Apple Investment in U.S.: $100 Billion Expansion Plan

Apple’s investment in U.S. manufacturing has taken a monumental leap, recently announcing a staggering commitment of $100 billion over the next four years, highlighting its reinvigorated focus on U.S. industries. This includes a pivotal $2.5 billion allocation for an iPhone glass factory in partnership with Corning, underscoring the tech giant’s dedication to boosting domestic production. With President Trump lauding this move during a high-profile announcement, it’s clear that Apple aims to not only strengthen its supply chain investments but also reshape the landscape of U.S. manufacturing expansion. By ensuring that all glass for iPhones and Apple Watches is made locally, Apple is setting a new standard in the tech industry. As this initiative unfolds, it signals a robust shift in production dynamics that could redefine the future of American tech manufacturing.

In a bold stride towards bolstering its domestic footprint, Apple is significantly increasing its fiscal inputs into American industry, reflecting an urgent rallying cry for U.S.-based manufacturing. During a joint press briefing with former President Trump, the company outlined its ambitious spending plans, which are poised to create a ripple effect across various sectors, particularly in specialty glass and technology. This strategic move not only aligns with growing trends in reshoring but also positions Apple as a pivotal player in the retooling of the U.S. supply chain landscape. With a firm commitment to localizing production, especially at the Corning factory responsible for iPhone glass, Apple is redefining its operational ethos. The overarching goal is clear: to foster an integrated domestic supply chain that supports innovation and economic growth within the U.S.

Apple’s Historic Investment in U.S. Manufacturing Expansion

Apple’s recent announcement to invest an unprecedented $100 billion in U.S. companies marks a significant shift in the tech giant’s manufacturing strategy. This decision comes on the heels of President Trump’s earlier statements regarding the need for boosting domestic production. The $2.5 billion allocated for the Corning factory in Kentucky is a key part of this investment, as it will significantly enhance the iPhone glass production capabilities within the United States. With a focus on local sourcing, Apple aims to ensure that all glass for its flagship products, including iPhones and Apple Watches, is manufactured domestically.

This investment in U.S. manufacturing expansion not only strengthens Apple’s supply chain but also creates thousands of new jobs across various sectors. By collaborating with established firms like Corning and others in the American Manufacturing Program, Apple is making a robust commitment to support domestic industries. This initiative is expected to foster a surge in localized job creation and reduce dependency on overseas manufacturing, aligning with the broader economic goals set forth by the Trump administration.

Impact of Trump’s Apple Announcement on the Tech Industry

The commitment articulated by President Trump in conjunction with Apple’s CEO Tim Cook reshapes the tech landscape’s perception towards American manufacturing. The announcement has elicited promises that Apple will not only invest in physical infrastructure but will also bring back elements of the supply chain previously outsourced. This resonates with Trump’s economic policies that emphasize the importance of revitalizing manufacturing within the U.S. Such developments could yield a ripple effect across the technology sector, encouraging other companies to reevaluate their outsourcing strategies.

Moreover, the collaboration between Apple and various suppliers, stemming from this initiative, is indicative of a larger trend towards domestic production and innovation. As the technology industry responds to calls for greater local manufacturing, the emphasis on high-quality components made in the U.S. is emerging as a significant competitive advantage. This may signal a turning tide for the industry, where national interest in U.S. manufacturing grows stronger, potentially revolutionizing how tech companies operate globally.

Apple Corning Factory: A New Benchmark for Homegrown Tech

The establishment of the Apple Corning factory represents not just a fiscal boost but also a technological renaissance in the U.S. manufacturing sector. By committing $2.5 billion to enhance iPhone glass production, Apple is setting a new benchmark for how tech companies can leverage domestic resources. The factory will ensure that the materials for its flagship products meet stringent quality standards while also injecting a substantial economic impact in Kentucky.

This initiative by Apple, alongside advancements in glass production technologies at the Corning facility, will also likely inspire innovation in other related sectors. The geographical concentration of critical components may usher in closer collaborations among tech firms and suppliers, facilitating a comprehensive ecosystem that enhances operational efficiencies and drive costs down. As the U.S. becomes a central hub for iPhone glass, it might stimulate further investment in related technologies and manufacturing processes.

Strengthening the Apple Supply Chain with Domestic Partnerships

Apple’s pledge to bolster its U.S.-based supply chain is not merely about investment; it’s a calculated move to secure the integrity and reliability of its operations. Integrating suppliers like GlobalWafers and Texas Instruments into its network signifies a strategic shift towards localized production. This partnership is critical as it ensures that Apple has responsive and adaptable supply chains that can meet consumer demand for products like the iPhone and its innovative features.

