Altcoin Season: Coinbase Set for September Surge

As the crypto landscape continues to evolve, the emergence of altcoin season signals an exciting period for investors and traders alike. According to a recent report from Coinbase, multiple factors such as increasing liquidity, regulatory clarity, and positive macroeconomic momentum are converging to set the stage for a rally in alternative cryptocurrencies. With a notable shift in market dynamics expected by September, analysts foresee a significant capital rotation from Bitcoin to altcoins, contributing to an overall bullish sentiment. The September crypto outlook is particularly promising, as Ethereum and other altcoins have demonstrated strong price action, attracting greater institutional interest. In light of these trends, understanding the effects of regulatory impacts on altcoins will be crucial for navigating this transformative phase in the cryptocurrency market.

In the realm of digital assets, the phenomenon popularly referred to as ‘altcoin season’ heralds a time of intensified activity and potential profit for investors focusing on cryptocurrencies outside of Bitcoin. This shift in attention to alternative digital currencies often coincides with favorable market conditions, including a surge in liquidity and favorable regulatory developments. Notably, as we approach the upcoming months, seasoned analysts are closely monitoring crypto market trends that may indicate a substantial rotation toward these altcoins, particularly Ethereum and its network of affiliated tokens. A comprehensive analysis of September’s market outlook demonstrates robust growth potential as stakeholders anticipate an influx of investment. Furthermore, the impact of regulatory clarity on these alternative assets could play a pivotal role in shaping their future trajectory.

Understanding the Upcoming Altcoin Season

As we approach September, indicators suggest a potential altcoin season is on the horizon. Recent analysis from Coinbase highlights a shift in trading dynamics, as increased liquidity, clearer regulatory frameworks, and favorable macroeconomic conditions converge to create an environment ripe for altcoin growth. With Bitcoin’s market dominance waning, capital seems to be shifting into altcoins, providing new opportunities for investors looking to diversify their portfolios. The anticipation of an altcoin season is fueled by a significant uptick in altcoin market capitalization, which has surpassed $1.4 trillion since early July, signalling renewed investor interest outside of Bitcoin.

Regulatory clarity also plays a vital role in this upcoming altcoin season. With the U.S. Securities and Exchange Commission (SEC) providing more defined guidance, institutions are more willing to enter the altcoin space, leading to potential explosive growth. As noted in Coinbase’s report, the anticipated regulatory progress is bolstering institutional confidence. Moreover, as we see the Altcoin Season Index approach critical thresholds, retail investors may also feel emboldened to engage with altcoins, creating a ripple effect that could accelerate the overall market trend.

Coinbase’s Insights on Crypto Market Trends

Coinbase’s recent outlook report titled “Altcoin Season Cometh” emphasizes not just the revival of altcoins but the broader trends affecting the entire crypto market. This includes macroeconomic conditions that have shown promise as economic indicators improve. Additionally, Coinbase has noted a significant resurgence in liquidity metrics, highlighted by increased stablecoin issuance and spot trading volumes. These trends indicate a growing appetite for both altcoins and Bitcoin as confidence returns to the market. Thus, investors can expect a revitalized approach to their trading strategies, particularly as liquidity remains plentiful.

Furthermore, Coinbase’s analysis touches on the macroeconomic factors influencing cryptocurrency investments. The report suggests that the M2 money supply—essentially the total amount of money in circulation—has a predictive relationship with Bitcoin price movements. As we move later into Q3 and into Q4, increased money supply could unlock greater retail participation in the crypto space, ultimately bolstering altcoin performance. Understanding these trends will not only help investors forecast potential movements in the altcoin market but also aid in making informed decisions.

Ethereum’s Central Role in the Altcoin Landscape

Ethereum (ETH) continues to assert itself as a cornerstone of the altcoin ecosystem as institutional investment flows into digital assets grow. According to Coinbase’s report, several institutional treasuries are holding substantial amounts of ETH, underlining its importance as a vehicle for altcoin investment. With over 2.95 million ETH in institutional holdings, representing more than 2% of the total supply, Ethereum drives development and investment in complementary altcoins, particularly those with ties to its blockchain.

The recent price action of high-beta tokens associated with ETH, such as LDO, illustrates the heightened activity surrounding Ethereum-based projects. The SEC’s viewpoint on liquid staking has further bolstered investor confidence, providing a stable foundation for tokens reliant on Ethereum’s network. As these altcoins leverage Ethereum’s smart contract capabilities, they are likely to experience heightened volatility and potential for growth as the altcoin season unfolds.

