After-Hours Trading Updates: Key Company Earnings Reports

After-hours trading updates provide a critical insight into market movements that follow the traditional trading day. Investors can gauge stock price movements and the potential impact on their portfolios based on the latest company earnings reports. During these extended hours, notable fluctuations can signal shifts in market performance, often driven by announcements regarding quarterly performance or future expectations. For instance, recent updates show strong gains for companies like Expedia Group and Instacart, showcasing how after-hours events can shape investment news highlights. By keeping an eye on these developments, traders can make informed decisions and better navigate the stock market landscape.

In the world of finance, after-hours stock trading reveals essential updates on equity performance and corporate announcements that may not be reflected during regular trading hours. These after-market fluctuations offer investors a sneak peek into potential shifts in overall market dynamics and allow for quicker reactions to new information, particularly after crucial earnings disclosures. Monitoring these after-hours activities is vital for understanding how specific companies are faring as well as tracking broader investment narratives. As such, staying updated on late trading trends and financial revelations can significantly inform trading strategies and investor confidence.

Expedia Group Soars After Earnings Report

Expedia Group’s shares surged over 15% in after-hours trading following a robust earnings report for the second quarter. The travel booking giant not only exceeded analyst expectations in terms of revenue and earnings but also raised its guidance for the full year. This remarkable performance signals strong market demand for travel services, contributing to positive stock price movements. As investment analysts highlight, investor confidence in Expedia’s growth trajectory plays a pivotal role in this surge.

The impressive after-hours trading updates reflect well on Expedia’s strategic initiatives and recovery in the travel sector. As international travel rebounds, the company’s operational adjustments and increased marketing efforts are helping to boost overall engagement and bookings. This trend reinforces the narrative surrounding travel stocks and their recovery potential, making them attractive for investors looking to capitalize on emerging market trends.

Block’s Earnings Guidance Boosts Stock Price

Shares of Block, the parent company of Cash App, rose nearly 7% in reaction to the company’s updated earnings guidance, raising full-year gross profit expectations from $9.96 billion to an impressive $10.17 billion. This upgrade highlights the growing confidence in Block’s sustained performance and adaptability in the evolving fintech landscape, aligning with broad investment news highlights that emphasize the importance of guidance in driving stock price movements.

The company’s solid after-hours trading updates sparked optimism about its future performance, reinforcing investor interest. As Block continues to innovate and expand its offerings, not only is it drawing direct comparisons with competitors but also reflecting stronger market performance that analysts are keen to monitor. This bullish sentiment is particularly noteworthy given the stock’s recent volatility, showing that investors are responding positively to fundamentally sound financial metrics.

Akamai Technologies Raises Guidance Amid Market Optimism

Akamai Technologies experienced a notable 3% increase in share price after it announced revised guidance for its adjusted earnings. The update, projecting earnings per share between $6.60 and $6.80, surpassed earlier forecasts and analysts’ expectations, which contributes to a favorable sentiment in after-hours trading. Investors are reassured by Akamai’s strategic positioning in the cloud computing sector, a sector projected for significant growth in the coming quarters.

The market’s positive response to Akamai’s performance underscores the critical role of earnings reports in guiding investor sentiment. Companies that consistently exceed their projections often see a corresponding boost in their stock price, as demonstrated in this case. Consequently, the focus remains on overall market performance after hours, revealing how investors are aligning their portfolios with robust growth forecasts.

Texas Roadhouse Reports Mixed Earnings Results

Texas Roadhouse’s shares declined by over 2% after the company reported second-quarter earnings that fell slightly short of expectations. With reported earnings of $1.86 per share against an anticipated $1.90, it highlighted a disconnect between analyst predictions and actual performance. However, revenue figures did exceed expectations, indicating potential for recovery or adjustment within the upcoming months.

Investors are often wary of stocks that underperform against market forecasts, as seen with Texas Roadhouse despite its revenue success. Market performance after hours tends to react sharply to such discrepancies, leading many analysts to reassess their growth forecasts for the company. This serves as a reminder to investors about the complexities of earnings releases and the mixed signals they can generate.

Instacart Sees Strong After-Hours Trading Gains

Maplebear, operating as Instacart, experienced a staggering 10% jump in its share price after posting quarterly results that surpassed analysts’ expectations. With earnings at 41 cents per share and revenue of $914 million outperforming predictions, the grocery delivery service is capitalizing on the growing demand in e-commerce and food delivery sectors. These impressive after-hours trading updates suggest that Instacart’s strategy resonates well with customers navigating a post-pandemic marketplace.

