Altcoin Season: Index Hits 51 as Hype Surges High

As the cryptocurrency market heats up, the term “Altcoin Season” is circulating widely among traders and investors alike. This phase, marked by significant price movements in alternative coins, has captured attention as the Altcoin Season Index has recently climbed to 51, signaling growing interest. With a critical benchmark of 75 still ahead, many are closely watching the altcoin market for signs of a full-blown rally. Amidst the buzz in crypto news, traders are developing various trading strategies to capitalize on this potential momentum shift. Whether it’s chasing trends or evaluating fundamentals, the enthusiasm surrounding altcoins is palpable and suggests exciting times ahead.

The surge in alternative cryptocurrencies, often referred to as altcoins, has many in the blockchain community abuzz about the possibility of an upcoming upswing. Evidence from the Altcoin Season Index shows a notable increase, hinting that the altcoin marketplace is on the verge of an explosive breakout. As traders refine their approaches and share insights via crypto news platforms, discussions surrounding trading tactics have intensified tremendously. The market dynamics suggest that many may soon be reevaluating their positions to better engage with the unfolding opportunities. All signs point towards an invigorating phase in the world of digital assets and alternative currencies.

Understanding the Altcoin Season Index

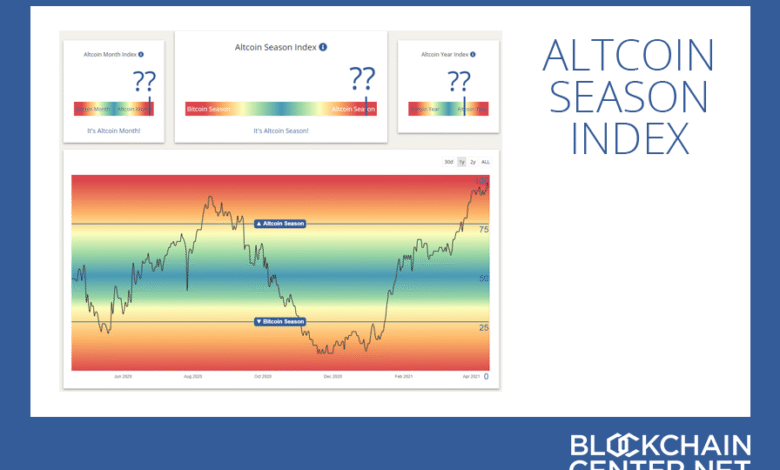

The Altcoin Season Index (ASI) serves as a vital indicator in the cryptocurrency market, gauging the relative performance of altcoins against Bitcoin. Essentially, a higher ASI score indicates a market trend where altcoins are outperforming BTC, signaling potential investment opportunities for traders looking to capitalize on altcoin season. In recent days, the ASI surged from 39 to 51, suggesting that traders are becoming increasingly optimistic about altcoins, and the market is gearing up for a potentially lucrative period.

For traders and investors alike, this measurable increase in the ASI is worth monitoring, as reaching a score above 75 could signify the reflective beginning of an official altcoin season. Those engaged in crypto investing should pay close attention to movements within the ASI and adapt their trading strategies accordingly to maximize returns during this pivotal time. As interest in altcoins grows, so does the potential for profitable trades.

The Current Hype Surrounding Altcoin Season

Recently, discussions about the upcoming altcoin season have flooded social media platforms, amplifying excitement among traders. The heightened expectations are fueled by a convergence of market signals, Google Trends data, and a surge in search terms related to altcoins. This collective buzz hints at a forthcoming surge in altcoin prices, with traders eagerly awaiting opportunities to invest in lesser-known cryptocurrencies that could see significant appreciation during altcoin season.

Encouragingly, organic conversations among crypto enthusiasts emphasize caution despite the enthusiasm. Many traders advise setting clear entry and exit strategies to avoid chasing volatile altcoin pumps. The mantra to ‘define your thesis’ resonates, urging participants to remain disciplined even in an environment charged by speculation and rapid market changes. Therefore, while altcoin season creates excitement, a calculated approach remains crucial.

