Amazon CEO and Board Chair Proposal Rejected by Shareholders

The recent Amazon CEO and Board Chair Proposal ignited intense discussions surrounding corporate governance, ultimately leading to a decisive vote by shareholders. In a striking display of unity, approximately 82% of stakeholders rejected the motion aimed at separating the roles of CEO and board chair. This proposal was influenced by a growing trend among S&P 500 companies advocating for clearer leadership structures. Advocates argued that such separation allows for better oversight and governance, while critics, including Amazon’s current leadership under Andy Jassy, defended the existing model. As Amazon navigates its future, this rejection reflects the shareholders’ confidence in the current leadership style and governance approach.

The topic of leadership roles within corporations is more pertinent than ever, particularly in light of the recent Amazon vote on the separation of CEO and board chair positions. This discussion resonates across the spectrum of corporate governance, echoing trends seen in major firms throughout the S&P 500. As shareholders increasingly seek to implement measures that delineate authority between company executives and board members, the rejected proposal at Amazon is a notable case study. Many industry experts view this as part of a broader movement, considering the heightened number of shareholder proposals aimed at restructuring leadership dynamics. The emphasis on strategic leadership under Andy Jassy’s direction highlights the complexities brands face in balancing governance and operational efficiency.

Amazon CEO and Board Chair Proposal Rejected by Shareholders

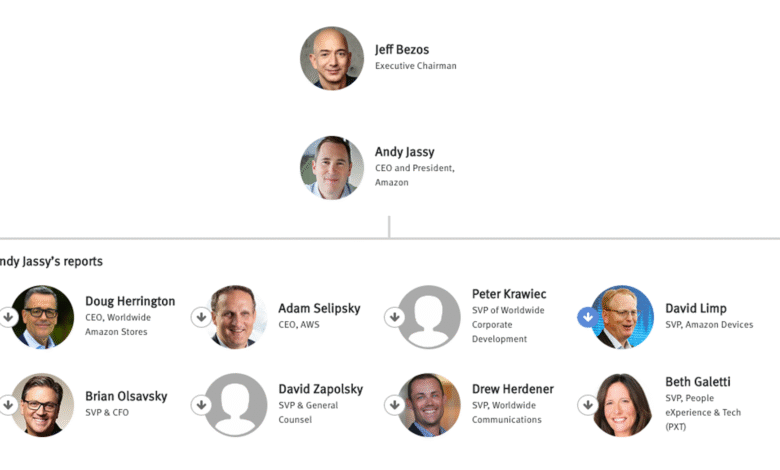

In a significant move during Amazon’s recent annual shareholder meeting, a proposal suggesting the separation of the roles of CEO and board chair faced overwhelming opposition, with about 82% of shareholders voting against it. This proposal was particularly interesting due to the recent organizational changes at the company, where Andy Jassy stepped into the CEO role and Jeff Bezos maintains his status as executive chairman. Such a separation is often presented as a step towards enhancing corporate governance within large enterprises, aligning with the practices of the majority of S&P 500 companies. However, shareholders appear to have favored the existing leadership structure.

The rejection of the proposal illustrates the ongoing debate surrounding corporate governance practices and the roles of leadership within major corporations. Advocacy groups, including the Accountability Board, argue that separating these roles benefits the organization by allowing for better oversight from the board, thereby focusing the CEO on strategic business operations. Despite these arguments, Amazon’s management has emphasized the importance of flexibility in leadership roles, indicating that adapting to specific circumstances is crucial for the company’s success.

The Importance of Corporate Governance in S&P 500 Companies

Corporate governance remains a hot topic among S&P 500 companies, especially in light of recent trends where shareholder proposals for separating the roles of CEO and board chair have surged. This trend represents an increased desire for accountability and transparency in the leadership structures of major firms. The Harvard Law School Forum on Corporate Governance reported a staggering 113% increase in such proposals among Russell 3000 companies in early 2023, suggesting that shareholders are becoming more proactive in seeking changes that enhance oversight and governance.

In this environment, the decisions of companies like Amazon regarding leadership roles signify broader implications for corporate governance practices across the industry. By retaining combined leadership, Amazon argues that they can maintain strategic agility, allowing the board to adapt leadership to evolving circumstances. However, the continued rise in shareholder proposals indicates a growing demand for more traditional governance structures that delineate responsibilities between executive leadership and board oversight, thus ensuring a more robust governance framework.

