After Hours Stock Market Moves: Gap, Dell, UiPath & More

After hours stock market moves often reflect pivotal shifts in investor sentiment, as traders react to crucial earnings reports and forecasts long after traditional trading hours. This extended trading period provides a unique opportunity for investors to capitalize on immediate market reactions driven by companies releasing significant stock market news. As seen in recent stock movements, organizations like Gap and Dell Technologies showcase how earnings announcements can dramatically influence share prices, making these stocks to watch for savvy investors. Whether it’s disappointing revenues, unexpected earnings beats, or revised guidance, trading updates from after hours can set the tone for the following day’s trading session. Staying informed about these developments allows investors to navigate the complexities of after hours trading more effectively.

Post-market trading activities, commonly referred to as extended trading sessions, unveil a fascinating landscape for investors eager to glean insights from the latest financial disclosures. During these hours, stocks can either surge or falter, reflecting the immediate reactions of the market to earnings announcements and other impactful news. Recent fluctuations in shares for key players like American Eagle Outfitters and Ulta Beauty highlight the volatility that can emerge in the after hours period, where trading often becomes a whirlwind of speculation and quick decisions. By keeping an eye on stocks making headlines during these sessions, traders can identify critical trends and information that might shape their strategies. Understanding the implications of after hours stock market movements equips investors with the foresight to seize opportunities and mitigate risks.

Significant After Hours Stock Market Moves

The after hours stock market moves reflect significant changes that can impact overall trading sentiments. Recently, stocks like Gap and American Eagle Outfitters experienced considerable declines due to disappointing earnings reports. After hours trading allows investors to react immediately to such updates, influencing future trading decisions. The sharp drop in Gap’s shares, which fell by more than 16%, was attributed to a lack of optimistic revenue guidance, leaving analysts and investors surprised.

Conversely, several companies such as Dell Technologies and Ulta Beauty reported unexpected earnings that exceeded market expectations. These positive results resulted in an after hours trading surge, with Dell’s shares rising by over 5%. Such fluctuations in extended trading not only provide a glimpse into investor sentiment but also highlight stocks to watch as the new market day approaches.

Key Stocks to Watch in Extended Trading

Among the stocks to watch in after hours trading are giants like Costco and Zscaler, which have shown resilience against economic uncertainty. Costco reported earnings that slightly exceeded analysts’ predictions, showcasing strong performance despite minimal movement in share price. Meanwhile, Zscaler’s rise of over 4% following its successful earnings release indicates a positive outlook in the cybersecurity sector, demonstrating how trading updates can reshape investor confidence.

In contrast, Elastic NV and PagerDuty highlighted the risks of failing to meet expectations. The drop of over 11% for Elastic after its outlook fell short of analysts’ predictions serves as a reminder of the volatility in the market. These scenarios emphasize the importance for investors to stay alert and track stock market news closely, particularly during after hours trading when significant price movements can occur.

Impacts of Disappointing Earnings on Stock Performance

Disappointing earnings can exert substantial pressure on stock performance, especially in after hours trading. American Eagle Outfitters and PagerDuty are prime examples of how missed earnings expectations can lead to a sharp decline in share value. American Eagle’s adjusted loss per share of 29 cents, worse than expected, resulted in an over 8% decline in stock value. Such outcomes reveal the sensitivity of after hours trading to earnings reports, where investor sentiment can shift rapidly.

This volatility often results in increased trading activity as investors react to news. PagerDuty’s forecast also underwhelmed, causing its stock to drop more than 6%, exemplifying the cascading effects of disappointing financial disclosures. Therefore, monitoring trading updates in the after hours market remains crucial for identifying potential investment opportunities and risks.

Positive Earnings Surprises Fuel Stock Gains

On the other hand, earnings surprises can generate significant bullish momentum in after hours trading. Companies like Ulta Beauty and UiPath demonstrated this trend, reporting earnings that considerably exceeded market expectations. Ulta’s exceptional earnings of $6.70 per share propelled its stock more than 8%, reflecting how positive trading updates can drive investor confidence and stock price appreciation.