Key Trading Strategies for Altcoin Season

The emergence of altcoin season presents unique trading strategies tailored specifically for altcoins. Investors looking to navigate this environment can benefit from implementing diversified strategies that leverage the volatility seen during this period. Identifying underperforming altcoins with strong fundamentals can lead to advantageous positions, especially when bolstered by positive market sentiment and increasing trading volumes.

Moreover, traders should focus on using technical analysis to identify optimal entry points and set realistic profit targets. Utilizing indicators such as moving averages and RSI can aid in discerning the best moments to buy or sell altcoins. This strategic approach helps mitigate risks associated with the inherent market volatility during altcoin season, allowing traders to capitalize on price movements effectively.

The Impact of Social Sentiment on Altcoin Prices

The role of social media sentiment in influencing altcoin prices can’t be overstated, especially as altcoin season approaches. Platforms like Twitter and Reddit are buzzing with discussions about the potential of various altcoins, and traders often turn to these channels to gauge market sentiment. The influx of hashtags related to ‘altcoin season’ and specific altcoins can lead to increased buying pressure as traders respond to the collective enthusiasm and fear of missing out (FOMO).

Monitoring these interactions provides insights into which altcoins may experience sudden price surges. However, traders should remain vigilant about the potential for misinformation on social media, as not all hype is justified. In such a rapidly evolving market, distinguishing genuine opportunities from mere speculation is crucial; therefore, combining social sentiment with thorough research is essential for savvy trading.

Market Behavior During Altcoin Season

Historical trends indicate that altcoin season often coincides with relative outperformances in the altcoin market compared to Bitcoin. This behavior can typically result from broader market optimism and the influx of capital seeking diversification. As altcoins begin to rise, a cascading effect often follows, with more investors looking to capitalize on the growth dynamics within the altcoin landscape.

In observing these market behaviors, it’s clear that traders should equip themselves with robust strategies to harness the momentum effectively. Trading volumes, price action, and social media sentiment can often help guide investor decisions. By analyzing these market behaviors, traders can position themselves to take advantage of potential rallies during altcoin season.

Google Trends Insights for Altcoins

Google Trends data is a valuable tool for understanding the market’s pulse, especially during significant events like the onset of altcoin season. Recent spikes in searches for ‘altcoins’ and related terms reveal consumer interest and potential trading activities within the crypto landscape. Such surges indicate that public awareness and engagement with altcoins escalate as market conditions shift, often foreshadowing price trends.

Utilizing Google Trends to identify interest levels allows traders to align their strategies with market psychology. For instance, when searches for specific altcoins peak, it may indicate a forthcoming price movement. Therefore, incorporating trends data into trading strategies can provide a comprehensive understanding of when to enter or exit positions effectively.

Regional Insights: Where is the Altcoin Craze Happening?

The global landscape of altcoin interest is diverse, with several regions leading the charge in search volume and trading activities. Leading countries such as Senegal, Bulgaria, and the Netherlands represent hotspots for altcoin enthusiasm, which highlights unique cultural and economic factors contributing to the altcoin season’s skewed distribution.

Traders aiming to tap into emerging markets may analyze these regions for potential investments in lesser-known altcoins. Understanding the local market dynamics can unveil opportunities that more established markets may overlook. By aligning trading strategies with regional trends, investors can capitalize on the global altcoin phenomenon effectively.

Behavioral Signals Indicating Altcoin Season’s Arrival

As the cryptocurrency landscape evolves, behavioral signals often hint at significant transitions in market sentiment, especially leading into altcoin season. Increasing trading volumes, amplified engagement on social media platforms, and rising ASI scores all showcase the market’s transition from Bitcoin dominance to altcoin investment. Monitoring these behavioral indicators can provide traders with the foresight needed to act confidently.

Moreover, keeping an eye on charts and patterns can reveal pivotal entry points for traders. Market participants should be alert to fluctuations and prepare to make informed decisions based on real-time data. As excitement builds and traders adopt speculative positions, understanding these behavioral signals can ensure traders remain one step ahead during the burgeoning altcoin season.

