After-Hours Stock Moves: Key Gains and Losses Analyzed

After-hours stock moves can significantly influence trading strategies and investor insights, making them a crucial focus for those active in after hours trading. As companies release quarterly earnings and other pivotal announcements, their stocks often experience notable fluctuations in the extended hours following the market’s close. For instance, AppLovin’s shares surged after posting better-than-expected results, while Arm Holdings saw a decline despite solid earnings, illustrating the varying reactions among investors to stock market news. Keeping abreast of these after-hours shifts can provide traders with a competitive advantage in formulating their next moves. In this dynamic landscape, pre-market updates can also foster intelligent decision-making as investors look to capitalize on emerging trends.

When the trading day concludes, the after-market phase presents an opportunity for discerning investors to react to fresh information, often leading to pronounced shifts in stock valuations. Extended trading periods allow for a unique glimpse into market sentiment, as unexpected earnings reports and news could result in immediate buy or sell decisions. Stocks like those of AppLovin and Arm Holdings exhibit how the after-hours environment can diverge markedly from regular trading hours, emphasizing the need for thoughtful trading strategies. Investors who stay aware of after-hours stock movements can enhance their understanding of potential market trends. Thus, engaging with post-market developments is vital for those seeking to sharpen their investment acumen.

After-Hours Stock Moves: Key Players Making Waves

In the world of after-hours trading, a handful of companies are making significant impacts that are shaping market perceptions. For instance, AppLovin has seen a remarkable surge of 13% following a strong quarterly earnings report that beat expectations on both profit and revenue. This level of growth not only underlines the company’s resilience but also provides valuable investor insights into its successful strategies moving forward. Conversely, Arm Holdings faced a stark decline of 9% due to disappointing guidance which failed to meet Wall Street’s anticipations, highlighting how pivotal post-market announcements can influence stock prices dramatically.

Monitoring after-hours stock movements has become essential for investors looking to capitalize on market fluctuations. Companies like Skyworks and Bumble display the volatility of this trading period as well, with Skyworks reporting strong earnings yet still seeing a 4% decrease in share price. On the other hand, Bumble managed to maintain investor interest with its 8% spike despite a drop in revenue, highlighting that the context behind earnings can play a crucial role in determining market reactions. Staying informed through after-hours trading sessions not only enhances trading strategies but significantly enriches the understanding of the stock market news landscape.

Market Reactions to Earnings Reports: A Breakdown

Earnings season often brings swift reactions in the stock market, particularly in after-hours trading when investor sentiment tends to be more sensitive to news. Recently, H & R Block saw a positive market response with a 2% increase in shares after reporting better-than-expected earnings during the fiscal third quarter. This performance demonstrates how strong earnings can generate bullish perspectives among investors, reinforcing confidence in the company’s strategic direction. Similarly, Dutch Bros experienced a 5% jump, showcasing the market’s appreciation for consistent growth and effective sales strategies.

On the flip side, Fortinet’s sharp 11% decline illustrates how guidance plays a critical role in shaping investor expectations. Even though the cybersecurity firm reported a solid earnings beat, a cautious forward outlook led to a significant sell-off. This instance serves as a reminder that while positive earnings results are favorable, they must be paired with robust guidance to sustain investor confidence. Understanding these dynamics is crucial for traders when developing strategies to capitalize on earnings results and overall market movements.

Strategies for Navigating Pre-Market and After-Hours Trading

As the stock market evolves, incorporating after-hours and pre-market updates into trading strategies has become increasingly vital. Investors need to be savvy about the implications of after-hours movements, as these stocks can experience significant volatility based on late-breaking news or earnings reports. For traders looking to gain an edge, tracking key trends and shifts in after-hours trading can reveal both opportunities and risks. Analyzing reports related to companies like Avis Budget, which saw a mild increase yet failed to meet revenue expectations, can guide decision-making processes in the pre-market hours.

