Aave Total Value Locked Hits $24.4B Amid Rising Momentum

Aave total value locked (TVL) has soared to an impressive **$24.389 billion**, marking a significant milestone for this leading DeFi lending platform. This surge reflects a growing confidence among investors in Aave’s capabilities as a decentralized finance powerhouse. With a market capitalization of **$3.335 billion**, Aave continues to solidify its position as one of the most prominent platforms in the DeFi ecosystem. Recently, the AAVE cryptocurrency has been gaining traction, trading at **$222** and boasting a robust 24-hour trading volume of **$410.28 million**. As participation from both institutional and retail investors enhances its platform activity, Aave’s lending protocol stands as an exemplar of innovation within the crypto landscape.

With the total value locked in Aave reaching unprecedented heights, it’s evident that the decentralized lending ecosystem is gaining traction among cryptocurrency enthusiasts. **Aave TVL** has become a focal point, illustrating not only the platform’s growth but also the broader advancements within the decentralized finance landscape. As one of the leading lending protocols, Aave showcases an impressive array of services that cater to the needs of users looking to lend or borrow digital assets. Its native token, **AAVE**, plays a crucial role in this ecosystem by facilitating governance and incentivizing participation. The resilience observed in the Aave platform highlights the ongoing evolution within the DeFi sector, as it continues to attract significant capital and provide innovative financial solutions.

Understanding Aave’s Total Value Locked (TVL) Impact

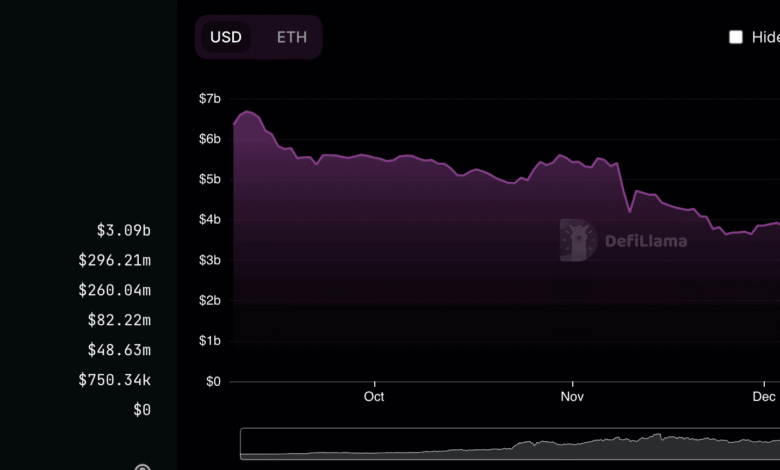

The total value locked (TVL) in Aave has recently set a new all-time high of approximately $24.4 billion, marking a significant uplift in the decentralized finance (DeFi) sector’s growth. This milestone not only reflects heightened investor trust but also highlights the platform’s robustness as a leading DeFi lending solution. Aave’s TVL is a critical metric in understanding the liquidity available within the platform, providing a clear indicator of its popularity and user engagement in DeFi lending, where participants benefit from lending rates and financial tools.

With a thriving market cap of around $3.335 billion, Aave is distinctly positioned among its peers in the competitive DeFi ecosystem. The substantial amount locked into the platform indicates a steady influx of assets, showcasing Aave’s ability to attract institutional and retail investors alike. Through innovative features such as flash loans and interest rate switching, Aave offers users a unique approach to decentralized borrowing and lending, which enhances its appeal and drives the increasing TVL.

Key Features of the Aave DeFi Lending Platform

Aave stands as a pivotal player in the decentralized finance landscape due to its unique offerings that cater to a wide array of users. The platform specializes in noncustodial liquidity, allowing individuals to lend or borrow cryptocurrencies without third-party involvement. This intrinsic nature of trustlessness not only safeguards users’ assets but also promotes greater adoption among those looking to engage with digital finance. Additionally, with support for multiple blockchain environments, Aave amplifies accessibility to diverse crypto assets, enhancing liquidity possibilities.

Aave’s functionality extends beyond mere lending and borrowing. The platform introduces sophisticated features such as flash loans, which allow users to borrow instantly without collateral, provided that the amount is returned within a single transaction block. This feature, along with an array of customizable interest rates, makes Aave a preferred choice for many users seeking adaptability within the DeFi space. Moreover, by utilizing staking mechanisms for governance, community members can influence the protocol’s future developments, ensuring a decentralized approach to decision-making.

