After Hours Stock Moves: PANW, TTWO, TOL and More

After hours stock moves can often set the stage for the next day’s trading, providing investors with crucial insights into market sentiment. Recently, notable stocks making big moves have included Palo Alto Networks and Take-Two Interactive, with price fluctuations driven by earnings reports and proposed offerings. For instance, Palo Alto saw a nearly 4% decline after disappointing revenue forecasts, while shares of Keysight Technologies climbed 5% following strong earnings results. Understanding these after hours trading dynamics is essential for traders looking to refine their strategies; utilizing after hours trading tips can significantly enhance decision-making. As the market evolves, keeping an eye on after hours stock moves is becoming increasingly vital for those seeking to capitalize on market opportunities.

The fluctuations in stock prices after regular trading hours are often referred to as extended hours trading, which highlights how the market reacts to significant news outside of conventional hours. This phenomenon allows investors to respond to key announcements, such as earnings reports from major players like Palo Alto Networks and Keysight Technologies, which can trigger substantial shifts. Keeping track of stocks that exhibit notable changes, such as Take-Two Interactive and Modine Manufacturing, can provide insights into broader market trends and investor confidence. Being equipped with strategies tailored for these after hours movements can empower traders to maximize their investment potential. As the financial landscape continues to evolve, understanding these after hours transitions is vital for navigating today’s complex markets.

Understanding After Hours Stock Moves

After hours stock moves provide investors with critical insights into how stocks react after the official trading day ends. During this period, stocks can experience significant price fluctuations based on the earnings reports or announcements made by companies, as seen with Palo Alto Networks and Take-Two Interactive Software. The factors influencing these moves often include earnings results that surpass or fall short of expectations, which can lead to increased volatility as investors make quick decisions.

For instance, after-hours trading can amplify market reactions to news. If a company like Keysight Technologies reports better-than-expected earnings, as seen in its latest performance with earnings of $1.70 per share, it can lead to substantial price gains post-market. Conversely, disappointing results, such as those from Palo Alto Networks, can result in sharp declines. This volatility is a reminder for traders to be aware of potential risks associated with after hours trading.

Key Stocks Making Big Moves After Hours: PANW and TTWO

Among the notable stocks making significant after hours moves, Palo Alto Networks (PANW) and Take-Two Interactive (TTWO) are at the forefront. PANW saw its shares dip nearly 4% after announcing its earnings which revealed a shortfall in remaining performance obligations. This development hints at a slower revenue growth forecast, leading to cautious investor sentiment.

On the other hand, Take-Two Interactive’s stock fell by 3% following their announcement of a $1 billion stock offering. This type of offering can dilute current shares, possibly leading to negative investor perceptions in the short term. These examples showcase how earnings reports and corporate actions can significantly affect stock performance during after hours trading.

Strong Performers: Keysight Technologies and Modine Manufacturing

Keysight Technologies shone brightly in the after hours trading session, as its stock surged 5% on the back of impressive earnings that beat market expectations. Reporting earnings of $1.70 per share against a predicted $1.65, Keysight’s success underscores the significance of exceeding Wall Street’s forecasts, particularly in the tech sector where investor confidence is often tethered to performance metrics.

Similarly, Modine Manufacturing saw a positive response in after hours trading, with a 2% increase following a robust earnings report. With earnings surpassing projections at $1.12 per share, this performance illustrates how companies can capitalize on their strengths to attract investor interest. The trend of strong quarterly earnings continues to be a key driver of stock market performance, especially in volatile trading environments.

Real Estate Stocks on the Rise: Toll Brothers

Toll Brothers, a prominent luxury homebuilder, experienced a soaring stock price after reporting impressive fiscal results. The company’s shares shot up 6% in after hours trading, as they announced earnings of $3.50 per share, significantly exceeding analysts’ expectations. This positive news reflects the growing demand for luxury homes, which has bolstered investor confidence in the real estate sector.