Furthermore, effective trading strategies must account for how various sectors respond to after-hours announcements. Stock movements following earnings reports, such as those from Zillow and CF Industries, can indicate broader market trends and investment potential. By utilizing advanced charting tools and staying updated on market news, investors can harness after-hours trading to refine their strategies. This holistic approach not only enhances the likelihood of profitable trades but also contributes to a more profound understanding of market dynamics.

Investor Insights into Future Market Trends

Understanding investor psychology is essential for anticipating future market trends, especially in volatile environments like after-hours trading. As seen with companies like Arm Holdings, failing to meet expectations can lead to swift declines in stock prices, reflecting the significant weight that investor sentiment carries. Conversely, positive earnings reports from firms such as Axon Enterprise, which saw a rise of 5%, demonstrate that optimism can drive market movements significantly. Analyzing these responses provides valuable insights into how future trends might develop in the stock market.

Investors should also be aware of broader economic indicators that could affect stock market performance in after-hours trading. For example, housing market trends have influenced Zillow’s stock price fluctuations, emphasizing the interconnected nature of various market sectors. By remaining alert to these environmental factors and incorporating analytical tools to interpret market reactions, investors can better position themselves for potential shifts in stock valuations. Overall, harnessing investor insights not only aids in informed decision-making but also fosters a proactive approach to navigating the evolving stock landscape.

The Impact of Earnings Announcements on Stock Strategies

Earnings announcements remain pivotal in shaping stock strategies, particularly during critical market phases such as after-hours trading. Companies like Bumble, despite reporting stagnant growth, experienced significant movements—an 8% increase as traders responded to the potential for future rebounds. This response accentuates the importance of strategic planning around earnings revelations. Investors must anticipate not just the results but also the management’s future outlook, as seen with Fortinet, where projections significantly influenced price actions.

Furthermore, the varied reactions of firms like Flutter Entertainment, which faced a nearly 2% drop despite notching revenue growth, underline how expectations versus reality can alter strategic considerations. Employing thoughtful analysis of earnings reports enables traders to adjust approaches proactively, helping them navigate complex environments formed by investor sentiment and market perception. Ultimately, integrating thorough analyses of earnings announcements into broader trading strategies leads to enhanced decision-making and greater market adaptability.

Navigating Stock Market News and Investor Sentiment

In the fast-paced realm of stock markets, understanding the nuances of stock market news can significantly influence investment decisions. Recent movements in after-hours trading reveal how investor sentiment can shift rapidly in response to earnings reports, providing insights that are crucial for developing effective trading strategies. For instance, AppLovin’s strong quarterly performance sparked a rally, showcasing how positive news can energize investor confidence and lead to stock price increases even outside regular trading hours.

Conversely, negative developments, such as Zillow’s underwhelming guidance amidst a recovering housing market, highlight how adverse news can dampen stock performance, presenting challenges to investors. Successful navigation of stock market news requires a keen eye on both performance metrics and broader economic signals that inform investor sentiment. By combining real-time updates with strategic analysis, investors can better position themselves to capitalize on trends emerging from post-market news, ensuring that their trading strategies remain adaptable and informed.

Long-Term Implications of After-Hours Trading

The long-term implications of after-hours trading are multifaceted and can set the stage for future stock market dynamics. As seen with companies such as Carvana, which reported impressive earnings but saw a slight decrease in shares, market reactions can sometimes defy expectations. This can occur when investors take a more cautious approach due to macroeconomic factors or overall market sentiment. Understanding these underlying trends is critical for investors looking to forge a path through the sometimes turbulent waters of post-market activity.

Moreover, the cumulative effects of after-hours trading sessions can lead to extended market trends, which may influence strategic decisions for both short-term and long-term investors. The psychological impact of sustained rallies or downturns can shape trading behavior, emphasizing the importance of psychological resilience in investing. By recognizing these patterns and preparing for potential volatility, traders can enhance their investment strategies and build a more sustainable approach to navigating the stock market over time.

