After Hours Stocks: Biggest Moves from Super Micro to Wynn

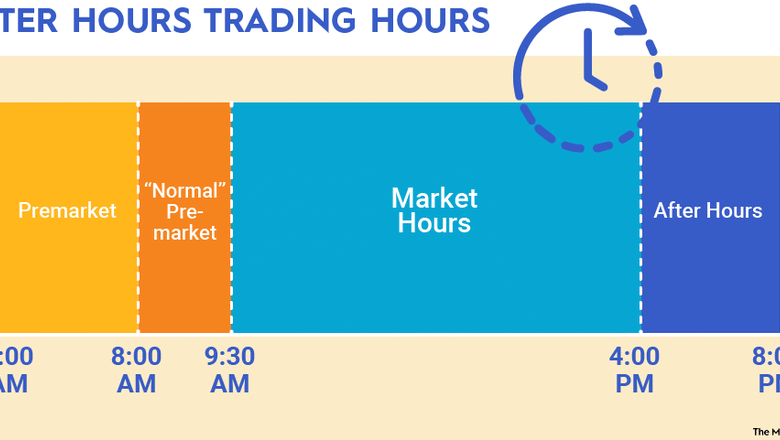

After hours stocks have become an essential aspect for investors looking to analyze market trends outside regular trading hours. The post-market trading period offers unique opportunities for those eager to capitalize on stocks making moves based on earnings reports and other pivotal market updates. For instance, notable companies like Super Micro Computer and Electronic Arts recently demonstrated significant shifts in their stock prices, reflecting investors’ reactions to their earnings performances. As trading news unfolds, these after hours transactions provide critical insight into potential market directions before the next day’s opening bell. With the ongoing emphasis on stock earnings, understanding after hours trading becomes increasingly vital for strategizing investment decisions.

In the realm of investing, the time after the market closes serves as an intriguing platform for trading activity. These post-market actions, often referred to as after hours trading, unveil the latest developments in the stock market landscape. Investors frequently track the movement of shares, particularly those that are making notable gains or losses, as they react to corporate earnings announcements and other significant events. This period of active trading is crucial for obtaining early insights into potential stock performance before the dawn of the next trading day. Overall, keeping an eye on these off-hours transactions is essential for anyone keen on leveraging trading insights and forecasting future market trends.

After Hours Trading Highlights: Key Stocks on the Move

In today’s after hours trading, several companies stand out with significant price movements. Super Micro Computer saw its shares drop by 5% following disappointing earnings and a grim outlook for the next quarter. Despite reporting $4.60 billion in revenue for the third fiscal quarter, this fell short of the forecasted $5.42 billion, leading to investor concerns. Such movements underscore how after hours trading can reflect immediate reactions to earnings reports and market updates that can happen outside normal trading hours.

Another notable stock making moves after hours is Electronic Arts, which rose by 5% after surpassing its earnings expectations with $1.80 billion in adjusted revenue. This is notable given that analysts had only anticipated $1.56 billion. This example illustrates how robust earnings in after hours trading can influence stock sentiment and indicate broader market performance, making it crucial for investors to stay informed on trading news beyond regular trading hours.

Market Updates: Earnings Reports Driving Stock Prices

Market updates focusing on quarterly earnings reports provide insight into why certain stocks are making moves. For instance, Arista Networks shares fell by 7% despite beating revenue expectations, raising questions about the sustainability of its growth. This drop highlights that even when companies report better-than-expected earnings, the broader context and future outlook can significantly impact stock price reactions in after hours trading.

Conversely, Advanced Micro Devices showcased resilience in after hours trading, seeing its stock increase nearly 4%. The company reported earnings of 96 cents per share against an anticipated 94 cents, demonstrating how exceeding expectations can lead to positive market responses. These fluctuations illustrate the intricate relationship between stock earnings and after hours trading, often driven by investor sentiment and perception of future performance.

