Banco Industrial Remittance Services Revolutionized with Sukupay

Banco Industrial remittance services are revolutionizing the way Guatemalans send money across borders, thanks to the recent integration of Sukupay, a cutting-edge crypto-based payment platform. As the largest bank in Guatemala, Banco Industrial is at the forefront of innovation in the banking sector, providing affordable services for its customers. With a flat fee of just $0.99 for remittances, clients can easily deposit funds directly into their accounts, making cross-border transactions smoother than ever. The adoption of cryptocurrency speaks to a broader trend in Guatemala banking, where businesses are increasingly turning to technology for efficiency and cost-effectiveness. As Michel Caputi, Head of the Strategic Alliances Division, stated, Banco Industrial is proud to lead this pioneering effort, highlighting the significant advantages of cryptocurrency integration in their financial offerings.

The remittance solutions offered by Banco Industrial are a game-changer for individuals seeking efficient ways to transfer money internationally. By partnering with Sukupay, Banco Industrial not only simplifies the process of sending and receiving funds but also embraces innovative technologies like crypto payments and digital currencies. This strategic move enhances the bank’s reputation as a leader in facilitating cross-border remittances, carving out a niche where traditional banking meets modern fintech solutions. Customers can now enjoy seamless transactions, with the added benefit of cryptocurrency being integrated into their banking experience. In a region where financial access is vital, these developments present exciting opportunities for both senders and recipients alike.

Understanding Banco Industrial Remittance Services

Banco Industrial stands as the largest banking institution in Guatemala, offering a multitude of financial services, including an innovative remittance service. Their integration of Sukupay allows customers to send and receive cross-border payments conveniently and affordably. With a flat fee of just $0.99, Banco Industrial’s remittance services become an attractive option for those looking to transfer funds efficiently. This feature not only simplifies the remittance process but also makes it accessible for the broader population in Guatemala.

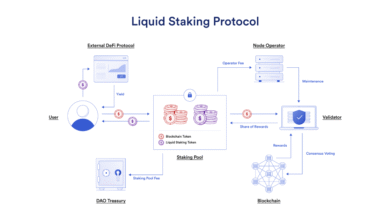

By leveraging advanced technology, Banco Industrial has positioned itself at the forefront of Guatemala banking. The partnership with Sukupay marks a significant shift in traditional banking practices, showcasing the bank’s commitment to integrating the latest innovations, such as cryptocurrency and digital payment solutions. Customers can now deposit their remittance directly into their bank accounts, providing them with immediate access to their funds, which is crucial for meeting everyday needs.

The Impact of Sukupay on Cross-Border Remittances

The introduction of Sukupay as a remittance provider has transformative implications for cross-border transactions. Traditionally, sending money across borders can involve high fees and lengthy waiting times. However, with Sukupay, Banco Industrial customers can experience a streamlined process that minimizes costs and maximizes convenience. The flat fee structure not only reduces the financial burden on individuals sending money to family and friends abroad, but it also encourages more frequent transactions, boosting relational ties and economic exchanges in the region.

Moreover, Sukupay’s cryptocurrency integration serves as a modern alternative to fiat currency, addressing the increasing demand for faster and more secure payment methods. This innovative approach positions Banco Industrial as a leader in the remittance sector in Latin America, making it possible for users to utilize digital currencies for real-world applications. As banks continue to evolve, the success of Sukupay will likely inspire other financial institutions to adopt similar technologies, potentially reshaping the entire landscape of cross-border remittances.

The Future of Cryptocurrency Integration in Banking

As the world shifts toward digital currencies, the future of banking is undoubtedly interwoven with cryptocurrency integration. Banco Industrial, by incorporating Sukupay into its services, is not just enhancing remittance solutions but also paving the way for future innovations in financial technology. The growing acceptance of crypto payments underscores a significant cultural shift in how individuals perceive and utilize money, making Banco Industrial a vital player in this transformative phase.

Looking ahead, it’s likely that more banking institutions will begin to explore similar partnerships, recognizing the value of cryptocurrency in enhancing efficiency and reducing costs. Consumers will benefit from a more diversified range of service offerings, providing increased autonomy and security in their financial transactions. Thus, Banco Industrial remains an exemplar of progressive banking practices, enabling clients to harness the full potential of modern financial tools.

Advantages of Using Sukupay for Remittances

Utilizing Sukupay through Banco Industrial brings several advantages to customers engaging in remittances. First and foremost is the incredibly low fee of $0.99 for sending and receiving funds. This cost-effective model encourages more individuals to use formal channels for money transfers instead of relying on informal or underground services, which can be risky and expensive. Furthermore, direct bank deposits ensure that recipients have immediate access to their funds, which is crucial for managing urgent financial needs.

Additionally, the integration of cryptocurrency into the remittance process elevates the overall user experience by providing a modern and efficient payment solution. With cryptocurrency, transactions can be processed almost instantaneously, eliminating the days-long waiting periods commonly associated with traditional banking methods. As the demand for quicker and more secure transactions rises, Sukupay positions Banco Industrial not only as a financial service provider but also as a pioneer in adopting tech-driven solutions to enhance customer satisfaction.