Andy Jassy’s Leadership Style and Its Impact on Amazon

Since taking over as CEO of Amazon in 2021, Andy Jassy’s leadership has been characterized by a focus on innovation and customer satisfaction, as well as a commitment to adaptability in an ever-changing market. Unlike his predecessor, Jeff Bezos, who is often associated with a more hands-on and visionary approach, Jassy seems to lean towards a collaborative style that empowers managers across various departments. This leadership philosophy is crucial as Amazon navigates complex challenges in the technology and retail sectors, striving to sustain its competitive edge in the S&P 500.

Moreover, Jassy’s approach also reflects an understanding of corporate governance issues facing modern conglomerates. By maintaining an executive chair position for Bezos while he leads the company, Jassy benefits from the wisdom and insights of the founder without conflating the two powerful roles of CEO and board chair. This separation, despite being the subject of shareholder debate, allows Jassy to focus on operational issues while Bezos can still lend strategic direction, thus fostering both innovation and stability within Amazon’s governance structure.

The Rise of Shareholder Proposals for Leadership Separation

The increasing number of shareholder proposals for separating the CEO and board chair roles represents a significant shift in corporate governance paradigms. This trend is fueled by a growing recognition that distinct leadership roles can lead to better oversight and strategic decision-making. With large companies like Amazon facing scrutiny, the necessity for transparent governance structures has never been more critical. Shareholder advocacy is gaining traction, with proposals reflecting a desire to ensure that board members can independently oversee executive performance, crucial for maintaining trust in the company’s direction.

In 2023, the notable rise in 113% in these proposals within the Russell 3000 presents a clear signal from investors that they are embracing the push for traditional governance models. By advocating for the separation of roles, shareholders believe they can enhance accountability, creating a healthier balance of power that prevents executive overreach. As companies grapple with these requests, a substantial dialogue is forged regarding the implications for corporate governance, consequently shaping the future business landscape.

The Role of Shareholders in Corporate Governance

Shareholders play a pivotal role in shaping corporate governance structures and policies within publicly traded companies like Amazon. Their ability to vote on important proposals—such as the separation of the CEO and board chair roles—grants them significant influence over how the company is governed. This active participation demonstrates a shift toward a more engaged shareholder base, which is increasingly interested in how companies are managed, particularly in terms of leadership accountability and oversight. As seen in Amazon’s recent shareholder meeting, the overwhelming majority voted against the separation proposal, signaling their confidence in the existing governance structure.

Moreover, the rising trend of corporate governance proposals highlights the dynamic nature of shareholder expectations. Today’s investors are no longer passive; they demand transparency and responsibility from corporations. This growing assertiveness is a key factor behind the spike in proposals for role separation among S&P 500 companies, reflecting a broader trend focused on ensuring better oversight and ensuring that executives are held accountable for their actions. As this trend evolves, corporations may need to adapt their governance structures to align with shareholder expectations to maintain investor trust and support.

Insights into Amazon’s Current Governance Structure

Amazon’s governance structure, particularly since the transition to Andy Jassy as CEO, has come under scrutiny, especially regarding the decision to retain Jeff Bezos as executive chairman. This decision aligns with a unique strategic vision where the organization seeks flexibility and responsiveness rather than adherence to conventional patterns of governance. By maintaining the dual leadership roles, Amazon aims to leverage Bezos’s experience and insights while enabling Jassy to address day-to-day operations and execute the company’s vision amidst a changing market landscape.

Critics, however, argue that the lack of separation between these powerful roles could pose risks to the company’s governance dynamics. The prevailing view among proponents of role separation is that a distinct boundary fosters better checks and balances, which are essential for risk management and corporate integrity. While Amazon has successfully navigated its complexities without role separation, the dialogue surrounding its governance structure and shareholder input continues to develop, driving discussions around the importance of leading practices in corporate governance among S&P 500 companies.

Understanding the Corporate Governance Landscape

The corporate governance landscape is evolving, particularly as companies like Amazon face increasing scrutiny regarding leadership roles and accountability. Governance structures are not merely a set of rules; they encompass practices that dictate the relationship between stakeholders and a company’s management. Shareholder proposals advocating for role separation reflect a broader movement toward ensuring that businesses comply with the highest standards of transparency and ethical management. As investors demand more rigorous governance frameworks, companies must adapt protocols to reflect these expectations.

