After Hours Stocks: Big Moves from United Airlines and More

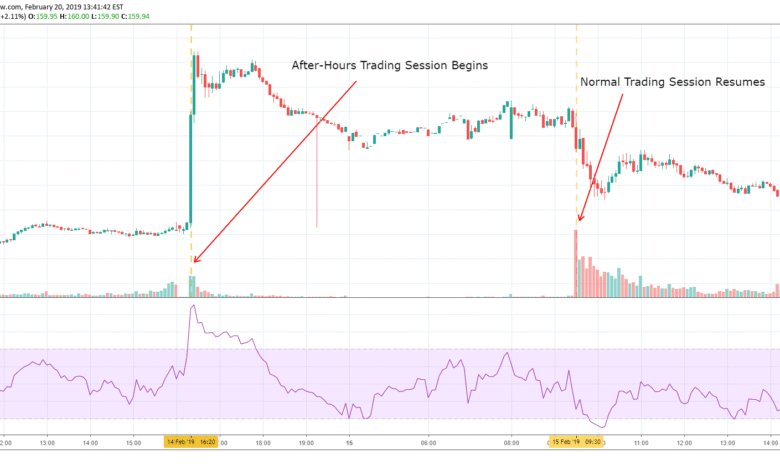

After hours stocks offer a unique glimpse into the market dynamics that unfold once the regular trading day concludes. Investors eager to capitalize on evening developments often turn their attention to significant movers like United Airlines and J.B. Hunt Transport. In the latest stocks after hours news, United Airlines saw a commendable rise of nearly 7% post-announcement of earnings that exceeded expectations. Conversely, Interactive Brokers faced a decline of 5% despite its announcement of a stock split, showcasing the volatility that characterizes after hours trading. With key developments such as Nvidia stock news and shifts in other market players, the after hours environment continues to hold intrigue for savvy investors seeking opportunities beyond standard trading hours.

The realm of after hours trading unveils a captivating segment of the financial marketplace where investors can witness fluctuations in stock prices well after the traditional market closes. Many retail and institutional investors monitor updates on prominent companies like J.B. Hunt Transport and United Airlines for sudden shifts in their equity valuations. This unique trading period allows traders to react quickly to earnings reports, earnings revisions, and key market events. As a case in point, the stock performance of companies such as Interactive Brokers and Nvidia can shift dramatically based on their latest financial disclosures. Mastering this after hours landscape is essential for capitalizing on investment potentials that may not be immediately visible during regular market hours.

United Airlines Stock Surges After Positive Earnings Announcement

After the recent earnings report, United Airlines experienced a significant surge in its stock price, climbing nearly 7%. The company’s adjusted earnings of 91 cents per share outperforming analysts’ predictions of 76 cents per share has boosted investor confidence. This positive reaction suggests a strong recovery trajectory for United Airlines, particularly as travel demand continues to show resilience in the post-pandemic landscape. The market’s excitement was also evident in shares of competitors like Delta Air Lines and Southwest Airlines, which posted gains of 4% and nearly 2%, respectively.

Despite the promising earnings beat, United Airlines reported revenues of $13.21 billion, which fell short of the expected $13.26 billion. This mixed outcome highlights the challenges still faced by the airline industry, despite rising demand. Investors will be keenly watching how United Airlines manages costs and adapts to evolving consumer behavior in the upcoming quarters, signaling the importance of sustaining momentum in the face of ongoing market volatility.

Interactive Brokers News: Mixed Earnings and Stock Split Announcement

Interactive Brokers saw its stock fall by 5% following its latest earnings release, which reported earnings of $1.88 per share—below the expected $1.92 per share. This dip is notable given that the firm’s adjusted revenue of $1.40 billion paralleled forecasts, illustrating a disconnect between earnings expectations and actual performance. Investors may have reacted negatively to the disappointing earnings despite the solid revenue figures, reflecting a heightened sensitivity to earnings shocks in today’s volatile market.

Adding to the news, Interactive Brokers announced a four-for-one stock split aimed at making shares more accessible to a broader range of investors. Furthermore, the company is increasing its dividend by 7 cents, raising it to 32 cents per share, indicating a commitment to returning value to shareholders. This combination of strategic financial moves could stabilize confidence and potentially create a repositioning in Interactive Brokers’ stock as it strives to appeal to a diverse investor base.

J.B. Hunt Transport: Stock Slump Despite Earnings Beat

Despite beating earnings expectations, J.B. Hunt Transport saw its stock price decline by 6% following the earnings report. The transportation giant announced results that exceeded estimates for both earnings and revenue, which typically would lead to investor optimism. However, the disappointing year-over-year declines in revenue and operating income have raised flags about the sustainability of J.B. Hunt’s growth, ultimately impacting market perceptions.

The challenges faced by J.B. Hunt highlight the complexities of the current logistics landscape, where demand fluctuations and shipping costs can significantly influence profitability. Investors will need to evaluate the company’s future strategies and operational adjustments to navigate these hurdles. The focus moving forward will likely be on how effectively J.B. Hunt can capitalize on market opportunities while addressing existing headwinds such as increasing competition and regulatory pressures.

Nvidia Stock Edges Down on Regulatory Challenges

Nvidia’s stock dipped 5% as it announced looming regulatory challenges, primarily concerning its plans to record a hefty $5.5 billion charge for graphics processing units being exported to China and other nations. This declaration signals potential impediments as the company has received notification from the U.S. government, demanding specific licenses for exporting these chips. Consequently, investors are wrestling with concerns over how these regulatory issues will affect Nvidia’s sales and market position, especially as demand for high-performance graphics continues to grow.

