Actively Managed ETFs Exceed $1 Trillion: A Growing Trend

Actively managed ETFs, representing a formidable shift in investment vehicles, have recently crossed the remarkable $1 trillion milestone, highlighting their growing influence in the financial landscape. As the ETF market growth accelerates, driven by increasing interest in innovative investment strategies, these funds are gaining traction among investors seeking to mitigate market volatility. Amid uncertainties such as tariff disputes, many are turning to active equity ETFs for their inherent flexibility and responsiveness to changing market conditions. This trend underscores a broader movement in the industry, transitioning from traditional passive management to more dynamic approaches that allow for targeted asset allocation. Financial experts suggest that the appetite for these actively managed ETFs will continue to expand, especially as investors seek effective ways to navigate an unpredictable economic environment.

The rise of actively managed exchange-traded funds signifies a transformative phase in the investing world, appealing to those looking for hands-on approach amidst ongoing economic fluctuations. These dynamic investment tools are increasingly favored for their potential to adapt strategies in response to market shifts. With a spotlight on factors like tariff uncertainties and heightened market volatility, investors are gravitating towards these adaptable vehicle alternatives. The robust growth trajectory of such products illustrates a response to a demand for more nuanced and proactive market engagement. As financial landscapes evolve, the surge in actively managed ETFs reflects a shift in how individuals and advisors are re-evaluating traditional investing paradigms.

The Rise of Actively Managed ETFs

Actively managed ETFs have emerged as a significant player in the finance market, reaching a historic milestone of over $1 trillion in assets under management. This remarkable growth highlights the increasing investor interest in these funds, especially as more complex investment strategies become prevalent in today’s volatile market. Unlike traditional ETFs that primarily follow a passive management approach, actively managed ETFs provide a more dynamic investment strategy, allowing managers to make real-time adjustments based on market conditions.

The surge in actively managed ETFs can be attributed to several factors, including the demand for sophisticated strategies amidst economic uncertainty. As investors seek to mitigate risk during turbulent times, they are drawn to these investment vehicles that promise greater control and flexibility. Moreover, the rise of technology and improved trading platforms has made it easier for fund managers to implement active strategies, enhancing the appeal of active equity ETFs.

Understanding Investment Strategies in a Volatile Market

Investment strategies must evolve in response to market conditions, particularly in times of volatility. As the ETF market continues to grow, the emphasis on active vs. passive management becomes an essential discussion point. Investors who have traditionally relied on passive management are now considering how actively managed ETFs can offer potential advantages. These funds can quickly adjust their holdings and strategies in response to market shifts, which is a critical asset as tariff uncertainties and geopolitical events disrupt stock valuations.

The flexibility of actively managed ETFs does not come without risks, however. Investors must assess their risk tolerance and investment goals before diving into these funds. While they provide opportunities for higher returns, the potential for losses can also be significant due to the aggressive nature of many active strategies. Financial advisors often recommend a balanced approach that includes a mix of actively managed and passive funds to create a diversified investment portfolio that can weather market volatility.

Tariff Uncertainty and Its Impact on ETF Market Growth

Tariff uncertainty has become a significant factor driving the recent growth in actively managed ETFs. Investors are increasingly concerned about the implications of tariffs on global trade and corporate earnings, leading them to seek investment strategies that allow for nimble responses to these developments. As markets react to shifting trade policies, the demand for actively managed ETFs that can actively reposition based on economic indicators is likely to rise.

This environment creates fertile ground for funds that employ systematic strategies, such as options-based income ETFs, which can potentially cushion against market downturns. The ability to adapt to changing economic landscapes is a desirable trait for investors looking to safeguard their portfolios. Thus, actively managed ETFs are positioned to outperform traditional investment vehicles in a world laden with tariff disputes and economic unpredictability.

Market Volatility and the Shift towards Active Management

Market volatility has a profound impact on investment behaviors, prompting a shift towards actively managed ETFs. The recent trends indicate that with increasing market fluctuations, investors feel a greater need for the expertise of active managers who can navigate through complex market scenarios efficiently. As uncertainties rise, notably from global factors such as tariff policies, many investors gravitate towards active management to achieve their investment targets.

