Eli Lilly Obesity Pill Challenges Novo Nordisk’s Wegovy

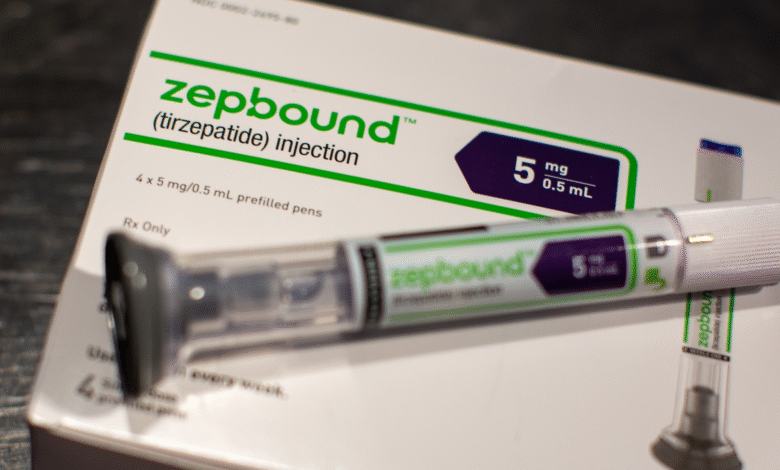

The Eli Lilly obesity pill stands poised to enter the competitive weight loss drug arena, challenging the dominance of Novo Nordisk’s Wegovy. Although recent late-stage trial data for Eli Lilly’s drug, known as orforglipron, did not meet investor expectations, it remains a promising alternative in obesity treatments. Analysts speculate that the pill could capture a significant share of the market, particularly as it offers potential advantages like simple dosing and no dietary restrictions. With the increasing prevalence of obesity and the demand for effective weight loss solutions, the Eli Lilly obesity pill could represent a new era in obesity management. As healthcare providers look for more accessible options, the discussion surrounding Eli Lilly’s drug approval is becoming more relevant than ever.

The Eli Lilly weight loss pill is entering the spotlight as a formidable contender against existing obesity therapies, notably the oral form of Novo Nordisk’s semaglutide. Despite underwhelming trial results, the orforglipron formulation may provide numerous benefits over traditional injections, including simpler administration and a more appealing price point. As the landscape of obesity management evolves, the potential of oral weight loss medications is increasingly recognized, especially among those seeking non-invasive treatment options. Eli Lilly’s strategic push towards a broader global presence could reshape how obesity is treated, as anticipated launches draw closer. With mounting interest in innovative obesity solutions, Eli Lilly’s approach may define the future of weight loss drugs.

Eli Lilly’s Obesity Pill: A Strong Competitor in the Weight Loss Drug Market

Eli Lilly’s obesity pill, designed under the developmental name orforglipron, is positioned to compete vigorously in the weight loss drug market, especially against Novo Nordisk’s oral Wegovy. Despite recent trial data that surprised investors with lower-than-expected weight loss results, analysts remain optimistic about Eli Lilly’s prospects. The pill’s daily regimen offers a promising alternative to weekly injections commonly associated with obesity treatments, which could significantly enhance patient compliance and satisfaction. As consumers increasingly seek convenient treatment options, Eli Lilly’s potential to enter the market could reshape the landscape of weight loss drugs.

The competitive dynamics in this segment highlight not only the effectiveness of the medications but also consumer preferences for ease of use and affordability. Eli Lilly’s attempted entry amidst the prevailing success of Novo Nordisk’s Wegovy indicates a potentially lucrative battle for market share. While the current data is concerning, Eli Lilly’s management expects that features like simpler manufacturing and no dietary restrictions could make their pill appealing once it hits global markets, targeting a launch as early as late 2026.

Frequently Asked Questions

What is the Eli Lilly obesity pill and how does it compare to Novo Nordisk’s Wegovy?

The Eli Lilly obesity pill, known as orforglipron, is a daily oral medication designed to aid weight loss by mimicking the GLP-1 hormone, similar to Novo Nordisk’s Wegovy, which is also a GLP-1 agonist. While orforglipron’s late-stage trial data showed less weight loss than expected compared to Wegovy, it has advantages such as no dietary restrictions and easier manufacturing.

