AI in Wealth Management: Revolutionizing Advisory Services

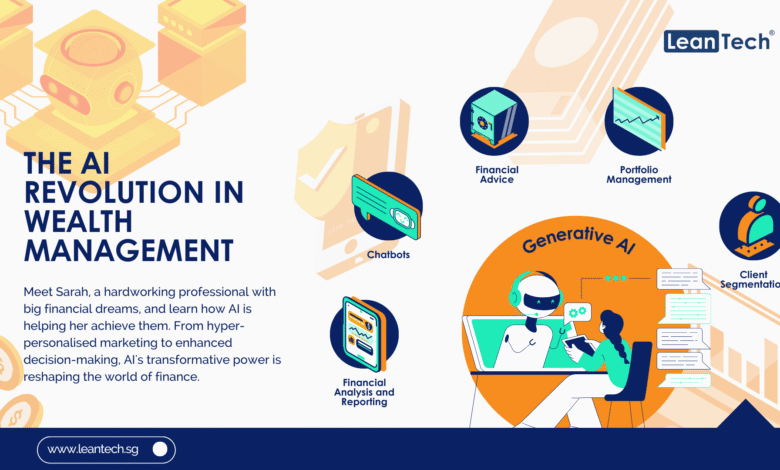

AI in wealth management is revolutionizing how financial advice is delivered, marking a significant shift in the advisory landscape. With the emergence of autonomous financial advisors powered by advanced wealth management technology, clients can now enjoy personalized financial advice tailored to their unique needs. This technological advancement allows financial advisors to enhance their productivity and focus on strategic planning while AI handles routine tasks, providing a more efficient service. As AI for financial planning evolves, it enables firms to streamline operations, ensuring that clients receive timely and responsive solutions. The result is a more democratized advisory model, where quality financial guidance is accessible to a broader audience, including middle-income families who previously faced barriers to entry.

The integration of artificial intelligence in financial advisory services is ushering in a new era of wealth management practices. By utilizing intelligent systems and autonomous agents, wealth managers can provide highly customized solutions that cater to the diverse needs of their clients. This advancements not only enhances the role of financial professionals but also transforms the entire advisory framework, making it more adaptive and efficient. As a result, individuals seeking financial guidance can anticipate real-time adjustments to their investment plans and receive expert insights at a fraction of traditional costs. This shift signals a promising future in which advanced technology empowers more investors to access high-quality financial advisory services.

The Rise of AI in Wealth Management

AI in wealth management is not just a trend; it marks a critical turning point in how financial advising is conducted. By integrating advanced autonomous systems into their practices, financial advisors can leverage technology to provide more personalized financial advice and services. This AI-driven approach allows advisors to analyze vast datasets quickly, identifying client patterns and preferences that would otherwise remain unnoticed. As a result, clients receive bespoke financial strategies that are tailored to their current circumstances, life goals, and market dynamics.

Moreover, the operational efficiencies gained through AI technology catalyze a radical restructuring of traditional advisory firms. Automated client onboarding processes and intelligent portfolio management systems not only reduce operational costs but also allow human advisors to focus on strategic, high-value engagement with clients. This transformative impact leads to a leaner operational model and significantly improves the overall client experience, making it truly responsive and engaging.

Personalized Financial Advice Revolutionized

The future of financial planning lies in hyper-personalized advice made possible by AI technologies. Utilizing machine learning and data analytics, autonomous financial advisors can construct real-time financial plans that adjust as clients’ lives evolve. This means that clients receive immediate support and adjustments to their financial strategies, whether it’s a sudden market fluctuation or a significant life event like a job change or family addition.

Such advancements in personalized financial advice will democratize access to quality financial planning, especially for demographics that have traditionally faced barriers, like middle-income families. Due to the reduction in costs associated with advisory services through efficient AI tools, a broader array of clients can access professional advice, significantly altering the financial planning landscape. This shift ensures that robust financial strategies are available to a more diverse population, empowering individuals with the knowledge and support necessary for informed financial decisions.

Frequently Asked Questions

How is AI in wealth management changing the role of financial advisors?