In the context of S&P 500 companies, the emphasis on corporate governance has implications for investor relations, business operations, and overall market perceptions. A robust structure promotes trust among investors, ensuring they feel represented and heard in the company’s decision-making processes. Given that governance trends are increasingly influenced by shareholder activism, companies like Amazon must navigate these demands delicately, balancing innovative leadership strategies with essential governance requirements to maintain and grow investor confidence.

The Future of Amazon’s Leadership Structure

As Amazon continues to evolve under the leadership of Andy Jassy, the future of its organizational structure is an ongoing conversation among stakeholders. With increasing pressures from shareholders for traditional governance structures, the trajectory for Amazon’s leadership approach remains uncertain. Potential changes to the separation of CEO and board chair roles could influence the company’s strategy moving forward and how it managed its corporate governance. While Amazon currently enjoys significant shareholder support, the landscape could shift should sentiments around leadership changes remain pertinent.

Adapting to the needs of shareholders while also maintaining the impetus for innovation will be crucial for Amazon’s sustained success. As seen with the rejection of the recent proposal to formalize a split structure, the company has the opportunity to further develop its leadership strategy through continuous dialogue with shareholders and governance experts. Balancing such factors will be key to achieving operational effectiveness and stakeholder satisfaction in the years to come.

Frequently Asked Questions

What was the outcome of the Amazon CEO and Board Chair Proposal vote?

Amazon shareholders rejected the proposal for the separation of the CEO and board chair roles, with approximately 82% voting against it at the annual meeting. This decision maintains the current leadership structure established in 2021 upon Andy Jassy’s appointment as CEO.

Why do some advocate for CEO board chair separation in S&P 500 companies like Amazon?

Advocates argue that separating the CEO and board chair roles improves corporate governance and oversight. The Accountability Board proposed this change for Amazon, claiming that such a structure allows the CEO to focus on business strategies while the board enhances its governance role.

How has Andy Jassy’s leadership affected Amazon’s corporate governance?

Since Andy Jassy became CEO in 2021, Amazon has maintained a structure where the roles of CEO and board chair are separated, with Jeff Bezos as executive chairman. This arrangement is believed to support adaptive leadership that meets the company’s evolving needs.

What does Amazon’s rejection of the CEO and board chair separation proposal mean for shareholder governance?

By rejecting the proposal, Amazon signifies that it prefers its current governance model, allowing the board flexibility to determine leadership structures based on the company’s needs, rather than conforming to trends among S&P 500 companies.

What was the rationale behind submitting the Amazon shareholder vote proposal for CEO board chair separation?

The proposal aimed to formalize the separation of CEO and board chair roles at Amazon, citing that this structure is common among S&P 500 companies. Proponents believe it enhances corporate governance by allowing boards to focus on oversight while CEOs manage business operations.

How prevalent are proposals for CEO and board chair separation among large companies like Amazon?

Proposals for separating CEO and board chair roles have increased significantly, with a reported 113% rise among Russell 3000 companies in early 2023, indicating a growing trend in corporate governance discussions.

What is Amazon’s perspective on maintaining the combined CEO and board chair roles under current leadership?

Amazon believes that retaining the current combined roles allows the board to better adapt to the company’s evolving circumstances and implement the leadership structure that best serves shareholder interests, as noted in their filings.

| Key Points |

|---|

| Amazon shareholders rejected a proposal to separate the roles of CEO and board chair, with 82% voting against it. |

| The proposal was intended to align Amazon’s structure with that of the majority of S&P 500 companies. |

| The separation of roles occurred in 2021 when Andy Jassy became CEO, and Jeff Bezos remained as executive chairman. |

| Shareholder proposals for separating CEO and board chair roles have increased by 113% among Russell 3000 companies in early 2023. |

| Amazon argued that the current structure allows for a leadership more appropriate to its needs and circumstances. |

Summary

The Amazon CEO and Board Chair Proposal faced significant opposition, with 82% of shareholders voting against the separation of the two roles. The company believes that the current leadership structure is optimal for its operations, having transitioned to this format in 2021 under Andy Jassy. As shareholder interest in governance structures grows, Amazon emphasizes the importance of adapting leadership to meet evolving needs rather than conforming to the majority standard. This decision reflects Amazon’s commitment to maintaining flexibility in its governance approach.