The Role of AAVE Cryptocurrency in the Ecosystem

The AAVE cryptocurrency plays a crucial role within the Aave ecosystem, serving both as a utility token and a governance asset. It enhances user engagement by allowing holders to participate in voting on crucial protocol proposals, shaping the direction of Aave’s future. Currently trading at about $222, AAVE has demonstrated volatility common in cryptocurrency markets, yet it remains integral in determining the protocol’s health and attractiveness to users, particularly in staking and liquidity mining scenarios.

Moreover, AAVE functions as a critical component for securing loans on the platform. Users must collateralize their loans with AAVE or other cryptocurrencies, providing a mechanism to maintain the ecosystem’s integrity. With over $632.96 million of AAVE staked, participants are incentivized to contribute to the ecosystem’s sustainability and performance, thus ensuring that Aave continues to thrive in the competitive DeFi landscape.

Recent Growth and Market Momentum for Aave

The recent surge in Aave’s TVL is indicative of a larger trend in the decentralized finance market, as both institutional investors and retail users flock to DeFi protocols for higher yields and diversified financial products. With the historical performance of Aave, particularly following the implementation of significant updates such as Ethereum V2 and the introduction of Avalanche rewards, the platform has proven capable of adapting to evolving market conditions and user needs. Such responsiveness is crucial for maintaining momentum and attracting further capital influx.

As Aave continues to establish new baseline metrics for the total value locked, its impact reverberates across the DeFi landscape. A few key elements contributing to this growth include strategic partnerships, increased marketing outreach, and user-friendly updates that enhance the overall experience. Aave’s innovative approach, combined with its ongoing commitment to transparency and user empowerment, equips it as a leader in the decentralized finance sector, paving the way for future advancements.

Institutional Participation in Aave’s Ecosystem

Institutional interest in Aave has been on the rise, as evidenced by the significant amount of capital flowing into the platform. This adoption not only boosts Aave’s TVL but also validates the importance of decentralized finance protocols in the broader financial ecosystem. Institutional players are increasingly recognizing the potential of DeFi to offer innovative financial products that stand apart from traditional banking systems, which often lack flexibility and transparency.

The involvement of established financial entities has also led to increased legitimacy for platforms like Aave. As more institutions turn to decentralized networks for lending and borrowing, it fosters a collaborative environment where innovation can thrive. Aave’s ability to cater to both retail users and institutional investors can enhance its market share and influence within the DeFi landscape.

Future Projections for Aave’s TVL Growth

As Aave continues to innovate and expand its services, projections indicate a promising trajectory for the platform’s total value locked. Investors are optimistic about future developments that enhance usability and integration with other financial products. By continually adjusting its offerings to respond to market trends, Aave can attract more users and increase its market capitalization over time.

This upward trend in Aave’s TVL will likely parallel the overall growth of the DeFi sector, as more users look to decentralized platforms for their financial needs. Innovations in the lending protocol and the expansion of its asset offerings could further drive TVL upward, thereby solidifying Aave’s position at the forefront of decentralized finance solutions.

The Significance of Aave’s Treasury Holdings

Aave’s treasury holdings amount to approximately $86.17 million, a significant asset that underscores the financial health of the protocol. These treasury reserves not only provide a buffer against market volatility but also represent capital that can be strategically deployed for further development and improvements within the platform. As a noncustodial lending protocol, utilizing treasury funds effectively can lead to enhancements in features such as user interfaces, security measures, and product offerings.

Moreover, maintaining strong treasury holdings can inspire confidence among stakers and investors, ensuring them that Aave is well-positioned to navigate the complexities of the DeFi landscape. These reserves can also facilitate experiments with new financial products and services, potentially attracting a broader user base while propelling the platform forward.

Staking Mechanisms and Their Importance

Aave’s staking mechanism plays a vital role in incentivizing both participation and security within the platform. Users who stake AAVE not only earn rewards but also contribute to the protocol’s security and governance demands. This dual function of staking helps to create a more resilient ecosystem, allowing Aave to fund operations while providing users with tangible benefits for their engagement.

The importance of staking cannot be overstated, as it binds users closer to the platform by offering them a stake in its success. As more users participate through staking, Aave’s governance becomes increasingly decentralized, reflecting the collective decisions of its community. This inclusive approach ensures that the protocol remains adaptable and responsive to user needs and market shifts.

