Berkshire Hathaway Earnings Decline Amid Tariff Uncertainty

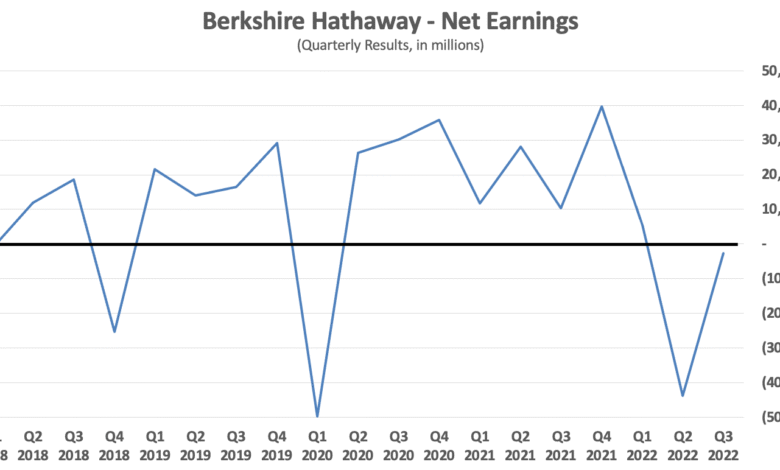

In a surprising turn of events, Berkshire Hathaway earnings decline has taken center stage, raising eyebrows among investors and analysts alike. The latest Berkshire Hathaway report indicates a steep 14% drop in operating profits, primarily attributed to a staggering 48.6% fall in insurance underwriting profit during the first quarter of 2025. Warren Buffett has warned that the impact of tariffs, alongside geopolitical uncertainties, might continue to weigh heavily on the conglomerate’s financial performance. As Berkshire Hathaway navigates these turbulent waters, the company has seen its profits for the year significantly impacted, with losses linked to unpredictable market conditions. With a focus on the future, analysts will be keenly assessing Berkshire Hathaway 2025 earnings as the firm continues to grapple with these challenges.

The recent developments surrounding the legendary conglomerate unveil a concerning downtrend in operating earnings, compelling stakeholders to scrutinize the financial health of this multifaceted enterprise. Amidst a backdrop of tariff complexities and fluctuating market dynamics, the latest data underscores a notable contraction in profits, particularly from its insurance divisions. As the uncertainties of global economics persist, the firm faces critical challenges ahead that could further dampen profitability. Investors are left pondering how tariff repercussions might shape the outlook for Berkshire Hathaway’s diverse portfolio in the coming years, prompting discussions about its long-term strategies. Ultimately, these factors underscore the significance of understanding Berkshire Hathaway’s operational landscape amidst shifting economic tides.

Berkshire Hathaway Earnings Decline and Its Impact on Operations

Berkshire Hathaway’s recent report showed a significant decline in earnings, with operating profits falling by 14% to $9.64 billion in the first quarter of 2025 compared to the same period last year. This unexpected downturn stemmed largely from a dramatic 48.6% decrease in insurance underwriting profit, which highlights the deep integration of Berkshire’s various sectors, including its insurance and railroad businesses. The substantial loss in underwriting profits raised concerns about the company’s ability to adapt to ongoing economic pressures, specifically those linked to tariffs and changing market conditions.

As one of the largest conglomerates in the world, Berkshire Hathaway’s financial health is critical not just for its shareholders but also for the wider market. The reported decline in earnings comes amidst warnings from Warren Buffett about tariff-induced uncertainties. With the company experiencing substantial losses in its insurance division, it has become increasingly clear that the potential for future earnings could be affected by external factors, including the political landscape and trade policies.

Understanding the Factors Behind Berkshire Hathaway’s Earnings Decline

The decline in Berkshire Hathaway’s operating earnings can be traced back to several key factors, chief among them being changing tariff regulations. President Trump’s administration has implemented tariffs that have created a tumultuous environment for businesses firmly rooted in the American economy. This introduces challenges such as increased costs for materials and unpredictable changes in supply chains, ultimately affecting overall profitability. Berkshire’s report outlined how these tariffs are not merely a short-term hiccup but represent a significant risk that could ripple through government and economic policies, creating a longer-lasting impact.

Furthermore, the recent losses attributed to insurance underwriting reflect a pivotal area where Berkshire Hathaway traditionally excels. The almost halved profit in this sector illustrates how external risks can influence revenues, regardless of the company’s internal strength and operational strategy. As companies like Berkshire navigate through fluctuating currency markets and increased costs associated with tariffs, their ability to maintain historical performance levels becomes increasingly challenged. Consequently, investors are left to contemplate the long-term implications of such earnings volatility.

