Auto Parts Tariffs: Industry Groups Unite Against Trump Policy

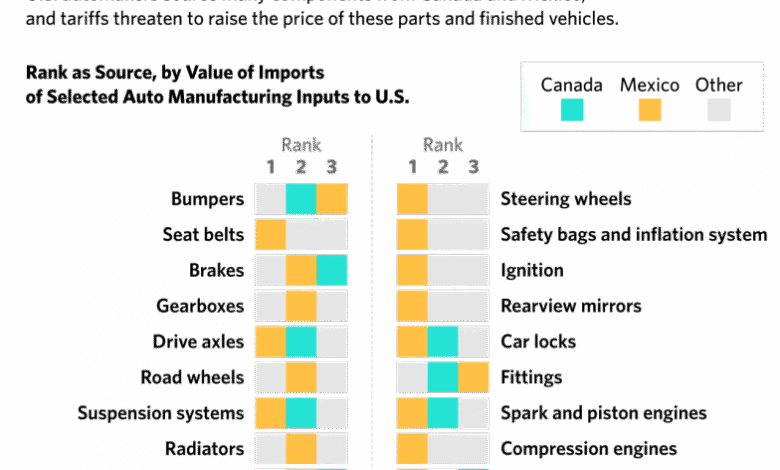

Auto parts tariffs are poised to disrupt the U.S. automotive industry significantly, with new levies set to take effect on May 3. These tariffs, which could reach as high as 25%, have prompted a rare unified response from six influential automotive policy groups, including major dealers and suppliers. This collective lobbying effort against the Trump administration underscores the pressing concerns surrounding the tariffs’ potential impact on U.S. automotive production and the financial stability of auto manufacturers. As these tariffs threaten to place immense pressure on suppliers already facing distress, the ripple effects could harm the broader industry and jeopardize approximately 10 million jobs nationwide. With rising costs and the prospect of layoffs looming over the sector, the auto industry is in urgent need of tariff relief to maintain its position as a critical contributor to the U.S. economy.

In an epoch marked by trade challenges, the implications of tariffs on automotive components have sparked intense debates across the industry. Many stakeholders, from franchised dealers to parts suppliers, are voicing their concerns regarding these impending tariffs implemented by the current administration. As the automotive sector braces itself for potential turmoil, the need for a unified stance against these import duties has never been clearer. The upcoming financial pressures threaten not only the survival of numerous suppliers but also the stability of vehicle production in the United States. Consequently, the automotive sector is calling for strategic conversations with policymakers to navigate these turbulent waters.

Impact of Auto Parts Tariffs on U.S. Automotive Production

The impending implementation of 25% tariffs on auto parts, scheduled to take effect on May 3, is raising alarm bells among various stakeholders within the U.S. automotive industry. Leading organizations are uniting in their effort to inform the Trump administration that these tariffs pose a serious threat to domestic automotive production. With the automotive sector being a critical pillar of the U.S. economy, supporting around 10 million jobs and contributing over $1.2 trillion annually, the repercussions of such tariffs could ripple through manufacturing, affecting everything from suppliers to dealerships.

Experts articulate that the tariffs will likely intensify the financial strain on auto suppliers who are already facing difficulties, particularly amidst current global supply chain issues. The letter sent to the administration emphasizes that an abrupt increase in costs could precipitate significant production disruptions. These disruptions may lead to production halts, layoffs, and even bankruptcies among key suppliers, indicating that the stability of the entire automotive ecosystem is at risk. As such, failure in one supplier could lead to widespread shutdowns in manufacturing lines, drawing parallels to the disruptions experienced during the pandemic.

Unified Lobbying Efforts Against Tariffs

In a rare and unprecedented move, six major policy groups representing the U.S. automotive industry are collaborating to lobby against the imposition of the auto parts tariffs announced by the Trump administration. This joint effort marks a significant moment of solidarity across a traditionally fragmented industry, highlighting the critical nature of the situation. Signatories of the letter include the leaders of influential organizations such as the Alliance for Automotive Innovation and the National Automobile Dealers Association, showcasing the diverse representatives of dealers, suppliers, and major automakers coming together for a common cause.

The collective stance against the tariffs underscores the understanding that all parties within the industry stand to be affected by these economic measures. These groups not only represent the immediate stakeholders but embody the broader workforce and economic interests throughout the U.S. The call for reconsideration of the tariffs also aligns with previous tariff relief measures granted to other sectors, such as consumer electronics and semiconductors, suggesting that similar considerations might be warranted for the automotive industry.

Implications of Higher Costs on Consumers and Supply Chains

The auto parts tariffs will inevitably lead to increased costs for consumers, significantly affecting vehicle pricing across the board. Industry leaders predict that the increased costs — estimated to exceed $100 billion — will manifest in higher prices for both new and used vehicles. Such price increases could further stall sales, resulting in a discernible decline in vehicle unit sales, contradicting the industry’s growth projections and harming the overall economy.

Moreover, the ripple effect of these tariffs on suppliers could create a bottleneck in the global automotive supply chain. Experts warn that manufacturers in the U.S. are not equipped to make drastic changes to their supply chains quickly. The transition to greater domestic production entails time and investment, which the tariffs do not accommodate for. A balanced approach that considers both the urgency for domestic manufacturing and the realities of global supply chains is essential to mitigate the adverse effects.

Trump Administration’s Response to Lobbying

In response to the concerned lobbying from the automotive industry, President Trump has acknowledged the possibility of reassessing the auto parts tariffs. Following the release of the letter from industry groups, he indicated an openness to providing necessary relief to manufacturers struggling to adjust to the imposed tariffs. Discussions around tariff adjustments or relief have been welcomed by industry insiders, suggesting that such actions could help stabilize an otherwise precarious situation.