Challenges and Considerations of Crypto Payments

Despite the promising advantages of crypto payments, there are still challenges and considerations that Banco Industrial and its customers must face. One significant barrier is the volatility of cryptocurrencies, which can fluctuate dramatically in value within short periods. For individuals sending or receiving money, this raises concerns about the actual value of the transferred funds at the time of receipt. Addressing these challenges will require further education on cryptocurrency and thoughtful management of market risks by both banks and customers.

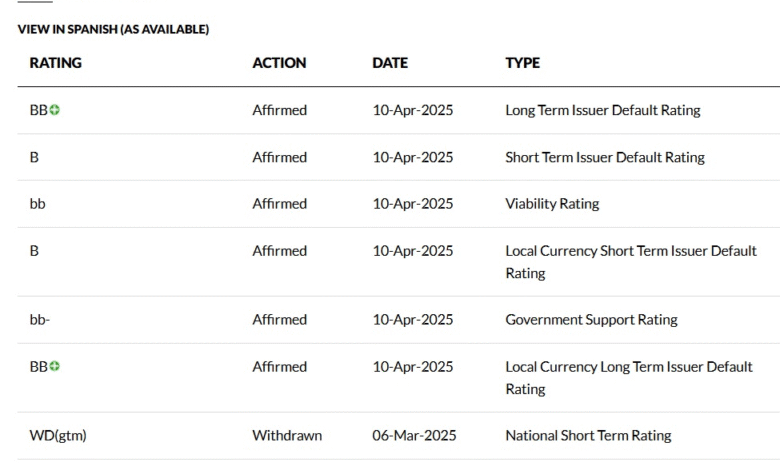

Another consideration involves the regulatory landscape surrounding cryptocurrency that varies across countries. As Banco Industrial expands its remittance services via Sukupay, it must remain compliant with financial regulations both locally in Guatemala and internationally. This compliance is vital not just to avoid penalties but also to build trust with customers who may be hesitant to adopt new technology. By proactively addressing these challenges, Banco Industrial can establish itself as a reliable leader in the integration of digital payments in its banking services.

The Role of Banco Industrial in Financial Inclusion

Banco Industrial has always been committed to enhancing financial inclusion, and its partnership with Sukupay significantly aligns with this mission. By offering affordable remittance services through cryptocurrency, the bank opens avenues for individuals who might not have had access to traditional banking services due to high fees or geographical barriers. This incorporation of Sukupay allows individuals from various backgrounds to participate in the economy by facilitating easier access to essential financial services.

The accessibility of Banco Industrial’s remittance services can lead to broader economic empowerment in Guatemala. As families receive remittances more reliably and efficiently, they can invest in education, healthcare, and other critical needs. This, in turn, ensures a more inclusive growth model where every individual can contribute and thrive. Banco Industrial’s initiative to utilize modern payment solutions highlights the importance of empowering even the most underserved populations, setting an example for other banks in the region.

How Sukupay Enhances User Experience

The integration of Sukupay into Banco Industrial’s remittance services significantly enhances user experience by streamlining various aspects of payment processing. Customers benefit from a straightforward interface that allows them to send and receive money with just a few clicks. This user-friendly approach encourages adoption among those who may be unfamiliar with digital transactions, particularly in regions where cash has traditionally dominated. The convenience factor cannot be overstated, as it allows users to perform transactions quickly and efficiently from the comfort of their homes.

In addition, Sukupay’s blockchain technology ensures that all transactions are transparent and secure, giving customers peace of mind when sending money across borders. The added layer of security helps to build trust, particularly among those hesitant to use digital payments. As customers witness faster processing times and increased reliability of their remittance services with Banco Industrial, they are more likely to embrace the shift towards digital banking and fintech solutions.

The Significance of Pioneering Crypto Solutions in Latin America

Banco Industrial’s early adoption of Sukupay marks a significant achievement in the financial landscape of Latin America. As one of the first banks in the region to integrate a cryptocurrency provider into its services, Banco Industrial is establishing itself as a thought leader and innovator. This pioneering move not only demonstrates their commitment to modernizing financial services but also encourages other institutions to explore similar integrations, potentially reshaping banking across the region.

Additionally, this advancement has broader implications for the regional economy. By accepting cryptocurrencies, Banco Industrial enhances its adaptability to global financial trends, aligning with the increasing legitimacy of digital assets. This fosters a progressive banking culture in Latin America, which can attract more investors and stakeholders looking to engage with modern financial technologies. As a result, clients can expect access to more diverse and efficient financial products in the near future.

Customer Testimonials on Banco Industrial’s Remittance Services

Feedback from customers utilizing Banco Industrial’s remittance services through Sukupay has been overwhelmingly positive. Clients have reported significant satisfaction with the low fees and the speed at which transactions are processed. Many have expressed how accessing funds quickly has improved their daily lives, allowing for more timely support to family members abroad. This positive customer reception reinforces the bank’s decision to integrate cryptocurrency into its service offerings and showcases how it has successfully addressed long-standing issues in the remittance sector.

