Banks in Trump’s Economy Flourish: Insights on Markets and Consumers

Banks in Trump’s economy are experiencing a remarkable renaissance, marked by unprecedented growth and profitability. The impact of the Trump economy has reverberated through the financial sector, significantly boosting Wall Street profits and encouraging robust U.S. consumer borrowing. Recent financial market trends reveal that corporate acquisitions and large loans have surged, driving up stock and bond trading volumes to new heights. This favorable environment has enabled the six largest U.S. banks to report a staggering $39 billion in profits for the second quarter alone, defying analyst expectations with a 20% increase in core earnings year-over-year. As we explore the dynamics of this evolving economy, it becomes evident that banks are not only thriving but are also playing a crucial role in shaping the financial landscape for consumers and businesses alike.

Banks within the context of the Trump administration’s economic policies have seen a significant uplift, reflecting broader trends in the financial sector. The current economic climate, influenced by fiscal strategies and legislative changes, has fueled financial institutions’ growth, resulting in heightened profitability and consumer engagement. Factors like increased corporate mergers, substantial loan activity, and investor confidence are driving investment banking profitability, particularly for major players like JPMorgan. As geopolitical uncertainties loom, the resilience of the banking system showcases a pivotal shift in how these entities navigate market dynamics, ultimately benefiting a diverse swath of American consumers and businesses.

The Surge of Banks in Trump’s Economy

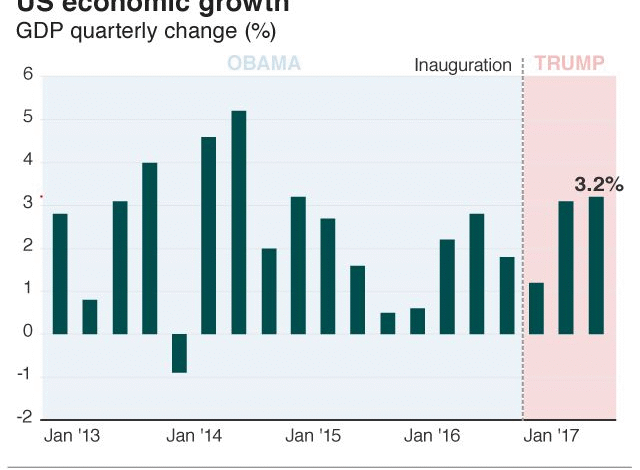

In the current economic climate under President Donald Trump, banks are experiencing unprecedented growth and profitability. This surge is largely attributed to favorable conditions in the financial markets, which have created lucrative opportunities for investment banks and traditional lenders alike. Wall Street, specifically, is benefiting from a boom in stock and bond trading, with many firms reporting record trading volumes. As companies race to take advantage of the competitive landscape, the demand for financial services continues to escalate, driving banks to reap substantial gains.

The six largest U.S. banks, including giants like JPMorgan Chase, reported a collective profit of around $39 billion in the second quarter alone—a figure that greatly exceeded analysts’ projections and marked a 20% rise from the previous year. This impressive financial performance reflects an important trend: businesses are acquiring each other in strategic mergers, spurred by low-interest rates and robust consumer spending. In this environment, banks have shifted their focus to providing loans and financial advice, contributing to their overall profitability and signaling a strong economic underpinning.

Wall Street Profits and Economic Resilience

Despite the tumultuous events in the early part of the year, Wall Street has shown remarkable resilience amid changing economic policies. After President Trump initiated aggressive tariffs, many feared a downturn, yet the markets have rallied, largely due to the rebound from earlier shocks. Investors have become less anxious about the administration’s tariff announcements, viewing them as political posturing rather than genuine threats to the financial system. This collective confidence has allowed banks to thrive, as they navigate through periods of uncertainty with remarkable agility.

Moreover, the positive trends in the financial markets have led to increased revenues for banks. For instance, JPMorgan Chase reported significant increases in its investment banking revenues, surpassing market expectations by a substantial margin. The bank’s advisory services for mergers and initial public offerings (IPOs) have particularly benefited from a surge in corporate activity as companies position themselves for growth. This trend towards increased corporate acquisitions signifies a healthy investment climate, where businesses feel empowered to finance their strategies amid economic uncertainties.

