AI Software Investment Set for a Golden Age Today

AI software investment is rapidly becoming a focal point for savvy investors looking to capitalize on the transformative power of technology. As renowned analyst Dan Ives from Wedbush Securities highlights, the software segment of artificial intelligence is currently enjoying what many are calling a ‘golden age.’ This means there are significant opportunities for investing in software companies that are innovating and reshaping the tech landscape through artificial intelligence. With the launch of his artificial intelligence ETF, Ives is leading the charge, targeting stocks that hold potential within this AI revolution. Companies like Oracle, which he predicts will become central to AI developments, are among the promising choices for those interested in aligning their portfolios with the future of technology.

The investment landscape around machine learning tools and intelligent software solutions is witnessing unprecedented growth, driven largely by the evolving demands of the tech industry. This sector, often termed as the frontier of artificial intelligence advancement, is characterized by a shift in how businesses integrate AI technologies to thrive. Notably, specialists like Dan Ives have been pivotal in guiding investors towards promising assets within this realm, emphasizing the importance of selecting robust software entities. The narrative surrounding technology investments is no longer limited to conventional names; rather, it embraces a broad spectrum of innovative companies. As we delve deeper into the strategies for capitalizing on software-oriented AI advancements, understanding this dynamic market becomes vital for both new and experienced investors.

The Rise of AI Software Investment

As we delve into the realm of artificial intelligence, the subcategory of software is emerging as a key player, as highlighted by Dan Ives of Wedbush Securities. Known for launching an artificial intelligence ETF, Ives emphasizes that we are currently in a ‘golden age’ for AI software investment. This statement reflects the substantial growth and innovation happening in the software sector, which is expected to facilitate numerous applications of AI in both consumer and enterprise markets. The focus on software goes beyond just identifying companies that label themselves as AI-driven; it involves discerning which businesses are genuinely pioneering the next wave of technological advancement.

Investing in AI software provides a unique opportunity as companies harness the power of machine learning and data analytics to enhance their offerings. For instance, industry giants like Oracle and Palantir are at the forefront of this AI revolution, showing significant stock performance and market interest. With Ives’ assertion that the market may be underestimating the potential growth in the sector, now could be the ideal time for investors to consider AI software as a viable and transformative investment.

Dan Ives and the AI Revolution

Dan Ives, a long-time tech analyst, has positioned himself as a leading voice in the AI revolution through his insights and strategic investments. His recent initiative, the Dan Ives Wedbush AI Revolution ETF, is aimed at transforming how investors approach the AI landscape. Ives believes that the convergence of software and AI will redefine multiple industries, creating lucrative opportunities for those who can identify the right players. By concentrating on a diversified portfolio that includes not just the ‘big names’ but also emerging tech firms, Ives provides a roadmap for investors wanting to tap into this dynamic market.

Ives’ emphasis on research and data-driven analysis sets his approach apart in a crowded marketplace. He advocates for a holistic view of the AI industry, stressing the importance of understanding which companies are genuinely making advancements in AI technology. As he continues to track and reassess AI-related stocks every quarter, Ives empowers investors with knowledge and insight necessary to navigate the rapidly evolving AI space.

Oracle’s Role in the AI Landscape

According to Dan Ives, Oracle is poised to be the epicenter of AI software developments in the upcoming year. With shares already rising by nearly 62%, it is clear that investor sentiment aligns with Ives’ predictions. As Oracle invests heavily in enhancing its AI capabilities, it becomes a critical player in the market ripe for investment. The company’s commitment to integrating AI across its platforms positions it as a robust option for investors looking to capitalize on this technological shift.

Moreover, Oracle’s strategic partnerships and advancements in AI analytics and cloud technology further cement its position in the market. As industries increasingly turn to cloud computing coupled with AI innovations, Oracle’s growth trajectory may continue positively. This essential role in driving AI applications makes Oracle not just an investment opportunity but a cornerstone of the AI evolution championed by Ives, aligning perfectly with broader trends in the tech investment landscape.

Investing in Artificial Intelligence ETFs

Artificial Intelligence ETFs are emerging as a comprehensive solution for investors aiming to tap into the burgeoning AI sector. With the Dan Ives Wedbush AI Revolution ETF at the forefront, investing in these funds provides an efficient pathway for engaging with multiple AI-focused companies without the need for individual stock selection. Ives’ ETF includes a range of equities, from established giants like Microsoft and Nvidia to smaller innovators, highlighting the diversity within the AI investment landscape.