Moreover, testimonials highlight Banco Industrial’s commitment to customer care which plays a vital role in fostering user confidence. The bank’s willingness to guide and support customers through the transition towards digital banking solutions illustrates its dedication to ensuring that all clients are equipped to navigate these modern services. Such strong customer relationships not only build loyalty but also encourage word-of-mouth referrals, which are invaluable in expanding the bank’s reach within the community.

Frequently Asked Questions

What are the benefits of using Banco Industrial remittance services with Sukupay?

Banco Industrial remittance services, enhanced by Sukupay, offer several benefits including lower fees, with a flat rate of just $0.99 for sending and receiving remittances. This integration allows customers to deposit funds directly into their bank accounts, making it more convenient and cost-effective than traditional methods. Additionally, using cryptocurrency for remittances accelerates the process and expands accessibility for users in Guatemala.

How does Sukupay integrate with Banco Industrial remittance services?

Sukupay integrates seamlessly with Banco Industrial remittance services by enabling crypto-based cross-border payments. This partnership allows customers to leverage cryptocurrency technology for faster transactions, all while enjoying the security and reliability associated with Banco Industrial, Guatemala’s largest bank.

Can I send cross-border remittances through Banco Industrial using cryptocurrency?

Yes, you can send cross-border remittances through Banco Industrial using cryptocurrency via Sukupay. This innovative service allows users to send and receive funds quickly and at a low transaction fee, enhancing the overall remittance experience for customers looking to send money back home.

What makes Banco Industrial remittance services distinct in Guatemala?

Banco Industrial remittance services are distinct due to their pioneering use of Sukupay’s crypto-based payment technology. As the first major bank in Latin America to implement such a system extensively, Banco Industrial is setting a new standard for remittance services, offering secure, efficient, and low-cost options for cross-border transactions.

Is Sukupay a safe option for remittances through Banco Industrial?

Yes, Sukupay is a safe option for remittances through Banco Industrial. The integration of cryptocurrency technology adds an extra layer of security and transparency to transactions, ensuring customer confidence in sending and receiving funds. Banco Industrial’s established reputation further enhances the safety of this service.

What is the fee structure for Banco Industrial remittance services using Sukupay?

Banco Industrial remittance services using Sukupay have a simple fee structure, charging customers a flat fee of $0.99 for sending and receiving remittances. This competitive pricing makes it a popular choice among users looking for economical solutions for their cross-border remittance needs.

How can I deposit funds received through Banco Industrial remittance services into my account?

To deposit funds received through Banco Industrial remittance services, customers can easily transfer the funds directly into their bank accounts once the remittance is processed. This direct deposit feature, facilitated by Sukupay’s integration, simplifies the process and allows for immediate access to funds.

What role does cryptocurrency play in Banco Industrial’s remittance services?

Cryptocurrency plays a vital role in Banco Industrial’s remittance services by enabling faster and more cost-effective transactions. The integration with Sukupay allows customers to utilize digital currencies for cross-border payments, making remittances more efficient and accessible for those in Guatemala.

Why should I choose Banco Industrial for my remittance needs over other banks?

Choosing Banco Industrial for your remittance needs offers distinct benefits such as the pioneering use of Sukupay’s cryptocurrency technology, low transaction fees of $0.99, and direct deposits into bank accounts. These features provide a modern, secure, and user-friendly remittance experience compared to traditional banking options.

Are there any limits on sending remittances through Banco Industrial using Sukupay?

Yes, there may be limits on the amount you can send through Banco Industrial’s remittance services using Sukupay. Users should check with the bank for specific limits, which can vary based on regulatory guidelines and account type. However, the service is designed to accommodate a wide range of remittance needs.

| Key Point | Details |

|---|---|

| Banco Industrial’s Announcement | The largest bank in Guatemala has integrated Sukupay for enhanced remittance services. |

| Sukupay Integration | Sukupay is a crypto-based cross-border payment provider. |

| Remittance Fees | Customers can send and receive remittances for a flat fee of $0.99. |

| Deposit Options | Funds can be directly deposited into bank accounts. |

| Pioneering Solution | This service is highlighted as a modern solution unique to Latin America. |

| Michel Caputi’s Statement | The Head of Strategic Alliances at Banco Industrial stated they are pioneers in implementing crypto-based remittances in retail banking. |

| Historical Significance | Sukupay claims this is the first extensive implementation of a crypto-native protocol in a leading retail bank in Latin America. |

Summary

Banco Industrial remittance services have revolutionized the way customers can send and receive money across borders. By integrating Sukupay, the bank has effectively harnessed cryptocurrency to provide a low-cost solution for remittances, setting a new standard in Latin America. With a flat fee of only $0.99, this service not only facilitates convenient deposits into bank accounts but also aligns with modern financial trends, positioning Banco Industrial as an industry leader in innovation.