Aave: Exploring the Rising AAVE Token and Its Future

Aave is rapidly establishing itself as a beacon of opportunity in the often turbulent crypto market. This Ethereum-based DeFi platform, powered by the AAVE token, has recently experienced a significant price surge, capturing the attention of both investors and analysts alike. As one of the more resilient tokens in the DeFi space, Aave is nearing its yearly high, leading many to speculate about its potential for sustained growth. With the backing of affluent investors known as “whales,” Aave’s performance hints at a renewed interest in Ethereum lending services. This rise in demand is not only promising for the AAVE token but also signals a potential revival in the broader DeFi sector, making now an opportune moment for crypto enthusiasts to pay attention.

The Aave protocol has been a vital player in decentralized finance, particularly as an Ethereum lending service that offers unique opportunities for users. Known for its innovative approach, it has attracted significant attention with its recent price increase, driving discussions around the AAVE cryptocurrency. As the world of decentralized finance expands, Aave’s robust features position it as a formidable contender against other DeFi platforms. This surge in interest reflects a growing confidence in the crypto market as investors seek reliable assets. In light of its evolving ecosystem and potential future developments, Aave remains a focal point for anyone watching the dynamics of the crypto landscape.

The Rise of Aave: A Beacon in the Crypto Market

In the often tumultuous landscape of the crypto market, the Ethereum-based DeFi platform Aave has emerged as a guiding light. As a platform for decentralized lending, Aave’s AAVE token is currently witnessing an impressive surge, nearing its yearly high. This remarkable growth has caught the attention of both veteran investors and newcomers, prompting questions about the sustainability of such a leap. Analysts are intrigued by the sudden influx of capital into Aave, marking it as one of the few tokens defying the bearish trends prevalent in the current market.

The revival of interest in DeFi is a significant driver behind AAVE’s price surge. Traditional market indicators are beginning to align favorably, suggesting a potentially transformative moment for Aave. As big investors, often referred to as ‘whales’, consolidate their positions in AAVE, the prospect of a robust recovery in the DeFi sector is becoming increasingly tangible. Renewed confidence is seen through consistent activity across wallets and a steady rise in daily active addresses, indicating growing engagement with the platform.

Aave’s Expansion: Scaling New Heights in DeFi

Since its inception on Ethereum in 2020, Aave’s trajectory has been nothing short of remarkable. The platform has continually evolved, moving from its initial launch to the third iteration, v3, which now spans across twelve blockchains. Notably, Aave is planning to extend its reach to Solana, a burgeoning competitor to Ethereum. Looking ahead, the anticipated launch of Aave’s own Layer-2 scaling solution is generating considerable excitement, as it promises to enhance transaction efficiency and user experience across the board.

The upcoming v4 upgrade is also expected to introduce the “Unified Liquidity Layer,” which aims to integrate all aspects of Aave’s ecosystem. This integration is likely to streamline operations and drive further user engagement. Moreover, the focus on Aave’s proprietary stablecoin, GHO, signals a strategic pivot. By enhancing yield opportunities for stablecoin deposits, Aave is actively positioning itself to attract a broader audience and sustain its competitive edge in the DeFi market.

Aave’s Stability: A DeFi Heavyweight

Aave’s reputation as a leading DeFi lending platform is bolstered by its resilience during recent market downturns. When many platforms faced significant challenges, Aave executed a record number of liquidations efficiently, averaging around 250 million USD without major disruptions. Such stability under pressure garnered Aave significant confidence among investors, contributing to its solid ‘Tried and Tested’ label within the crypto community. This effective handling of market fluctuations exemplifies the protocol’s robustness and instills further trust in its users.

Despite being a recognized leader in the DeFi sphere, some market analysts assert that Aave remains undervalued. Key performance indicators are already reaching historical highs, yet the price of AAVE lags significantly behind potential projections based on these metrics. With rising revenues surpassing previous quarters and a Total Value Locked experienced nearly double the input since the year’s commencement, Aave appears well-positioned for long-term growth. Navigating through turbulent waters with strategic functionality could prove to be the catalyst for AAVE’s investment appeal.