Stocks Making Moves: Spotlight on Industry Leaders

The performance of industry leaders can significantly influence the market, particularly during after hours trading. Wynn Resorts’ shares fell by 2% after reporting first-quarter earnings below consensus estimates. With adjusted earnings of only $1.07 per share and revenues of $1.70 billion, the results disappointed Wall Street expectations, showcasing the crucial nature of timely stock earnings updates. Investors often react swiftly in after hours trading, emphasizing the importance of close monitoring for those tracking major sector players.

In the tech segment, Super Micro Computer’s decline points to the volatility of industry-leading firms based on earnings revelations. With revenues missing forecasts, investors’ uncertainty can lead to sharp declines during after hours trading. Observing how stocks making significant moves can signal trends in respective industries is pivotal for investors looking to adjust their strategies promptly.

Understanding After Hours Trading: Risks and Opportunities

After hours trading presents unique risks and opportunities for investors. Stocks like Sarepta Therapeutics may experience drastic price drops—in this case, 23%—due to unexpected results and adverse market perceptions. While the potential for loss is significant, successful navigation of after hours trading can yield substantial returns for those who correctly interpret trading news and market updates.

Furthermore, trading opportunities in after hours can offer advantages due to lower competition and less noise in market transactions. For example, Upstart Holdings declined by 17% despite reporting first-quarter successes. Understanding these dynamics allows investors to strategically leverage after hours trading, especially when stocks are making moves following earnings announcements. Importantly, keeping up with reports and analysis during these trading windows can help minimize risks associated with quick market adjustments.

Navigating After Hours Stocks: Strategies for Investors

Investors looking to navigate after hours stocks should employ strategic methodologies by analyzing earnings reports and market responses. For instance, the case of Electronic Arts, which rebounded with a positive earnings report, illustrates how detailed understanding of stock performance can guide trading decisions. By identifying stocks making significant moves and analyzing the underlying reasons, investors can position themselves advantageously.

Additionally, focusing on stocks that consistently demonstrate resilience in after hours trading, like Advanced Micro Devices, can be a key part of an investment strategy. Understanding the broader trends and industry implications, along with the context of earnings reports, can enhance decision-making processes, allowing investors to capitalize on opportunities presented by after hours trading.

Impact of Earnings Reports on Stock Movements

Earnings reports serve as critical events that trigger movements in stock prices, particularly evident in after hours trading. For instance, when companies like Super Micro Computer report underwhelming earnings, it can lead to substantial share price declines. Investors often react swiftly to such news, illustrating the powerful influence these earnings announcements carry over stock movements.

Conversely, strong earnings revelations, as seen with Electronic Arts, can uplift stock prices and boost investor confidence. This reflects a broader trend in which companies exceeding analysts’ expectations can create momentum that carries beyond after hours trading, reinforcing the critical nature of understanding how earnings impact market behavior.

After Hours Trading Trends: Analyzing Common Patterns

Analyzing trends in after hours trading can reveal common patterns among stocks making moves following earnings announcements. One pattern that emerges is the tendency for certain sectors, like technology and gaming, to experience more volatility post-earnings reports. Stocks like Advanced Micro Devices and Electronic Arts confirm this trend, showcasing how investor sentiment can shift dramatically based on quarterly earnings outcomes.

Another notable trend is the reaction to missed earnings expectations, often leading to significant price drops, as illustrated by Arista Networks and Wynn Resorts. These patterns underscore the importance of vigilance among investors who are navigating after hours trading, as they can identify emergent trends and adjust their portfolios accordingly.

Preparing for After Hours Stock Movements: What Investors Should Know

Preparing for after hours stock movements requires understanding the implications of earnings reports and their timing. Investors should closely monitor scheduled earnings releases and be ready to react to market updates as they happen. For example, predicting how stocks like Upstart Holdings will respond to their earnings guidance can provide a competitive edge.

