AI in Financial Services: FCA Partners with Nvidia for Innovation

AI in financial services is revolutionizing the way banks and financial institutions operate, paving the way for unprecedented efficiencies and innovative solutions. The recent partnership between Nvidia and the UK’s Financial Conduct Authority (FCA) marks a significant shift, offering a Supercharged Sandbox for firms eager to explore the capabilities of artificial intelligence in banking. With improved data access and regulatory support for AI, financial services are poised to enhance customer experiences while ensuring privacy and security. This initiative not only fosters financial services innovation but also encourages firms to safely experiment with advanced AI technologies, addressing longstanding challenges in the industry. As institutions embrace this AI sandbox model, the future of banking looks increasingly brighter with the integration of cutting-edge artificial intelligence.

The intersection of technology and finance is yielding a new era of possibilities, particularly through the integration of advanced machine learning systems in banking operations. As firms experiment with AI technologies, there is a growing demand for frameworks, such as the FCA’s recently introduced Supercharged Sandbox, which facilitates controlled experimentation with artificial intelligence. This regulatory support for AI aims to propel financial services innovation, encouraging institutions to develop robust solutions without compromising privacy. As companies like Nvidia provide the necessary infrastructure, the landscape of financial services is rapidly transforming, prioritizing customer security while navigating the complexities of data handling. Thus, the use of artificial intelligence in banking is becoming a cornerstone for future advancements, addressing both operational hurdles and consumer needs efficiently.

The Role of AI Innovation in Financial Services

Artificial intelligence is rapidly transforming the landscape of financial services worldwide. By enabling banks and financial institutions to analyze vast amounts of data more efficiently, AI can drive innovation and improve customer experiences. The collaboration between Nvidia and the Financial Conduct Authority (FCA) signifies a major step towards adopting AI responsibly, while ensuring that institutions can safely explore groundbreaking tools and technologies. The initiative aims to mitigate risks associated with AI implementation, particularly in areas such as privacy and data security.

Moreover, the FCA’s Supercharged Sandbox is tailored to assist firms that are still in the nascent stages of AI exploration. By providing enhanced regulatory support and technical expertise, the project encourages entities to harness AI without the fear of immediate compliance pitfalls. This approach fosters a nurturing environment for innovation, allowing financial institutions to experiment with artificial intelligence solutions that can enhance their service offerings and operational efficiency.

Regulatory Support for AI in Finance

The introduction of the AI sandbox by the FCA highlights the importance of regulatory support in the financial sector. As financial services institutions strive to implement AI technologies, they must navigate a complex landscape of compliance requirements. The FCA’s initiative provides a structured framework that allows banks to experiment with AI while maintaining compliance with existing regulations. This proactive approach aims to address concerns regarding privacy and fraud, which have become increasingly pertinent as financial services leverage advanced AI tools.

In addition, this regulatory backing is vital for building public trust in AI applications within banking. By ensuring that AI models and systems undergo rigorous testing and meet high standards of regulatory oversight, the FCA’s Supercharged Sandbox aims to alleviate fears around data misuse and security breaches. Such measures reassure consumers that their financial institutions are committed to deploying technology in a responsible manner, paving the way for broader acceptance and implementation of AI in everyday banking transactions.

Harnessing Nvidia’s Technology for Financial Services

Nvidia’s cutting-edge technology is at the forefront of AI innovation, particularly in its partnership with the FCA. By providing advanced graphics processing units (GPUs) and AI enterprise software, Nvidia empowers financial institutions to process and analyze vast data sets more effectively. This technological backing is crucial for banks looking to enhance existing services and develop new AI-driven solutions tailored to customer needs. The collaboration sets a precedent for how technological partnerships can facilitate substantial advancements in the financial sector, particularly in creating AI-driven tools.