The Shift from Memes to Fundamentals: Aave’s Next Chapter

Recent trends have shown investors favoring the memecoin sector, possibly losing sight of the foundational effectiveness and utility of established platforms like Aave. However, with a shift in strategy toward fundamental principles, Aave is recovering lost ground. The ongoing restructuring of its tokenomics aims to provide tangible value back to its token holders, with plans for a revenue-sharing model poised to reward investors. This pivot not only reinstates faith among existing stakers but attracts fresh interest from those prioritizing sustainable investment.

As Aave navigates this transformation, it positions itself back in the spotlight during a crucial moment in the market landscape. The introduction of a token burn and buyback initiative signals a commitment to value appreciation, potentially setting a precedent that emphasizes financial fundamentals over speculative incentives. Such strategic moves could herald a new narrative in the crypto space, especially with external factors like falling interest rates creating fertile ground for cryptocurrency investments that are built on solid foundations instead of purely speculative excitement.

Looking Ahead: Aave’s Future Prospects

As the crypto market continuously evolves, it is essential to assess how Aave can sustain its recent momentum. With broader market conditions often influencing individual token performance, AAVE could experience turbulence if Bitcoin, the market leader, does not maintain upward trends. However, Aave’s robust fundamentals offer a strong narrative for long-term investors as they evaluate portfolios against emerging cash flow metrics. Watchful investors may find that AAVE stands out as a compelling opportunity amidst wider crypto market fluctuations.

The current mini-rally surrounding Aave serves as an important signal for those looking to diversify their investment portfolios in anticipation of future growth. As more investors begin focusing on performance and user engagement as key indicators, Aave’s established presence in the DeFi ecosystem ensures it won’t be overlooked. Ultimately, Aave offers enticing possibilities for both seasoned and novice investors exploring a space that promises innovation coupled with economic resilience.

Frequently Asked Questions

What is Aave and how does it function within the DeFi platform?

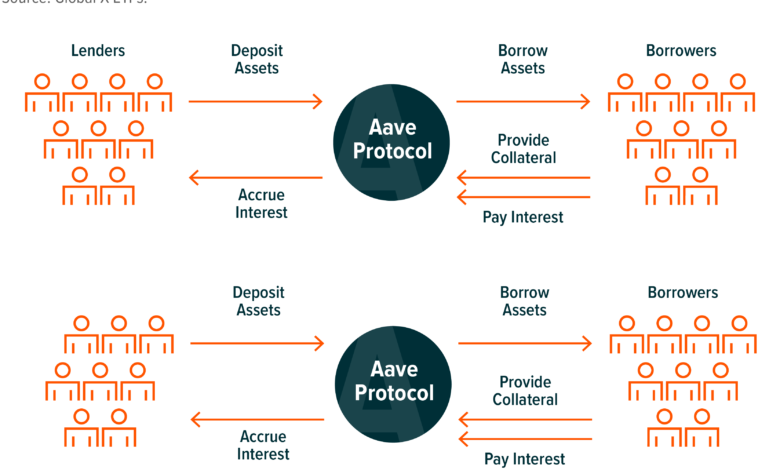

Aave is a decentralized finance (DeFi) platform built on the Ethereum blockchain that allows users to lend and borrow cryptocurrency. Its primary function is to facilitate lending services where users can lend their crypto assets to earn interest or borrow against their crypto holdings, using AAVE tokens as collateral.

Why has the AAVE token experienced significant price surges recently?

The AAVE token has surged in price due to increased interest from affluent investors and crypto whales, with recent data showing a 40% rise in just a week and a staggering 137% increase since the beginning of the year. This price surge is linked to renewed confidence in the DeFi market and related improvements in Aave’s network and services.