U.S. Consumer Borrowing Trends

U.S. consumers are also playing a pivotal role in the current banking landscape, with borrowing levels on the rise. Reports from JPMorgan indicate that consumer borrowing has increased by 5% year-on-year, driven predominantly by higher credit card usage and loans for personal expenses. This uptick in consumer borrowing is a strong indicator of economic confidence, as households are willing to take on debt to fund their expenditures. Moreover, the ability to manage and repay these loans efficiently suggests that consumers are optimistic about their financial futures.

This robust borrowing behavior supports the overall health of the banking sector, as financial institutions gain from interest payments and fees associated with consumer loans. Notably, as spending among American consumers remains strong, banks are well-positioned to continue capitalizing on this trend. The combination of steady borrowing and repayment signals a resilient consumer base that is vital for sustaining the growth of banks operating in Trump’s economy.

The Impact of Financial Market Trends on Banks

Financial market trends have a direct influence on the performance of banks operating within Trump’s economic framework. For instance, the recent trend of merger and acquisition activity among corporations has led to an upsurge in demand for banking services, ranging from corporate loans to financial advisory roles. This dynamic environment fosters significant opportunities for banks to expand their market share and profitability, capitalizing on corporate entities seeking to leverage existing resources for growth.

Additionally, turbulent market conditions resulting from trade debates have been beneficial for banks engaged in trading activities. As volatility increases, banks’ trading desks typically see higher volumes of activity, translating into increased revenues. This adaptability has allowed leading banks to report greater earnings, even in times of uncertainty, underlining the resilience and strategic positioning of financial institutions in an ever-evolving marketplace.

JPMorgan Earnings Report Highlights

The recent earnings report from JPMorgan Chase serves as a prime example of the banking sector’s success amid the Trump economy. The bank reported an astonishing $15 billion in quarterly profit, highlighting its position as the most profitable bank in the U.S. This performance not only reflects the bank’s operational efficiency but also its ability to navigate complex market conditions strategically. The strength of its investment banking segment, which experienced a 7% rise in revenue, underscores the bank’s proactive approach to seizing opportunities in the financial markets.

Such impressive financial results underscore the broader trends at play in the banking industry, with firms like JPMorgan capitalizing on favorable economic conditions. Analysts note that despite concerns over potential recessionary pressures, the bank’s optimistic outlook indicates a shifting perspective on economic risks. By adapting to the evolving landscape and responding swiftly to market demands, JPMorgan and other banks have positioned themselves to thrive regardless of future challenges that may arise under the current administration.

Navigating Risks in a Turbulent Economy

While banks are currently flourishing in this economic environment, risks remain on the horizon, particularly as they relate to geopolitical tensions and domestic policy changes. Notably, the rapid shifts in Trump’s economic policies, including tariff implementations, have created areas of uncertainty that banks must navigate. According to analysts, a potential recession could impact consumer behavior significantly, thereby affecting banks’ profitability. However, the current data suggests that the banks are effectively managing these risks while still delivering robust results.

To mitigate these challenges, banks are closely monitoring economic indicators that could signal shifts in the market. As stated by JPMorgan’s CFO, their internal measures of U.S. economic risks have improved, suggesting that worst-case scenarios may not be as imminent as once thought. By maintaining a cautious yet optimistic approach, banks can better position themselves to weather any potential downturns while continuing to support consumer and corporate borrowing.

Consumer Spending Patterns Under Trump’s Administration

Consumer spending is a critical factor influencing the banking sector’s performance in Trump’s economy. Reports indicate that American consumers are maintaining confidence in their economic situation, which is reflected in their spending habits. The ability to borrow and spend simultaneously strengthens both the banking sector and the overall economy, creating a feedback loop where banks benefit from consumer loans while consumers enjoy access to credit, encouraging further spending.

As long as consumer sentiment remains high, banks are expected to thrive, with continuous investments into consumer-centric loan products. This creates a favorable cycle that bolsters economic stability and promotes sustainable growth. With an economy characterized by resilient consumer behavior, banks are well-equipped to provide the necessary financial services and products that cater to a borrowing populace, ultimately solidifying their role in a thriving economy.

