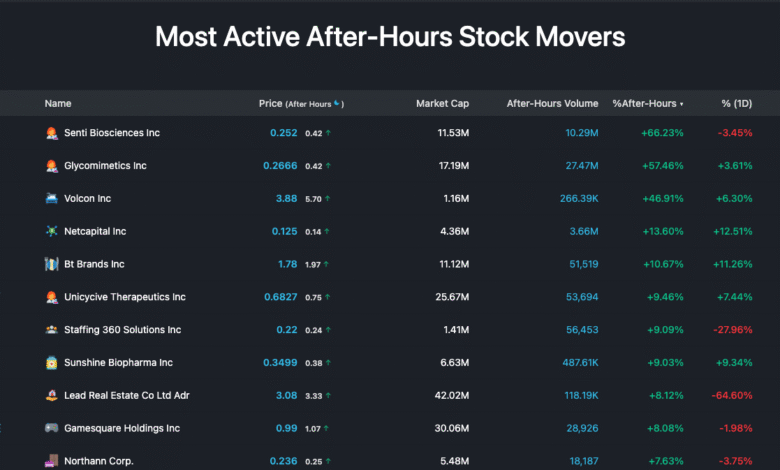

After Hours Stock Moves: Apple, Amazon, and More Trending

After Hours Stock Moves are often a key indicator of the market’s reaction to corporate earnings and forecasts. In the latest session, notable movements included Apple stocks, which declined by 2% due to underwhelming results from its Services division, while Amazon stock news highlighted a 4% drop following disappointing guidance. Airbnb’s revenue forecast has also taken a hit, as shares slipped over 4%, prompting concerns about macroeconomic factors impacting its performance. Additionally, Roku’s earnings report revealed a modest loss, contributing to a 3% decrease in its stock. Meanwhile, Twilio experienced a remarkable stock surge of over 7%, showcasing the volatility and dynamic nature of after-hours trading in the stock market.

Extended trading sessions, particularly after regular hours, reveal significant shifts in stock values that reflect investor sentiment. Recent highlights include movements in tech and e-commerce stocks, such as the drop in Apple and Amazon’s shares following their latest earnings reports. In contrast, companies like Twilio showcased resilience with substantial increases in stock price following impressive earnings figures. This after-hours activity provides valuable insight into how the market is digesting financial results and forecasts, underscoring the liquidity and responsiveness of traders in these off-hours. Whether discussing Airbnb’s guidance or Roku’s earnings performance, these after-hours stock shifts are crucial for understanding trending investment narratives.

Understanding After Hours Stock Moves: A Comprehensive Analysis

After hours stock moves provide investors with insight into the market’s reaction to corporate earnings reports and news. Companies like Apple and Amazon often have significant price fluctuations after the trading day closes, reflecting how investors respond to earnings surprises or guidance updates. For instance, Apple’s recent 2% drop post-earnings revealed concerns over its Services division performance, which fell slightly short of expectations. This drop highlights the market’s sensitivity to even minor misses in forecasts, especially for tech giants that depend heavily on service revenues.

Conversely, the strong performance of companies like Twilio, which saw a surge of over 7% after exceeding earnings expectations, underscores the potential rewards of after hours trading. This volatility in stock prices after hours can be attributed to lower trading volumes, which often exaggerate price movements, making it crucial for investors to interpret these shifts cautiously. The fluctuating fortunes of stocks like Roku and Block remind us that the after hours market can be a double-edged sword, offering both risks and opportunities for savvy investors.

Airbnb’s Revenue Forecast and Investor Sentiment

Airbnb’s latest revenue forecast has generated mixed feelings among investors, particularly with its shares taking a hit of more than 4% following the announcement. The projected revenue range of $2.99 billion to $3.05 billion fell short of analyst expectations, stirring concerns about the company’s ability to navigate a challenging macroeconomic environment. As Airbnb’s management pointed out, softening trends in their U.S. segment were evident, possibly indicating a broader cooling in travel demand which investors are keenly watching.

These developments underscore the importance of setting realistic expectations in revenue forecasting amid economic uncertainty. Given Airbnb’s reliance on transient travel, fluctuations in consumer confidence can dramatically affect its earnings trajectory. Investors need to weigh these risks against Airbnb’s ongoing recovery post-pandemic, as maintaining a cautious yet optimistic outlook remains essential for navigating such financial landscapes.

