Aluminum Tariffs Spark a Green Recycling Boom in the U.S.

Aluminum tariffs have taken center stage in the discussion of U.S. trade policy, particularly following President Trump’s imposition of a 50% duty on aluminum imports. While the primary goal was to bolster domestic production and revive factories, these tariffs have inadvertently sparked a green recycling boom across the nation. As manufacturers face rising costs from imported aluminum, the recycling of scrap metal has emerged as an environmentally friendly and economically viable alternative. This shift not only addresses the U.S. aluminum deficit but also aligns with broader sustainability goals, driving innovation in scrap metal recycling. The result is a dynamic landscape where producers seek cost-effective solutions and consumers benefit from environmentally friendly aluminum products, pointing towards a sustainable future in manufacturing.

The recent elevation of tariffs on aluminum imports has significantly influenced the U.S. aluminum market, prompting discussions around protective trade measures and their implications. These import duties, enacted with the aim of reviving local aluminum factories, have catalyzed the growth of an alternative segment: the recycling industry. With the surge in costs associated with importing aluminum, there has been a notable pivot towards utilizing recycled materials, tapping into the potential of scrap metal. Such recycling efforts not only help mitigate the U.S. reliance on foreign aluminum but also contribute to a more sustainable manufacturing process, appealing to environmentally conscious consumers. This evolving scenario underscores the intricate interplay between trade policies and green technology advancements.

The Recycling Boom: An Unexpected Result of Tariffs

The implementation of President Trump’s aluminum tariffs has inadvertently sparked a significant growth trend in the recycling sector. As import costs rise due to the 50% tariffs, both consumers and manufacturers are seeking more cost-effective alternatives to primary aluminum. This quest has catalyzed a recycling boom, where metals previously treated as waste are now being repurposed efficiently, turning scrap into a sought-after commodity. Many businesses are now redirecting their focus toward recycling facilities, which consume only a fraction of the energy compared to traditional smelters, making they a prime solution to rising costs and an increasing demand for environmentally friendly aluminum.

Moreover, the recycling boom represents not only an economic opportunity but also a crucial step towards environmental sustainability. Scrap aluminum recycling is a far less energy-intensive process, consuming just 5% of the energy required to produce primary aluminum. This significant reduction in energy usage aligns with growing global environmental initiatives aimed at reducing carbon footprints and conserving energy resources. As businesses embrace this eco-friendlier approach, they are not only cutting down on costs but also contributing positively to the environment.

Impacts of Aluminum Tariffs on U.S. Industry

The tariffs imposed on aluminum imports have created a ripple effect across various sectors of the U.S. economy. With the country facing a substantial aluminum deficit, averaging 5.5 million tonnes of imports annually, the tariffs have resulted in a sharp increase in costs for downstream manufacturers. Those reliant on aluminum materials, like major brands PepsiCo and Campbell Soup, are feeling squeezed as the price of beverage cans and other necessary packaging materials rise dramatically. These changes have pushed manufacturers into a corner, prompting the exploration of alternative materials or sourcing strategies, further stimulating the demand for recycled aluminum.

As industries grapple with rising operational costs due to these tariffs, a clear demand for cost-effective recycling solutions emerges. Companies are increasingly aware of the economic incentives linked to using recycled aluminum, particularly as they work to maintain profit margins in the face of rising aluminum prices. This dynamic not only supports domestic production but also encourages a shift towards a more sustainable framework within the industry, where the push for efficient and eco-conscientious practices leads to a greener economy.

Reversing Trade Flows: Scrap Metal’s New Role

The current tariffs on primary aluminum have challenged traditional trade flows, leading to a significant reconsideration of how scrap metal is utilized. Previously, the U.S. exported millions of tonnes of scrap aluminum each year, but now, as recycling becomes increasingly profitable due to a lack of tariffs on scrap, domestic recycling plants are reclaiming that material for local use. As the U.S. adapts to this new landscape, there’s potential for the country to transition from being an exporter of scrap to becoming a net importer of raw aluminum, particularly from regions with ample supply.

This shift opens new avenues for international trade relations and recycling initiatives. As domestic demands for recycled aluminum surge, foreign scrap suppliers, especially from Europe, are eyeing the U.S. market as a lucrative opportunity. With the evolving trade policies and tariffs influencing cross-border transactions, there’s a pressing need for the U.S. to establish a stable and favorable trading environment to facilitate these flows. Such a strategy could contribute significantly to meeting domestic aluminum demands while enhancing the sustainability of aluminum production.

The Economic Case for Increased Recycling

Investing in aluminum recycling facilities presents a compelling business case for U.S. manufacturers aiming to mitigate the adverse effects of tariffs. Building a recycling plant requires only 10% of the capital investment needed for a traditional smelter, and the setup time is much faster, taking approximately one to two years compared to the five to six typically required for a new smelter. This rapid turnaround allows companies to scale their processes efficiently without being hindered by the burdensome costs associated with tariffed aluminum.