Macroeconomic Conditions Impacting Altcoin Prices

A comprehensive understanding of macroeconomic conditions is essential in navigating the altcoin market. Coinbase’s report indicates that favorable economic indicators, such as a stimulating monetary policy, can significantly enhance the performance of altcoins. As the Federal Reserve potentially implements easing measures, increased liquidity could create better conditions for robust altcoin trading and investing, making September an intriguing month for altcoin season.

Moreover, the current landscape points to investors migrating towards altcoins as a hedge against traditional market fluctuations. With Bitcoin’s dominance declining, many view altcoins as viable alternatives that present opportunities for higher returns. This shift is particularly evident among younger investors and retail participants eager to explore diverse altcoin options as market confidence regains traction. Keeping a pulse on economic developments will be critical for those participating in the upcoming altcoin season.

The Impact of Regulatory Developments on Altcoins

Regulatory clarity has become a significant factor influencing the potential success of altcoins. Coinbase’s insights highlight a growing comfort with altcoin investments as the SEC continues to provide definitive guidelines. This clarity not only reassures institutional investors but also encourages retail participants to venture into less-established altcoins without the concern of regulatory complications. As we look towards September, an uptick in regulatory support is poised to foster a more welcoming environment for altcoin traders.

In addition, the regulatory framework surrounding cryptocurrencies will likely evolve as more altcoins gain traction and investor interest. This evolution could inadvertently lead to a harmonization of rules that benefits the sectors within the blockchain ecosystem. As rules become clearer, we can expect a surge of innovation and investment in altcoins, further solidifying this period as a quintessential altcoin season.

Identifying Promising Altcoins Ahead of September

With the wave of altcoin momentum building, identifying promising altcoins is crucial for maximizing gains as we near September. Investors should pay attention to cryptocurrencies that are not only backed by strong fundamentals but have shown resilience through recent market fluctuations. Tokens like LDO and other high-beta assets connected to Ethereum could benefit significantly from the anticipated regulatory easing and increased liquidity, making them prime candidates for investment in the developing altcoin season.

Moreover, thorough analysis of altcoin fundamentals, such as market capitalization, liquidity metrics, and technological innovation will provide critical insight for investors. As the crypto market manages to attract more institutional funds, newer altcoins are likely to emerge as substantial players in this upcoming market wave. Navigating through this landscape requires careful consideration of both macro and token-specific factors.

The Role of Market Sentiment in Altcoin Rally

Market sentiment plays a pivotal role in the performance of altcoins, especially as the landscape prepares for a potential altcoin season. As Coinbase points out, the general mood around cryptocurrencies can shift dramatically, influencing not only the prices of Bitcoin but also of altcoins that follow its lead. Increased optimism following regulatory clarity and macroeconomic improvements may encourage a bullish sentiment, leading to a significant rise in altcoin investments.

Understanding market sentiment indicators—such as trading volume and social media trends—can help investors gauge when to enter or exit positions in altcoins. As we enter September, keeping an ear to the ground for market sentiment can provide necessary insights, ensuring that investors capitalize on the anticipated altcoin rally. Those who can discern bullish signals early on may find themselves at the forefront of this exciting market development.

Preparing for the Altcoin Season: Strategies for Investors

As we gear up for what is anticipated to be an explosive altcoin season, savvy investors should consider refining their strategies. Diversification remains a key strategy, spreading risk across various altcoins that show promise based on recent market analyses. Additionally, staying informed on trends and developments within the altcoin space will position investors to adapt swiftly to market movements as liquidity becomes more abundant.

Moreover, setting realistic goals based on market analysis is essential in establishing a successful investment strategy for altcoins. By leveraging insights from Coinbase and other trusted sources, investors can make informed choices that balance short-term gains with long-term potential. Finally, maintaining a disciplined approach will enable participants to navigate the frequently volatile altcoin market effectively, optimizing their engagement during this anticipated altcoin season.

The Future of Altcoins Post-September

Looking past September, the future of altcoins appears promising as broader trends take shape. If regulatory clarity continues to improve and macroeconomic conditions remain favorable, many analysts predict sustained growth for altcoins well into late 2023 and beyond. This resilience could foster a more innovative landscape where altcoins not only thrive but expand into new applications and functionalities within the crypto space.

Furthermore, as institutional investment becomes more commonplace in altcoins, we may see an influx of new projects aiming to meet the demands of a growing market. This influx could lead to increased competition, fostering innovation, and resulting in a richer ecosystem of altcoins. Ultimately, the future of altcoins seems intricately tied to ongoing developments in regulations, market demand, and technological advancement, setting an exciting stage for years to come.

Frequently Asked Questions

What is an altcoin season and how does it relate to crypto market trends?

Altcoin season refers to a period when alternative cryptocurrencies, or altcoins, significantly outperform Bitcoin in terms of price appreciation. This phase typically occurs when the general crypto market shows favorable trends, often driven by surging liquidity, positive regulatory clarity, and heightened investor interest. As indicated by Coinbase, the current market momentum heading into September suggests a robust altcoin season could be on the horizon.