Exploring the Future of Altcoins in Cryptocurrency

The altcoin market is poised for exciting developments as innovation and technology shape the future of cryptocurrency. With ongoing advancements in DeFi, NFTs, and blockchain technologies, altcoins will continue to play an increasingly vital role in diversifying investment portfolios and fueling the crypto economy. Understanding the potential of emerging altcoins can provide opportunities for informed investments.

As more players enter the crypto space, potential regulatory frameworks and technological advancements will drastically affect altcoin growth. Traders should stay informed about news in the crypto sector to anticipate shifts that may influence the altcoin market negatively or positively. The future remains bright for altcoins, and those who actively monitor trends will be prepared to benefit from anticipated changes.

Frequently Asked Questions

What is the Altcoin Season Index and how does it relate to altcoin season?

The Altcoin Season Index (ASI) is a measure that tracks the performance of altcoins relative to Bitcoin. An ASI score above 75 indicates a strong altcoin season, suggesting that altcoins are outperforming Bitcoin. Recently, the ASI has risen to 51, signaling increased interest and potential for a full-blown altcoin season.

How can I determine if we are officially in altcoin season?

To determine if we are officially in altcoin season, monitor the Altcoin Season Index. Once the ASI surpasses 75, it is considered a clear indicator that altcoins are gaining momentum and outperforming Bitcoin. Social media trends and increased trading volume in altcoins also signal the start of altcoin season.

What trading strategies are effective during altcoin season?

During altcoin season, successful trading strategies may include diversifying into multiple altcoins, setting predetermined entry and exit points, and avoiding chasing pumps. Analyzing market trends, using stop-loss orders, and staying updated with crypto news can also enhance trading success during this volatile period.

Where can I find the latest updates on the altcoin market?

You can find the latest updates on the altcoin market through various crypto news platforms, social media channels, and dedicated cryptocurrency news websites. Websites like BlockchainCenter provide real-time Altcoin Season Index updates and other relevant statistics to keep you informed.

What is the significance of social media chatter during an altcoin season?

Social media chatter often reflects traders’ sentiments and can indicate heightened interest in altcoins. Buzz around altcoin season can create FOMO (fear of missing out), leading to increased trading activity and potentially driving altcoin prices higher.

How does Google Trends data influence perceptions of altcoin season?

Google Trends data provides insights into public interest in altcoins and altcoin season. High search interest correlates with heightened market activity, as more traders seek information and potentially invest in altcoins during this period.

What should traders watch for as the Altcoin Season Index approaches 75?

As the Altcoin Season Index nears the 75 mark, traders should watch for increased trading volumes, positive price movements in altcoins, and social media sentiment. These factors could indicate that altcoin season is imminent and present trading opportunities.

What risks should I consider before investing during altcoin season?

Investing during altcoin season comes with risks, such as market volatility and the potential for price corrections. Traders should be aware of overbought conditions in altcoins, set risk management strategies, and stay informed about market trends to mitigate these risks.

| Key Point | Details |

|---|---|

| Current ASI Score | 51/100, up from 39 in four days |

| Needed Score for Official Start | 75/100 to signal the official start of altcoin season |

| Recent Trends | ASI increased 12 points recently, with strong social media buzz |

| Google Trends Data | Interest peaked at 100 for ‘altcoin season’ on July 18, currently at 97 |

| Leading Countries for Interest | Senegal, Bulgaria, Netherlands for ‘altcoins’; Samoa, Afghanistan for ‘altcoin season’ |

Summary

Altcoin Season is heating up as the Altcoin Season Index (ASI) reflects a significant score increase, drawing trader anticipation. With the ASI currently at 51 and a compelling social media buzz indicating a potential surge, it suggests that we may soon witness the long-awaited official launch of Altcoin Season. As interest peaks in various global regions through Google Trends, it becomes evident that traders are strategically positioning themselves for potential market fireworks, making it an exciting time for altcoin investment.