Similarly, UiPath’s forecast for second-quarter revenue between $345 million and $350 million, significantly above estimates, generated an increase of 11% in its stock. These upbeat results not only highlight the effectiveness of strong performance metrics but also underscore the importance of stocks to watch as market dynamics shift rapidly. Understanding these patterns helps traders to leverage periods of extended trading effectively.

Understanding Extended Trading Hours and Their Impact

Extended trading hours, or after hours trading, have become an integral part of the stock market ecosystem, allowing for more flexible trading options. Investors can react to news and earnings reports outside regular market hours, which often leads to significant volatility in stock prices. Understanding how these periods affect stock performance is crucial for savvy investors aiming to maximize their trading strategy.

During after hours trading, movements can be more pronounced due to lower volume compared to regular trading hours. As a result, stocks like Dell Technologies and Zscaler can see sharp price movements that may not reflect their performance during standard hours. This volatility offers both opportunities and challenges, making it essential for traders to stay informed about stock market news and developments during these extended hours.

The Role of Analysts in Stock Predictions

Analysts play a pivotal role in shaping investor expectations and stock performance through their forecasts and stock ratings. Their insights can provide traders with a clearer picture of potential market movements, particularly during volatile periods such as after hours trading. For instance, when analysts predict earnings for companies like Gap or Elastic NV, deviations from these predictions often lead to drastic stock fluctuations following earnings announcements.

The responsibility of analysts goes beyond simple forecasts; they assess market conditions, sector performance, and macroeconomic factors that can influence after hours trading. By closely monitoring analysts’ expectations, investors can gain a competitive edge in the market, helping them to navigate through potential stock gains or losses more effectively.

Volatility in the Technology Sector During After Hours

The technology sector is often at the forefront of after hours trading volatility, as evidenced by stocks like Dell Technologies and UiPath. Positive earnings reports in this domain can lead to significant price surges, which is exactly what happened in recent trading sessions. For Dell, a revenue surpassing analyst expectations led to over a 5% increase in its share price, demonstrating the tech industry’s sensitivity to earnings surprises.

Conversely, companies like PagerDuty have demonstrated that even slight earnings misses can lead to notable declines. The tech sector’s inherent volatility during extended trading hours can create both risks and opportunities for investors, emphasizing the importance of keeping an eye on developments and trading updates within this fast-paced environment.

Investor Strategies for After Hours Trading

Investors looking to capitalize on after hours trading must adopt strategic approaches to navigate its unique dynamics. One effective strategy is to stay informed about significant earnings announcements and their potential impacts on stock performance. By monitoring reports from companies like Ulta Beauty and Zscaler, investors can position themselves to make informed trading decisions based on the latest data.

Additionally, setting alerts for specific stock movements during after hours can help traders seize opportunities as they arise. Understanding patterns in stock market news, including how stocks respond to earnings surprises, can guide investment strategies. This proactive approach to after hours stock market activities can enhance the potential for profit while minimizing risks in volatile trading conditions.

The Importance of Monitoring Trading Updates

Staying updated with trading updates is essential for responsive market opportunities, especially in the unpredictable environment of after hours trading. As earnings reports and forecasts are released, they can drastically affect market sentiment, resulting in substantial stock price movements. Companies like American Eagle Outfitters and Elastic NV have shown how negative earnings can lead to significant drops, highlighting the necessity for investors to be alert during these trading sessions.

Moreover, timely updates provide insights into potential stocks to watch that could be poised for recovery or growth in upcoming trading days. As traders evaluate the reactions to new information, they can adjust their portfolios accordingly, capitalizing on market shifts influenced by earnings results and external events. Consequently, understanding the landscape of after hours trading helps investors make informed decisions that align with their financial goals.

Frequently Asked Questions

What are after hours stock market moves and why are they significant?