The surge in Instacart’s stock corresponds with a significant shift in consumer behavior, favoring convenience and online shopping solutions. Analysts are closely watching the company’s trajectory, as its success could signal strong investment potential for publicly traded companies in the e-commerce sector. The upward price movement emphasizes optimism among investors regarding continued growth, supported by the anticipated gross value of transactions exceeding forecasts.

Positive Earnings for Solventum Boost Stock Confidence

Shares of Solventum increased by 4% following the company’s announcement of second-quarter adjusted earnings that surpassed expectations. The healthcare firm has also updated its full-year guidance, raising projected earnings per share, which reflects a growing confidence in its financial stability. This development aligns with investment news highlights detailing how companies exceeding expectations tend to experience favorable market reactions.

The increase in Solventum’s share price underscores how healthcare companies, particularly those who consistently meet or exceed performance metrics, can attract investor interest in a competitive market. Positive earnings reports contribute to broader discussions around market performance after hours, as investors seek opportunities in sectors poised for growth and transformation in the coming years.

Synaptics Gains Ground with Solid Earnings Report

Following a better-than-expected fourth-quarter earnings report, Synaptics saw its stock climb over 2%. The adjusted earnings of $1.01 per share on revenue of $282.8 million exceeded analyst expectations, which signals robust business performance within the semiconductor industry. This positive development in after-hours trading showcases how tech-related companies are adjusting to the evolving market demands.

Investors appear encouraged by Synaptics’ ability to not only meet but exceed market estimates, reflecting a trend of positive stock price movements amid challenging market conditions. The response from the investment community highlights the potential for growth in the semiconductor sector, which is increasingly crucial in today’s technology-driven landscape. As the company continues to innovate, investor confidence is likely to strengthen further.

Mixed Results for Tripadvisor Impact Stock Performance

Tripadvisor’s shares saw an increase of over 5% after releasing second-quarter results characterized by mixed outcomes. While adjusted earnings surpassed estimates, the revenue, at $529 million, fell short of expectations. This discrepancy illustrates the volatility often observed in travel-related stocks and how mixed earnings can impact investor sentiment.

The after-hours trading updates reflect how earnings announcements can create immediate reactions in the stock market, even if the overall outcome is intertwined. Analysts are analyzing how Tripadvisor can capitalize on its strong earnings while addressing revenue shortfalls as the travel industry continues its recovery. Such dynamics present both challenges and opportunities for investors navigating the sector.

Viavi Solutions Outperforms Analysts’ Expectations

Viavi Solutions experienced a remarkable 11% jump after reporting fiscal fourth-quarter earnings and revenue that eclipsed projections. With its new quarter guidance indicating earnings and revenue above forecasts, it is indicative of a strong performance in the networking and testing sectors. This kind of robust after-hours trading can draw significant attention from investors keen on tech stocks.

The market’s reaction highlights the importance of both quarterly performance and forward-looking guidance in shaping investor strategies. Firms that manage to consistently beat expectations, like Viavi, often see their stocks rewarded in after-hours trading. As a result, investors are increasingly focused on market performance trends and how earnings reports can directly influence stock valuations.

Wynn Resorts Falls Short of Earnings Expectations

Despite posting revenues of $1.74 billion, Wynn Resorts saw its shares decline by 1% following a second-quarter earnings report that failed to meet Wall Street’s expectations. The earnings of $1.09 per share were below analysts’ forecasts, creating a mixed response from investors. This serves as a case study on how even established companies can struggle in a volatile market.

The stock performance highlights the critical nature of precise earnings forecasts and how deviations can lead to negative market reactions, especially in the hospitality and entertainment sectors. Investors are reportedly cautious and drawn to other opportunities as they factor in these mixed results in their strategies, showcasing the significance of reliable earnings guidance when evaluating potential investment risks.

Frequently Asked Questions

What impact do after-hours trading updates have on stock price movements?

After-hours trading updates provide critical insights into stock price movements, reflecting investor sentiment and market reactions to company earnings reports. For instance, a strong earnings report may lead to significant price increases during after-hours trading, while disappointing results can result in declines.

How do company earnings reports influence after-hours trading updates?

Company earnings reports significantly influence after-hours trading updates, as they provide the latest financial performance data. Positive earnings news can lead to stock price surges, while underwhelming results can trigger drops in market performance after hours.

Where can I find the latest market performance after hours?

You can find the latest market performance after hours through financial news websites, stock market apps, and brokerage platforms that provide real-time data on after-hours trading updates and stock movements.

What factors should investors consider when analyzing after-hours trading updates?