Amazon: Examining the Stock Decline After Earnings

Following its recent earnings report, Amazon experienced a notable decline of about 4%, attributed to missed operating income guidance. While the company’s overall financial performance exceeded Wall Street expectations, the projected income of $13 billion to $17.5 billion fell short of analyst forecasts. This discrepancy highlights the market’s focus not just on current performance but also on future growth projections, which challenge investors’ confidence in Amazon’s growth strategy amid an increasingly competitive landscape.

As Amazon continues to expand its avenues including AWS and e-commerce, the fluctuations in stock price reflect investor sentiment and the perception of growth sustainability. Investors are left to ponder Amazon’s ability to balance operational efficiency with its ambitious expansion goals in a fluctuating market. Thus, a deeper analysis of Amazon’s future strategies will be essential as the company navigates these earnings-related challenges.

Roku’s Earnings Report: Analyzing Market Reactions

Roku’s latest earnings report presented a nuanced scenario; despite a loss of 19 cents per share on $1.02 billion in revenue, the company managed to report results that were slightly better than consensus estimates. However, the shares still fell by about 3%, indicating that market reactions can often be completely independent of reported metrics if investor expectations diverge significantly. This is a reminder that in tech stocks, perception can often outweigh actual performance.

Investors must remain vigilant as Roku’s business faces external pressures from competition and fluctuating viewership trends. The company’s resilience in reporting results better than expected can be a positive sign for long-term prospects, but immediate market reactions can sometimes tell a different story. As Roku adapts to evolving market conditions, continuous assessment of viewer engagement and advertising revenue will be crucial to its recovery and stock performance in the future.

Twilio’s Stock Surge: What Investors Should Know

Twilio recently recorded a significant stock surge of over 7% after outperforming expectations in its first-quarter results. Posting adjusted earnings of $1.14 per share on $1.17 billion in revenue, the cloud communications company demonstrated robust performance which positively influenced investor sentiment. Investors are encouraged by Twilio’s guidance of stronger-than-expected revenue for the upcoming quarters, reaffirming their confidence in the company’s growth trajectory.

The favorable results showcase Twilio’s ability to innovate and adapt within the rapidly evolving tech landscape. As companies increasingly shift towards cloud communications, Twilio is poised to capitalize on this demand, suggesting potential for sustained upward momentum in its stock price. Investors should remain informed about Twilio’s growth strategies and market positioning to make well-informed decisions as they navigate this dynamic environment.

Block’s Struggles: A Closer Look After Earnings Miss

Block experienced a steep decline of over 17% following a disappointing earnings report where the company’s first-quarter revenue of $5.77 billion fell short of the expected $6.20 billion. Such a significant earnings miss not only spurred immediate stock price drops but also raised questions about Block’s future performance and market strategy, as investor confidence is closely tied to actual financial results.

In scrutinizing Block’s operational strategies, it’s crucial to consider the broader financial landscape and competition. Investors concerned about the potential for recovery rates must assess Block’s ability to strengthen its market position against competitors, especially in the financial technology sector. These developments remind investors of the inherent risks in growth investments, particularly when market conditions fluctuate.

Duolingo’s Promising Guidance: Capitalizing on Learning Trends

Duolingo’s stock surged by 9% after the company presented optimistic guidance for the upcoming quarter, forecasting revenue between $239 million and $242 million. This forward-looking outlook positions Duolingo favorably within the growing edtech market, affirming its potential to capture a significant share of the language learning sector. Investors are evidently responding positively to Duolingo’s strategic roadmap, as its user engagement continues to rise post-pandemic.

As the demand for online learning solutions expands, Duolingo’s prospects seem increasingly bright. The company’s focus on innovation and accessibility in language education can enhance its value proposition, attracting both new learners and retaining existing users. As investors look for high-growth opportunities, Duolingo’s strong performance and promising guidance could make it a compelling choice in a competitive market.

Instacart’s Market Outlook: Stability Amidst E-commerce Fluctuations

Instacart, operating under Maplebear, jumped 5% following a promising quarter outlook where it projected adjusted EBITDA between $240 million and $250 million. This favorable forecast exceeds analysts’ expectations of $234.8 million, suggesting that Instacart is navigating the competitive grocery delivery landscape effectively. Investors are closely watching Instacart’s performance amidst shifts in consumer shopping behavior.

The rise in demand for convenient grocery delivery services speaks to Instacart’s growth potential, especially as consumers adapt to increasingly digital shopping experiences. However, as the market remains competitive, sustaining this growth trajectory will require Instacart to continually innovate and enhance its service offerings. Investors should consider these factors when evaluating Instacart’s future stock performance.

