Bitcoin Price Decline: What’s Next for BTC Investors?

Bitcoin price decline has caught the attention of traders and analysts alike as it tumbles below the $110,000 mark for the first time in nearly 50 days. This significant downturn reflects the dominant bearish sentiment in the market, impacting not just Bitcoin but surrounding cryptocurrency trends. Since August 18, the leading digital currency has faced a staggering 5.7% drop against the U.S. dollar, exacerbating concerns over BTC price prediction and future performance. Some experts attribute this recent decline to increased whale activity and institutional sell-offs, leading to a turbulent Bitcoin trading news landscape. As BTC grapples with this setback, the implications for market bearishness reverberate across the cryptocurrency spectrum, causing major liquidations and raising questions about the path ahead for this cryptocurrency titan.

The downward trajectory of Bitcoin can be described using various terms, including the cryptocurrency’s dramatic price drop and subsequent market struggles. As the flagship digital asset slides beneath the crucial $110,000 threshold, investors can feel the weight of market bearishness affecting their decisions and strategies. Recent fluctuations in the Bitcoin landscape signal potential implications for the broader cryptocurrency market dynamics, sparking discussions and analysis around BTC’s future valuation. The unfolding scenario serves as a reminder of the volatility inherent in cryptocurrency trading, particularly as traders assess the latest developments and their potential impacts on Bitcoin’s next moves. This rollercoaster of trends not only affects Bitcoin but also sets the tone for altcoins and other digital assets vying for attention amid the uncertainty.

Understanding the Recent Bitcoin Price Decline

Bitcoin’s recent price decline below the $110,000 mark has raised significant concerns among investors and analysts alike. This decline, marking the first time in 47 days that BTC has dipped so low, signals a shift in market sentiment, with bears currently exerting their influence on the cryptocurrency’s performance. The primary catalyst behind this downward movement has been a series of large sell-offs, particularly from significant holders—often referred to as whales. These actions, combined with outflows from crypto ETFs, have contributed to a bearish outlook in the market, making it essential to analyze the underlying factors driving these trends.

With Bitcoin’s latest performance indicating a 5.7% decrease against the U.S. dollar since mid-August, many are questioning whether this downturn marks the beginning of a more prolonged bearish phase. Market indicators, including the moving average convergence divergence (MACD) oscillator, reflect this bearish pressure, suggesting that the path ahead for Bitcoin may be fraught with challenges. Investors are now more cautious, looking closely at market trends and Bitcoin price predictions as they navigate the current climate.

Impact of Market Bearishness on Bitcoin and Altcoins

The current market bearishness has not only affected Bitcoin but has also sent shockwaves through the altcoin space and derivatives markets. Recent trading activities have seen a staggering $895.28 million in liquidations within just a 24-hour period. Among these, the majority—over $809 million—came from long positions, indicating that traders who anticipated a price rebound faced considerable losses. This scenario underscores the volatility inherent in cryptocurrency trading and highlights the risks associated with long positions in a declining market.

Furthermore, the repercussions of Bitcoin’s price decline resonate deeply within the altcoin market, where significant sell-offs have cascaded downwards. Trading volumes for various altcoins, including Ethereum, have seen substantial fluctuations, with liquidations in ETH reaching more than $287 million. This interconnected nature of cryptocurrency markets amplifies the effects of Bitcoin’s performance, making it crucial for traders to stay informed about broader cryptocurrency trends and Bitcoin trading news to make educated decisions.

Strategies for Investors Amidst Bitcoin’s Volatility and Price Predictions

Given the current volatility surrounding Bitcoin and its recent price decline, investors must reassess their strategies carefully. With bears dominating the market, market analysts suggest that focusing on risk management and implementing stop-loss orders could be prudent decisions. Monitoring crucial price levels becomes essential not just for Bitcoin but also for the wider cryptocurrency market. Keeping abreast of BTC price predictions will help investors gauge potential rebounds or further declines, allowing them to adjust their portfolios accordingly.

