Bitcoin Million Prediction: Coinbase CEO’s Insight on Future

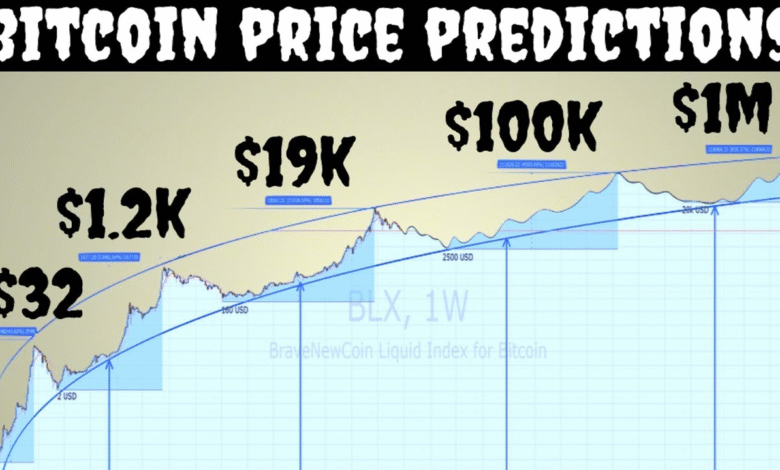

The Bitcoin million prediction has gained significant traction as industry leaders and analysts contemplate the future of cryptocurrency. Coinbase CEO Brian Armstrong recently forecasted that Bitcoin could soar to an astonishing $1 million within the next decade, driven by factors like institutional investment, regulatory clarity, and growing government Bitcoin reserves. His insights highlight a pivotal moment where large-scale entities are recognizing the potential of Bitcoin, especially with increasing interest in Bitcoin ETFs making crypto more accessible. As the landscape evolves, Armstrong believes that these developments could create a perfect storm for Bitcoin’s growth, bringing it closer to this ambitious price target. Indeed, the confluence of market demand and regulatory support may set the stage for Bitcoin’s meteoric rise, making it a focal point in discussions about the future of digital currency.

The potential for Bitcoin to reach unprecedented price levels is becoming a hot topic among investors and financial experts alike. With projections indicating that the leading cryptocurrency could achieve the $1 million mark, discussions around its viability are intensifying. Analysts are keenly observing movements in institutional investments, the burgeoning interest in cryptocurrency exchange-traded funds (ETFs), and the increasing involvement of governments in securing their Bitcoin assets. Many believe that these elements are likely contributing factors to future price surges, prompting a reevaluation of Bitcoin’s role in the financial ecosystem. As the momentum builds, it becomes clear that the narrative surrounding Bitcoin’s explosive potential is evolving, capturing the imaginations of both seasoned investors and newcomers.

Coinbase CEO’s Vision: The Path to $1M Bitcoin

Brian Armstrong, the CEO of Coinbase, has become a notable figure within the cryptocurrency community, particularly with his bold prediction that Bitcoin could reach a staggering $1 million by the year 2030. He believes that this ambitious forecast hinges on a mixture of regulatory clarity, institutional investment, and growing government interest in the asset. As more institutional players look to diversify their portfolios, Bitcoin is increasingly being seen as a viable alternative to traditional investments, further fueling speculation on its future price trajectories.

Armstrong’s insights reflect a significant shift in the landscape of cryptocurrency. The ever-expanding discussion around Bitcoin exchange-traded funds (ETFs) is pivotal, as these investment vehicles offer a structured and regulated method for investors to gain exposure to Bitcoin without needing to own the underlying asset directly. This ability to invest in a Bitcoin ETF underscores the growing acceptance and legitimization of Bitcoin within financial markets, making Armstrong’s prediction not just a lofty dream, but a feasible reality as conditions evolve.

The Role of Institutional Investment in Bitcoin’s Surge

Institutional investment is a critical component of the current cryptocurrency landscape, with more asset managers and financial institutions exploring the potential of Bitcoin as a strategic investment avenue. According to Armstrong, many institutions currently hold only 1% of their portfolios in Bitcoin, indicating that there is significant room for growth. If these entities increase their Bitcoin exposure to just 5% or 10%, the resulting inflow of capital would be monumental, potentially driving Bitcoin prices dramatically higher.

Moreover, the interest from large-scale investors reflects a broader trend of increasing adoption and confidence in the cryptocurrency market. Institutional involvement can be the catalyst for Bitcoin’s stabilization and growth, making it a more attractive option for retail investors. By building a more robust foundation of support through institutional buying, Bitcoin could further solidify its status as ‘digital gold’ and pave the way for Armstrong’s $1M prediction.