The Future of Banking amid Economic Uncertainty

As we look ahead, the future of banking in Trump’s economy remains a topic of speculation and interest. With current trends suggesting stability and growth, banks like JPMorgan are likely to continue adapting their strategies to align with market demands. However, factors such as geopolitical risks, policy changes, and global economic shifts could impact this trajectory. Banks must stay agile, ready to pivot in response to any fluctuations in the economic landscape.

Moreover, the ongoing confidence among consumers and corporate leaders will be crucial in determining the long-term outlook for the banking sector. As businesses and individuals alike continue to engage with financial institutions, maintaining a strong relationship built on trust and reliability will be paramount. By focusing on their core strengths and addressing the evolving needs of their customers, banks can ensure their continued success in a complex economic environment.

Frequently Asked Questions

What is the impact of Trump’s economy on banks and financial market trends?

Trump’s economy has significantly benefited banks and financial markets, with Wall Street experiencing heightened activity due to increased stock and bond trading, corporate acquisitions, and robust consumer spending. Reports show that major U.S. banks achieved a profit surge, indicating a positive scenario for financial firms amidst the current administration’s economic policies.

How have Wall Street profits changed under the Trump economy?

Under Trump’s economy, Wall Street profits have risen markedly, with the six largest U.S. banks reporting about $39 billion in profits during the second quarter. This reflects a more than 20% increase in core earnings from the previous year, showcasing the profitability of financial institutions amid ongoing market dynamics.

How does consumer borrowing in Trump’s economy affect banks?

Consumer borrowing has increased in Trump’s economy, contributing to overall bank profitability. Institutions like JPMorgan reported a 5% rise in loans year-on-year, driven by higher credit card usage and wholesale loans, signaling consumer confidence and indicating a solid economic climate for banks.

What are the recent trends in financial markets during Trump’s presidency?

Financial market trends during Trump’s presidency include a revival in trading volumes and investment banking activities. Despite the initial market shocks due to trade tariffs, investors have shown resilience, leading to increased corporate borrowing and a spurt in multibillion-dollar deals, benefiting banks significantly.

How do Trump’s policies influence JPMorgan’s earnings reports?

JPMorgan’s earnings reports reflect the economic effects of Trump’s policies, showcasing $15 billion in quarterly profits. The bank’s success can be attributed to trading gains during market fluctuations and strong investment banking revenues, highlighting the positive relationship between governmental economic strategies and financial outcomes.

What factors are contributing to the profitability of banks in Trump’s economy?

Banks are thriving in Trump’s economy due to a combination of factors such as increased consumer spending, rising corporate acquisitions, and the favorable environment for trading activities. As the six largest U.S. banks report robust profits, these elements create a lucrative landscape for financial institutions.

Are banks optimistic about the future of the U.S. economy in Trump’s era?

Yes, banks are generally optimistic about the future of the U.S. economy under Trump’s administration. With improved consumer borrowing rates and diminished recession fears, financial analysts indicate a ‘soft landing’ scenario for the economy, which fosters a positive outlook among banking institutions.

How have investment banking fees changed in the current economic climate?

Investment banking fees have seen an uptick despite market uncertainties, with JPMorgan reporting a 7% increase in revenues from this sector. This surge, driven by corporate dealings and market adaptations, underscores banks’ ability to capitalize on changing economic conditions while maintaining profitability.

| Key Point | Details |

|---|---|

| Flourishing Banks | Banks are thriving in Trump’s economy with significant profits. |

| Wall Street Activity | Surge in stock and bond trading, corporate acquisitions, and large loans. |

| Profit Levels | The six largest U.S. banks reported $39 billion in profits for Q2. |

| Consumer Spending | Consumers are spending, borrowing, and repaying loans effectively. |

| Investment Banking Growth | Investment banking has seen a revenue spike, indicating corporate confidence. |

| Economic Stability | Indicators show a reduced risk of recession and improving economic conditions. |

| Corporate Optimism | Corporate leaders are navigating uncertainties and proceeding with major transactions. |

Summary

Banks in Trump’s economy are experiencing unprecedented growth and profitability. This positive trend stems from robust consumer spending, effective loan repayments, and a booming Wall Street driven by stock trading and mergers. The resilience shown by American consumers and the banking sector amid uncertainty highlights a strong economic climate. As the largest banks report significant profits, it signals a favorable outlook for the markets and consumers alike, suggesting that the financial landscape is thriving, and banks are well-positioned for continued success.