Argentina Dollar Exchange Rate: A Remarkable Decrease

The Argentina dollar exchange rate has become a focal point for economic observers as the nation strives to stabilize its financial landscape. Amid ongoing discussions regarding the Argentina peso decline, recent trends suggest a positive turn for the local currency against the dollar. With the peso showing resilience, the foreign exchange market in Argentina could witness significant shifts, especially with the government’s signals of possible interventions in the event of a sharp appreciation. Moreover, the support from the IMF credit facility aimed at revitalizing economic stability in Argentina adds a layer of optimism. As the country navigates these complex dynamics, the implications for how the peso stands against the dollar will remain critical for households and businesses alike.

In the ever-evolving landscape of Argentina’s economy, the interplay between the local peso and the U.S. dollar attracts widespread attention, particularly among investors and currency traders. The recent trends indicating a potential recovery of the Argentine peso against its American counterpart suggest a broader narrative surrounding currency stability and market confidence. With measures from authorities to boost economic resilience, including leveraging international credit lines, the situation signals a shift towards a more controlled approach in the foreign exchange realm. Moreover, as the national currency adapts to changing pressures, discussions on how it aligns with global dollar valuations and trading practices become essential. Overall, the fluctuations in the currency exchange rate present both opportunities for growth and risks of volatility in the Argentine financial system.

The Impact of Argentina’s Peso Decline on Exchange Rates

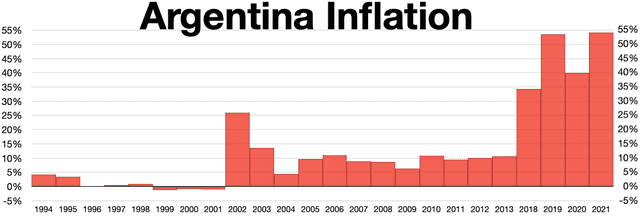

The recent decline of the Argentine peso against the dollar has sparked discussions about the broader implications for the country’s economy. With the peso’s value plummeting, consumers have seen a dramatic increase in the cost of imported goods, leading to inflationary pressures. The government is finding it challenging to maintain stability, especially with the IMF’s credit facility in play, which aims to provide a safety net for addressing potential crises. The effects on the foreign exchange landscape are substantial, as foreign investors weigh options in a fluctuating economy.

Additionally, the risk of further depreciation raises questions among exporters and importers alike. While a weaker peso can enhance export competitiveness, it also increases the costs for companies relying on foreign materials. The continuity of this pattern may lead to a dual concern among economic stakeholders: achieving sustainability while preventing a sudden spike in dollar demand, further complicating the efforts to stabilize the peso.

Understanding the Foreign Exchange Environment in Argentina

The foreign exchange market in Argentina is currently navigating through turbulent waters. The recent fluctuations in the dollar-peso exchange rate reveal the ongoing struggle between the monetary policy aimed at stabilizing the peso and the commercial realities faced by businesses in the nation. This scenario reflects a larger trend where the government is caught in a balancing act, attempting to manage a free-floating currency amidst global economic pressures and internal challenges.

Investors must stay alert to the changing dynamics, particularly as the central bank may intervene if the exchange rate approaches critical thresholds, such as 1,000 pesos per dollar. The prevailing uncertainty affects long-term investment decisions, with the fear of depreciation lingering on the horizon. As businesses recalibrate their strategies, understanding the intricacies of Argentina’s foreign exchange environment becomes essential for navigating this complex market.

Diving into IMF’s Role in Argentina’s Economic Stability

The International Monetary Fund (IMF) plays a crucial role in Argentina’s quest for economic stability, particularly during these turbulent times. With a recently secured $20 billion credit facility, the government has garnered significant resources to bolster its financial position and counteract inflationary pressures. This financial backing is seen as a lifeline that could help stabilize the peso while enabling the central bank to maneuver more confidently in the foreign exchange markets.

Moreover, access to IMF funds can help restore investor confidence, confirming that Argentina is taking active measures to manage its economy amid local and international pressures. However, it also brings the burden of needing to adhere to the IMF’s guidelines, which may involve austerity measures that could further complicate the socio-economic landscape. The challenge for Argentina will be to effectively utilize this support while fostering an environment conducive to growth and prosperity.

Forecasting the Future of the Argentine Peso Against the Dollar

As analysts examine the future of the Argentine peso against the dollar, predictions remain cautiously optimistic. The central bank’s potential intervention to purchase dollars if the exchange rate falls significantly could stabilize the market and assuage fears of further devaluation. Experts suggest that if the dollar-peso rate continues on this trajectory and settles around the intervention point, it may signal a momentary reprieve for the peso.

However, this forecast greatly hinges on external economic conditions, including the performance of the dollar in the global marketplace. Should international markets favor a stronger dollar, Argentina may face renewed pressure on its currency despite current successes. Monitoring these fluctuations and understanding the correlations between external market influences and local economic policies will be key to deciphering the future of the peso.

The Role of Government in managing Exchange Rates

Government actions have a profound impact on managing exchange rates, and Argentina is currently navigating a complex landscape influenced by various fiscal and monetary policies. The administration’s commitment to shifting from a fixed to a free-floating exchange rate system reflects innovative strategies aimed at cushioning the peso’s volatility. This is a significant departure from historical practices aimed at propping up the currency, demonstrating a willingness to embrace market dynamics.

However, this transition requires skilled oversight, as miscalculations could trigger not only economic instability but also widespread public dissent. As seen with Minister Caputo’s recent announcements, the government must communicate transparently while ensuring that the market perceives their actions as legitimate and beneficial. Balancing economic policy with the realities of public sentiment will be pivotal in maintaining exchange rate stability.