How does Coinbase’s altcoin analysis predict the upcoming September crypto outlook?

Coinbase’s altcoin analysis suggests that a shift in market dynamics could lead to a significant altcoin season as September approaches. The analysts note factors such as stronger macroeconomic conditions, a clearer regulatory framework, and increased market capitalization of altcoins, which have appreciated over 50% since July. This outlook positions September as a potential launchpad for a widespread altcoin rally.

What are the regulatory impacts on altcoins during an altcoin season?

Regulatory impacts during an altcoin season can significantly influence market dynamics. For instance, Coinbase highlights that recent clarity from regulators, particularly regarding liquid staking practices, fosters a positive environment for altcoins. This clarity encourages institutional and retail participation, paving the way for a potentially explosive altcoin market as seen in historical trends.

Are Ethereum and altcoins expected to thrive during this projected altcoin season?

Yes, Ethereum and various altcoins are expected to thrive during this anticipated altcoin season. Ethereum remains central to institutional investments in the crypto ecosystem, and high-beta tokens linked to ETH, such as LDO and ARB, have demonstrated strong price movements. The momentum gathered in the altcoin market could lead to a robust performance for Ethereum as well as numerous altcoins.

What indicators should investors watch for during an altcoin season based on Coinbase’s report?

Investors should monitor several key indicators during an altcoin season, as outlined in Coinbase’s report. These include liquidity metrics like stablecoin issuance, changes in Bitcoin’s market dominance, and the overall crypto market capitalization, which has shown promising signs of growth. Additionally, any positive regulatory developments could further enhance market sentiment toward altcoins, particularly as September unfolds.

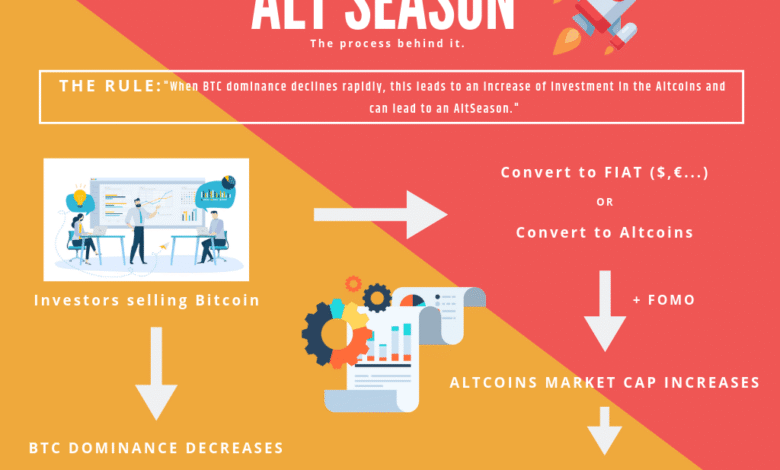

How does the decline of Bitcoin’s dominance signal an altcoin season?

The decline of Bitcoin’s dominance indicates that capital is rotating into altcoins, which is a hallmark of an altcoin season. According to Coinbase, Bitcoin’s dominance dropped from 65% to 59% from May to August, suggesting that investors are increasingly confident in altcoins. This shift often leads to increased price movements in alternative cryptocurrencies as market dynamics change during such periods.

| Key Points |

|---|

| Coinbase anticipates a full-scale altcoin season imminent by September due to increasing liquidity and favorable regulatory framework. |

| Market conditions have improved, suggesting the potential for a broader altcoin rally. |

| Altcoin market capitalization surged over 50%, hitting $1.4 trillion since early July. |

| Bitcoin’s market dominance dropped from 65% in May to 59% in August, indicating capital rotation into altcoins. |

| A significant amount of capital ($7.2 trillion) is available in U.S. money market funds, potentially entering crypto markets. |

| Liquidity metrics are recovering, which could support a price rally in altcoins. |

| Ethereum remains a key asset among institutions with millions held by various treasuries. |

| High-beta tokens like LDO are showing strong price movements, with LDO up 58% month-to-date. |

| Overall, Coinbase expresses a strong bullish sentiment for the upcoming altcoin season. |

Summary

Altcoin season is set to unfold as market dynamics shift in favor of altcoins, driven by increased liquidity and positive macroeconomic conditions. As we approach September, Coinbase’s insights highlight a strong potential for an altcoin rally, underscoring the need for investors to capitalize on the changing landscape. With the market capitalization of altcoins rising and Bitcoin’s dominance declining, this could be a pivotal moment for altcoins to gain traction, making it crucial to stay informed and ready to participate in this exciting phase.