AI Stocks: Top Picks for Investors in 2023

AI stocks are emerging as a focal point for investors aiming to capitalize on the transformative era of artificial intelligence. With the investment landscape evolving rapidly, AI investment opportunities are abundant, particularly as the best AI companies continue to innovate. Analysts predict that the future of AI stocks will be shaped by substantial funding, with tech giants like Alphabet and Amazon planning to channel billions into AI technology investments. These trends suggest that AI in finance and other sectors could yield unprecedented returns. As the demand for advanced AI solutions skyrockets, savvy investors are positioning themselves ahead of the curve.

Investing in stocks related to artificial intelligence is becoming increasingly attractive, especially amidst the rising interest in cutting-edge technologies. As the market shifts, those looking into technological advancements will likely encounter a wealth of prospects. The trend towards investing in intelligent systems and automation solutions shows that many of the top performers in the tech industry are exploring innovative applications. Financial analysts agree that the potential growth in this sector makes AI-driven assets compelling for forward-thinking investors. As this financial landscape evolves, keeping an eye on leading firms in AI could prove vital for achieving substantial investment success.

The Rise of AI Stocks in 2024

As the AI landscape expands, 2024 is shaping up to be a pivotal year for AI stocks. The increasing commitment from major tech companies signals a robust growth trajectory, as investments in AI technology continue to soar. With industry leaders like Microsoft, Alphabet, and Amazon pledging billions towards AI infrastructure, the opportunities for investors are likely to grow exponentially. This investment influx is aligning perfectly with the anticipated advancements in AI technology that promise to revolutionize various sectors, including finance, healthcare, and e-commerce.

Moreover, AI stocks are now being viewed as a crucial element of a diversified investment portfolio. The potential for these companies to drive innovation and improve operational efficiencies presents a unique opportunity for both new and experienced investors. They are not just investing in a trend; they are aligning themselves with the future of technology and exploring long-term gains in performance. As AI invests in streamlining processes and enhancing productivity across industries, the proliferation of these technologies will have lasting impacts, ensuring that AI stocks remain at the forefront of investment discussions.

Investment Opportunities in Generative AI

Generative AI is at the core of the current investment boom, offering numerous opportunities for savvy investors. As stated by John Belton, portfolio manager at Gabelli Funds, this trillion-dollar investment cycle is just beginning. Companies are actively exploring generative AI’s capabilities in areas such as content creation, data analysis, and logistics improvements. Investors who position themselves early in these companies have the potential to see significant returns as businesses increasingly adopt these technologies for enhancing productivity and reducing costs.

The implications of investing in generative AI extend beyond immediate financial returns. These technologies are set to transform not only company operations but also consumer experiences. For instance, AI could personalize marketing efforts, improving engagement and conversion rates while simultaneously driving up revenues. As the capabilities of generative AI expand, the types of use cases will also multiply, presenting ongoing opportunities for growth. Investors should keenly observe companies leveraging these advancements, ensuring they align with the best AI investment opportunities for their portfolios.

Frequently Asked Questions

What are the best AI stocks to invest in right now?

Some of the best AI stocks currently include key players like Microsoft, Nvidia, and Amazon, which are heavily investing in AI infrastructure and technology. Portfolio managers such as those at Gabelli Funds highlight these companies for their strong potential returns from AI investments.

What should I know about AI investment opportunities in 2023?

In 2023, AI investment opportunities are expanding rapidly, with top tech firms expected to spend around $1 trillion on AI. This represents a significant growth cycle, particularly in generative AI, presenting appealing prospects for investors looking to capitalize on advancements in AI technology.

How is generative AI influencing the future of AI stocks?

The future of AI stocks seems promising due to the growing adoption of generative AI technologies. Companies investing heavily in AI, such as Alphabet and Microsoft, are already seeing substantial returns, suggesting a robust market for AI stocks as corporate productivity can significantly increase with better AI tools.

Why are some tech companies overspending on AI technology investments?

Some investors are concerned that tech companies may be overspending on AI technology investments without immediate returns. However, portfolio managers believe that as AI capabilities improve and costs decrease, the long-term benefits will justify initial expenditures.

How can AI in finance impact stock investments?

AI in finance is revolutionizing stock investments by enhancing data analysis and decision-making processes. Financial firms leveraging AI technologies, like those mentioned by Gabelli Funds, are experiencing improved efficiencies and potentially higher returns, which could positively influence AI stocks.

What role do the ‘Magnificent Seven’ play in AI stocks?

The ‘Magnificent Seven’ refers to seven major tech companies, including Microsoft, Nvidia, and Amazon, that are at the forefront of AI technology investments. Their significant capital expenditures and advancements in AI are seen as critical drivers for the future performance of AI stocks.

Which sectors are most likely to benefit from AI stocks in the coming years?

Sectors such as healthcare, automotive (e.g., Tesla’s autonomous vehicles), and advertising (e.g., Meta Platforms’ targeted ads) are expected to benefit significantly from AI stocks. Companies implementing AI technologies for efficiency and cost-saving measures will likely see improved financial performance.

How do AI stocks fit into a diversified investment portfolio?

AI stocks are an excellent addition to a diversified investment portfolio as they are part of a rapidly growing sector with substantial long-term potential. Investing in established companies that are pioneers in AI, like those highlighted by Gabelli Funds, can help mitigate risks while capitalizing on AI market trends.

| Key Points | Details |

|---|---|

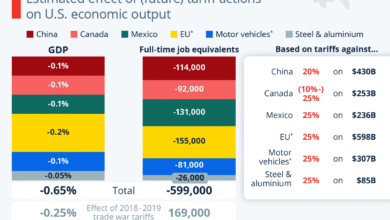

| Investment Cycle | The trillion-dollar investment cycle into generative AI is just beginning, with substantial investment expected in AI infrastructure. |

| Companies Planning Investments | In 2025, Google, Amazon, Meta, and Microsoft plan to invest up to $320 billion in AI and related technologies. |

| Investor Sentiment | Early investments are showing results, yet the full potential of generative AI is not recognized by all investors. |

| Top Performing Holdings | The Gabelli Growth Fund holds significant shares in ‘Magnificent Seven’ companies, with Microsoft, Nvidia, and Amazon performing well. |

| Optimism for AI | Costs are decreasing while capabilities are improving, leading to further corporation productivity and labor replacement. |

| Emerging Use Cases | AI is being used across sectors including advertising, autonomous vehicles, and healthcare. |

| Specific Investment Insights | ServiceNow and Broadcom among key companies identified to benefit from the AI trend. |

Summary

AI stocks are at the forefront of a significant investment movement as companies rapidly adopt and integrate artificial intelligence into their operations. With major players like Google, Amazon, and Microsoft investing billions, the landscape for AI investment is evolving quickly. As costs decrease and capabilities increase, the potential for AI to drive corporate productivity and innovation is immense. Investors are encouraged to keep an eye on rising stocks in this sector, particularly those identified by experts, as AI stocks represent a promising avenue for growth in the coming years.