The reported revenue of $2.71 billion also surpassed the anticipated $2.48 billion, further validating Toll Brothers’ strong market position amid fluctuating economic conditions. For real estate investors, such performances highlight the importance of monitoring earnings reports and their direct correlation to stock movements, especially in a dynamic market where luxury real estate continues to thrive.

Market Trends in After Hours Trading

Monitoring market trends in after hours trading can provide valuable insights into potential future stock movements. For instance, reactions to earnings reports, as seen with various stocks, often set the tone for the next trading day. Investors are advised to pay attention to after hours results as they can indicate investor sentiment towards a company’s future performance.

Additionally, watching for patterns relating to stocks making big moves can be beneficial. By analyzing how stocks like Keysight Technologies and Modine Manufacturing respond to earnings announcements and market events, investors can cultivate strategies tailored for after hours trading. Such insights are essential in navigating the complexities of the stock market and managing portfolio risks effectively.

Strategies for After Hours Trading: Tips for Investors

For investors looking to navigate the often unpredictable waters of after hours trading, understanding key strategies is essential. One effective approach is to remain informed about upcoming earnings reports and announcements from companies within their investment realm. This awareness enables traders to anticipate potential market reactions and make proactive decisions.

Additionally, utilizing tools that track after hours stock fluctuations, such as limit orders and stop-loss orders, can help manage risk. These strategies can be particularly beneficial when stocks such as Take-Two Interactive announce significant changes, allowing traders to protect their investments from adverse movements that may occur in after hours sessions.

Analyzing Palo Alto Networks Stock Performance

Palo Alto Networks stock has been a subject of scrutiny following its recent performance, where it fell nearly 4% after revealing its remaining performance obligations fell below analyst expectations. This decline serves as a reminder of the volatility that can occur when companies do not meet market forecasts, which can trigger sell-offs among investors.

The shortfall in performance obligations may indicate challenges ahead for the security giant, as continued underperformance can lead to declining investor confidence. As a result, analysts will be closely monitoring Palo Alto’s next moves and strategic responses to regain market traction.

Take-Two Interactive: Impact of Stock Offering on Earnings

Take-Two Interactive’s recent proposed $1 billion common stock offering illustrates the delicate balance between raising capital and maintaining investor confidence. Following the announcement, the stock saw a 3% drop as investors reacted to the dilution effect this offering could have on existing share values.

Earnings predictably influence stock performance in today’s market climate, and any immediate declines post-offering could shift perceptions among analysts and investors. As a result, it’s crucial for Take-Two Interactive to articulate a clear strategy regarding the usage of these funds to reassure stakeholders and mitigate negative sentiment.

Understanding Keysight Technologies Earnings Drive

Keysight Technologies demonstrated the power of strong earnings results, showcasing a 5% increase in stock price during after hours trading after exceeding expectations with $1.70 earnings per share. This robust performance established the company as a leader within its sector, frequently influencing investor perceptions and broader market sentiment.

Such earnings reports often provide insights into not just the company’s operational efficiency but also reflect overall market conditions. By continually outperforming, Keysight Technologies can reinforce its position in the electronic test equipment space, indicating potential for future growth and profitability.

Market Dynamics: Modine Manufacturing’s Strong Quarter

Modine Manufacturing’s upward movement in the stock market by 2% after reporting a better-than-expected earnings of $1.12 per share exemplifies the dynamic nature of market reactions. Exceeding analyst expectations fosters positive sentiment, particularly in industries where innovation and efficiency are paramount.

As investors increasingly focus on companies that deliver consistent performance, Modine’s ability to surpass revenue forecasts suggests a solid foundation for future growth. Understanding the factors that drive such earnings can help investors make informed decisions when considering investments in similar sectors.

Frequently Asked Questions

What are after hours stock moves and why are they significant?