Furthermore, as industries increasingly compete for energy resources, the lower energy requirements for recycled aluminum make it an appealing option. Companies like BMW and Hyundai are showing significant interest in sourcing low-carbon aluminum, and an expanded U.S. recycling industry could seamlessly cater to this growing market demand. These trends depict a transformative shift within the aluminum sector that not only helps alleviate the pinch of aluminum tariffs but also fosters a more sustainable manufacturing ecosystem.

Environmental Benefits of Aluminum Recycling

The environmental impact of aluminum recycling cannot be overstated. Traditional aluminum production is not only energy-intensive but also produces substantial greenhouse gas emissions. By shifting focus to aluminum recycling, industries can achieve remarkable energy savings, with the process requiring just 5% of the energy consumed in primary aluminum production. This strategic shift towards recycling not only supports environmental sustainability efforts but also helps in meeting corporate social responsibility goals as consumers increasingly prefer products that are eco-friendly.

Additionally, enhanced recycling practices can lead to a notable reduction in landfill waste. As scrap aluminum is repurposed effectively, fewer resources are wasted, and the transition to a circular economy is promoted. This practice not only preserves natural resources but also fosters innovation within recycling technologies, further enhancing efficiency and reducing environmental footprints. In a world grappling with climate change challenges, the movement towards environmentally friendly aluminum presents a viable solution, marrying economic incentives with ecological responsibility.

Challenges in Scaling U.S. Recycling Operations

Despite the apparent advantages of increased aluminum recycling, scaling operations effectively poses several challenges. Industries must navigate a landscape characterized by fluctuating supply and demand for scrap metal. As demand for recycled metal rises, ensuring a consistent and quality supply becomes crucial to maintain production levels. The volatile nature of scrap markets could potentially disrupt operations, prompting businesses to develop robust strategies for sourcing and processing aluminum sustainably.

Moreover, the initial investment in recycling infrastructure can be a barrier for some companies, particularly smaller firms. Ensuring access to the necessary technology and expertise to create efficient recycling operations will be critical for companies looking to capitalize on the growing trend. Additionally, as government policies may shift with changing administrations, consistent support for recycling initiatives will be vital to sustaining momentum and achieving long-term goals in environmental and economic sustainability.

Future Prospects for U.S. Aluminum Recycling

Looking ahead, the future of aluminum recycling in the U.S. appears promising but requires careful planning and investment. The growing domestic demand for aluminum, coupled with rising costs from tariffs on imports, presents a unique moment for the recycling industry to flourish. By prioritizing investments in technology and infrastructure, the U.S. could capitalize on its potential to meet a significant portion of its aluminum needs through recycling, alleviating pressure from foreign dependency.

Advancements in recycling technology will also play a crucial role in shaping the industry’s path forward. Innovations that improve the efficiency and effectiveness of aluminum recycling could yield high-quality recycled aluminum that meets the stringent demands of modern manufacturing. By embracing these changes and fostering a culture of sustainability, the U.S. aluminum sector can not only rebound from the challenges presented by tariffs but also emerge as a global leader in recycled aluminum production.

The Role of Policy in Promoting Recycling

Policy decisions made at the federal and state levels will significantly influence the success of aluminum recycling initiatives in the U.S. Current tariffs create a protective environment for domestic producers, but additional policies, such as incentives for recycling or the implementation of export controls on scrap metal, could further bolster the domestic recycling landscape. Models that promote local recycling capabilities can ensure that more waste does not leave the country while enhancing the local economy.

Additionally, public awareness and education about the importance of recycling practices are paramount. Governments can play a significant role in encouraging not only businesses but also consumers to adopt environmentally friendly behaviors and to view recycled products as viable alternatives to primary materials. By integrating educational initiatives and supportive policies, stakeholders can create a comprehensive approach that prioritizes the health of the environment while also securing a stable economic future.

Collaboration Across Sectors: A Path Forward

The path to a robust U.S. aluminum recycling industry requires collaboration across various sectors, including government, industry leaders, and environmental organizations. Such partnerships can foster innovation and address the challenges of scaling recycling operations effectively. By pooling resources and expertise, stakeholders can work together to develop sustainable practices that enhance the recycling process while addressing environmental concerns.

The engagement of communities in recycling initiatives also plays an essential role in driving change. Public programs that promote recycling and provide accessibility to recycling facilities can foster greater participation among individuals. This collective effort, supported by partnerships, can lead to more effective recycling operations, thereby ensuring that the U.S. not only adapts to the aluminum tariffs but ultimately thrives within a global economy focused on sustainability and resource conservation.

Frequently Asked Questions

How do aluminum tariffs impact the recycling boom in the U.S.?

Aluminum tariffs, particularly those implemented by Trump, have led to increased costs for imported aluminum, prompting many manufacturers to turn to domestic recycling. This shift supports a recycling boom, as recycling aluminum uses only about 5% of the energy required to produce primary aluminum, making it a more environmentally friendly option.

What is the relationship between Trump’s aluminum tariffs and the U.S. aluminum deficit?

Trump’s aluminum tariffs aim to revive domestic production in response to a significant U.S. aluminum deficit. Despite the tariffs, the U.S. still imports around 5.5 million tonnes of aluminum annually. The tariffs have raised costs, leading domestic consumers to explore recycled aluminum as a viable alternative.