As Apple expands its supply chain investments, the focus will shift towards developing sustainable practices that align with modern manufacturing needs. The collaboration with various U.S. suppliers highlights a commitment to not only enhance production capabilities but also to innovate within the manufacturing sector. This marks a significant step forward in ensuring that Apple’s products remain competitive in a rapidly evolving technological landscape, with a focus on efficiency, sustainability, and American leadership.

The Future of iPhone Glass Production in the U.S.

The U.S. production of iPhone glass at the new Corning factory holds transformative potential for the future of Apple products. This initiative not only localizes the production process but also allows Apple to maintain better quality control over one of its most essential components. By bringing glass manufacturing onto U.S. soil, Apple can also adapt more swiftly to design changes and innovation cycles, ensuring that its products remain at the forefront of technology.

Additionally, producing iPhone glass domestically supports the entire ecosystem of suppliers and related industries, fostering growth in the tech sector. As the Corning facility ramps up production, it may become a vital part of Apple’s global strategy, contributing to the company’s goal of a fully integrated domestic supply chain. This could lead to innovations in material science and manufacturing efficiency previously unattainable due to geographical constraints.

Tracing Back to Apple’s Historical U.S. Investment Commitment

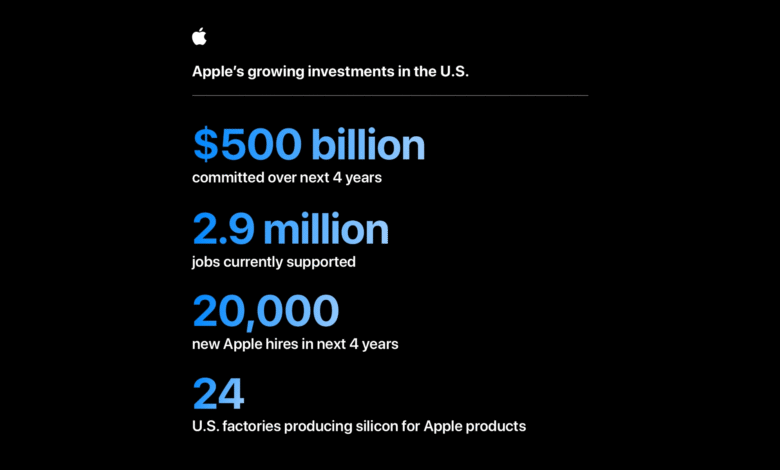

Apple’s journey of substantial U.S. investment stretches back several years, with each cycle unveiling a deeper commitment to the American economy. In 2018, the promise of $350 billion was just the beginning, which escalated to $500 billion earlier in the year. With the latest announcement highlighting a total investment of $600 billion over four years, it showcases Apple’s ongoing dedication to U.S. manufacturing and local talent.

These promises made by Apple underscore a strategic intention beyond mere financial metrics; they illustrate a vision of economic reinvigoration within the U.S. Each commitment fuels advancements in various technological sectors, fostering synergy among local businesses. As Apple continues to forge partnerships within the U.S. landscape, it reaffirms its role as a pivotal player in moving the needle toward sustainable growth and innovation.

Leveraging Domestic Manufacturing for Technological Advancements

In addition to expanding its supply chain, Apple is leveraging its commitment to U.S. manufacturing to drive technological advancements. Through localized production, the company aims to enhance its research and development capabilities, ensuring that new innovations can be rapidly prototyped and brought to market. This reflects a broader understanding that technological progress is deeply intertwined with manufacturing capabilities.

Moreover, as Apple invests in U.S. production processes, it opens pathways for collaborations with educational institutions and research entities. By fostering a closer relationship between academia and industry, Apple aims to cultivate a workforce that is not only skilled in current technologies but also innovative thinkers prepared for the future of tech.

Building a Resilient Semiconductor Landscape in the U.S.

Apple’s emphasis on building a resilient semiconductor landscape within the U.S. is another vital aspect of its investment strategy. The company is keen on localizing its chip production, with TSMC’s Arizona facility playing a central role in this initiative. By integrating domestic chip manufacturing into its supply chain, Apple seeks to mitigate risks associated with global supply chain disruptions, ensuring that production remains uninterrupted.

The focus on semiconductor investments is crucial, given the increasing reliance on advanced chips in modern technology. By fostering a robust domestic semiconductor industry, Apple not only secures its supply chain but also contributes to the overall tech ecosystem in the U.S., promoting innovation and competitiveness. This strategic direction reaffirms Apple’s commitment to leading the charge in technological advancements while championing local job creation.

The Broader Economic Implications of Apple’s Investments

The economic implications of Apple’s substantial investments are profound, potentially reshaping not only the company but also the broader landscape of U.S. manufacturing and tech sectors. With a commitment to inject $100 billion into local economies, Apple aims to catalyze significant job creation, thus supporting communities nationwide. This focus on domestic investments aligns with national economic goals and highlights the importance of companies taking a proactive stance on revitalizing manufacturing.