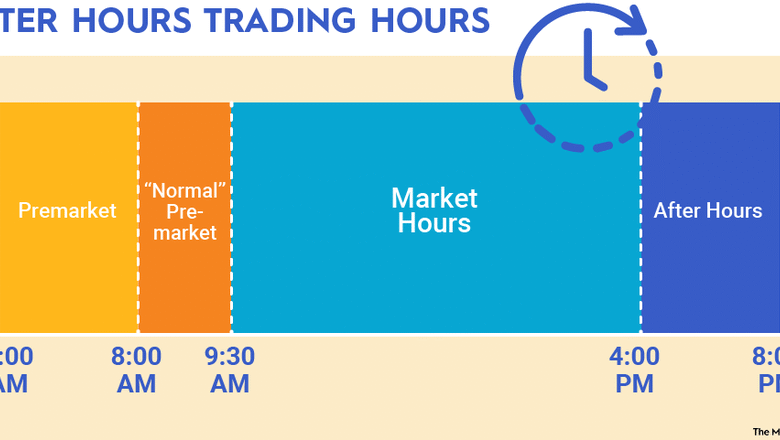

After hours stock moves refer to the fluctuations in stock prices that occur after the standard trading hours of major exchanges, typically from 4 PM to 8 PM EST. These moves can be significant as they often react to news releases or earnings reports that come out after the market closes, such as those from companies like Palo Alto Networks and Take-Two Interactive. Observing after hours trading can provide insights into how investors are responding to key developments.

How do after hours trading tips help investors navigate stock moves?

After hours trading tips can guide investors in understanding the factors influencing stock movements during non-traditional hours. Tips might include watching for earnings surprises from companies like Keysight Technologies or monitoring market reactions to stock offerings like that of Take-Two Interactive. Effective use of these tips can enhance decision-making and risk management for trading after hours.

What is the impact of Palo Alto Networks stock on after hours trading?

Palo Alto Networks stock often experiences notable after hours moves, especially following earnings announcements or performance reports. For instance, after reporting lower-than-expected remaining performance obligations, its shares fell nearly 4% in after hours trading, highlighting how investor sentiment can quickly react to financial disclosures.

Why did Take-Two Interactive stock slide in after hours trading?

Take-Two Interactive stock declined by 3% during after hours trading primarily due to the announcement of a proposed $1 billion common stock offering. This type of corporate action can dilute existing shares, leading to sell-offs as investors reassess the stock’s future potential.

What earnings report influenced Keysight Technologies stock movements after hours?

Keysight Technologies saw its stock climb 5% in after hours trading after it reported fiscal second quarter earnings that exceeded analysts’ expectations. With earnings of $1.70 per share on revenue of $1.31 billion, the positive surprise drove investor optimism in the after hours market.

How did Toll Brothers stock perform after hours and what were the key reasons?

Toll Brothers stock gained 6% after hours as the company reported stronger-than-expected earnings of $3.50 per share and a revenue of $2.71 billion, significantly surpassing analysts’ forecasts. This positive earnings beat is a key driver of after hours stock moves, as it reflects the company’s robust financial health.

What are the risks associated with trading during after hours stock moves?

Trading during after hours stock moves carries several risks, such as lower liquidity, wider bid-ask spreads, and potential volatility. Stocks may experience exaggerated movements, influenced by fewer participants as seen with companies like Modine Manufacturing posting strong earnings that may not be sustained when the market reopens.

| Company | Stock Movement | Key Details |

|---|---|---|

| Palo Alto Networks | -4% | Reported remaining performance obligations of $13.5 billion, below the $13.54 billion expectation. |

| Take-Two Interactive Software | -3% | Announced a proposed $1 billion common stock offering. |

| Keysight Technologies | +5% | Posted Q2 earnings of $1.70 per share, exceeding expectations of $1.65. |

| Modine Manufacturing | +2% | Earnings of $1.12 per share topped expectations of 96 cents. |

| Toll Brothers | +6% | Q2 earnings of $3.50 per share surpassed the $2.83 estimate. |

Summary

After hours stock moves revealed significant shifts in various companies’ shares, with Palo Alto Networks and Take-Two Interactive seeing declines of 4% and 3%, respectively, due to earnings and stock offerings. In contrast, Keysight Technologies, Modine Manufacturing, and Toll Brothers posted impressive gains, driven by strong earnings that outperformed analyst expectations. These movements illustrate the volatile nature of the market outside regular trading hours.