Aave’s Position in the Decentralized Finance Landscape

Aave’s positioning as a leading DeFi lending platform is solidified by its innovative features and high TVL. The ability to lend and borrow across a variety of cryptocurrencies while utilizing advanced financial tools places Aave at the forefront of the decentralized finance movement. Brands aiming for dominance recognize the essential nature of robust lending protocols like Aave, which not only accommodate individual investors but also appeal to larger institutional players seeking to diversify their portfolios.

As decentralized finance continues to evolve, Aave’s approach to providing a wide range of financial services indicates a promising future for the platform. Its ongoing developments and community engagement reinforce its status as a critical player in the industry, and sustained growth in TVL could further establish Aave’s influence as a leading option within the decentralized finance ecosystem.

Frequently Asked Questions

What is Aave Total Value Locked (TVL) and why is it significant?

Aave Total Value Locked (TVL) refers to the total amount of assets deposited in the Aave lending protocol. As of now, Aave’s TVL has reached an all-time high of approximately $24.4 billion, indicating strong investor confidence in this decentralized finance (DeFi) platform. A high TVL is crucial as it demonstrates the platform’s popularity, liquidity, and reliance among users within the DeFi ecosystem.

How has Aave TVL impacted the AAVE cryptocurrency’s performance?

The increase in Aave TVL to $24.4 billion has positively influenced the performance of the AAVE cryptocurrency, which is currently trading at around $222. Higher TVL often correlates with increased demand for the native token, as more users engage with the lending protocol for borrowing and staking, subsequently enhancing the overall market capitalization of AAVE.

What factors contributed to Aave’s record TVL in the DeFi sector?

Several factors have contributed to Aave achieving its record TVL, including institutional interest, a resurgence in retail participation within the DeFi sector, and notable events like the launch of Ethereum V2 and Avalanche (AVAX) rewards. Additionally, incentive programs and improved functionalities such as flash loans and diverse asset support have attracted more users to the Aave lending protocol.

What is the role of Aave’s lending protocol in decentralized finance (DeFi)?

Aave’s lending protocol plays a critical role in decentralized finance (DeFi) by providing a noncustodial platform where users can lend and borrow a variety of crypto assets without intermediaries. The protocol’s unique features, such as overcollateralized loans and flexible interest rate options, make it an essential component of the DeFi space, facilitating liquidity and providing financial services globally.

What are the benefits of using Aave’s Total Value Locked for investors?

Investors can gain insights from Aave’s Total Value Locked (TVL) as it reflects the platform’s health and growth potential. A higher TVL suggests a robust user base and liquidity, making Aave a safer choice for lending and borrowing. Additionally, it indicates potential revenue opportunities, as the protocol generates annualized fees that contribute to the profitability of investors involved in staking AAVE or providing liquidity.

How does Aave’s TVL compare to other DeFi lending platforms?

Aave currently ranks among the largest DeFi lending platforms by Total Value Locked (TVL), standing at about $24.4 billion. This positions Aave competitively against other platforms in the DeFi space, showing its significance and dominance in attracting users and capital. Monitoring Aave’s TVL in relation to competitors offers valuable insights into the trends and dynamics within the DeFi lending market.

| Key Point | Details |

|---|---|

| Total Value Locked (TVL) | $24.389 billion |

| Market Capitalization | $3.335 billion |

| Fully Diluted Valuation | $3.53 billion |

| Lending Activities | $14.865 billion borrowed |

| AAVE Staked | $632.96 million (19% of market cap) |

| Annualized Protocol Fees | $342.05 million |

| Annualized Revenue | $44.45 million |

| Treasury Holdings | $86.17 million |

| Funds Raised | $48.7 million |

| Annual Operating Expenses | $18.07 million |

| Key Features | Noncustodial loans, flash loans, interest rate switching, multi-chain support, staking-based governance |

Summary

Aave Total Value Locked has achieved an impressive milestone of $24.389 billion, demonstrating robust investor confidence and a significant resurgence in the decentralized finance sector. As Aave continues to lead in innovative lending practices and feature-rich offerings, its position among the top DeFi protocols is solidified. The platform captures a diverse user base, driving substantial lending activities and generating healthy revenues while maintaining transparency and flexibility in operations.