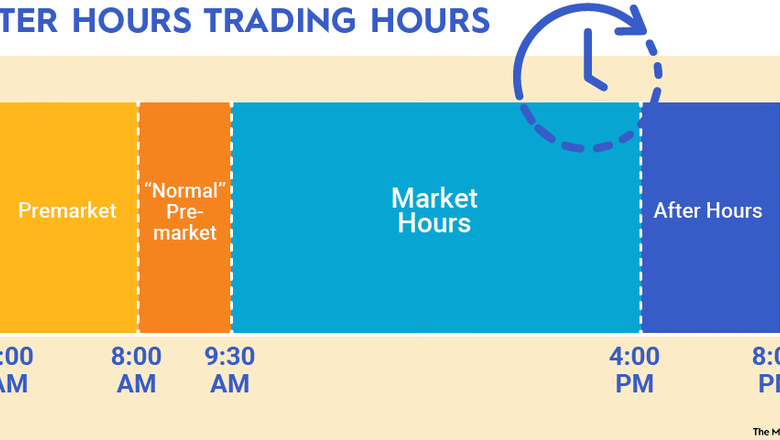

After hours stock market moves refer to the trading activity that occurs after the official closing of the stock markets, typically from 4 PM to 8 PM Eastern Time. These moves are significant as they can indicate immediate investor reactions to earnings reports, economic news, or geopolitical events, allowing traders to adjust their positions based on new information.

How do after hours trading stocks behave compared to regular trading hours?

Stocks in after hours trading can experience higher volatility and lower liquidity compared to regular trading hours. This means prices can swing dramatically due to fewer participants and increased reaction to news and earnings announcements. Investors should exercise caution when trading stocks in the after hours market.

Where can I find the latest stock market news related to after hours trading?

The latest stock market news concerning after hours trading can be found on financial news websites, stock market apps, and news sections of brokerage platforms. These sources often provide real-time updates and articles discussing stocks to watch and significant moves in extended trading.

What stocks made the biggest moves after hours in the latest trading session?

In the latest after hours trading session, notable stocks included Gap which plummeted over 16% due to disappointing revenue guidance, and Dell Technologies which rose more than 5% after exceeding revenue expectations. Other companies like Ulta Beauty and UiPath also saw significant movements, highlighting the dynamic nature of after hours stock trading.

How can I monitor after hours trading updates effectively?

To effectively monitor after hours trading updates, utilize financial platforms that offer live tracking of stock movements, subscribe to financial news alerts, and follow market analysts on social media. Many brokerage accounts also provide features to view after hours performance and detailed trading updates.

What factors influence after hours stock market moves?

After hours stock market moves are influenced by several factors including earnings reports, changes in revenue guidance, macroeconomic news, geopolitical events, and overall investor sentiment. Understanding these factors can help traders anticipate potential stock movements during after hours trading.

Are there risks associated with after hours trading?

Yes, there are risks associated with after hours trading, including increased price volatility, lower trading volumes, and potential for wider spreads between bids and asks. This can make it more difficult to execute trades at desired prices, so it’s essential to approach after hours trading with caution.

What strategies can I use for trading stocks in after hours?

Strategies for trading stocks in after hours include staying informed about earnings reports and stock market news, utilizing limit orders to control purchase prices, and closely monitoring market trends and trading volumes. Additionally, having a clear exit strategy is crucial due to the heightened volatility in this trading session.

| Stock | Movement | Key Highlights |

|---|---|---|

| Gap | -16% | Disappointing Q2 revenue guidance overshadowed a Q1 earnings beat. |

| Costco | No significant change | Reported $4.28 EPS with $63.2B revenue, slightly exceeding estimates. |

| Dell Technologies | +5% | Q1 revenue of $23.38B exceeded expectations; raised full-year guidance. |

| Ulta Beauty | +8% | EPS of $6.70 and revenue of $2.84B surpassed analyst expectations. |

| American Eagle Outfitters | -8% | Q1 adjusted loss of 29 cents per share worse than expectations. |

| Elastic NV | -11% | Full-year revenue outlook missed expectations. |

| PagerDuty | -6% | Q2 earnings outlook did not meet estimates. |

| Zscaler | +4% | Fiscal Q3 results surpassed expectations, better guidance provided. |

| UiPath | +11% | Q2 revenue guidance significantly exceeded analyst estimates. |

| NetApp | -6% | First-quarter earnings outlook did not meet analyst expectations. |

Summary

After hours stock market moves can greatly influence the investments of traders and investors alike. The recent trading session has shown significant activity as various stocks reported their earnings and outlooks. While companies like Gap and American Eagle Outfitters faced declines due to disappointing forecasts, others like UiPath and Dell Technologies surged ahead with strong quarterly performances. Observing these movements is essential for understanding market trends and making informed investment decisions.