Is Eli Lilly’s obesity pill expected to gain approval in the weight loss drug market?

Eli Lilly’s obesity pill, orforglipron, is anticipated to receive approval by late 2026, according to analysts. Despite disappointing trial results, many believe it can still compete effectively against Novo Nordisk’s Wegovy due to its convenient daily dosing and potential for lower pricing.

What are the advantages of the Eli Lilly obesity pill over Wegovy?

The Eli Lilly obesity pill offers several advantages over Wegovy, including no dietary restrictions, easier absorption as a small-molecule drug, and potentially simpler and less expensive manufacturing processes, which could lead to a lower price point for consumers.

How could Eli Lilly’s obesity pill affect the pricing of weight loss drugs in the market?

Eli Lilly’s orforglipron may provide a pricing advantage in the obesity treatment market as it is likely easier and cheaper to produce than Novo Nordisk’s Wegovy. This cost-effectiveness could attract more patients, especially as many health plans do not cover obesity treatments.

What are the expected market share implications for Eli Lilly’s obesity pill compared to Novo Nordisk’s product?

Analysts predict that Eli Lilly’s oral obesity pill could capture about 60% of the daily oral weight loss drug market segment by 2030, suggesting significant competition for Novo Nordisk’s Wegovy, especially in the context of patient preference for convenient treatment options.

What side effects have been reported with Eli Lilly’s obesity pill, and how do they compare to Wegovy?

In clinical trials, Eli Lilly’s obesity pill, orforglipron, was noted to have higher side effects than anticipated. While specific side effects vary, it has underperformed compared to Novo Nordisk’s Wegovy, which has shown a more favorable safety profile in studies.

How do Eli Lilly and Novo Nordisk’s obesity treatments work?

Both Eli Lilly’s orforglipron and Novo Nordisk’s Wegovy function as GLP-1 receptor agonists, aiming to suppress appetite and regulate blood sugar levels. However, orforglipron is a small-molecule oral drug, making it easier to take compared to Wegovy’s injectable peptide form.

What challenges does Eli Lilly face in the development of its obesity pill?

Eli Lilly faces significant challenges in the competitive obesity treatment sector, such as responding to disappointing trial data and overcoming market skepticism. Additionally, it must navigate pricing strategies and insurance coverage issues prevalent in the weight loss drug market.

| Key Points | Details |

|---|---|

| Eli Lilly’s obesity pill compared to Novo Nordisk’s Wegovy | Despite disappointing trial data, analysts believe Eli Lilly’s pill has potential as a competitor in the weight loss market. |

| Trial Data Insights | Trial data for orforglipron showed less weight loss than expected, but it still holds promise. |

| Advantages of Eli Lilly’s Pill | Potential benefits include no dietary restrictions, easier manufacturing, and possibly lower pricing. |

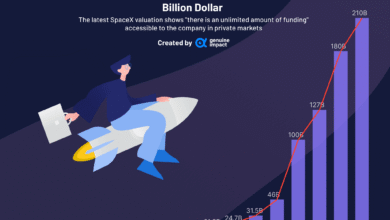

| Market Potential | Goldman Sachs predicts Eli Lilly could capture about 60% of the daily oral segment by 2030. |

| Challenges Ahead | Development of obesity treatments faces hurdles, but Eli Lilly’s formulation might overcome some if approved. |

| Conclusion | Eli Lilly’s next steps are critical to determining its place in the evolving obesity treatment market. |

Summary

Eli Lilly’s obesity pill is set to make waves in the weight loss market, directly competing with Novo Nordisk’s established oral Wegovy drug. Despite some disappointing trial data that initially affected investor confidence, analysts remain optimistic about the distinct advantages that Eli Lilly’s formulation presents. With features such as potentially lower costs, simpler manufacturing, and the absence of dietary restrictions, Eli Lilly’s pill may capture a significant share of the market upon its release. Furthermore, as the global demand for convenient weight loss options grows, Eli Lilly’s strategic plans and the unique characteristics of its obesity pill position it as a formidable contender in the industry. Ultimately, the drug’s success will depend on further research and its acceptance by both patients and insurers.