Industry executives have voiced optimism that relief efforts might lead to a more favorable environment for automotive production in the U.S. While the administration’s willingness to engage in these discussions is a positive sign, it remains to be seen how comprehensive the relief will be and how soon it can be implemented. The industry’s calls for a sustainable solution underscore the necessity of balancing protectionist policies with the practical realities facing manufacturers and suppliers, paving the way for a more robust automotive sector.

Long-term Solutions for the Automotive Supply Chain

Addressing the current challenges posed by auto parts tariffs necessitates a strategic focus on long-term solutions for the automotive supply chain. Key industry leaders advocate for policies that enhance local manufacturing capabilities and improve resilience within the supply chain. While immediate tariff relief would provide temporary alleviation, the sector requires robust frameworks that enable adaptation to potential future disruptions, ensuring the harmonious functioning of the automotive ecosystem.

Investments in technology and infrastructure, alongside stronger partnerships with local suppliers, can foster a more sustainable automotive landscape in the U.S. By promoting innovation and streamlining production processes, the industry can better position itself to weather external shocks, thus minimizing the reliance on foreign imports. This proactive approach to strengthening the domestic supply chain not only addresses the current tariff-related issues but also sets the stage for a more competitive and resilient future for the U.S. automotive industry.

Frequently Asked Questions

What are the potential impacts of auto parts tariffs on the U.S. automotive industry?

The 25% tariffs on auto parts, set to take effect, could severely disrupt the U.S. automotive industry by increasing costs for manufacturers and suppliers. This could lead to production stoppages, layoffs, and even bankruptcies among auto suppliers already in distress. The ripple effect may cause delays in automotive production and higher vehicle prices for consumers.

How are auto manufacturers responding to the Trump administration’s proposed auto parts tariffs?

Auto manufacturers are uniting in a rare move to lobby the Trump administration against the proposed 25% tariffs on auto parts. Six major policy groups representing various stakeholders in the automotive industry have collectively expressed their concerns, highlighting the potential jeopardy these tariffs pose to U.S. automotive production and job security.

What is the position of suppliers regarding the tariffs on auto parts?

Suppliers have expressed significant concern over the proposed auto parts tariffs, noting that many are already in financial distress. They warn that the additional costs could lead to a breakdown in the supply chain, jeopardizing production lines for major automakers and resulting in widespread layoffs and factory closures.

Why might the Trump administration reconsider the auto parts tariffs?

The Trump administration may reconsider the tariffs due to pressure from the automotive industry, which argues that the tariffs could hamper U.S. automotive production and negatively impact an industry that supports millions of jobs. Additionally, there is a precedent for tariff relief in other sectors, suggesting a potential for similar appeasements for the automotive industry.

What are the broader implications of the auto parts tariffs on the global supply chain?

The auto parts tariffs could disrupt the global supply chain, creating a domino effect that impacts production timelines and costs. Experts predict a reduction in vehicle sales and increased prices across new and used cars, coupled with heightened expenses amounting to over $100 billion for the automotive industry, which could impact both suppliers and consumers.

How do tariffs on auto parts influence U.S. automotive production?

Tariffs on auto parts directly influence U.S. automotive production by increasing the cost of materials for manufacturers. This added financial burden could lead to reduced production capabilities, hinder competitiveness, and ultimately result in lower output of vehicles in the U.S. market.

What unique coalition of automotive groups is opposing the auto parts tariffs?

A unique coalition opposing the auto parts tariffs includes six key policy groups in the automotive industry, representing a diverse range of stakeholders such as franchised dealers, suppliers, and major automakers. This unified stance is aimed at addressing the potential detrimental effects of the tariffs on U.S. automotive production.

What role does lobbying play in the discussion of auto parts tariffs?

Lobbying plays a crucial role in addressing the potential impacts of auto parts tariffs. Industry groups are actively communicating with the Trump administration to advocate against the tariffs, aiming to protect U.S. automotive production and the associated jobs, highlighting the collective voice of the industry to influence policy decisions.

| Key Points | Details |

|---|---|

| Joint Letter Against Tariffs | Six major U.S. automotive policy groups unite against a 25% tariff on auto parts, citing potential jeopardy of automotive production. |

| Urgent Concerns | Suppliers are already distressed; tariffs could lead to production stoppages, layoffs, and bankruptcies. |

| Economic Impact | The U.S. automotive sector supports 10 million jobs and contributes $1.2 trillion to the economy annually. |

| Historic Cooperation | The unified response from multiple organizations is unprecedented within the automotive industry. |

| Presidential Response | President Trump expressed willingness to reconsider tariffs, which could relieve affected auto manufacturers. |

| Future Outlook | Tariffs could lead to increased vehicle prices and a projected drop in sales by millions of units. |

Summary

Auto parts tariffs are currently a matter of heated debate as six prominent U.S. automotive policy groups have come together to lobby against a proposed 25% tariff on auto parts, which threatens to disrupt the nation’s automotive production. This rare conjunction of groups including franchised dealers and major automakers signals significant unease within the industry, as they warn that such tariffs could exacerbate existing financial stresses among suppliers and ultimately harm the broader economy. With President Trump indicating openness to reconsidering these tariffs, the future of auto parts tariffs remains uncertain, but the collective voices of the industry reflect the urgent need for careful consideration to avoid detrimental impacts on jobs and production.