Barclays Profit Report Shows £2.7 Billion Pre-Tax Earnings

In an impressive display of resilience, Barclays profit report unveiled a pre-tax profit of £2.7 billion ($3.6 billion), marking an 11% year-on-year increase that exceeded analyst expectations of £2.49 billion. This boost can largely be attributed to robust performances in the investment banking sector, driving group revenues to an impressive £7.7 billion. During an appearance on CNBC’s “Squawk Box Europe,” Barclays CEO C.S. Venkatakrishnan shared insights about the current climate, highlighting anticipated market volatility stemming from ongoing U.S. trade policies. Despite initial stock movements indicating optimism, Barclays shares ultimately closed down 0.4%, raising eyebrows amid ongoing UK banking news. Investors are particularly concerned about Barclays’ exposure to U.S. markets, which significantly shapes the bank’s stock performance and earnings outlook going forward.

The latest financial disclosures from Barclays shed light on the bank’s quarterly earnings, revealing significant profitability highlights amid a complex economic backdrop. With a clear focus on investment banking profits as a driving force, Barclays has positioned itself at a pivotal moment for U.K. financial institutions. Led by CEO C.S. Venkatakrishnan, the bank is navigating the impact of fluctuating global trade policies, which pose both risks and opportunities for its market strategy. Noteworthy is the bank’s ability to enhance its earnings despite prevailing uncertainties, a testament to its robust operational foundations. As UK banking news continues to evolve, analysts and investors alike will closely monitor Barclays’ strategies and performance trends in response to shifting economic conditions.

Barclays Profit Report Highlights Strong Performance

In its latest profit report, Barclays has surprised analysts by reporting a pre-tax profit of £2.7 billion, translating to $3.6 billion. This figure represents an impressive 11% year-on-year increase, notably surpassing expectations set by analysts, who had predicted a profit of £2.49 billion. This upward trend in Barclays earnings showcases the resilience of the bank amid fluctuating market conditions, largely fuelled by improvements in the investment banking sector. With group revenues of £7.7 billion, exceeding forecasts of £7.33 billion, the strength of Barclays’ financial performance cannot be overlooked.

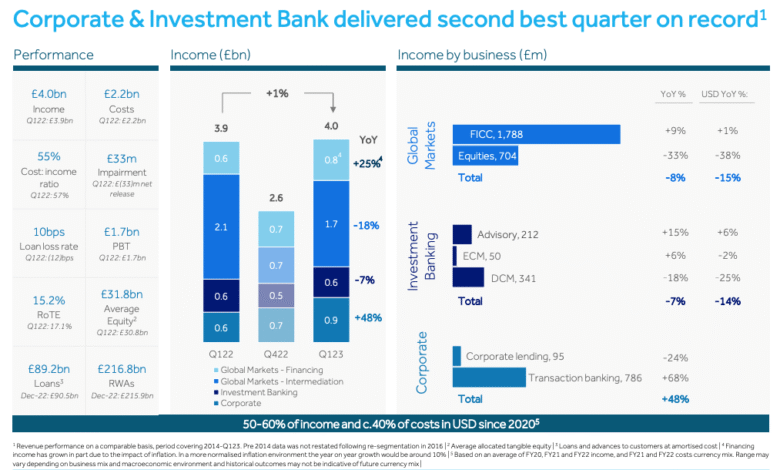

The increase in profitability has been largely attributed to the bank’s investment banking division, which reported a remarkable 16% increase in income, reaching £3.87 billion. This sector has consistently proven to be Barclays’ most profitable, contributing significantly to their overall earnings. As the CEO C.S. Venkatakrishnan highlighted in his comments, the bank is well-prepared to handle emerging market volatility and potential economic slowdowns, further solidifying its stature in UK banking news. With a return on tangible equity soaring to 14%, the positive outlook around Barclays’ profit report sets a promising tone for future investor confidence.

Investment Banking Profits Drive Barclays’ Growth

Barclays’ recent earnings report illustrates the significant role that investment banking profits play in the bank’s overall growth strategy. The investment banking division not only benefitted from a strong performance in the first quarter, but it also helped mitigate the effects of challenging trading conditions on other sectors. With a robust 16% increase in income, Barclays has reaffirmed its competitive position in the investment banking marketplace, especially within the context of evolving trade policies that may affect other banks more acutely.