Additionally, diversifying into altcoins that show resilience in the face of Bitcoin’s fluctuations can mitigate risks. Conducting thorough market analysis and staying updated on Bitcoin trading news and broader cryptocurrency developments will enable investors to seize opportunities even during bearish trends. Awareness of potential support and resistance levels can inform crucial entry and exit points, crucial for navigating the complexities of the currently bearish environment.

The Role of Whale Activity in Bitcoin Price Trends

Recent analyses highlight the significant role that whale activity plays in Bitcoin’s price trends. A notable instance was observed when a major holder sold 24,000 BTC, contributing directly to the decline below the critical $110,000 threshold. Such large transactions can create panic and trigger a chain reaction of sell-offs among smaller investors, exacerbating market volatility. As whales move in and out of positions, their actions can sway market sentiment dramatically, pushing prices up or down.

Investors keen on comprehending the intricacies of Bitcoin must pay close attention to these movements by whales. Tools that track wallet transactions and exchanges can provide insight into these activities, allowing traders to better anticipate potential price shifts. Furthermore, understanding the psychology behind whale transactions can aid in making more informed decisions, especially in a market littered with unpredictability and bearish trends.

Analyzing BTC Price Predictions Post-Decline

Following Bitcoin’s recent decline, investors are increasingly focused on BTC price predictions to gauge potential future movements. Analysts are now revisiting their forecasts in light of the current market conditions. As the leading cryptocurrency slips below the pivotal psychological level of $110,000, questions arise as to whether this will lead to further declines or if a recovery is on the horizon. Many experts are now contemplating whether Bitcoin will test lower support levels, such as the $103,689 point on the EMA and $100,859 on the SMA, crucial thresholds that could redefine the market trend.

While some analysts remain cautiously optimistic about Bitcoin’s recovery potential, others warn of a possible bear market taking shape if the altcoin and derivatives markets do not stabilize. Expectations of renewed bullish momentum hinge on Bitcoin reclaiming those crucial price levels, accompanied by positive trading news. Consequently, traders must remain vigilant, adjusting their strategies as market predictions evolve in response to Bitcoin’s behavior.

The Psychological Effects of Key Price Levels on Bitcoin Trading

The psychological impact of key price levels on Bitcoin trading cannot be overstated. The recent drop below the $110,000 threshold has ignited widespread concern among traders, affecting market sentiment and decision-making processes. Such levels often serve as self-fulfilling prophecies, where the mere act of breaking through a significant benchmark can lead to added selling pressure. As the psychological barriers shift, traders must navigate the landscape with an understanding of how these threshold levels could influence overall Bitcoin market dynamics.

Investors often align their strategies with these psychological price points, with many placing significant orders around them. Thus, witnessing BTC dip below $110,000 may encourage further sell-offs or motivate some to buy in anticipation of a rebound. This cyclical behavior emphasizes the importance of analyzing trader psychology in conjunction with objective market analysis to foresee potential price movements adequately.

Future Trends in Cryptocurrency Amidst Bitcoin’s Challenges

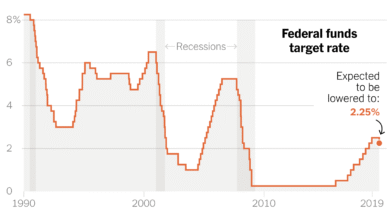

As Bitcoin continues to navigate its price decline, the overarching trends within the cryptocurrency market warrant close examination. The evolving landscape suggests that future trends may heavily depend on external factors, such as regulatory developments, technological advancements, and macroeconomic influences. The current bearish sentiment surrounding Bitcoin could also influence increased investor interest in alternative digital assets, as traders search for potentially more lucrative opportunities.

Additionally, as market participants become more sophisticated, the integration of advanced trading strategies and analytical tools could shape the future of cryptocurrency investments. While Bitcoin’s challenges may seem daunting now, the resilience of the cryptocurrency market historically suggests that new trends can emerge, providing potential opportunities for traders who remain adaptable and informed.

Assessing Technical Indicators for Bitcoin Trading Strategies

To devise effective trading strategies in light of Bitcoin’s price decline, understanding technical indicators becomes paramount. Tools such as moving averages, MACD, and support and resistance levels allow traders to analyze Bitcoin’s price action and identify entry and exit points. The recent break of moving averages indicates bearish momentum, which traders must take into consideration when setting their positions and planning for potential rebounds.

