumps affect crypto market volatility?

Bitcoin flash dumps contribute to crypto market volatility by creating sharp price movements. When Bitcoin experiences a sudden drop, like the one below $111K, it influences other cryptocurrencies, causing a ripple effect across the market. This volatility can be exacerbated by leveraged trading in the derivatives market, resulting in liquidations that further amplify price swings.

What strategies should traders consider during Bitcoin flash dumps?

During Bitcoin flash dumps, traders may want to adopt bitcoin trading strategies that include setting stop-loss orders to limit potential losses and identifying key support levels for potential buying opportunities. Being aware of market sentiment and liquidity conditions can also help traders navigate these rapid price changes effectively.

How do liquidations in the derivatives market influence Bitcoin’s price?

Liquidations in the derivatives market play a significant role in influencing Bitcoin’s price during flash dumps. When a large number of long positions are liquidated, it can create additional selling pressure, leading to sharper price declines. For instance, the recent $611.81 million in liquidated positions contributed to the rapid decrease in Bitcoin’s value as traders sought to manage their risk.

Why do Bitcoin flash dumps happen after periods of stability?

Bitcoin flash dumps can occur after periods of stability due to the buildup of market pressure. When prices hover around a stable range, as seen when Bitcoin traded near $114.5K, traders may start to accumulate positions, leading to heightened sensitivity to any bearish news or trends. This creates a precarious environment where a small trigger, like Ether hitting a record high, can cause a significant sell-off.

What role does Ethereum’s performance play in Bitcoin flash dumps?

Ethereum’s performance can heavily influence Bitcoin flash dumps. When Ether reaches record highs, it often attracts significant attention and trading volume, resulting in shifts in focus among traders. If Ether’s performance leads to profit-taking or increased selling pressure, Bitcoin may also experience a flash dump as traders reassess their positions across the crypto market.

Are Bitcoin flash dumps likely to continue amid market volatility?

Yes, Bitcoin flash dumps are likely to continue amid market volatility. As the crypto market remains influenced by rapid price changes, traders will need to adapt to the heightened risk. Continued uncertainty in the trading environment, coupled with significant movements in assets like Ether, can lead to more frequent and severe Bitcoin flash dumps.

| Aspect | Details |

|---|---|

| Bitcoin Price Movement | Dropped to a low of $110,671 after fluctuating between $114,500 and $115,100. |

| Ether Record High | Ether reached a new peak of $4,957, influencing Bitcoin’s decline. |

| Market Reaction | The broader crypto market experienced a downturn of 1.5%. |

| Other Cryptocurrencies | BNB (-1.33%), Solana (-3.29%), Dogecoin (-4.4%), Ethereum (-3.15%). |

| Liquidations | Approximately $611.81 million worth of positions liquidated, with $445 million in long bets. |

Summary

Bitcoin flash dumps refer to sudden and significant declines in Bitcoin’s price, exemplified by the recent drop to $110,671 after a day of stability. This phenomenon often occurs amidst extreme volatility in the cryptocurrency market, especially after major events such as Ethereum reaching record highs. As seen in the latest market trends, many traders are grappling with rapid shifts, leading to high liquidation levels and prompting discussions about future market directions. Despite the uncertainty, both long-term holders and active traders navigate these fluctuations in hopes of capitalizing on potential rebounds.