Moreover, the growth in AI ETFs is indicative of a larger trend where investors seek exposure to sectors that promise expansive growth potential. These funds not only provide access to key market players but also allow for dynamic adjustments as Ives reassesses the AI 30 stocks quarterly, ensuring that the portfolio remains aligned with the continually evolving dynamics of the AI revolution. Consequently, investors can maximize their returns while mitigating individual stock risks.

The Importance of Research in AI Investing

Conducting thorough research is crucial for success in AI investing, particularly when navigating areas as rapidly changing as artificial intelligence. Dan Ives advocates for a systematic approach that involves examining the authenticity and capabilities of companies claiming to be AI-focused. This rigorous due diligence allows investors to distinguish between genuine innovators and those merely riding the AI wave with superficial claims.

By staying informed on market trends and technological advancements, investors can better position themselves to capitalize on opportunities, especially within the AI software landscape. Ives’ dedication to research exemplifies how a data-driven mindset can enhance investment decisions, ultimately leading to successful outcomes in a market defined by frequent fluctuations and emerging technologies.

Identifying Emerging AI Players

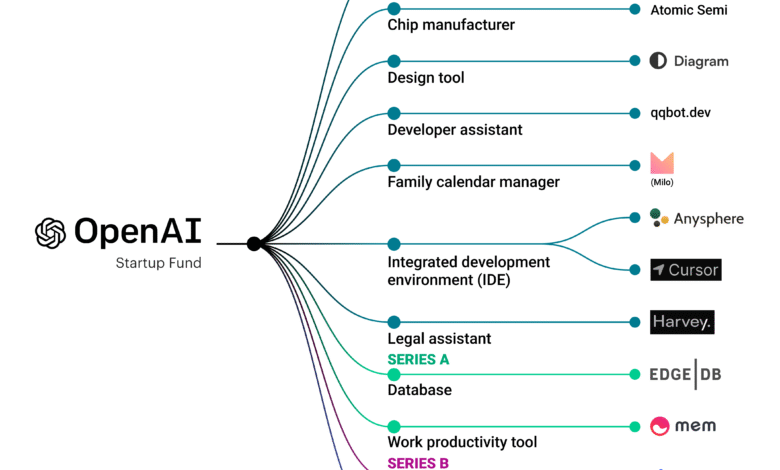

While market attention often gravitates toward established tech giants, Dan Ives encourages investors to look for emerging players in the AI space. His philosophy suggests that some of the most transformative advancements will come from companies that are not yet recognized as AI leaders but are making significant strides in innovation. This creates a rich opportunity for investors willing to take calculated risks on lesser-known stocks that may offer substantial returns.

Emerging AI players, such as SoundHound and Innodata, underscore the potential for breakthrough technologies that could reshape industries and consumer experiences. By diversifying portfolios with these companies, investors can not only hedge against downturns among major players but also tap into the exciting possibilities that such startups represent within the evolving landscape of artificial intelligence.

The Future of AI Investments

Looking ahead, the future of AI investments appears bright, with analysts like Dan Ives paving the way for a more profound understanding of the sector. As AI technology permeates every aspect of business and life, the stock market is likely to reflect these changes through increased valuations and new investment opportunities. Strategic investments in AI software, as outlined by Ives, could yield significant results as the technology continues to mature and integrate into various industries.

As the marketplace evolves, investors must remain agile and informed about trends that could influence AI-related stocks. This adaptability will be key to capitalizing on the ongoing AI revolution, ensuring that investors are well-equipped to harness the full potential of this transformative technology.

AI Investment Strategies for Success

Developing effective investment strategies in the AI domain requires a blend of foresight, research, and flexibility. Dan Ives emphasizes the need for investors to adopt a theme-oriented approach, focusing on not just the obvious tech giants but also promising up-and-comers and niche players in the software sector. By positioning themselves strategically across a diverse range of AI stocks, investors can mitigate risks and enhance their chances of success.

Incorporating various perspectives and analyses, from industry reports to technological forecasts, can further refine investment strategies. This multifaceted approach helps in recognizing trends indicative of the AI software landscape’s evolution, which may not be immediately apparent. Investing in AI with a keen eye on broader contexts can ultimately yield more favorable outcomes for those looking to engage with this exciting sector.