When analyzing after-hours trading updates, investors should consider earnings reports, guidance changes, overall market sentiment, and macroeconomic news that may influence stock behavior in after-hours sessions.

How do after-hours trading updates affect investment news highlights?

After-hours trading updates contribute to investment news highlights by showcasing significant stock movements following earnings announcements or company guidance changes, thus informing investors about potential opportunities or risks in the market.

Can after-hours trading updates lead to long-term investment strategies?

Yes, after-hours trading updates can inform long-term investment strategies by highlighting companies with strong performances or growth potential. Investors should consider these updates in conjunction with overall market trends and company fundamentals.

What are the risks associated with after-hours trading updates?

The risks associated with after-hours trading updates include lower liquidity, potentially higher volatility, and the impact of fewer participants in the market, which can lead to exaggerated price movements.

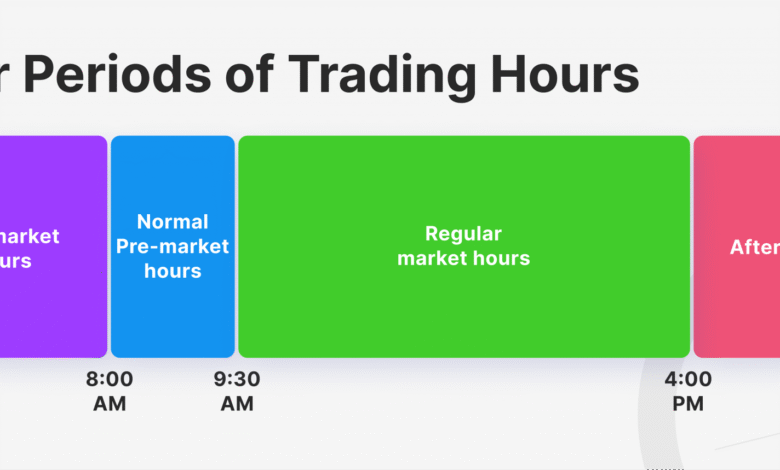

How does market performance after hours differ from regular trading hours?

Market performance after hours often differs from regular trading hours due to lower trading volume and increased volatility, as traders react to earnings reports and economic news that were released after the market closed.

Why do some stocks see drastic changes in price during after-hours trading updates?

Stocks may see drastic changes in price during after-hours trading updates due to investor reactions to earnings reports and guidance that differ from expectations, causing a surge or drop in demand for the stock.

What tools can help track after-hours trading updates effectively?

Investors can use financial news platforms, stock charting tools, and brokerage trading platforms to effectively track after-hours trading updates, providing real-time insights into stock performance and market movements.

| Company | After-Hours Change | Key Points |

|---|---|---|

| Expedia Group | +15% | Exceeded earnings/revenue expectations, raised full-year guidance. |

| Block | +7% | Raised full-year gross profit guidance to $10.17 billion. |

| Akamai Technologies | +3% | Raised adjusted earnings guidance to $6.60-$6.80 per share. |

| Texas Roadhouse | -2% | Reported $1.86 EPS below estimates, but revenue exceeded expectations. |

| Maplebear (Instacart) | +10% | Exceeds earnings/revenue estimates with positive future projections. |

| Solventum | +4% | Reported earnings/revenue above expectations, raised EPS guidance. |

| Synaptics | +2% | Better than expected Q4 results with adjusted earnings of $1.01 per share. |

| Tripadvisor | +5% | Mixed Q2 results; exceeded earnings but missed on revenue expectations. |

| Viavi Solutions | +11% | Surpassed earnings/revenue expectations, guided higher for current quarter. |

| Wynn Resorts | -1% | Reported earnings/revenue below expectations. |

| Take-Two Interactive Software | +4% | Surpassed Q1 revenue expectations, raised annual bookings forecast. |

| Figs | +7% | Reported earnings higher than estimates, exceeding revenue anticipations. |

| -10% | Second-quarter earnings below expectations. | |

| Sweetgreen | -23% | Reported results below expectations, lowered full-year revenue guidance. |

| Yelp | -3% | Narrowed guidance below consensus estimates. |

| Microchip Technology | -6% | Provided guidance that missed Wall Street expectations. |

Summary

After-hours trading updates show significant movements among various companies based on their latest earnings reports. Notably, Expedia Group experienced a remarkable 15% surge after reporting strong Q2 results and raising its full-year guidance. Conversely, companies like Sweetgreen saw a steep decline of 23% after falling short of market expectations. Overall, the after-hours market reflects a mixture of optimism and caution, emphasizing the impact of earnings performance on stock valuations.