Moreover, this focus on investment banking comes at a critical time when other financial institutions are reconsidering their strategies in light of global economic pressures. Barclays’ proactive measures in expanding its investment banking capabilities, including its acquisition of Lehman Brothers’ assets, have positioned it well amid rising market volatility. As the company contemplates its next steps, the ability to sustain or grow these profits will be crucial, potentially influencing overall stock performance as market conditions evolve.

Barclays CEO Comments on Market Volatility

In a recent interview, Barclays CEO C.S. Venkatakrishnan discussed the implications of ongoing U.S. trade policies, emphasizing the high level of market volatility that has become a fixture in the current economic landscape. His remarks highlight the bank’s comprehensive approach to risk management, signaling preparedness for various economic scenarios, including potential slowdowns in both the U.K. and U.S. Venkatakrishnan’s insights reflect a broader concern among financial leaders regarding the stability of markets and investor sentiment.

The CEO’s comments also underscore Barclays’ adaptive strategies in navigating these challenges. As one of the leading banks in the U.K., Barclays recognizes the importance of maintaining a competitive edge while being cognizant of external pressures. His reflections are particularly pertinent given the bank’s considerable exposure to the U.S. market, where trade tensions may continue to affect profitability and overall performance. The proactive stance taken by the management speaks volumes about Barclays’ commitment to safeguard its interests amidst uncertain market conditions.

Impact of UK Banking News on Barclays Stock Performance

The interplay between recent UK banking news and Barclays stock performance has been significant, particularly following the bank’s quarterly results announcement. Initially, Barclays shares saw a modest rise of 2%; however, the closing down by 0.4% indicates a tempered investor sentiment amidst broader market concerns. Investors are closely monitoring how ongoing uncertainties, particularly surrounding U.S. trade policies, will affect the bank’s strategies and future earnings.

Additionally, Barclays’ recent performance contrasts with other financial institutions as its stock has shown resilience compared to competitors grappling with challenges in their U.S. operations. Analysts suggest that while Barclays remains focused on its core business strengths, the bank’s heavy reliance on the U.S. consumer and investment banking sectors could present risks that may influence future stock valuations. Keeping abreast of UK banking developments will be essential for investors looking to gauge the bank’s ongoing performance in an evolving economic climate.

Navigating Economic Uncertainty: Barclays’ Strategic Outlook

Barclays is positioning itself strategically to navigate the increasing economic uncertainty stemming from global trade tensions and domestic fiscal policies. As noted by CEO Venkatakrishnan, the bank’s focus on preparedness for various scenarios, including potential slowdowns, underscores its proactive stance in the face of shifting market dynamics. This strategic outlook not only aims to counteract the risks associated with market volatility but also highlights the bank’s commitment to sustaining a robust operational foundation.

Moreover, Barclays’ ability to adapt is evidenced by its earnings performance, with marked gains in its investment banking division serving as a buffer against potential downturns. As economic conditions remain unpredictable, Barclays’ management will need to remain vigilant and agile, continuously assessing market conditions and adjusting strategies accordingly. The targeted approach and insights into future market developments are crucial for maintaining investor confidence and protecting the bank’s valuable market position.

Future Prospects for Barclays Amidst Trade Tensions

The ongoing trade tensions, particularly between the U.S. and global partners, pose significant challenges to banks like Barclays, requiring diligent strategy review and adaptation. Although Barclays has exhibited strong profit growth, as evidenced in its latest earnings release, there remains a palpable cautiousness among investors. The market’s reaction to trade news will likely continue to weigh heavily on Barclays stock performance, as the potential for regulatory changes could significantly impact business operations.

Looking ahead, Barclays must navigate an increasingly complex landscape, where trade policy shifts could contribute to market instability. While the bank enjoys a robust capital position and a strong presence in investment banking, the implications of U.S. tariffs and other geopolitical factors must be accounted for in planning. Investors will be closely scrutinizing Barclays’ strategies for managing these external pressures as they assess the bank’s resilience and ability to sustain profit growth amidst mounting uncertainties.

Barclays U.S. Consumer Banking Segment Performance

Barclays’ U.S. consumer banking segment has demonstrated marked improvements, particularly with a return on tangible equity rising to 9.1% in 2024 from 4.1% the previous year. This notable increase showcases the bank’s operational efficiency and strategic focus on enhancing profitability in a competitive market. However, despite this improvement, the segment experienced a 7% decline in profit before tax, indicating ongoing challenges in achieving sustainable growth against a backdrop of fluctuating economic conditions.