Utilizing these technical indicators, investors can better predict market trends and adjust their trading strategies accordingly. Keeping abreast of market developments and having the ability to interpret data accurately will be crucial in navigating the current crypto landscape. As Bitcoin’s price continues to fluctuate, those equipped with refined technical analysis skills will stand a better chance at mitigating risks and capitalizing on future opportunities.

Institutional Influences on Bitcoin and Market Dynamics

Institutional investors have played a pivotal role in shaping Bitcoin’s market dynamics, particularly during significant price fluctuations. The recent downturn has been partially attributed to increased sell-offs from institutional holders, contributing to the bearish sentiment that permeates Bitcoin trading. As more institutions enter the cryptocurrency space, their actions have greater implications for market trends, as their buying and selling behaviors can greatly influence Bitcoin’s liquidity and price stability.

Moreover, the interaction between institutional movements and retail investor reactions highlights the complexities of market behavior in response to Bitcoin’s performance. As institutions adjust their strategies based on market conditions, retail investors must remain agile, understanding that their own trading decisions are often influenced by these larger players. Ultimately, the relationship between institutional involvement and Bitcoin’s price trends remains critical in determining future market trajectories.

Frequently Asked Questions

What are the key factors contributing to the recent Bitcoin price decline?

The recent Bitcoin price decline can be attributed to significant whale activity, with a major holder selling 24,000 BTC, and outflows from exchange-traded funds (ETFs), along with broad institutional sell-offs. The cumulative effects of these activities have led to a bearish sentiment in the Bitcoin market.

How does the current Bitcoin price decline affect cryptocurrency trends?

The current Bitcoin price decline has negatively impacted cryptocurrency trends overall, resulting in significant liquidations in altcoins and derivatives markets, amounting to $895.28 million within 24 hours. Such volatility can deter investment and influence traders’ perception of market stability.

What is the significance of the $110,000 level in relation to the Bitcoin price decline?

The $110,000 level is crucial as it acts as a psychological threshold and resistance point for Bitcoin. Falling below this mark gives bears a stronger position, increasing fears of further downsides and marking a potential shift in the market’s bullish trend.

What is the outlook for BTC price prediction following this decline?

Given the current Bitcoin price decline and bearish indicators like the MACD oscillator, analysts may predict continued volatility. If BTC falls significantly below $103,689 on the EMA or $100,859 on the SMA, it could signal further challenges and a risk to the larger bullish trend.

How are traders reacting to the Bitcoin price decline in current Bitcoin trading news?

Traders are reacting cautiously amid the Bitcoin price decline, with many liquidating long positions in response to market bearishness. The swift market reaction, with $809 million liquidated from long positions, indicates significant concern about future price movements.

What does the bearish momentum imply for the future of Bitcoin and the crypto market?

The bearish momentum seen in Bitcoin’s price decline suggests potential difficulties ahead for BTC and the broader crypto market. If downward pressures persist, it could hinder Bitcoin’s recovery efforts and influence overall market trends negatively.

| Aspect | Details |

|---|---|

| Current Price | Below $110,000 for the first time in 47 days |

| Price Decline | 5.7% decrease against USD since August 18 |

| Recent Low | Dropped to $109,465 after peak at $112,000 |

| Whale Activity | One major holder sold 24,000 BTC contributing to decline |

| Market Impact | $895.28 million in liquidations, largely from long positions |

| Critical Level | $110,000 is a key resistance point and psychological barrier |

| Bearish Indicators | Momentum indicators and MACD show bearish pressure |

| Support Levels | Concerns grow below $103,689 (EMA) and $100,859 (SMA) |

Summary

The Bitcoin price decline has been prominent recently, as it has fallen below the $110,000 mark for the first time in 47 days, highlighting ongoing market weakness. Factors contributing to this downturn include significant whale selling, institutional sell-offs, and outflows from ETFs. With bearish momentum indicators signaling an ongoing struggle for recovery, the cryptocurrency faces critical thresholds that could impact its future price trajectory. Investors should remain vigilant as the market grapples with these challenges.