Financial experts emphasize that in times of market volatility, the strategies employed by actively managed ETFs can offer a crucial safeguard. These funds can capitalize on short-term opportunities while also implementing defensive strategies to protect against downside risks. As a result, investors are increasingly recognizing the value of having an actively managed ETF within their portfolio to cushion against unpredictable market behaviors.

The Future of Actively Managed ETFs in the Investment Landscape

As we look to the future, the role of actively managed ETFs is projected to expand significantly in the investment landscape. With their proven ability to adapt and thrive in turbulent environments, these funds may redefine how investors approach asset management. The ETF market growth indicates a robust appetite for innovative investment strategies, which is likely to encourage more fund managers to launch new actively managed products that meet investor demands.

Experts believe that the increasing sophistication of retail and institutional investors will drive this trend forward. As more investors become familiar with the benefits of actively managed ETFs, we can expect to see an influx of capital into these vehicles. The ability to leverage various investment techniques, including strategic asset allocation and sector rotation, not only enhances individual portfolio performance but also adds a layer of resilience against market shocks.

Exploring Active Equity ETFs and Their Benefits

Active equity ETFs are a standout category within the actively managed ETF landscape. These funds combine the benefits of traditional equity investing with the structural advantages of ETFs, including real-time trading and tax efficiency. As such, they appeal to a diverse range of investors looking to maximize returns while minimizing costs.

Investors are drawn to active equity ETFs for their potential to outperform benchmarks, especially during times of market volatility. With skilled fund managers at the helm, these ETFs aim to exploit market inefficiencies and capitalize on emerging trends, setting them apart from their passive counterparts. As the loyalty towards active management grows, so too does the curiosity surrounding the different strategies that active equity ETFs can employ.

Navigating the ETF Market during Tariff Concerns

Navigating the ETF market during times of tariff concerns requires a strategic mindset. The unpredictable nature of trade disputes means that investors need to stay informed and ready to adjust their strategies. Many financial advisors recommend incorporating actively managed ETFs into portfolios as they provide more flexibility to respond to sudden changes in market dynamics influenced by tariffs.

With the potential for increased market volatility due to tariff implications, investors might find that having the right mix of actively managed ETFs can serve as a vital tool for risk management. These funds not only allow for tactical shifts in asset allocation but also may lead to superior returns compared to traditional passive options, especially in a landscape riddled with unpredictability.

Investment Strategies to Overcome Market Challenges

Investment strategies that account for current market challenges are essential for achieving long-term financial success. In the face of market volatility, investors must choose funds wisely, considering how actively managed ETFs can fit within an overall investment strategy. By proactively engaging with market trends and adjusting positions accordingly, active managers can potentially provide better outcomes than passive counterparts.

Furthermore, employing diverse investment strategies across different actively managed ETFs can enhance a portfolio’s resilience. Options-based income ETFs, for instance, could offer a buffer during economic downturns, while growth-focused ETFs might capitalize on market recoveries. Given the ongoing shifts in market sentiment caused by events like tariff disputes, balancing these strategies is more vital than ever.

The Impact of Market Conditions on ETF Selection

The impact of market conditions on ETF selection cannot be understated. As market dynamics evolve, so do investor preferences for fund types and management styles. As evidenced by the growth of actively managed ETFs amid tariff uncertainties, investors are gravitating towards products that promise agility and responsiveness to shifting market conditions.

Moreover, understanding how different market conditions influence the performance of both passive and active funds is integral for making informed investment decisions. As we see more actively managed ETFs entering the market, focusing on achieving a strategic balance in portfolio composition can significantly enhance risk-adjusted returns, enabling investors to thrive no matter the economic climate.

Frequently Asked Questions

What are actively managed ETFs and how do they differ from traditional ETFs?