Optimizing Trading Strategies with Investor Insights

Optimizing trading strategies requires continuous integration of investor insights gleaned from after-hours trading performance. The ability to analyze stock movements from companies like Dutch Bros and CF Industries provides traders with empirical data to inform pivots in their approaches. By focusing on earnings beats and revenue trajectories, investors can better anticipate market reactions, leading to enhanced decision-making capabilities during after-hours trading.

Additionally, understanding the cyclical nature of earnings reports and investor behavior can empower traders to refine their strategies further. As market conditions shift, particularly post-earnings announcements, those who leverage detailed insights from after-hours sessions can identify unique opportunities. A proactive stance combined with comprehensive analysis significantly increases the chance of successful trades, thereby maximizing potential returns across fluctuating market conditions.

The Future of After-Hours Trading and Its Influence on Market Trends

The trajectory of after-hours trading is increasingly vital to understanding market trends as it evolves with technological advancements and investor behavior. Investors are becoming more adept at leveraging after-hours trading to identify patterns that can suggest future stock movement, as shown by varying performances from companies like Fortinet and Avis Budget. The more investors engage with after-hours movement, the more it shapes their trading strategies, highlighting the growing relevance of pre-market and post-market analysis in their decision-making processes.

Moreover, as companies continue to innovate and adapt, the patterns observed in after-hours trading will likely influence investor sentiment moving forward. Active participation in these trading windows provides critical insights into market reactions to newly released information. Ultimately, understanding the future of after-hours trading requires vigilance and adaptability, ensuring investors can capitalize on emerging trends and navigate potential challenges with confidence.

Frequently Asked Questions

What are after-hours stock moves and how do they affect the stock market?

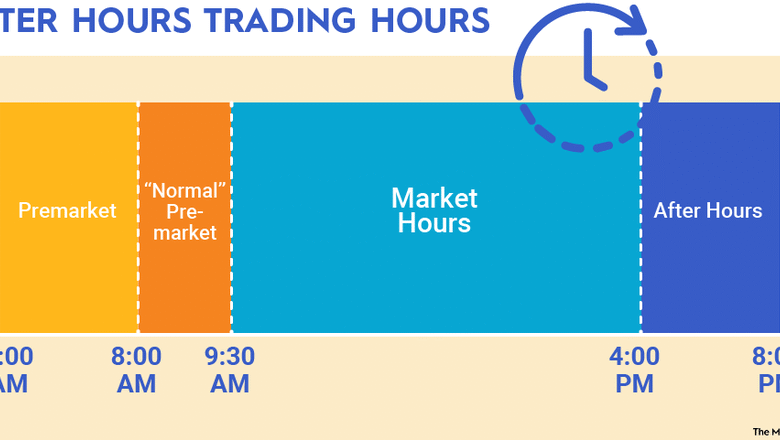

After-hours stock moves refer to the price changes that occur in a stock’s price outside of regular market hours, typically from 4:00 PM to 8:00 PM EST. These moves are influenced by earnings reports, economic news, or other significant announcements made after the market closes. Investors often react to these updates, leading to volatility and potential buying or selling opportunities. Understanding after-hours trading can enhance investor insights and inform trading strategies.

How do companies like AppLovin and Arm Holdings perform in after-hours trading?

Companies like AppLovin and Arm Holdings often experience significant after-hours stock moves based on their earnings releases. For instance, AppLovin’s shares rallied 13% after reporting stronger-than-expected quarterly results, demonstrating investor confidence. Conversely, Arm Holdings saw a 9% drop due to disappointing guidance, highlighting how after-hours trading can reveal short-term investor sentiment and impact stock market news.

What should investors consider when looking at after-hours trading activity?

Investors should consider that after-hours trading typically has lower liquidity and higher volatility compared to regular trading hours, which can lead to wider bid-ask spreads. It’s essential to analyze the earnings reports or news driving after-hours stock moves, as they may indicate broader trends or company outlooks. Paying attention to after-hours price actions can help craft effective trading strategies.

How can pre-market updates complement after-hours stock moves?