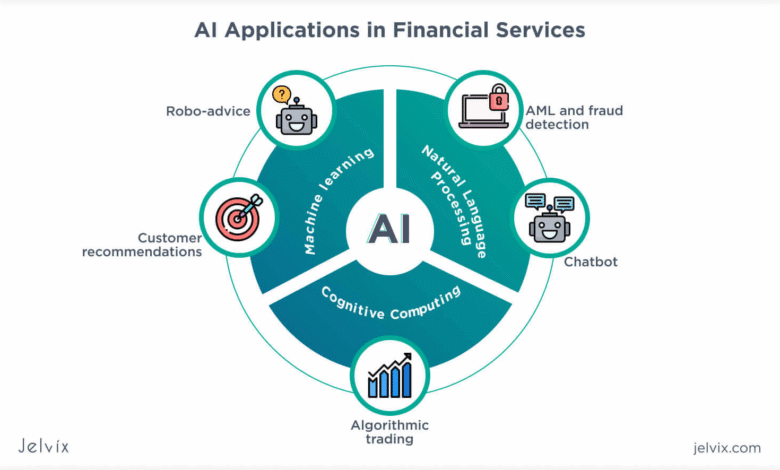

Furthermore, harnessing Nvidia’s robust AI capabilities allows financial services firms to explore machine learning and natural language processing applications in greater depth. This means banks can employ AI to provide personalized customer experiences, automate compliance processes, and even detect fraudulent activities with increased accuracy. As such partnerships flourish, the potential for innovation in the financial services sector grows exponentially, promising a future where AI plays an integral role in driving operational excellence.

The AI Sandbox: Accelerating Financial Services Innovation

The launch of the Supercharged Sandbox represents a significant leap forward in the quest for financial services innovation. By offering a controlled environment for experimentation with artificial intelligence, the FCA aims to remove barriers that have historically hindered progress in adopting new technologies. This sandbox approach allows institutions to test hypotheses and refine their AI models before rolling them out to the wider market, thus minimizing risks associated with untested technologies.

Moreover, as firms engage in the sandbox, they benefit from shared insights and collaborative learning, fostering a community of innovation within the financial sector. Such programs not only encourage creativity but also ensure that institutions adhere to high standards of compliance, which is essential in an industry where trust and security are paramount. The outcomes of these experiments can lead to groundbreaking solutions that redefine how financial services operate and interact with consumers.

Addressing Privacy Concerns in AI Applications

As financial institutions embrace AI technologies, privacy concerns have emerged as a significant challenge. Data privacy remains a top priority for regulators and consumers alike, particularly with the potential for misuse of sensitive personal information. The FCA recognizes these challenges and has tailored its regulatory framework to provide clarity on how data should be handled, ensuring that banks can utilize AI while remaining compliant with privacy regulations.

Furthermore, the partnership with Nvidia aims to equip financial services with the necessary tools to safeguard consumer data effectively. The technology not only enables sophisticated data processing capabilities but also includes mechanisms to monitor data usage and ensure compliance with privacy standards. By addressing these concerns head-on, the FCA’s Supercharged Sandbox fosters confidence among consumers as banks experiment with AI-driven initiatives, ultimately driving greater adoption of innovative financial solutions.

Generative AI and its Implications for Banking

Generative AI has swiftly become a centerpiece in discussions about the future of banking. While it holds tremendous potential for innovation, it also introduces unique compliance challenges that financial institutions must navigate. Recent remarks from industry leaders indicate that there is significant excitement around generative AI; however, there are also concerns regarding its misapplication in fraudulent activities.

The FCA’s initiative to facilitate experimentation with AI through the Supercharged Sandbox includes specific considerations for generative AI. By providing a regulatory framework within which firms can safely explore the capabilities of generative models, the FCA helps institutions mitigate the inherent risks associated with these advanced technologies. This proactive stance encourages innovation while ensuring that compliance remains a priority, thereby fostering a responsible approach to adopting generative AI in banking.

Fostering Economic Growth through AI in Financial Services

The implications of AI adoption extend far beyond improved operational efficiency; it holds the potential to drive significant economic growth within the financial services sector. This growth can occur through enhanced productivity, innovation in financial products and services, and improved customer engagement. The FCA’s Supercharged Sandbox is strategically designed to unlock these possibilities by supporting firms as they explore AI technologies.

Moreover, by facilitating the adoption of AI with adequate regulatory support, the FCA ensures that financial institutions can contribute to a more competitive marketplace. As AI technologies mature and are implemented effectively, they can lead to the development of new services that not only meet but exceed consumer expectations, further stimulating economic activity in the financial sector and beyond.

Challenges of Implementing AI in Banking

While the potential for AI in banking is significant, the path to implementation is fraught with challenges. One major concern is the existing skills gap within the workforce; many financial services firms face difficulties in finding qualified personnel who can manage and deploy AI technologies effectively. Additionally, the rapid pace of AI development presents a constant need for training and upskilling employees to keep up with technological advancements.

Furthermore, regulatory ambiguity surrounding AI can pose hurdles for institutions attempting to innovate. The FCA’s sandbox will help to clarify these regulations, providing a clearer pathway for companies looking to integrate AI into their operations. As banks continue to navigate these complications, initiatives like the Supercharged Sandbox will play a pivotal role in smoothing the transition into a more AI-centric future in financial services.