Atlassian’s Stock Decline: A Red Flag for Investors?

Atlassian saw its stock plunge by 15% after the company’s fiscal fourth-quarter revenue outlook fell short of investor expectations. With projected sales ranging between $1.35 billion and $1.36 billion, compared to the anticipated $1.36 billion by analysts, investors reacted sharply, highlighting the delicate balance between expectations and market performance. This case serves as a critical reminder of the importance of clear communication and transparency in forecasting.

Investors must be cautious as Atlassian navigates these challenges, as missed expectations can significantly impact stock valuation. The emphasis on achieving operational efficiency and understanding market dynamics will be crucial for Atlassian to regain investor confidence and stabilize its stock moving forward. Thus, monitoring developments closely will be important for stakeholders.

Frequently Asked Questions

What caused Apple stocks to drop after hours in recent trading?

After hours stock moves for Apple saw a drop of about 2%, attributed to disappointing performance in its Services division. Revenue for this segment was reported at $26.65 billion, slightly below the $26.70 billion expected by analysts.

Why did Airbnb’s stock price slip significantly after hours?

Airbnb shares fell over 4% in after hours trading due to a revenue forecast that underperformed expectations. The company projected second-quarter revenue between $2.99 billion and $3.05 billion, missing the analysts’ average estimate of $3.04 billion.

What impact did Amazon stock face after its earnings report?

Amazon experienced about a 4% decline in after hours trading after it issued a lower-than-expected operating income guidance for the second quarter, forecasting a range between $13 billion and $17.5 billion, which fell short of the $17.64 billion consensus among analysts.

How did Roku perform in after hours trading following its earnings report?

Roku shares decreased by 3% after hours. Despite posting first-quarter results that slightly beat estimates, the company reported a loss of 19 cents per share, which, while better than the anticipated loss of 27 cents, still did not impress investors.

What led to Block’s significant stock plunge after hours?

Block’s shares plunged more than 17% in after hours trading after its first-quarter revenue fell short of analysts’ expectations, reporting $5.77 billion compared to the anticipated $6.20 billion.

What was notable about Twilio’s after hours stock surge?

Twilio’s stock surged more than 7% after hours, driven by first-quarter results that exceeded Wall Street expectations, reporting adjusted earnings of $1.14 per share and $1.17 billion in revenue, along with a positive revenue forecast for the second quarter.

What performance did Reddit show in after hours trading recently?

In after hours trading, Reddit’s stock surged approximately 18% after reporting better-than-expected first-quarter earnings and a promising sales outlook for the second quarter, forecasting sales between $410 million and $430 million.

Why did Atlassian’s stock fall after hours?

Atlassian saw a significant 15% drop in after hours trading due to its fiscal fourth-quarter revenue outlook which did not meet investor expectations, with projected sales between $1.35 billion and $1.36 billion, slightly below the expected $1.36 billion.

What drove Duolingo’s stock increase in after hours?

Duolingo’s stock jumped 9% after hours as the company provided optimistic revenue guidance for the second quarter, projecting revenue between $239 million and $242 million, surpassing analysts’ estimates of $234 million.

| Company | Stock Movement | Key Highlights |

|---|---|---|

| Apple | -2% | Services revenue fell short of expectations at $26.65 billion. |

| Airbnb | -4% | Expected Q2 revenue of $2.99 – $3.05 billion, below analyst expectations. |

| Amazon | -4% | Q2 operating income guidance missed estimates, forecasting $13 – $17.5 billion. |

| Roku | -3% | Q1 loss of 19 cents per share was better than expected. |

| Block | -17% | First-quarter revenue of $5.77 billion missed expectations of $6.20 billion. |

| Maplebear (Instacart) | +5% | Upbeat forecast with expected EBITDA of $240 – $250 million. |

| Twilio | +7% | Q1 results beat expectations with earnings of $1.14 per share. |

| +18% | Forecast sales of $410 – $430 million, surpassing analyst predictions. | |

| Atlassian | -15% | Q4 revenue outlook was below analyst estimates. |

| Duolingo | +9% | Positive Q2 revenue guidance expected between $239 – $242 million. |

Summary

After Hours Stock Moves reflect the dynamic response of investors to quarterly earnings reports from major companies. Notably, Apple and Airbnb experienced significant declines due to unmet revenue expectations, while Reddit and Duolingo enjoyed substantial gains supported by optimistic forecasts. These movements illustrate the immediate impact of financial performance on stock valuations in after-hours trading.