Furthermore, knowing which stocks tend to show resilience or volatility in after hours trading can inform strategic investments. Documenting historical performance of stocks making moves after earnings can illuminate trends and support informed decision-making, equipping investors to harness opportunities within after hours trading effectively.

Key Factors Influencing After Hours Stock Performance

Various factors influence the performance of stocks in after hours trading, particularly following earnings reports. Market sentiment, anticipated guidance, and historical performance play crucial roles. For instance, if a company consistently meets or exceeds expectations, such as Advanced Micro Devices, it may foster confidence leading to a positive after hours response.

Conversely, companies like Sarepta Therapeutics may see sharp declines due to market cynicism or poor guidance following earnings. Understanding these underlying factors can significantly enhance investors’ ability to navigate after hours trading effectively, allowing them to make educated predictions about stock movements.

Conclusion: The Importance of Staying Updated in After Hours Trading

Staying updated with after hours trading and market dynamics is essential for investors looking to capitalize on opportunities presented by stocks making significant moves. With companies like Electronic Arts providing positive surprises, having timely access to trading news and market updates can lead to strategic advantages.

Ultimately, understanding not just the numbers from earnings releases but also the broader implications for the market can empower informed trading decisions. By following after hours trading trends and keeping a finger on the pulse of stock movements, investors can better position themselves for success in a constantly evolving market environment.

Frequently Asked Questions

What are after hours stocks and how do they perform?

After hours stocks refer to shares traded outside of regular market hours, usually from 4 PM to 8 PM ET. During this time, stocks can experience significant price movements due to earnings reports or news. Key players often analyze trading volumes and volatility to gauge the after hours trading landscape.

Which stocks are making significant moves in after hours trading today?

Today, notable stocks making moves after hours include Super Micro Computer, which fell about 5%, and Electronic Arts, which gained 5%. These changes reflect market reactions to recent earnings announcements.

How do after hours trading and stock earnings affect stock prices?

After hours trading can greatly influence stock prices, especially following stock earnings reports. Companies like Arista Networks and Advanced Micro Devices showed price movements after releasing their earnings, which either surpassed or fell short of analyst expectations.

What factors drive after hours trading for stocks?

Factors driving after hours trading include earnings results, trading news, and significant market updates. For instance, Super Micro Computer’s weak earnings outlook negatively affected its stock price, illustrating how sensitive stocks can be to company performance.

What risks are associated with after hours trading stocks?

After hours trading stocks often come with risks such as lower liquidity, increased volatility, and wider spreads. Traders should be wary, as low trading volumes can lead to abrupt price changes, as seen with Sarepta Therapeutics and Upstart Holdings.

How can I get the latest updates on after hours stocks?

To get the latest market updates on after hours stocks, follow financial news outlets or stock analysis platforms. These sources provide insights into stocks making moves after hours, including detailed analyses of earnings outcomes and company forecasts.

Are there any benefits to trading after hours stocks?

Yes, trading after hours stocks allows investors to react immediately to market news and earnings reports. For example, Electronic Arts saw immediate benefits after a strong earnings report, demonstrating potential trading opportunities during these hours.

What should investors look for in stocks making moves after hours?

Investors should look for significant earnings surprises, changes in guidance, and overall market sentiment. Stocks like AMD and Wynn Resorts exemplify how after hours trading can reflect immediate market reactions to financial performance.

| Company Name | Stock Movement | Earnings Per Share (EPS) | Revenue | Consensus Estimate | Remarks |

|---|---|---|---|---|---|

| Arista Networks | -7% | $0.65 | $2.00 billion | $0.59 | Narrowly beat revenue estimates. |

Summary

After hours stocks experienced notable activity with key companies revealing their latest financial performance. Arista Networks, Super Micro Computer, and Wynn Resorts struggled with disappointing earnings reports, while Advanced Micro Devices saw a positive reaction from investors due to better-than-expected earnings. As these companies navigate the challenges in their respective industries, the after-hours trading scenarios highlight market volatility and investor sentiment, showcasing the unpredictable nature of after hours stocks.