The Role of Tariffs in Berkshire Hathaway’s Financial Future

Tariffs have emerged as a double-edged sword for Berkshire Hathaway, posing significant risks while also presenting opportunities for strategic adaptation. The company has historically thrived during moments of adversity, leveraging its vast cash reserves to make strategic acquisitions and investments. However, the uncertainty associated with tariffs complicates decision-making, making it harder for the conglomerate to predict long-term costs and supply chain dynamics. With Berkshire’s cash reserves now exceeding $347 billion, investors are eager to see how Buffett will utilize this capital in the face of tariff-related pressures.

As tariffs continue to disrupt industries and affect consumer behavior, Warren Buffett’s seasoned approach will be crucial for navigating these hurdles. The firm’s proactive stance in addressing these uncertainties has been reflected in their cautious yet optimistic outlook. Buffett has historically advised investors to focus on the long-term potential of businesses rather than short-term fluctuations, and this philosophy will likely play a critical role in how Berkshire Hathaway positions itself amidst ongoing tariff debates and potential policy changes.

Berkshire Hathaway’s Diverse Portfolio and Its Performance Challenges

Berkshire Hathaway’s diverse portfolio spans multiple sectors, including insurance, transportation, and energy, which has traditionally acted as a buffer against economic downturns. However, recent earnings reports indicate that even such a well-diversified conglomerate is not immune to market volatility. With significant losses in insurance profits, largely due to unprecedented wildfires and a depreciating dollar, the company faces pressing challenges. Simply put, diversification alone may not shield Berkshire from the negative impacts of global events and economic policy shifts that are currently reshaping the business landscape.

Moreover, the performance of specific sectors within Berkshire’s portfolio further complicates its operational outlook, as tariffs disproportionately affect certain industries. For instance, the railroad industry faces unique challenges arising from changes in trade and the cost of transporting goods. As a result, investors need to remain vigilant and informed about the interconnectedness of Berkshire’s assets and the potential ripple effects of tariff changes on its overall profitability.

Warren Buffett’s Insights on Future Earnings and Tariffs

Warren Buffett has always maintained an optimistic view of Berkshire Hathaway’s long-term profitability, despite immediate earnings declines. His experience as a long-term investor positions him well to advise shareholders during times of uncertainty, specifically with concerns about tariffs impacting earnings. The commentaries from Berkshire’s recent earnings report reflect Buffett’s strategic foresight, calling attention to the significance of understanding macroeconomic trends and geopolitical factors that may foreseeably influence future business outcomes. As tariffs continue to fluctuate, how Buffett adapts his investment strategies will be the focal point for both the company and its investors.

Buffett’s clear message revolves around resilience and opportunity amidst economic challenges. By emphasizing the unpredictability of tariffs and foreign exchange dynamics, he urges shareholders to maintain a long-term perspective on earnings rather than fixating on quarterly losses. This approach aligns with Berkshire’s historical performance track record, signaling that while current conditions may be rough, future earnings can rebound as markets adjust and stabilize. For investors, the key takeaway lies in understanding that the conglomerate’s strategic planning leverages an enduring commitment to navigating through adversity towards future growth.

Insurance Underwriting Profits and Their Influence on Berkshire Hathaway’s Earnings

Insurance underwriting profits are historically a crucial component of Berkshire Hathaway’s earnings, providing a steady income stream and cushioning against economic fluctuations. However, the recent 48.6% decline in these profits has raised alarms among investors and analysts alike, as this signals potential underlying issues that could affect the conglomerate’s broader performance. The factors contributing to this downturn range from catastrophic events, such as wildfires, to shifts in market dynamics that are increasingly influenced by geopolitical uncertainties.

As the insurance sector grapples with rising claims and unforeseen conditions, Berkshire Hathaway’s reliance on stable underwriting income faces unprecedented challenges. With a strategic approach to risk management and investment, Buffett’s team will need to innovate solutions to restore confidence in their underwriting operations. Understanding the pulse of the insurance market, particularly in relation to tariffs and economic policy impacts, will be vital for the future success of Berkshire Hathaway’s integrated business model.

Market Reactions to Berkshire Hathaway’s Earnings Report

Market reactions to Berkshire Hathaway’s earnings report have been a mixed bag, reflecting concerns over the company’s declining profits amidst ongoing geopolitical uncertainties. Investors are keenly aware that a 14% drop in operating earnings can lead to broader implications not only for Berkshire but also for the stock market as a whole. As concerns regarding tariffs and their effects on future operations intensify, market sentiment regarding Berkshire’s stock may fluctuate accordingly, influencing investment decisions.

Furthermore, as Berkshire Hathaway reports notable gains in share price in spite of these earnings concerns, it suggests that market perceptions may be rooted more in long-term potential than short-term results. This reflects Buffett’s long-standing investment philosophy, emphasizing the importance of evaluating a company’s fundamental strengths over reactive market movements. As the financial community digests the implications of Berkshire’s latest report, future trading patterns could shift based on how effectively the company navigates its current challenges.