AI in wealth management is redefining financial advisory roles by supporting a model where a single advisor can be augmented by multiple autonomous AI agents. These AI tools assist in client onboarding, portfolio management, and delivering personalized financial advice, thereby allowing human advisors to focus on strategic planning and building client relationships.

What benefits can clients expect from using financial advisor AI for their wealth management needs?

Clients can expect to receive hyper-personalized financial advice tailored to their unique circumstances and real-time market conditions. AI enables faster, more responsive advisory services, allowing clients to gain insights and adjustments to their financial plans immediately, resulting in an overall more integrated and effective experience.

What technological advancements are included in wealth management technology powered by AI?

Wealth management technology powered by AI includes tools for automating routine operational tasks like data management, compliance reporting, and portfolio tracking. These advancements enhance operational efficiency, reduce costs, and improve the quality of advice delivered to clients, making it accessible to a wider audience.

How does personalized financial advice improve with the introduction of AI in wealth management?

AI enhances personalized financial advice by analyzing vast amounts of data to create tailored financial plans that evolve with market changes and personal life events. This level of personalization ensures that investors receive timely and relevant financial insights, improving their overall financial decision-making.

Can AI for financial planning help to democratize access to financial advice?

Yes, AI for financial planning can democratize access to wealth management by significantly lowering the costs of delivering quality financial advice. This enables firms to serve a broader demographic, particularly benefiting middle-income families and younger generations who previously faced barriers to accessing personalized financial planning services.

What are the implications of autonomous financial advisors on the future of wealth management firms?

The rise of autonomous financial advisors suggests a shift towards leaner operations within wealth management firms, where technology replaces many traditional operational roles. This change could empower a single advisor to effectively manage hundreds of clients, potentially disrupting the industry and challenging existing forecasts of advisor shortages.

How might the structure of wealth management firms change due to AI integration?

With AI integration, wealth management firms may see a consolidation of market share towards larger firms that utilize superior technology, while smaller firms could become more specialized and lucrative through the adoption of AI. Consequently, this could lead to a more competitive landscape with both larger firms and new, tech-driven boutique players.

What challenges do wealth management firms face in adopting AI technologies?

Wealth management firms face challenges in adopting AI technologies, including the need for significant investment in technology and a shift in operational mindset. Slow or superficial integration of AI could be detrimental to these firms, as the industry trends towards rapid advancements in productivity and service delivery.

What is the potential for AI in rethinking client-advisor ratios in wealth management?

AI has the potential to dramatically rethink client-advisor ratios in wealth management, enabling a single AI-enhanced advisor to effectively manage the needs of hundreds of clients. This creates a non-linear capacity increase compared to traditional models, which typically cannot serve more than a limited number of clients without compromising service quality.

| Key Point | Description |

|---|---|

| Regime Change in Productivity | AI will fundamentally reshape wealth management, creating an ecosystem where a single advisor is supported by AI tools. |

| ‘RIA of 1’ Concept | A model where individual advisors can manage more clients with the help of autonomous AI applications. |

| Enhanced Efficiency | AI tools will drastically improve client onboarding, service, and portfolio management. |

| Cost Reduction | Lower costs in providing advice will make high-quality financial planning accessible to broader demographics. |

| Client Benefits | Investors will receive personalized advice that adjusts in real-time to their needs. |

| Implications for Advisors | AI-empowered advisors will serve significantly more clients without sacrificing personal attention. |

| Industry Disruption | The structure of advisory firms will change, affecting small versus large RIA dynamics. |

| Future Outlook | The success and competitiveness of firms will depend on the effective integration of AI in their operations. |

Summary

AI in wealth management is set to revolutionize how financial advisory services are delivered. By enabling a single advisor to efficiently manage hundreds of clients through autonomous tools, the industry will see unprecedented productivity and accessibility. This shift not only enhances the quality of advice but also democratizes access to financial planning for middle-income families and younger generations. As AI continues to reshape the advisory landscape, firms that embrace these technologies will thrive, while those that hesitate may fall behind.