Are aluminum tariffs encouraging environmentally friendly aluminum practices?

Yes, the tariffs on primary aluminum create a price advantage for recycled aluminum, which is more environmentally friendly. The domestic recycling industry benefits as it consumes significantly less energy compared to smelting new aluminum, thereby contributing to greener practices.

What challenges do downstream manufacturers face due to aluminum tariffs?

Downstream manufacturers, such as those producing beverage cans or tinplate steel, face increased costs due to Trump’s aluminum tariffs. These price hikes can threaten their profit margins and lead to the exploration of alternative materials, including scrap metal recycling.

How could recycling affect the trade dynamics of aluminum imports?

The surge in domestic recycling driven by aluminum tariffs could potentially reverse traditional trade flows, with the U.S. becoming less reliant on scrap metal exports and focusing more on internal recycling solutions. This dynamic may also create new opportunities for exporting recycled aluminum.

What role does scrap metal recycling play in mitigating the impact of aluminum tariffs?

Scrap metal recycling plays a critical role in offsetting the economic impact of aluminum tariffs by providing a cost-effective and environmentally friendly alternative to primary aluminum. As tariffs drive up the costs of imports, domestic recycling becomes a more attractive option for manufacturers.

Can the U.S. aluminum recycling industry meet demand despite tariffs?

Yes, if the U.S. optimizes its recycling capacity, it could significantly reduce its dependence on aluminum imports. Current estimates suggest that recycling all U.S. scrap could meet about half of the nation’s import needs, presenting a substantial opportunity for the industry.

What is the potential economic benefit of expanding the aluminum recycling industry in the U.S.?

Expanding the aluminum recycling industry could yield considerable economic benefits, including reduced reliance on foreign aluminum, lower production costs for manufacturers, and a more sustainable industrial ecosystem, supporting the U.S. goal of self-reliance in aluminum production.

How do newer recycling facilities compare to traditional smelters in terms of cost and time?

Building new aluminum recycling facilities is significantly cheaper, requiring only about 10% of the capital expenditure of traditional smelters and can be operational within one to two years, in contrast to the five-to-six-year timeline for smelting facilities.

What is the future outlook for aluminum tariffs and recycling practices in the U.S.?

While aluminum tariffs are currently causing disruptions, they may inadvertently promote a stronger domestic recycling industry, aligning with environmental goals and national self-reliance policies, fostering growth in both the recycling market and environmentally friendly aluminum production.

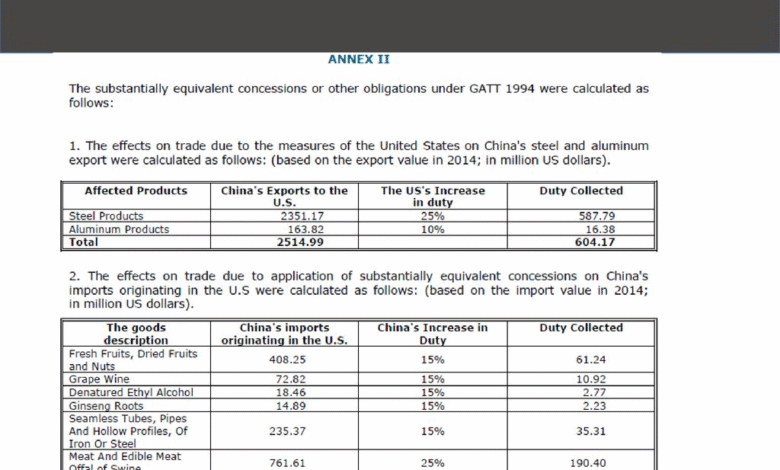

| Key Point | Description |

|---|---|

| Trump’s aluminum tariffs | The tariffs are leading to increased recycling efforts as consumers avoid costs from duties. |

| Energy efficiency of recycling | Recycling aluminum uses only 5% of the energy needed for primary production, reducing environmental impact. |

| U.S. aluminum trade dynamics | Tariffs may alter U.S. trade flows from scrap metal exporter to importer. |

| Economic incentives for recycling | With tariffs on primary aluminum but none on scrap, recycling becomes economically attractive. |

| Impact on downstream manufacturers | Increased costs lead manufacturers like PepsiCo to seek recycled alternatives, helping combat demand destruction. |

| Possibility of changing global scrap flows | Potential for increased scrap imports to the U.S. as domestic supply decreases. |

| Sustainability benefits | Maximizing scrap recycling could meet half of U.S. aluminum import needs. |

| Investment in recycling facilities | New plants require less capital and time compared to new smelters, making them a more feasible option. |

Summary

Aluminum tariffs, specifically the 50% tariffs imposed by President Trump, have led to unintended consequences fueling a boom in aluminum recycling. Instead of merely protecting domestic production, the tariffs have shifted economic incentives, encouraging increased recycling and diminishing reliance on imports. As industries seek to mitigate rising costs from tariffs, they are turning to recycled aluminum, which is both cost-effective and environmentally friendly. This dynamic not only supports sustainability but may also reshape U.S. aluminum trade flows, positioning the country towards greater self-reliance in aluminum production.