Furthermore, as other firms observe the ripple effects of Apple’s investments, they may be inspired to reconsider their own strategies towards U.S. manufacturing. The resulting competition could incentivize advancements and improvements across various sectors, leading to a revitalized economy centered around innovation, skilled labor, and sustainable practices. This trend could ultimately redefine American manufacturing and technology, establishing a new era of high-quality, homegrown products.

Frequently Asked Questions

What is the significance of Apple’s investment in U.S. manufacturing expansion?

Apple’s recent announcement of a $100 billion investment in U.S. manufacturing expansion highlights the company’s commitment to enhancing its domestic supply chain. This investment includes $2.5 billion allocated for a new iPhone glass factory in Kentucky, operated by Corning, which emphasizes the importance of U.S.-made components in Apple’s products.

How does Apple’s investment impact the iPhone glass production industry in the U.S.?

With Apple’s commitment to invest $2.5 billion in Corning for iPhone glass production, the U.S. glass manufacturing sector is set for significant growth. The new factory will not only create jobs but also secure a reliable source of glass for iPhones and Apple Watches, ultimately strengthening Apple’s supply chain in the U.S.

What was Trump’s role in the announcement of Apple’s investment in the U.S.?

President Trump played a pivotal role in the announcement of Apple’s $100 billion investment in the U.S., emphasizing its historic nature during a press conference. He highlighted that this investment represents Apple’s commitment to bringing manufacturing jobs back to the U.S., which aligns with his administration’s economic policies.

What other companies are involved in Apple’s U.S. supply chain investments?

Apple’s investment initiative includes partnerships with several companies such as Corning, Coherent, GlobalWafers, and Texas Instruments. This diverse collaboration aims to enhance U.S. manufacturing capabilities, particularly in chip production and other essential hardware components.

How will Apple’s supply chain investments affect chip production in the U.S.?

Apple’s supply chain investments aim to produce over 19 billion chips in the U.S. through collaborations with TSMC in Arizona and GlobalWafers. This integrated approach emphasizes domestic chip production, ensuring a robust supply chain free from overseas dependencies.

What have been Apple’s previous commitments to U.S. investments?

Apple has a history of pledging significant investments in the U.S., including a $350 billion commitment made in 2018, followed by an increase to $430 billion by 2021. The latest $100 billion announcement raises the company’s total U.S. investment pledges to $600 billion, reinforcing its dedication to domestic manufacturing.

Why is Apple focusing on domestic manufacturing for iPhones and other products?

Apple’s focus on domestic manufacturing for iPhones stems from a desire to strengthen its supply chain, reduce reliance on imports, and enhance quality control. By manufacturing components like glass and chips in the U.S., Apple aims to create more jobs and boost the domestic economy.

What can we expect from Apple’s American Manufacturing Program going forward?

Going forward, Apple’s American Manufacturing Program is expected to create new factories and jobs across the U.S., enhancing local production capabilities. This initiative also seeks to integrate the entire supply chain, ensuring components are manufactured domestically, thus promoting further investments in U.S. manufacturing.

How does this investment affect Apple’s reputation and future business strategy?

Apple’s investment in U.S. manufacturing is likely to enhance its reputation as a responsible corporate citizen committed to American jobs and innovation. This strategy also aligns with growing consumer interests in domestically-produced products, potentially boosting brand loyalty and market share.

What are the potential challenges Apple may face with its U.S. investments?

Despite Apple’s significant investments, potential challenges include navigating regulatory environments, labor shortages, and the complexities of establishing new manufacturing facilities. Additionally, the company may face pressure to balance costs while maintaining quality and meeting production timelines.

| Key Point | Details |

|---|---|

| Total Investment | Apple will invest an additional $100 billion in U.S. companies and suppliers over the next four years. |

| iPhone Glass Factory | $2.5 billion will be allocated for a new glass manufacturing facility in Kentucky, operated by Corning. |

| American Manufacturing Program | Partnerships with companies like Corning, Coherent, and others for domestic production efforts. |

| U.S.-Based Supply Chain | Apple’s U.S. supply chain is expected to produce over 19 billion chips this year. |

| Historical Commitments | Apple has pledged a total of $600 billion for U.S. investment over four years. |

Summary

Apple’s investment in the U.S. marks a significant commitment to enhancing domestic manufacturing and supply chains. With a total pledge of $100 billion, including $2.5 billion directed towards an iPhone glass factory, this initiative emphasizes Apple’s dedication to supporting U.S. companies and creating job opportunities. This investment is crucial for bolstering the domestic economy and establishing a fully integrated supply chain within the United States.