Exports and Their Influence on Currency Strength

The dynamics between exports and currency strength are especially salient in the context of Argentina’s current economic challenges. While a weaker peso can enhance export competitiveness, it can also create hesitance among exporters if they perceive market conditions as unstable. This dual reality may prevent them from adequately responding to favorable dollar-peso exchange rates that would normally benefit their export activities.

Additionally, the reluctance of exporters to sell dollars in a declining market affects liquidity. If these market participants adopt a wait-and-see approach, it can further exacerbate the peso’s weakening. Therefore, creating an encouraging framework for exporters is essential, ensuring they feel secure in engaging with the foreign exchange market. A balanced approach that allows for flexibility while promoting confidence may help invigorate Argentina’s economic landscape.

Strategies for Stabilizing the Argentine Currency

Developing strategies aimed at stabilizing the Argentine currency is imperative as inflation continues to affect the daily lives of citizens. The government has indicated a readiness to intervene in the foreign exchange market but must carefully measure its responses to fluctuations in the dollar-peso exchange rate. This planning involves not only immediate measures but also long-term strategies that can address underlying economic vulnerabilities.

Implementing policies that promote growth and attract foreign investment are crucial parts of this stabilization strategy. By ensuring that the economic conditions result in sustainable development, Argentina can naturally strengthen its currency in the face of external shocks. Stakeholders must recognize that the path towards a stable peso requires a collaborative effort from both the government and the private sector.

Market Expectations and Sentiment Analysis

Market sentiment plays a significant role in currency valuation, and in Argentina’s case, expectations surrounding the dollar-peso exchange rate are particularly dynamic. Investor confidence sways not merely on economic indicators but also on political stability and the effectiveness of government initiatives to manage economic situations. Analysts are keenly observing the reactions to ongoing government policies, deciphering their potential influence on market confidence.

Understanding market sentiment allows businesses and policymakers to navigate their next steps. Positive perceptions can lead to increased investments and participation in the foreign exchange markets. Conversely, widespread pessimism could prompt rapid dollar purchases, exacerbating the situation. Thus, addressing these sentiments through proper communication and transparent policies is fundamental for enhancing Argentina’s economic resilience.

Navigating Global Influences on the Dollar-Peso Rate

Global economic trends heavily influence national currencies, and the dollar-peso exchange rate is no exception. Factors such as the strength of the U.S. dollar, geopolitical shifts, and changes in trade agreements can significantly affect how the Argentine peso performs in international markets. Recent declines in the dollar’s strength against other currencies have provided an opportunity for the peso, showing that external conditions can offer both challenges and opportunities.

Argentina’s policymakers must remain vigilant of these global developments, aligning their strategies accordingly to safeguard against potential downturns. By creating adaptive monetary policies, the government can position itself to react positively to global shifts, eventually leading to a more resilient peso. Thus, maintaining an eye on worldwide economic trajectories is essential for anticipating and responding to changes in the dollar-peso dynamic.

Frequently Asked Questions

What factors are contributing to the decline of the Argentina peso against the dollar?

The recent decline of the Argentina peso against the dollar can be attributed to several factors, including the central bank’s successful management of the dollar-peso exchange rate, the ongoing injection of foreign exchange by exporters, and the bullish sentiment surrounding Argentina’s economic stability due to the $20 billion IMF credit facility that bolsters market confidence.

How does the IMF credit facility influence the Argentina dollar exchange rate?

The IMF credit facility plays a crucial role in stabilizing the Argentina dollar exchange rate by providing the government with necessary liquidity and financial backing. This support helps to reassure investors and traders, ultimately contributing to a more stable peso and reducing volatility in the foreign exchange markets.

What can we expect for the future of the Argentina peso against the dollar?

The future of the Argentina peso against the dollar seems cautiously optimistic. If the dollar exchange rate drops nearer to the central bank’s intervention point of 1,000 pesos per dollar, we can expect the government to actively manage liquidity by purchasing dollars to stabilize the peso, ensuring economic stability in Argentina.

How has the recent peso decline impacted trade and exports in Argentina?

The recent peso decline has made Argentine exports relatively cheaper, potentially increasing competitiveness in international markets. However, it could also discourage exporters from bringing dollars into the market due to lower exchange rates, which may lead to a tighter foreign exchange scenario in Argentina if not managed carefully.

What were the effects of Argentina’s shift to free-floating currency bands on the dollar exchange rate?

Argentina’s shift to free-floating currency bands has led to a more adaptable dollar exchange rate, resulting in a recent decrease in the dollar-peso ratio. This change has allowed for a more responsive economic policy framework, which aims at stabilizing the economic conditions and enhancing international investor confidence.

| Key Point | Details |

|---|---|

| Dollar-Peso Decrease | The dollar-peso exchange rate continues to fall, potentially below the central bank’s set limits. |

| Successful Economic Transition | Argentina has shifted to a free-floating currency system without major devaluation. |

| Recent Exchange Rate Highlights | The dollar closed at nearly 1,100 pesos, representing a 4% drop in one day. |

| Expectations of Further Decreases | Dollar futures fell nearly 6%, suggesting anticipated declines towards 1,000 pesos. |

| Central Bank Strategy | If the exchange rate hits 1,000 pesos, the central bank will intervene to stabilize it. |

| IMF Credit Line | Argentina secured a $20 billion credit line to support its economy and currency. |

| Criticism and Support | Economy Minister Luis Caputo asserts victory over predictions of devaluation. |

Summary

The Argentina dollar exchange rate has shown significant improvement, with the peso appreciating against the dollar and expectations of further decreases. As the country navigates through a new economic policy guided by President Milei, Argentina celebrates the anticipated fall in the dollar-peso exchange rate below central bank limits. The government’s strategic use of IMF support and market interventions could stabilize currency fluctuations while restoring confidence in the peso.