What are the key features of the Aave price surge seen in 2024?

In 2024, the AAVE token’s price surge can be attributed to a combination of factors including increased purchasing by wealthy investors, record-high daily active addresses on the platform, and upcoming enhancements such as the launch of Aave’s Layer-2 solution and the introduction of a proprietary stablecoin, GHO.

How does Aave ensure the sustainability of its DeFi operations during market fluctuations?

Aave has a robust operational framework that allows it to manage substantial market fluctuations effectively. During the recent market downturn, it managed the largest number of liquidations seamlessly, demonstrating its resilience as a leading DeFi platform. Aave’s ability to process approximately 250 million USD in liquidations without major disruptions underlines its operational strength.

What upcoming developments can Aave users expect in the future?

Aave users can look forward to several significant developments, including the rollout of a Layer-2 scaling solution aimed at enhancing transaction efficiency, the introduction of a new revenue-sharing model, and the implementation of a token burn mechanism intended to add value for AAVE token holders.

How do the fundamentals of Aave compare to its current market valuation?

Despite Aave’s strong fundamentals, including all-time high revenues and increased Total Value Locked, analysts suggest that the AAVE token is currently undervalued. With key performance indicators showing significant growth, the price of AAVE remains approximately 80% below its potential value based on these fundamentals.

What impact do market trends have on the performance of Aave’s DeFi platform?

Market trends significantly influence Aave’s performance, including broader movements in the cryptocurrency market and shifts in investor sentiment towards riskier assets. The current mini-rally in AAVE and other tokens indicates a potential shift back towards fundamentals-driven investments in DeFi, influenced by factors such as interest rate changes and regulatory developments.

How does Aave plan to improve token utility and value for its users?

Aave aims to enhance the utility and value of its AAVE token through measures such as implementing a revenue-sharing model that distributes dividends to token holders and advancing tokenomics restructuring. These initiatives are designed to provide direct benefits to stakers and align with sustainable earnings principles in the DeFi ecosystem.

What makes Aave a prominent player in the DeFi lending space?

Aave’s reputation as a prominent player in the DeFi lending space stems from its innovative features, such as flash loans, a diverse range of supported assets, and a strong track record of performance under market stress. Its ability to navigate challenges and provide reliable lending solutions has established it as a leading decentralized lending platform.

How can potential investors evaluate the long-term outlook for AAVE in the crypto market?

Potential investors can evaluate AAVE’s long-term outlook by analyzing key metrics like total value locked, revenue growth, user activity, and ongoing developments within the Aave ecosystem. With positive signs emerging from Aave’s operational resilience and upcoming upgrades, many analysts view it as a compelling long-term investment in the DeFi market.

| Key Points | Details |

|---|---|

| Aave Overview | Aave is an Ethereum-based DeFi platform, notable for its significant growth despite a turbulent crypto market. |

| AAVE Token Performance | The AAVE token has surged nearly 40% in a week and recorded a year-to-date increase of 137%. |

| Investor Interest | Affluent investors, notably ‘whales’, are increasingly buying AAVE, correlating with rising daily active wallet addresses. |

| Expansion Plans | Aave is expanding to multiple blockchains and plans to launch its own Layer-2 solution, enhancing ecosystem efficiency. |

| Market Position | Aave established itself as a dominant player in DeFi, able to manage high liquidations without disruption when the market crashed. |

| Tokenomics Restructuring | Aave is revising its tokenomics to benefit holders through a revenue-sharing model and potential buyback mechanisms. |

| Future Outlook | While sustaining recent price increases may be challenging, Aave’s fundamentals position it well for long-term investor interest. |

Summary

Aave is making a remarkable impact on the DeFi landscape, fueled by significant price increases and strategic expansions. As the platform develops its Layer-2 scaling solution and refines its tokenomics to enhance value for its holders, the prospects for AAVE appear promising. Investors looking for sustainability and robustness in the crypto market should consider Aave as a key player not to overlook.