The Future Outlook for AI in Financial Services

The future of AI in financial services appears promising, with significant opportunities for innovation and growth on the horizon. The FCA’s collaboration with Nvidia is just one example of how financial regulators and technology companies can work together to create a conducive environment for responsible innovation. As AI continues to evolve, its applications in banking will expand, enabling improved customer experiences and more efficient operations.

In addition, as banks overcome current challenges associated with adopting AI, they will likely witness transformative changes in their service delivery models. The integration of AI technologies promises to redefine the customer journey, streamline processes, and enhance risk management. Moving forward, the collaboration and regulatory frameworks established today will lay the groundwork for a robust future where AI plays a central role in financial services.

Frequently Asked Questions

How is the Nvidia partnership with the FCA enhancing AI in financial services?

The partnership between Nvidia and the Financial Conduct Authority (FCA) aims to accelerate AI in financial services by launching the Supercharged Sandbox project. This initiative enables banks to experiment with artificial intelligence by providing improved access to data, technical expertise, and regulatory support, thus fostering innovation while ensuring safety.

What is the AI sandbox and how does it relate to financial services innovation?

The AI sandbox, introduced by the FCA, is a controlled environment where financial services institutions can safely experiment with AI technologies. This sandbox supports financial services innovation by allowing firms to develop AI solutions while addressing regulatory concerns and minimizing risks associated with privacy and fraud.

What regulatory support is provided for AI in the financial services sector?

Regulatory support for AI in financial services is offered through initiatives like the FCA’s Supercharged Sandbox. This project provides guidelines and resources to facilitate safe experimentation with AI, helping firms navigate compliance issues while promoting the responsible use of artificial intelligence within the banking sector.

What challenges do banks face when implementing artificial intelligence in banking?

Banks face several challenges when implementing artificial intelligence in banking, including concerns about privacy, data security, and potential fraud. Additionally, regulatory hurdles and the need for compliance with stringent standards can hinder their ability to roll out advanced AI tools effectively. The FCA’s new sandbox aims to address these challenges by providing a supportive framework.

How does the FCA’s Supercharged Sandbox support banks in their AI development phases?

The FCA’s Supercharged Sandbox supports banks in their AI development phases by offering a platform for firms in the discovery and experiment stages to leverage Nvidia’s advanced AI computing capabilities. This initiative allows banks to test their AI concepts without the usual constraints, fostering innovation in financial services.

What role does Nvidia play in the advancement of AI in financial services?

Nvidia plays a crucial role in the advancement of AI in financial services by providing the necessary hardware and software solutions required to develop and optimize AI models. Their technology supports banks in training powerful AI systems, thus enhancing the overall efficiency and effectiveness of artificial intelligence applications within the financial sector.

What concerns do regulators have regarding AI applications in financial services?

Regulators have expressed concerns about AI applications in financial services mainly related to data privacy and security risks. Specifically, the use of large language models raises questions about how data is processed and stored, and there are apprehensions about the potential misuse of AI technologies for fraud. Regulatory frameworks like the FCA’s sandbox aim to address these concerns.

How can firms leverage AI to benefit financial services markets and consumers?

Firms can leverage AI to innovate financial services by developing personalized products, enhancing customer service through chatbots, streamlining operations, and improving risk assessment. By utilizing the tools and support provided by initiatives such as the FCA’s Supercharged Sandbox, firms can create solutions that increase market efficiency and offer better services to consumers.

| Key Points | |

|---|---|

| New Partnership with Nvidia | The FCA announced a collaboration with Nvidia to assist banks in safely experimenting with AI. |

| Launch of Supercharged Sandbox | A project aimed at improving data access, technical expertise, and regulatory support for financial services. |

| Experimentation Framework | Starting in October, UK financial institutions can experiment with AI using Nvidia’s technology. |

| Target Audience | Designed for firms in the discovery and experiment phase of AI development. |

| Privacy and Compliance Concerns | Banks face difficulties due to privacy issues and the risk of AI being used for fraud. |

| Regulatory Support | The FCA aims to help firms leverage AI to benefit markets while fostering economic growth. |

| Generative AI Risks | Generative AI tools come with distinct compliance risks as highlighted by industry experts. |

Summary

AI in financial services is transforming the industry, as evidenced by the FCA’s new partnership with Nvidia aimed at fostering safe experimentation with AI technologies. This initiative signifies a structural shift, providing financial institutions with the means to innovate while addressing critical issues like privacy and compliance risks. By integrating advanced AI capabilities through the Supercharged Sandbox, banks can explore new solutions that could enhance customer experiences and drive economic growth.