Bank Deregulation: Investor Optimism in the Trump Era

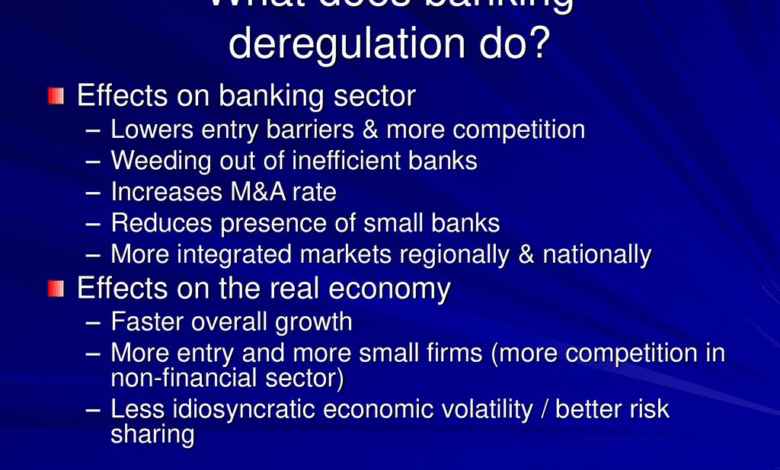

Bank deregulation is transforming the landscape of the financial sector, particularly under the Trump administration, which has ushered in a wave of relaxed regulations. Investors in bank stocks are betting that these changes will enhance profitability and stimulate growth within the sector. As optimism surrounds the potential for increased bank stock investment, many are witnessing a rise in their stock values. Analysts believe that this shift will allow banks to take on more risks, potentially leading to higher profits, albeit with accompanying challenges. While the immediate effects of financial deregulation spark excitement, it is essential to remain vigilant about the long-term implications for market stability and consumer protection.

The ongoing transformation of banking regulations, often referred to as financial liberalization, underscores the recent policy shifts that favor less oversight in the sector. This change is drawing significant attention from investors, particularly in light of how it could impact bank profitability and risk dynamics. The landscape for those involved in bank stocks is changing, as many perceive the loosening of restrictions as a boon for potential earnings. Moreover, with a heightened investor outlook on banks, analysts are actively evaluating the broader effects of these policies on both market stability and consumer trust. As the discussion about sustainable financial practices continues, stakeholders must weigh the risks and rewards of such regulatory changes.

Understanding Bank Deregulation Under the Trump Administration

Bank deregulation under the Trump administration has become a pivotal aspect of the current financial landscape. With a focus on easing restrictions, the administration has aimed to foster an environment conducive to banking growth and increased profitability. This shift not only influences the operational strategies of financial institutions but also significantly affects bank stock investments, as investors become increasingly inclined to maneuver within this anticipated more flexible regulatory framework.

As banks adjust their strategies in light of the anticipated deregulation, the investor outlook on banks has become more optimistic. Enhanced profitability prospects encourage stock purchases, showing a bullish trend in bank stocks. However, while the immediate effects of deregulation suggest a brighter outlook for bank profitability, it raises long-term questions about the effects of financial deregulation on market risks and stability. The potential increase in bank risks must be balanced against the need for robust consumer protections.

Frequently Asked Questions

How does bank deregulation under the Trump administration impact bank stock investments?

Bank deregulation under the Trump administration is anticipated to positively affect bank stock investments. Investors are betting that looser regulations will enhance the profitability of banks, leading to increased stock values as banks can undertake more risks without strict oversight.

What are the predicted financial deregulation effects on bank profitability and risks?

The predicted financial deregulation effects suggest that banks will experience a surge in profits as they capitalize on a less restrictive regulatory environment. However, taking on more risks can also expose banks to potential financial instability, raising concerns about market risks.

What is the investor outlook on banks following the Trump administration’s banking policies?

The investor outlook on banks has become increasingly optimistic following the Trump administration’s banking policies. The expectation of deregulation encourages investments in bank stocks, with many investors believing that these changes will drive growth and profitability in the banking sector.

What should investors consider regarding bank profitability and risks amidst deregulation?

Investors should consider both the potential increase in bank profitability due to deregulation and the associated risks that come with a less regulated environment. While the opportunity for higher returns exists, the long-term implications on market stability and consumer protection must also be weighed carefully.

How has the Trump administration’s approach to bank deregulation influenced market stability concerns?

The Trump administration’s approach to bank deregulation has raised significant concerns regarding market stability. While deregulation may boost bank profitability in the short term, the lack of stringent regulatory frameworks could lead to vulnerabilities reminiscent of past financial crises, necessitating a cautious investor perspective.

| Key Points | Details |

|---|---|

| Investor Sentiment | Bank investors are optimistic about looser regulations under the Trump administration. |

| Anticipated Outcomes | Increased profitability and growth for banks are expected as regulations ease. |

| Stock Value Impact | Stock values of banks are starting to rise in anticipation of a favorable regulatory environment. |

| Deregulation as a Positive Signal | Potential deregulation is seen as a positive for investors, prompting increased investment in banking stocks. |

| Analysis of Risks | Analysts predict a surge in profits as banks may take on more risks in a less restrictive framework. |

| Long-term Considerations | Questions arise regarding long-term market stability and consumer protection in light of deregulation. |

| Historical Context | The shift towards leniency raises concerns considering past financial crises due to insufficient regulation. |

| Investor Caution | Despite optimism, investors remain cautious as they assess the changing regulatory landscape. |

Summary

Bank deregulation is a critical topic as it influences the financial landscape significantly. The recent trend under the Trump administration suggests a move towards looser regulations, which many investors believe will stimulate profitability and growth. While this deregulation could lead to short-term gains for banks, the long-term implications for market stability and consumer protection cannot be overlooked. History has shown us that inadequate regulation can lead to severe repercussions, making it essential for stakeholders to consider the potential risks associated with this new approach. Ultimately, while the prospect of bank deregulation raises economic hopes, a balanced perspective on its consequences is necessary.