Pre-market updates reflect stock moves before the market opens the next day and may provide continuity in trends initiated in after-hours trading. For example, if a stock moves significantly after-hours on positive earnings, pre-market updates can further indicate whether this momentum continues or reverses. Monitoring both after-hours and pre-market trading gives investors comprehensive insights into potential market directions.

What are some effective trading strategies for capitalizing on after-hours stock moves?

Effective trading strategies for after-hours stock moves include researching earnings reports and market reactions, utilizing limit orders to manage price risks, and staying informed on events that may impact stock prices. Traders should also consider setting up alerts for significant price movements and be prepared for increased volatility during this period, utilizing proper risk management techniques.

Why did stocks like Zillow and Fortinet decline despite strong quarterly results in after-hours trading?

Stocks like Zillow and Fortinet may decline in after-hours trading despite reporting strong quarterly results due to guidance that fails to meet investor expectations or broader market concerns. For example, Zillow’s stock fell after it reported a profitable quarter but revealed challenges in the housing market. Similarly, Fortinet’s shares dropped due to guidance that aligned with expectations but lacked excitement, underscoring the importance of forward-looking statements in stock market news.

What types of companies typically see significant after-hours stock moves?

Companies that report earnings, announce major business developments, or provide updated forecasts often see significant after-hours stock moves. Technology firms, like AppLovin and Arm Holdings, and cyclical companies often respond dramatically to earnings reports or market changes, influencing investor sentiment and trading strategies.

Is after-hours trading advisable for all investors?

After-hours trading can be risky due to lower liquidity and higher volatility; therefore, it may not be suitable for all investors. Savvy traders with experience in the stock market may find it a useful tool to capitalize on quick price movements, while less experienced investors might prefer to stick to regular trading hours to avoid potential pitfalls.

How do after-hours stock moves impact overall market trends?

After-hours stock moves can indicate how investors perceive earnings results and company forecasts, which can set the tone for the following day’s market activity. Significant shifts during after-hours trading can lead to broader market trends, affecting how stocks are positioned when the market opens, thus influencing investor strategies and overall stock market sentiment.

Where can I find accurate information about after-hours stock moves?

Accurate information about after-hours stock moves can be found through financial news websites, stock market platforms, and brokerage services. Reputable sources such as CNBC, Bloomberg, or Reuters report key after-hours trading activity, making it easier for investors to track stock performance and adjust their strategies accordingly.

| Company | Stock Move | Reason for Move |

|---|---|---|

| AppLovin | +13% | Strong quarterly results; EPS of $1.67 vs $1.45 expected. |

| Arm Holdings | -9% | Guidance failed to impress; EPS outlook below expectations. |

| Skyworks Solutions | -4% | Reported earnings beat but stock fell despite positive guidance. |

| Avis Budget | +2% | Reduced loss compared to expectations, but revenue missed. |

| Bumble | +8% | Despite stagnant user growth, optimism about future revenue. |

| Zillow | -5% | Hit earnings expectations, but wary of challenging housing market. |

| Flutter Entertainment | -2% | Earnings and revenue fell short of expectations. |

| Fortinet | -11% | Sales guidance aligned with expectations, overshadowing earnings beat. |

| Carvana | -1% | Strong results but shares fell slightly. |

| H & R Block | +2% | Better earnings and revenue year-over-year. |

| Dutch Bros | +5% | Earnings and revenue beat expectations. |

| CF Industries | +1% | Beat earnings/revenue expectations; share buyback announced. |

| Axon Enterprise | +5% | Reported strong earnings and revenue above estimates. |

Summary

After-hours stock moves often reflect critical earnings reports and company announcements that can sway investor sentiment. In today’s after-hours trading, AppLovin impressed investors with a significant quarterly earnings beat, while Arm Holdings’ uninspiring fiscal outlook caused a notable drop in its share price. Overall, the after-hours moves are a clear indication of how companies are responding to market pressures and investor expectations, making it essential for investors to stay informed about these stocks in order to make informed trading decisions.