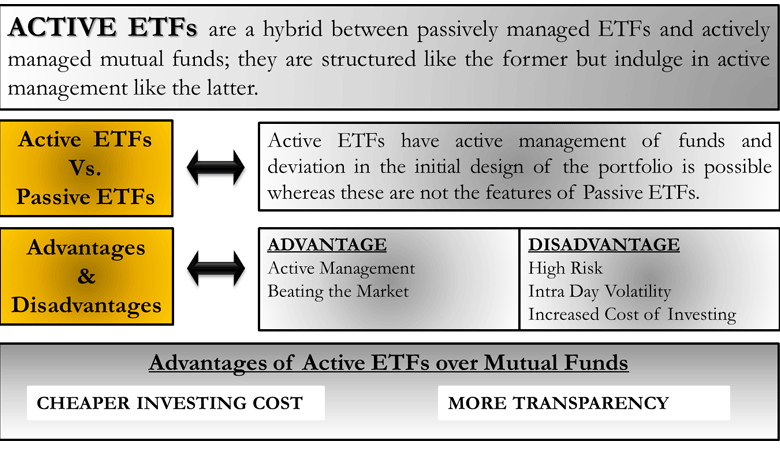

Actively managed ETFs are funds that are overseen by investment managers who attempt to outperform a benchmark index through active investment strategies. Unlike traditional ETFs that track indices passively, actively managed ETFs rely on active equity strategies to capitalize on market opportunities, which can lead to higher potential returns but also involves more risk.

How has the growth of actively managed ETFs impacted the overall ETF market?

The rapid growth of actively managed ETFs, which recently surpassed $1 trillion in assets under management, has significantly reshaped the ETF market. This increase reflects a growing appetite for diverse investment strategies amidst market volatility, as more investors seek active management to navigate uncertainties such as tariff implications and economic fluctuations.

What investment strategies are commonly employed by actively managed ETFs?

Actively managed ETFs utilize various investment strategies, including tactical asset allocation, risk management strategies like buffer ETFs, and options-based income strategies. These approaches aim to provide more tailored solutions in fluctuating markets and capitalize on active equity opportunities to deliver superior returns.

Why might investors prefer actively managed ETFs during periods of market volatility?

Investors often prefer actively managed ETFs during market volatility because they provide the potential for more dynamic management. Active managers can adapt their strategies and asset allocations to respond to rapid market changes and uncertainties, such as those introduced by tariff uncertainties, helping mitigate risks more effectively than passive index funds.

How do tariff uncertainties influence the growth of actively managed ETFs?

Tariff uncertainties create an environment of increased market volatility and investor apprehension, prompting many to seek actively managed ETFs. As investors look for safeguards against economic fluctuations, the demand for active investing strategies within ETFs is likely to grow, signaling a shift in how investors view risk in their portfolios.

What role do active equity ETFs play in investment diversification?

Active equity ETFs contribute to investment diversification by offering strategies that can outperform traditional market-cap-weighted indices. They allow investors to access a broader range of investment approaches and risk management techniques, including tactical allocations that can help buffer against market downturns, thus enhancing overall portfolio resilience.

| Key Points | Details |

|---|---|

| Actively Managed ETFs Milestone | Actively managed ETFs surpass $1 trillion in assets under management (AUM). This figure is comparable to major economic indicators like the market cap of Berkshire Hathaway. |

| Market Growth Drivers | The growth is driven by increased investor appetite for active investment strategies amid market volatility and uncertainty. |

| Industry Shift | While the ETF industry started with passive management, active ETFs are now gaining significant attention and growth. |

| Investor Sentiment | Investors prefer active managers during uncertain times for better navigation through volatility, influenced by tariff issues. |

| Emerging ETF Strategies | Growth in actively managed ETFs includes innovative products like options-based income and buffer ETFs. |

Summary

Actively managed ETFs have reached a significant milestone, with over $1 trillion in assets under management. This growth is fueled by investor demand for proactive management in volatile markets, particularly amid ongoing tariff uncertainties. As the ETF landscape evolves, actively managed ETFs are becoming a vital segment, blending traditional strategies with innovative approaches. Investors are increasingly turning to these funds to navigate market fluctuations, which suggests continued growth for this segment in the future.