Transforming Traditional Industries with AI

Artificial Intelligence is not merely confined to tech companies; it is increasingly transforming traditional industries. From healthcare to finance, AI has the potential to enhance operational efficiencies, improve customer experiences, and drive innovation. Dan Ives notes that the invigorating impact of AI is not just on known entities but also on sectors that are adopting AI technologies to transform their service delivery and business models.

As industries adapt to harness the power of AI, investment opportunities also expand. Companies that embrace AI technologies often enjoy improved productivity and competitiveness, making them appealing targets for investors looking for growth. By understanding how AI can enhance operations across various sectors, investors can place their bets on businesses that leverage AI to gain a significant market advantage.

Frequently Asked Questions

What are the top considerations when investing in AI software?

When investing in AI software, it’s crucial to consider the company’s actual use cases for artificial intelligence, not just their branding. Evaluate their technology, market position, and expertise in AI applications. Analysts like Dan Ives highlight the importance of understanding the core innovations within the AI revolution and which companies are truly at the forefront.

How does Dan Ives view the current state of AI software investments?

Dan Ives describes the current state of AI software investments as a ‘golden age,’ suggesting that significant opportunities exist within this sector. His insights emphasize that although many firms may claim to be AI-centric, rigorous analysis is necessary to identify true players in the AI revolution.

What is the Dan Ives AI Revolution ETF and why is it significant for AI software investors?

The Dan Ives AI Revolution ETF, trading under the ticker IVES, focuses on stocks transforming the AI landscape. It offers investors an opportunity to gain exposure to companies at the forefront of the AI revolution. With strategic holdings in software giants like Oracle and Palantir, the ETF is designed to capture the rapid growth of AI technologies.

What role do companies like Oracle play in the AI software market?

According to Dan Ives, Oracle is predicted to be at the ‘epicenter’ of the AI software market, suggesting that its advancements in AI technology will significantly influence the sector. Investors looking at AI software should monitor Oracle’s developments closely as it is a critical player in shaping the future of artificial intelligence investments.

How can investors safely invest in AI software with ETFs?

Investing in AI software through ETFs, such as the Dan Ives AI Revolution ETF, can mitigate risk by diversifying holdings across multiple companies involved in artificial intelligence. ETFs allow investors to engage with the AI landscape without needing to pick individual stocks, streamlining the investment process while still capturing the potential high returns of the AI revolution.

What companies are currently top performers in the AI software ETF space?

As of now, top performers in the Dan Ives AI Revolution ETF include Microsoft, Nvidia, and Broadcom. These companies have demonstrated strong growth and innovation in AI technologies, making them attractive options for investors looking to benefit from the ongoing AI software investment boom.

What should investors know about the growth potential of AI software companies?

Investors should be aware that the growth potential of AI software companies is significant. Dan Ives notes that the market is currently underestimating potential growth tied to the AI revolution. Companies at the forefront of AI innovation are likely to experience rapid expansion, making them worthwhile investments for those looking to capitalize on technological advancements.

How often does the Dan Ives AI ETF reassess its holdings?

The Dan Ives AI Revolution ETF reassesses its holdings on a quarterly basis. This regular evaluation allows the fund to include emerging names that become relevant in the AI context, ensuring that investors are part of the evolving landscape of AI investments.

| Key Point | Details |

|---|---|

| Dan Ives’ Insight | Identifies software as crucial in AI ‘golden age’ and warns of distinguishing true AI players. |

| Wedbush AI Revolution ETF | Launched by Ives to focus on transformative AI stocks, trading under IVES. |

| Predictions for Major Players | Oracle predicted to be central to AI theme in next year, with significant gains seen in other stocks like Palantir. |

| Diversification of Holdings | IVES consists of 30 companies across various sectors related to AI. |

| Investor Engagement | Research aims to guide investors on how to invest in AI, making it accessible to all. |

| Performance and Management | As of launch, IVES has $183 million in assets, with planned quarterly reassessment of holdings. |

| Valuation Perspective | Ives emphasizes the significance of transformational tech investments beyond current valuations. |

Summary

AI software investment is gaining immense attention as we enter a “golden age” for the sector, according to expert Dan Ives of Wedbush Securities. His focus on software within the AI landscape indicates a transformational shift that is essential for investors to understand. With significant growth projected and a focus on various companies that exemplify AI potential, Ives’ approach offers a nuanced strategy for those looking to navigate the burgeoning field of AI investments.