Government Bitcoin Reserves: A Game Changer

The recent announcement regarding the U.S. government’s strategic establishment of Bitcoin reserves marks a transformative event in the cryptocurrency world. This kind of initiative not only signals a commitment from government entities to the cryptocurrency but also encourages institutional investors to view Bitcoin as a legitimate asset class. Since governments control vast pools of capital, their engagement with Bitcoin could significantly influence market dynamics and foster greater adoption among investors.

Armstrong notes that governments across the globe are increasingly integrating cryptocurrency services, with Coinbase already serving numerous federal, state, and international entities. This growing relationship indicates a shift towards acceptance and perhaps even establishment of regulatory frameworks that will further solidify Bitcoin’s place in the global economic ecosystem.

Bitcoin ETFs: Driving Adoption and Price Predictions

Bitcoin ETFs have emerged as one of the most significant tools for enhancing market access and driving adoption of Bitcoin among institutional investors. By allowing investors to gain exposure to Bitcoin in a familiar and regulated format, ETFs play a crucial role in simplifying the investment process. Armstrong’s observations highlight that as institutional confidence increases in Bitcoin ETFs, so too will the flow of capital into Bitcoin, propelling prices closer to the ambitious predictions made by many leaders in the crypto sphere.

Furthermore, the potential approval of more Bitcoin ETFs could signal to investors that the market is evolving toward greater legitimacy and stability. As regulatory environments become clearer and more favorable, it can be expected that the momentum behind ETFs will attract even more investment, reinforcing Armstrong’s theory that Bitcoin may well reach $1 million, leveraging these products as foundational drivers of demand.

Regulatory Clarity: A Pillar for Bitcoin’s Growth

The conversation around regulatory clarity is becoming increasingly important as Bitcoin continues to gain traction among mainstream investors. Armstrong argues that the establishment of clear regulations can unlock substantial capital flow from institutional investors who have thus far been hesitant to engage with cryptocurrencies. The clarity he speaks of is essential for institutions, many of whom have cited regulatory uncertainty as a primary reason to limit their holdings in Bitcoin.

As governments and regulatory bodies move towards a more established framework for cryptocurrencies, there will likely be a significant reduction in perceived risks. With fewer barriers and clearer guidelines, institutions can confidently make larger allocations to Bitcoin, which has the potential to elevate its market price and support Armstrong’s $1M projection for the future.

Institutional FOMO: The Drive Behind Bitcoin’s Ascent

The fear of missing out (FOMO) is a powerful motivator in financial markets, and in the case of Bitcoin, it is creating an environment ripe for dramatic appreciation in value. Armstrong suggests that as more institutional investors see their peers gaining significant returns from Bitcoin, they may feel compelled to join the trend, driving demand even higher. This sense of urgency can create a feedback loop that only accelerates Bitcoin’s price movements towards Armstrong’s staggering $1 million forecast.

Moreover, as major institutions begin to publicly announce their Bitcoin holdings, others will likely follow suit, creating an avalanche effect. The combination of FOMO with institutional investment further underpins the foundation for Bitcoin’s valuation to potentially surge, emphasizing the importance of both psychological and market dynamics in the trajectory of Bitcoin’s price.

The Future of Bitcoin: What Lies Ahead?

Looking into the future, the trajectory of Bitcoin remains a topic of immense interest and debate. The landscape is shifting rapidly with increasing institutional investment, government engagement, and advancements in regulatory frameworks. These factors suggest that the conditions necessary for Bitcoin to flourish are becoming more favorable, leading experts like Armstrong to remain optimistic about its potential to reach $1 million.

However, while the possibilities are exhilarating, it’s essential to navigate the inherent volatility and risks that accompany such predictions. Investors must stay informed and prepared for both the opportunities and challenges that may arise as the cryptocurrency market continues to evolve. Ultimately, the collective actions of governments, institutions, and the regulatory environment will shape the future of Bitcoin and its journey towards that $1 million milestone.

Navigating the Risks in Bitcoin Investment

While many are optimistic about the potential for Bitcoin to soar to $1 million, it is crucial for investors to remain aware of the associated risks. Uncertainties such as regulatory updates, market volatility, and technological vulnerabilities can introduce significant challenges. Armstrong acknowledges that while many risks have diminished, vigilance is still necessary, particularly as the infrastructure around Bitcoin continues to develop.

Investors should keep abreast of ongoing developments in both the regulatory landscape and the advancement of Bitcoin’s security measures, especially as concerns regarding post-quantum cryptography emerge. By understanding these risks, individuals can take a more strategic approach to their investments, helping them navigate through the complexities of the cryptocurrency landscape more effectively.