The decline in stock is noteworthy, particularly for a company that has positioned itself as a leader in AI and gaming technologies. Investors will be closely monitoring how Nvidia adapts to these regulatory conditions while striving to secure its supply chains and maintain its competitive edge. The upcoming quarters will be critical as Nvidia maneuvers through this precarious landscape, potentially impacting its stock performance in the after-hours trading environment.

Understanding After Hours Stocks: Opportunities and Risks

After hours stocks present a unique trading opportunity, allowing investors to react to earnings reports and other significant news released outside of regular market hours. Trading during these hours can lead to greater volatility, as lower liquidity may exacerbate price movements. Assessing stocks such as United Airlines, Interactive Brokers, and Nvidia in after-hours trading can yield insights into market sentiment and future performance projections based on immediate investor reactions.

However, this trading environment also carries risks. For example, the dramatic drops or gains observed in companies like J.B. Hunt Transports underscore how earnings disappointments can trigger swift market movements when most investors are not participating. As a result, traders and investors must exercise caution and weigh the information released during after hours before making investment decisions based on often temporary price fluctuations.

Stock Market Sentiment: The Impact of Earnings Reports

Earnings reports play a pivotal role in shaping market sentiment, particularly for stocks in industries that are heavily influenced by economic cycles, such as airlines and logistics. The recent rises in stocks like United Airlines and declines in stocks like Interactive Brokers highlight how outperforming or underperforming earnings can shift investor attitudes dramatically. Market participants are closely attuned to these reports, looking for signs of growth trajectories and potential downturns.

As seen in the case of J.B. Hunt, even solid earnings can lead to stock price declines if there are underlying concerns about future profitability. This reaction reinforces the idea that investors are not solely focused on current performance—rather, they are also factoring in broader economic indicators and potential risks ahead. Therefore, understanding the full context of these earnings announcements is essential for stakeholders seeking to navigate the stock market landscape effectively.

Key Takeaways from Recent Market Movements

Recent market movements have provided key insights into how stocks respond to earnings reports and the subsequent impact on investor confidence. Companies like United Airlines showcased the power of a strong earnings beat, resulting in significant after-hours gains, while firms like Interactive Brokers experienced declines despite a revenue match. The evidence suggests that investors are increasingly scrutinizing not just earnings performance but also the broader picture affecting future growth.

As the market continues to react to these earnings reports, traders must remain vigilant, adapting their investment strategies to account for the shifting dynamics. For instance, understanding the nuances in how stocks respond during after-hour trading periods can offer lucrative opportunities, as investors become privy to immediate reactions and sentiment shifts. In conclusion, capturing these insights and employing them in trading strategies can enrich decision-making processes for both novice and seasoned investors alike.

The Future of Stocks: Emerging Trends to Watch

Looking ahead, certain emerging trends in the stock market warrant attention from investors. The rise of technology and AI continues to reshape consumer behavior and operational efficiencies for companies, presenting robust growth avenues. Stocks like Nvidia are at the forefront of this technological wave; however, they must navigate regulatory challenges that could impact their growth trajectories. Keeping an eye on how these factors influence stock performance will be crucial for investment strategies.

Additionally, shifts in consumer behavior due to economic cycles may lead to re-evaluations of investments in traditional sectors like airlines and transportation services. Companies such as United Airlines and J.B. Hunt will need to adapt to these changes to sustain growth. The ability to innovate and pivot in response to both market conditions and consumer preferences will define the competitive landscape moving forward. Investors should remain proactive in analyzing these trends to uncover promising opportunities in their portfolios.

Frequently Asked Questions

What are after hours stocks and how do they work?

After hours stocks refer to the trading of stocks that occurs after the regular market hours, typically from 4 PM to 8 PM ET. During this time, investors can react to news and events that arise after the market closes, affecting stock prices. Trading in after hours can be less liquid, leading to higher volatility and wider spreads than during regular hours.

How did after hours stocks perform for United Airlines recently?

Recently, United Airlines stock experienced a nearly 7% increase in after hours trading following the announcement of strong first-quarter earnings that exceeded analysts’ expectations. This performance highlights how after hours stocks can reflect immediate investor sentiment based on corporate earnings reports.

What factors influenced the decline of Interactive Brokers stock after hours?

After hours stocks for Interactive Brokers fell 5% after they reported earnings that were below analysts’ expectations. Despite meeting revenue forecasts, the unexpected decline in earnings coupled with news of a stock split may have influenced investor behavior, leading to a decrease in after hours trading.

Why did J.B. Hunt Transport see a drop in after hours stocks?

Despite exceeding earnings and revenue estimates, J.B. Hunt Transport’s stock fell 6% in after hours trading due to a year-over-year decline in both revenue and operating income. This divergence between expectations and actual performance can greatly impact investor confidence and stock price in after hours trading.

What recent news affected Nvidia stock in after hours trading?

Nvidia stock experienced a 5% decline in after hours trading following the announcement of a substantial $5.5 billion charge related to export licenses for GPUs. This news, particularly regarding export restrictions to China, significantly impacted investor sentiment, leading to the decrease in stock price during after hours.

| Company | Stock Movement | Earnings Report | Comments |

|---|---|---|---|

| United Airlines | +7% | Adjusted EPS: $0.91 (Est: $0.76) | Revenue of $13.21B missed expectations of $13.26B. |

Summary

After hours stocks have shown some significant movements recently, especially with United Airlines reporting stronger-than-expected earnings despite a slight revenue miss. Interactive Brokers faced a decline due to disappointing earnings in relation to expectations, while J.B. Hunt’s shares dropped despite beating earnings and revenue estimates. Meanwhile, Nvidia’s stock fell due to export issues impacting their business model. It’s essential for investors to stay updated on these after hours stocks, as they reflect on the dynamics affecting the market.