While income in the U.S. consumer banking sector saw a marginal increase of 1% to £864 million, the overall performance reflects a mixed outlook that Barclays must navigate carefully. To capitalize on the upward momentum and combat any potential income stagnation, the bank may need to innovate its product offerings or enhance customer engagement strategies further. The sector’s performance remains crucial for the overarching health of Barclays as it strives to reaffirm its strategic foothold in both UK and U.S. banking markets.

Investors Assess Barclays Amid Economic Changes

As Barclays continues to report strong earnings and navigate the challenges posed by a dynamic economic environment, investors are keenly assessing the bank’s future strategies. The recent profit report has sparked interest, but the bank’s substantial exposure to U.S. markets introduces a layer of complexity, particularly in light of ongoing trade discussions. Analysts urge caution, noting that while the bank has shown resilience, external factors could significantly sway investor confidence and stock performance.

The critical analysis of Barclays’ positioning highlights the need for the bank to maintain transparency and communicated strategies to mitigate risk. Investors are particularly interested in how management will respond to challenges from both domestic and global markets. The outlook for Barclays remains cautiously optimistic, contingent on its ability to adapt successfully to an ever-changing banking landscape while ensuring sustained profitability amidst economic fluctuations.

Frequently Asked Questions

What were the key figures in Barclays profit report for the first quarter?

In its profit report for the first quarter, Barclays reported a pre-tax profit of £2.7 billion, an 11% increase year-on-year. Group revenues reached £7.7 billion, exceeding analyst forecasts of £7.33 billion, with a notable 16% rise in investment banking income to £3.87 billion.

How did Barclays CEO comment on market volatility in the Barclays profit report?

In the Barclays profit report, CEO C.S. Venkatakrishnan expressed concerns about “fairly high market volatility” stemming from ongoing U.S. trade policies. He indicated that the bank is prepared for potential economic slowdowns in both the U.K. and the U.S.

What influenced Barclays stock performance after the earnings report?

Following the Barclays profit report, the stock initially rose by 2% in early trading but ultimately closed down 0.4%. Investor concerns surrounding the bank’s significant exposure to U.S. markets amid trade tensions played a crucial role in this stock performance.

What financial metrics showed improvement for Barclays in the profit report?

The Barclays profit report highlighted a return on tangible equity of 14%, up from 7.5% in the previous quarter. Additionally, the U.K. consumer banking unit reported a 12% rise in income and a 23% increase in pre-tax profit, reflecting robust performance across its business segments.

How are Barclays investment banking profits impacting its future outlook?

Barclays investment banking profits reached £3.87 billion in the latest profit report, indicating strong performance in this sector. However, reliance on U.S. markets raises concerns about future profitability, particularly as trade tensions continue, affecting their stock performance compared to other U.K. banks.

What challenges did Barclays mention in the earnings outlook related to U.S. trade policies?

In the Barclays profit report, CEO Venkatakrishnan noted that heightened economic uncertainty from U.S. trade policies could deter decisive actions from companies and consumers, posing a risk of economic slowdown that the bank must navigate.

How did Barclays results compare to analyst expectations?

Barclays’ profit report exceeded analyst expectations, with pre-tax profits of £2.7 billion surpassing the forecast of £2.49 billion, driven mainly by a robust performance in investment banking and higher group revenues.

What is the significance of Barclays’ acquisition of Tesco Bank mentioned in the profit report?

The acquisition of Tesco Bank significantly contributed to the growth in Barclays’ U.K. consumer banking income, which rose by 12% to £484 million, demonstrating the strategic benefits of expanding their consumer banking presence in the market.

| Key Point | Details |

|---|---|

| Pre-Tax Profit | £2.7 billion, an 11% increase year-on-year, surpassing expectations of £2.49 billion. |

| Group Revenues | £7.7 billion, exceeding the forecast of £7.33 billion. |

| Investment Banking Performance | Income grew by 16% to £3.87 billion, bolstered Barclays’ profitability. |

| Return on Tangible Equity | 14%, up from 7.5% in the previous quarter. |

| U.S. Market Exposure | Concerns over trade tensions affecting Barclays’ U.S. prospects. |

| U.K. Consumer Banking Performance | 12% rise in income to £484 million, 23% increase in pre-tax profit to £207 million. |

Summary

The Barclays profit report highlights a strong performance with a pre-tax profit of £2.7 billion, signaling a robust year-on-year growth amidst uncertainties in global trade policies. As Barclays navigates potential market volatility and economic slowdowns, the bank’s solid results underline its resilience, particularly within investment banking. Looking ahead, the focus remains on mitigating risks related to its significant U.S. market exposure while adapting to the challenging financial landscape.