Long-Term Strategies for Mitigating Earnings Declines at Berkshire Hathaway

In light of the recent earnings declines, Berkshire Hathaway must leverage its strategic capabilities to mitigate potential future losses. This involves a multi-faceted approach that not only includes managing operational costs but also identifying lucrative investment opportunities that arise from current market conditions. With a healthy cash reserve of over $347 billion, Buffett has the flexibility to pursue strategic acquisitions or invest in areas that align with emerging trends, helping to reinforce the company’s dedication to sustainable growth.

Additionally, Berkshire’s leadership should explore innovative ways to hedge against tariff impacts and related economic risks. By diversifying revenue streams further and emphasizing sectors with more stable growth patterns, Berkshire can bolster its financial resilience. As outlined in their latest report, overcoming the challenges posed by foreign exchange fluctuations and geopolitical tensions will be crucial for maintaining investor confidence and ensuring a brighter outlook for earnings through 2025 and beyond.

Frequently Asked Questions

What are the main causes of the Berkshire Hathaway earnings decline in 2025?

The Berkshire Hathaway earnings decline in 2025 was primarily driven by a 14% drop in operating earnings, totaling $9.64 billion compared to $11.22 billion in the previous year. A significant factor was the 48.6% decrease in insurance underwriting profit, which fell from $2.60 billion to $1.34 billion due to ongoing tariff uncertainty and an increase in losses related to wildfires.

How did tariffs impact Berkshire Hathaway’s profits in 2025?

Tariffs imposed under the Trump administration led to increased uncertainty for Berkshire Hathaway’s profits in 2025. The company highlighted that geopolitical risks and changing international trade policies might affect product costs, supply chains, and customer demand, contributing to the decline in operating earnings.

What was the impact of foreign exchange losses on Berkshire Hathaway’s earnings in the first quarter of 2025?

In the first quarter of 2025, Berkshire Hathaway faced a foreign exchange loss of approximately $713 million, contrasting with a forex gain of $597 million the previous year. This loss contributed to the overall decline in earnings, as the dollar depreciated nearly 4%, negatively impacting the conglomerate’s financial results.

What does the Berkshire Hathaway report indicate about the outlook for future earnings amid tariff uncertainty?

The Berkshire Hathaway report suggests an uncertain outlook for future earnings due to tariff impacts and geopolitical factors. The company noted it is unable to predict how these elements will affect costs and customer demand, indicating potential risks in upcoming periods.

How did the decline in insurance underwriting profit affect Berkshire Hathaway’s overall earnings?

The decline in insurance underwriting profit directly impacted Berkshire Hathaway’s overall earnings by reducing operational income significantly. The 48.6% drop to $1.34 billion highlighted how critical the insurance segment is to Berkshire’s profitability, which faced amplified challenges due to wildfires and tariffs.

What are the financial implications of Berkshire Hathaway’s decision to sell stocks during the market downturn?

Berkshire Hathaway’s choice to sell stocks during the market downturn meant that it avoided investing its cash reserves aggressively, which increased to over $347 billion. While the strategy resulted in short-term losses in publicly traded holdings, it underscores Warren Buffett’s approach of prioritizing financial stability over immediate gains amidst market volatility.

How does Warren Buffett suggest investors approach Berkshire Hathaway’s fluctuating earnings reports?

Warren Buffett advises investors to look beyond the quarterly fluctuations of Berkshire Hathaway’s earnings. He emphasizes that short-term investment gains or losses can be misleading, especially to those not versed in accounting principles, urging a long-term perspective on the company’s overall performance.

What can we expect from Berkshire Hathaway’s earnings in 2025 based on current trends?

Based on current trends, Berkshire Hathaway’s earnings in 2025 might continue to experience volatility due to uncertainties related to tariffs, foreign exchange losses, and sector-specific challenges. However, the company remains well-positioned with significant cash reserves, which could be advantageous in navigating future market conditions.

| Key Metrics | Q1 2024 | Q1 2025 | Change (%) |

|---|---|---|---|

| Operating Earnings (in billion) | $11.22 | $9.64 | -14% |

| Earnings per Share (Class B) | $5.20 | $4.47 | -14% |

| Insurance Underwriting Profit (in billion) | $2.60 | $1.34 | -48.6% |

| Foreign Exchange Impact (in million) | +597 | -$713 | N/A |

Summary

Berkshire Hathaway earnings decline has raised concerns as the conglomerate reported a significant drop in its operating earnings. The 14% fall in profits, primarily driven by a drastic decrease in insurance-underwriting profits, reflects the uncertainty created by tariffs and geopolitical risks. Despite an inner resilience indicated by increased cash reserves, the implications of ongoing macroeconomic changes pose challenges ahead for the firm. Investors are urged to remain steady and consider the potential long-term impacts over short-term fluctuations.