Why Bitcoin’s Growth is Inevitable

Bitcoin is often described as a revolutionary asset, and as outlined by Armstrong, multiple factors suggest that its growth is not just possible but inevitable. The combined effects of institutional investment, government support, and growing public interest form a trifecta that promotes Bitcoin’s ascendancy. As more entities recognize Bitcoin’s value and utility, the demand will inherently rise, placing upward pressure on its price.

Furthermore, the emergence of new financial products such as Bitcoin ETFs and increased regulatory clarity will only serve to bolster Bitcoin’s market position. As the financial landscape transforms and evolves, Bitcoin stands on the precipice of a new era where its integration into mainstream finance becomes more pronounced, laying the groundwork for Armstrong’s ambitious forecast of $1 million per Bitcoin.

Frequently Asked Questions

What is the Bitcoin million prediction by Coinbase CEO Brian Armstrong?

According to Coinbase CEO Brian Armstrong, Bitcoin could potentially reach $1 million by the year 2030, driven by factors such as institutional investment, government reserves, and increasing regulatory clarity.

How do Bitcoin ETFs influence the million prediction for Bitcoin?

Bitcoin ETFs (Exchange-Traded Funds) significantly influence the Bitcoin million prediction as they provide institutional investors easier access to Bitcoin, which could lead to increased demand and price growth, aligning with projections like Armstrong’s.

What role does government Bitcoin reserves play in Bitcoin’s million prediction?

Government Bitcoin reserves play a crucial role in the million prediction by establishing legitimacy and stability in the cryptocurrency market, fostering investor confidence and encouraging more substantial institutional investments in Bitcoin.

Why is institutional investment important for the Bitcoin million prediction?

Institutional investment is essential for the Bitcoin million prediction because as more large entities allocate higher percentages of their portfolios to Bitcoin, the increased demand could significantly drive up the price towards the projected $1 million.

What factors contribute to the optimism around Bitcoin’s price prediction reaching $1 million?

Factors contributing to the optimism around Bitcoin’s price prediction include regulatory clarity, increased government involvement, particularly with Bitcoin reserves, and a surge in interest from institutional investors and Bitcoin ETFs.

How does regulatory clarity affect Bitcoin’s potential to reach $1 million?

Regulatory clarity affects Bitcoin’s potential to reach $1 million by encouraging institutional investment; as rules become clearer, it removes barriers for large capital inflows into Bitcoin, which could support higher prices.

What does Brian Armstrong say about the risks to Bitcoin’s price reaching $1 million?

Brian Armstrong has pointed out that many risks that previously challenged Bitcoin’s growth, like government restrictions and security vulnerabilities, have diminished, providing a more favorable environment for its price to reach $1 million.

What is the significance of growing interest in Bitcoin from sovereign nations?

The growing interest in Bitcoin from sovereign nations is significant as it indicates increasing acceptance and potential support for Bitcoin as a reserve asset, fostering a more stable environment for future price increases towards $1 million.

How can broader institutional adoption impact Bitcoin’s price prediction?

Broader institutional adoption can drastically impact Bitcoin’s price prediction, potentially pushing it to $1 million as institutions increase their allocations and demand for Bitcoin rises alongside market acceptance.

What timeline has Brian Armstrong suggested for Bitcoin reaching $1 million?

Brian Armstrong has suggested that Bitcoin could reach $1 million within the next decade, specifically by 2030, influenced by various favorable market conditions and developments.

| Key Point | Explanation |

|---|---|

| Coinbase CEO’s Prediction | Brian Armstrong predicts Bitcoin could reach $1 million by 2030. |

| Regulatory Clarity | Emerging regulations and government involvement support long-term Bitcoin growth. |

| Government Involvement | The U.S. government is building a strategic Bitcoin reserve, indicating increased legitimacy. |

| Institutional Adoption | Many institutions hold only a small percentage of Bitcoin, but clarity could increase their investment. |

| ETFs | Exchange-traded funds are facilitating easier access and may lead to greater institutional investment. |

| Reduced Risks | Perceived risks like government restrictions or protocol vulnerabilities are diminishing. |

Summary

The Bitcoin million prediction is taking shape as Coinbase CEO Brian Armstrong lays out a compelling case for the cryptocurrency potentially hitting $1 million by 2030. Factors such as increasing governmental engagement, regulatory clarity, and heightened institutional interest are paving the way for this ambitious forecast. With institutions expressing willingness to allocate more capital into Bitcoin, coupled with the ongoing momentum surrounding ETFs, the conditions appear ripe for Bitcoin’s ascent towards unprecedented values. This combination of strategic moves and evolving market dynamics could be key drivers behind Armstrong’s optimistic outlook.